Despite Housing Market Concerns, Foreclosures Remain Rare

Though home prices appear to have leveled off in many places, they remain near record highs across the U.S.

With steep housing costs, some doubtlessly have flashbacks to the last time prices rose dramatically — the early to mid-2000s before the Great Recession of 2007 to 2009. Looking back may cause some to panic, as the Great Recession brought significant decreases in home values and a large number of foreclosures.

Fortunately, today’s housing market — as pricey as it is — appears to be in much better shape than in the lead-up to the Great Recession. Not only have home prices across the nation avoided major declines, but most homeowners have kept up with their mortgage payments and avoided foreclosure.

According to a LendingTree analysis of the most recent U.S. Census Bureau American Community Survey data, relatively few homeowners have lost their homes due to foreclosure.

Key findings

- Across the U.S., only 46,237 homes are vacant due to foreclosure. For comparison, there are 143.4 million housing units in the 50 states (excluding the District of Columbia).

- Homes nationwide are unlikely to be empty due to foreclosure — even if vacant. Across the U.S., 13,868,075 housing units are vacant. Of that amount, only 0.33% are empty because of foreclosure. Most others are only temporarily empty, typically because they’re used for vacations or on the market to be bought or rented.

- New York, Ohio and Michigan have the most foreclosed homes. In these states, 4,342, 3,489 and 3,454, respectively, are vacant due to foreclosure. On average, 0.06% of homes in these states are empty because they’ve been foreclosed on. Among only vacant homes in these states, an average of 0.68% are unoccupied due to foreclosure.

- Alaska, Rhode Island, Utah and Wyoming have no reported foreclosed homes. While the American Community Survey estimates there are zero foreclosed homes across these states, margins of error (see the methodology for more info) could impact that, albeit not by much.

States with the most foreclosed homes

No. 1: New York

- Number of housing units: 8,585,784

- Number of vacant housing units: 811,476

- Number of housing units vacant due to foreclosure: 4,342

- Margin of error for number of housing units vacant due to foreclosure: (+/-) 1,062

- Share of housing units vacant due to foreclosure: 0.05%

- Share of vacant housing units unoccupied due to foreclosure: 0.54%

No. 2: Ohio

- Number of housing units: 5,293,227

- Number of vacant housing units: 415,021

- Number of housing units vacant due to foreclosure: 3,489

- Margin of error for number of housing units vacant due to foreclosure: (+/-) 1,094

- Share of housing units vacant due to foreclosure: 0.07%

- Share of vacant housing units unoccupied due to foreclosure: 0.84%

No. 3: Michigan

- Number of housing units: 4,605,363

- Number of vacant housing units: 515,569

- Number of housing units vacant due to foreclosure: 3,454

- Margin of error for number of housing units vacant due to foreclosure: (+/-) 1,288

- Share of housing units vacant due to foreclosure: 0.07%

- Share of vacant housing units unoccupied due to foreclosure: 0.67%

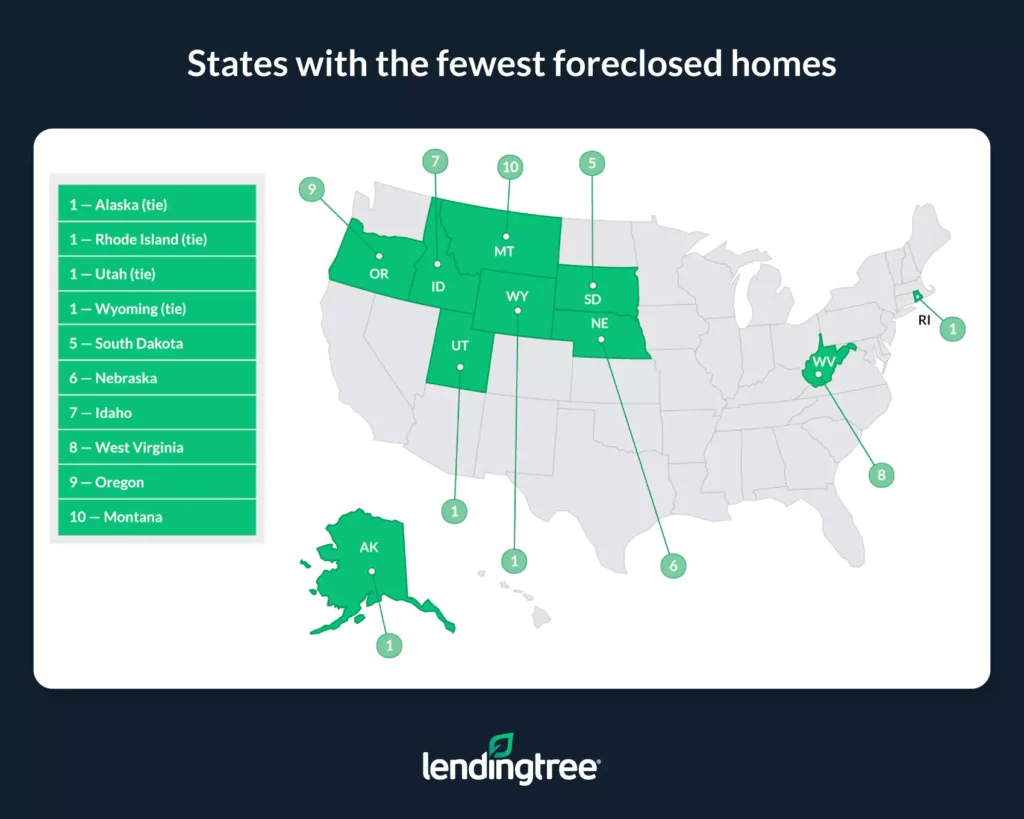

States with the fewest foreclosed homes

No. 1 (tie): Alaska

- Number of housing units: 329,160

- Number of vacant housing units: 54,586

- Number of housing units vacant due to foreclosure: 0

- Margin of error for number of housing units vacant due to foreclosure: (+/-) 170

- Share of housing units vacant due to foreclosure: 0.00%

- Share of vacant housing units unoccupied due to foreclosure: 0.00%

No. 1 (tie): Rhode Island

- Number of housing units: 486,017

- Number of vacant housing units: 39,329

- Number of housing units vacant due to foreclosure: 0

- Margin of error for number of housing units vacant due to foreclosure: (+/-) 242

- Share of housing units vacant due to foreclosure: 0.00%

- Share of vacant housing units unoccupied due to foreclosure: 0.00%

No. 1 (tie): Utah

- Number of housing units: 1,228,707

- Number of vacant housing units: 99,047

- Number of housing units vacant due to foreclosure: 0

- Margin of error for number of housing units vacant due to foreclosure: (+/-) 204

- Share of housing units vacant due to foreclosure: 0.00%

- Share of vacant housing units unoccupied due to foreclosure: 0.00%

No. 1 (tie): Wyoming

- Total number of housing units: 277,106

- Total number of vacant housing units: 33,785

- Number of housing units vacant due to foreclosure: 0

- Margin of error for number of housing units vacant due to foreclosure: (+/-) 207

- Share of all housing units vacant due to foreclosure: 0.00%

- Share of vacant housing units that are unoccupied due to foreclosure: 0.00%

Why aren’t foreclosures more common?

Foreclosures aren’t common in any state. This may seem surprising given how expensive owning a house can be. However, there are various reasons why.

Though home prices and current mortgage rates are high, most homeowners don’t appear to struggle to keep up with their payments. On the contrary, mortgage delinquency rates remain lower than before the pandemic, largely because a majority of current homeowners bought or refinanced a few years ago when mortgage rates were below 5.00%.

Even for those who bought more recently, strict lending standards implemented in the wake of the Great Recession and maintained in the face of recently rising mortgage rates help to ensure buyers aren’t at serious risk of default, even if their payments are relatively expensive. Today’s lenders are unlikely to approve a loan to a homebuyer who can’t demonstrate through financial characteristics such as a high credit score and a robust income that they’ll be able to keep up with their monthly payments long term.

Another reason foreclosures remain rare is that lenders don’t usually pursue them until they’ve exhausted other options. Even if a borrower falls behind on mortgage payments, lenders will typically try to work with them and help them become current before attempting to force a homeowner out of their property. Foreclosure is a time-consuming and expensive process that lenders are unlikely to seek unless a borrower becomes seriously delinquent.

Ultimately, the data is clear that most people aren’t at serious risk of losing their homes to foreclosure. Not only are the majority of homeowners current on their mortgages, but those who aren’t can often get the help they need to catch up on what they missed. While this doesn’t mean owning a house is easy — or suggest that those dealing with foreclosure aren’t facing serious struggles — it shows how relatively healthy most homeowners remain.

Tips for avoiding foreclosure

Falling behind on your mortgage and dealing with the threat of foreclosure is challenging, but the following tips can help you keep current on your payments and mitigate the risk of losing your home.

- Don’t bite off more than you can chew. Before buying a home, budget carefully to avoid taking on a mortgage too difficult to cover. Try to avoid getting a loan that’ll require spending more than 30% of your pretax income on monthly housing costs — including your mortgage and other expenses like utilities — and don’t stretch yourself to the breaking point. Proper planning may not protect you from unforeseen circumstances like losing a job, but it can help you save money and build savings in case of emergencies.

- If you need help, ask. Your lender doesn’t want to foreclose on you if it can avoid it. From a lender’s perspective, catching a delinquent homeowner up on missed payments is generally preferable to removing someone from their home. If you fall behind on your mortgage, don’t wait to ask for help. The sooner you reach out to a lender, the sooner it may be able to offer you something like forbearance or another type of mortgage modification that helps you get back on track.

- Don’t give up. The foreclosure process varies depending on factors like your lender and the state in which you reside, but (typically) foreclosures don’t happen overnight. Lenders often give multiple months of warnings before initiating a foreclosure. With that in mind, you may have more time to work with a lender than you might realize. Even if you fall behind, remaining proactive and working hard to become current can help you avoid losing your home.

Methodology

LendingTree analyzed data from the U.S. Census Bureau 2022 American Community Survey with one-year estimates — the latest available at the time of writing.

Specifically, LendingTree analyzed the number of homes reported as vacant due to foreclosure in each of the nation’s 50 states, excluding the District of Columbia.

Data published in the American Community Survey (ACS) is based on estimates derived from population samples across the U.S. This results in margins of error for estimates.

According to the U.S. Census Bureau, “A margin of error (MOE) describes the precision of an ACS estimate at a given level of confidence. The confidence level associated with the MOE indicates the likelihood that the ACS sample estimate is within a certain range (the MOE) of the population value. The MOEs for published ACS estimates are provided at a 90% confidence level.”

Using an example from this study, the Census estimates New York state has 4,342 housing units vacant due to foreclosure. The margin of error for this data point is plus or minus 1,062 housing units. Based on a confidence level of 90%, the Census is 90% certain that the number of foreclosed homes in New York falls between 3,280 and 5,404 housing units.

View mortgage loan offers from up to 5 lenders in minutes