How to Write a Gift Letter for Your Mortgage

When someone gives you money toward a home purchase, your lender requires them to sign a gift letter — this certifies that the funds aren’t a loan you’ll need to repay. They’ll also require documentation of the source of those funds.

We’ll cover how to easily write a gift letter (using our gift letter template), as well as the rules you need to know about gift funds. Knowing these rules will help you prevent mistakes that could delay your loan approval — or, in a worst case scenario, even cause your financing to fall through.

What is a gift letter for a mortgage?

A gift letter is a written statement confirming that funds given to a borrower — usually for a down payment — are a gift rather than a loan that has to be repaid. The letter will need to explain who is gifting the money, where the funds are coming from and the relationship between the donor and the recipient.

Gift funds can also be used to pay for:

- Closing costs. Mortgage closing costs average between 2% and 6% of your loan amount.

- Mortgage reserves. Cash reserves are only required in some cases. Mortgage reserve requirements usually ask for one to six months’ worth of monthly mortgage payments.

Gift funds cannot be used for:

- Any portion of your minimum borrower contribution requirement. If you’re using a conventional loan, you may have a required minimum contribution. If so, those funds have to come from you, and may not be gifted. The exact amount required depends on your loan-to-value (LTV) ratio.

- Buying investment properties. Conventional investment property loans don’t allow gifted funds. However, they do allow you to use home equity to buy an investment property.

Although conventional loans don’t allow you to use a down payment gift when buying an investment property, government loan programs do — if you purchase a two- to four-unit home that you’re house hacking. The catch: You’re required to live in one of the units as your primary residence for at least 12 months.

Learn more about investment property loan rates today.

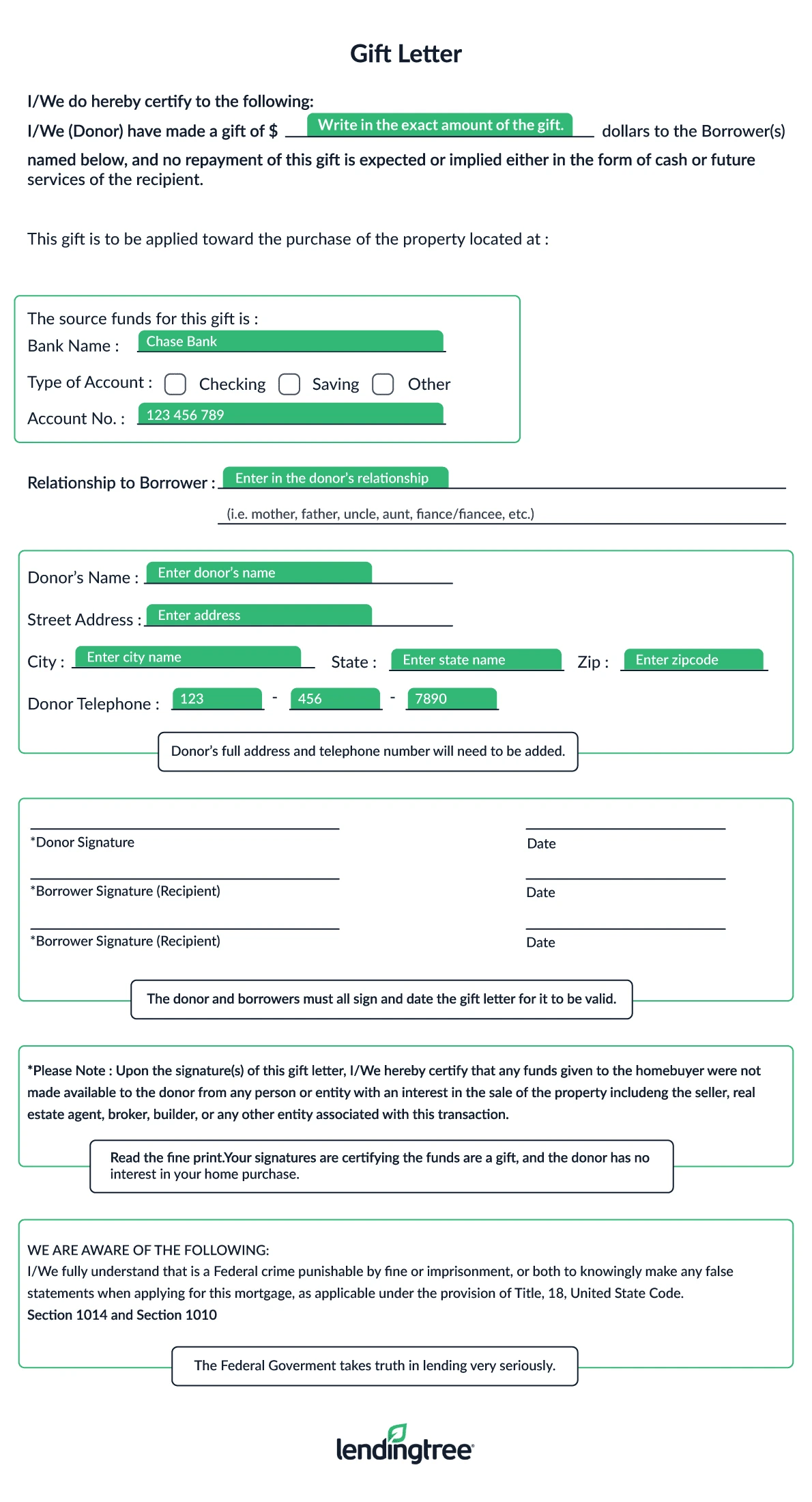

Gift letter for a mortgage template

Your lender may provide a mortgage gift letter template for you to use. If not, you can download the template below to create your own. Then, share it with anyone who’s gifting you money to read over and sign.

Click to download:

Why lenders care about gift letter information

Mortgage lenders care about the information on a gift letter for a mortgage for three reasons:

- To document that the person giving you the money isn’t involved in the home purchase. Someone who donates funds can’t be the seller, builder, real estate agent, broker or anyone else who has a financial interest in the property’s sale. Often, they’re family members or significant others. In some cases, if a family member is the seller, they may still be allowed to give you funds.

- To know how the funds should affect your debt-to-income (DTI) ratio. Gifted funds don’t count as debt when lenders calculate your DTI ratio, but borrowed funds do.

- To inform the IRS of the gift amount for tax purposes. Under IRS rules, the donor is responsible for the taxes associated with the gift, not the recipient. For 2024, you can gift up to $18,000 without any tax penalty. In 2025, that will go up to $19,000.

Click below to view the eight pieces of information in a gift letter and why lenders request each one:

Lenders check to make sure this amount matches what comes out of the donor’s account and goes into your account. The IRS sets limits each year on the maximum amount that can be gifted without a tax consequence.

This lets the lender know you aren’t borrowing money and won’t incur additional debt.

The gift letter ties the gift funds to the home you’re buying.

Details about the donor’s account, including the bank or investment company’s name, account number and account type (checking, savings or investment)Have a frank conversation with a potential gift donor to ensure they’re comfortable with it. Underwriters review this to make sure the money isn’t coming from an interested party (like a real estate agent or the home seller), and if you don’t provide it, the gift funds can’t be used.

Funds can be deposited into your account or the purchase escrow account.

Most loan programs require the funds to come from a relative or friend. Gift funds from your loan officer, real estate agent, builder or anyone who’s part of the purchase contract are almost always prohibited.

Be sure your donor is comfortable providing this information — it’s required to be included in the gift letter.

Once everyone signs, the gift letter is a legally binding document.

On most gift letters, there’s a notice about making false statements called a “fraud notice.” This notice highlights that, if the money being given isn’t really a gift, you could be accused of mortgage fraud if you complete a gift letter for it anyway.

How to document funds tied to a gift letter for a mortgage

Your gift letter has to be backed up with paperwork showing where the funds came from. You’ll typically need to provide the following:

For funds transferred by check:

- The gift check and deposit slip showing closing funds deposited into your account.

- The withdrawal slip or bank statement showing the funds leaving the donor’s account.

- The check made out directly to the closing agent. (Add the transaction escrow number to the check so the funds are directed into the escrow account tied to your purchase. You can get this information from the closing agent.)

For funds transferred electronically:

- Evidence of the transfer, like an electronic statement.

For funds transferred by wire:

- The settlement statement showing funds deposited or wired into the escrow account.

Important rules about gifted funds for a mortgage

Most loan programs allow gifts, but the amount you can use varies by loan type, as does the list of acceptable sources. Generally speaking, you can get gift money from a relative or friend, your employer or local labor union, a government agency or even a charitable organization.

We’ll outline gift letter rules for the following mortgage programs:

Fannie Mae gift guidelines

Lenders follow Fannie Mae guidelines to offer conventional loans, the most common home loan type. Conventional loans require a minimum 3% down payment that can come entirely from a gift if you’re buying a single-family residence.

Gift funds for a conventional loan can come from a relative, employer, close long-time friend, government down payment assistance (DPA) program or charitable organization.

Freddie Mac gift guidelines

Similar to Fannie Mae, Freddie Mac provides funding for conventional loans. Under Freddie Mac guidelines, your entire down payment can be gifted by a relative if you’re buying a single-family home as your primary residence. Freddie Mac also allows you to use wedding gift funds from relatives and friends under two conditions:

- You’ll need to provide a copy of your marriage license

- You’ll need to show the funds being deposited into your bank account within 90 days of your marriage license date

FHA gift guidelines

The Federal Housing Administration (FHA) insures loans made by FHA-approved lenders with a minimum 3.5% down payment that can be gifted. An FHA gift letter is required, with supporting documents similar to those required by conventional guidelines. FHA loans are popular with some first-time homebuyers because they allow a minimum 580 credit score to qualify, which is lower than the 620 minimum conventional lenders require.

Explore FHA loan rates.

VA gift guidelines

The U.S. Department of Veterans Affairs (VA) guarantees home loans for eligible military borrowers. VA loans don’t require a down payment, but VA guidelines allow borrowers to use gift funds toward closing costs, or a down payment, if they want to make one. The gift letter and documentation requirements are similar to FHA and conventional loans.

Explore VA loan rates.

USDA gift guidelines

The U.S. Department of Agriculture (USDA) guarantees no-down-payment USDA loans to families with a low to moderate income in eligible rural areas of the country. Like the VA loan program, gift money can be used to pay closing costs. You’ll need to provide a gift letter and supporting documents consistent with the gift letter rules of other loan programs.

Mortgage reserves are several months of mortgage payments in the bank to cover a financial emergency. Conventional lenders allow you to get a gift for reserves, if needed. However, FHA and VA loans don’t allow gifts to go toward mortgage reserves, so you’ll need to save up your own cash.

What is a gift of equity letter?

Home equity is the difference between a home’s value and outstanding loan balance, and a gift of equity allows a seller to gift a portion of their equity to a family member, fiancé/fiancée or a domestic partner. A gift of equity letter is required, instead of a regular gift letter.

With a gift of equity:

- The gift represents the amount of equity the seller gives to the relative buying the home.

- The documentation requirements are similar to a regular gift letter.

- There’s no exchange of actual money.

- The equity is given to the buyer as a credit at closing.

- Fannie Mae and Freddie Mac. Gifts of equity can only be made to a relative, fiancé/fiancée or domestic partner.

- FHA. Gifts of equity are only allowed for home sales between family members.

- VA. The VA doesn’t mention gifts of equity in its guidelines. If you’re curious whether you can use a gift of equity with your VA loan, reach out to your loan officer or lender.

- USDA. Any gift of equity will have to reduce the home price.

View mortgage loan offers from up to 5 lenders in minutes