Majority of Homeowners Tackling Home Improvement Projects, With Painting, Landscaping and Bathroom Upgrades Topping To-Do Lists

Home is where the heart is, but it’s also where the hammer is lately. In the past 12 months, 68% of homeowners started or completed home improvement projects, according to a LendingTree survey of nearly 2,200 U.S. homeowners, while 63% plan to begin one in the next year.

We’ll review the most popular improvements and how consumers pay for their upgrades. Additionally, stick around for tips on navigating home improvement projects — including whether a home improvement loan is right for you.

Key findings

- With high mortgage rates and low inventory, the majority of homeowners are tackling improvement projects to spruce up their homes. In the past 12 months, 68% of homeowners started or completed home improvement projects, while 63% plan to begin one in the next year. Among generations, millennial homeowners have been the busiest, with 78% working on upgrades in the past year and 72% planning to do so in the next 12 months.

- Among all planned or completed projects, interior painting, landscaping and bathroom remodels are the most popular. Among those who’ve started, completed or are planning to start a home project, 61% will focus on interior painting, 54% will work on landscaping and 47% will upgrade their bathrooms.

- The most popular way to pay for these projects typically is with savings. 40% of homeowners doing new windows work are primarily paying with savings — the highest among the projects we highlighted. Next were remodeling unused living spaces or basements, upgrading electrical wiring and adding new roofs, all tying at 39%. Of these four projects, adding a new roof has the highest expected cost at $9,525, on average.

- Reasons for beginning these projects vary among homeowners. When asked why they’ve worked on a project in the past year or plan to work on one in the next year, 36% say they need to make repairs as their house ages, 27% say their improvements are relatively small and 21% say they’re doing the repairs in preparation to sell their home. Across generations, millennials are most likely to be preparing to sell at 29%. Baby boomers are the least likely to make improvements for this reason, with just 10% making improvements because they’re preparing to sell.

Majority of homeowners are tackling home improvement projects

As the housing market remains competitive, many homeowners turn their attention inward. In the past 12 months, 68% of homeowners started or completed home improvement projects. Meanwhile, 63% plan to begin one in the next year.

Millennial homeowners ages 27 to 42 are the most likely age group to take on an improvement, with 78% working on upgrades in the past year and 72% planning to do so in the next 12 months. That’s followed by:

- Gen Zers (ages 18 to 26): 70% have started or completed a project in the past 12 months, while 64% plan to start one in the next 12 months.

- Gen Xers (ages 43 to 58): 65% have started or completed a project in the past 12 months, while 59% plan to start one in the next 12 months.

- Baby boomers (ages 59 to 77): 54% have started or completed a project in the past 12 months, while 53% plan to start one in the next 12 months.

According to LendingTree senior economist Jacob Channel, there are a few reasons why millennials are the most likely to take on these projects.

“One could be that they’re buying less expensive homes that need more work,” he says. “While there are certainly well-off millennials, members of the generation typically don’t have much wealth compared to their older peers. Owing to this, the only homes that some can afford might be fixer-uppers. Also, millennials may just have more energy to spend on home improvement projects than their older peers.”

Men are more likely to take on home improvement projects than women, with 73% working on improvements in the past 12 months and 67% planning improvements in the next 12 months. Comparatively, 63% of women have done improvements in the past 12 months and 59% are planning improvements for the next 12 months.

Homeowners with children younger than 18 are significantly more likely to be working on home projects than those without children and those with children older than 18. Here’s how that breaks down:

- Homeowners with children younger than 18: 80% have started or completed a project in the past 12 months, while 77% plan to start one in the next 12 months.

- Homeowners without children: 62% have started or completed a project in the past 12 months, while 54% plan to start one in the next 12 months.

- Homeowners with children older than 18: 58% have started or completed a project in the past 12 months, while 53% plan to start one in the next 12 months.

Interior painting projects are most popular — here’s what follows

When it comes to what homeowners are fixing up, the most popular projects are more minor fixes. Among those who’ve started, completed or are planning to start a home project, 61% will focus on interior painting — the top fix. Following that, 54% will work on landscaping and 47% will upgrade their bathrooms.

According to Channel, these projects are likely popular because they involve servicing easily visible and/or high-traffic home areas.

“The more eyes that something has on it, the more likely people might want to make it as presentable as possible,” he says. “Similarly, the more often a person uses something, like their kitchen or bathroom, the more incentive they have to make sure that it’s working as well as it can. On top of that, some of these projects might be more manageable than others, so people might be more willing to take them on.”

The next most popular home projects are:

- Updating/remodeling kitchen (45%)

- Installing/replacing flooring (42%)

- Updating lighting fixtures (40%)

- Painting exteriors (37%)

- Adding deck or patio (31%)

- Installing new windows (30%)

- Installing security system (28%)

- Installing new front door (27%)

- Adding storage space (25%)

- Upgrading electrical wiring (25%)

- Updating HVAC system (24%)

- Remodeling unused living space or basement (24%)

- Installing new water heater (23%)

- Adding new roof (22%)

- Taking on solar panel project (19%)

- Installing new siding (18%)

- Adding insulation (17%)

- Adding new fireplace (15%)

Meanwhile, 12% say they had started, completed or planned to start an improvement not mentioned above.

Many homeowners are paying for improvements with savings

To pay for renovations or upgrades, many homeowners are tapping into their savings. Of those who’ve started or completed a home improvement project in the past 12 months, 40% of homeowners doing new windows work are primarily paying with savings — the highest among the projects we highlighted. Meanwhile, 35% of those who plan to install new windows expect to pay with savings.

Next were remodeling unused living spaces or basements, upgrading electrical wiring and adding new roofs, all tying at 39% among those who’ve started or completed their projects in the past 12 months.

How homeowners plan to pay for their upgrades (by project type)

| Payment type | % among homeowners who’ve started or completed improvement projects in the past 12 months | % among homeowners who plan to start improvement projects in the next 12 months |

|---|---|---|

| Interior painting | ||

| Savings | 32% | 32% |

| Existing earnings/cash flow | 48% | 43% |

| Finance with a home equity loan | 2% | 5% |

| Finance with a personal loan | 3% | 5% |

| Finance with a home equity line of credit (HELOC) | 3% | 4% |

| Pay with a credit card | 12% | 11% |

| Delay expense or not pay it | 1% | 2% |

| Exterior painting | ||

| Savings | 27% | 27% |

| Existing earnings/cash flow | 41% | 39% |

| Finance with a home equity loan | 6% | 7% |

| Finance with a personal loan | 6% | 11% |

| Finance with a HELOC | 7% | 5% |

| Pay with a credit card | 11% | 10% |

| Delay expense or not pay it | 2% | 2% |

| Installing/replacing flooring | ||

| Savings | 35% | 30% |

| Existing earnings/cash flow | 34% | 34% |

| Finance with a home equity loan | 7% | 11% |

| Finance with a personal loan | 5% | 7% |

| Finance with a HELOC | 3% | 7% |

| Pay with a credit card | 15% | 11% |

| Delay expense or not pay it | 1% | 2% |

| Updating lighting fixtures | ||

| Savings | 28% | 24% |

| Existing earnings/cash flow | 46% | 46% |

| Finance with a home equity loan | 4% | 6% |

| Finance with a personal loan | 4% | 3% |

| Finance with a HELOC | 2% | 6% |

| Pay with a credit card | 15% | 14% |

| Delay expense or not pay it | 1% | 2% |

| Upgrading bathroom(s) | ||

| Savings | 37% | 32% |

| Existing earnings/cash flow | 27% | 28% |

| Finance with a home equity loan | 8% | 10% |

| Finance with a personal loan | 8% | 9% |

| Finance with a HELOC | 5% | 7% |

| Pay with a credit card | 15% | 11% |

| Delay expense or not pay it | 1% | 3% |

| Updating/remodeling kitchen | ||

| Savings | 35% | 34% |

| Existing earnings/cash flow | 29% | 25% |

| Finance with a home equity loan | 10% | 12% |

| Finance with a personal loan | 9% | 8% |

| Finance with a HELOC | 7% | 6% |

| Pay with a credit card | 11% | 12% |

| Delay expense or not pay it | 1% | 1% |

| Installing new windows | ||

| Savings | 40% | 35% |

| Existing earnings/cash flow | 24% | 25% |

| Finance with a home equity loan | 7% | 13% |

| Finance with a personal loan | 11% | 10% |

| Finance with a HELOC | 6% | 7% |

| Pay with a credit card | 10% | 7% |

| Delay expense or not pay it | 2% | 2% |

| Adding a deck or patio | ||

| Savings | 37% | 31% |

| Existing earnings/cash flow | 30% | 28% |

| Finance with a home equity loan | 8% | 11% |

| Finance with a personal loan | 8% | 9% |

| Finance with a HELOC | 5% | 9% |

| Pay with a credit card | 10% | 11% |

| Delay expense or not pay it | 2% | 2% |

| Installing a new front door | ||

| Savings | 32% | 22% |

| Existing earnings/cash flow | 38% | 37% |

| Finance with a home equity loan | 7% | 11% |

| Finance with a personal loan | 7% | 8% |

| Finance with a HELOC | 7% | 8% |

| Pay with a credit card | 9% | 12% |

| Delay expense or not pay it | 0% | 2% |

| Taking on a landscaping project | ||

| Savings | 27% | 27% |

| Existing earnings/cash flow | 49% | 45% |

| Finance with a home equity loan | 4% | 6% |

| Finance with a personal loan | 3% | 6% |

| Finance with a HELOC | 3% | 3% |

| Pay with a credit card | 13% | 12% |

| Delay expense or not pay it | 1% | 1% |

| Adding storage space | ||

| Savings | 29% | 29% |

| Existing earnings/cash flow | 33% | 28% |

| Finance with a home equity loan | 8% | 15% |

| Finance with a personal loan | 7% | 6% |

| Finance with a HELOC | 7% | 8% |

| Pay with a credit card | 12% | 11% |

| Delay expense or not pay it | 4% | 3% |

| Updating HVAC system | ||

| Savings | 32% | 29% |

| Existing earnings/cash flow | 25% | 21% |

| Finance with a home equity loan | 14% | 12% |

| Finance with a personal loan | 11% | 13% |

| Finance with a HELOC | 8% | 14% |

| Pay with a credit card | 10% | 9% |

| Delay expense or not pay it | 1% | 1% |

| Remodeling unused living space or basement | ||

| Savings | 39% | 30% |

| Existing earnings/cash flow | 35% | 31% |

| Finance with a home equity loan | 7% | 10% |

| Finance with a personal loan | 5% | 8% |

| Finance with a HELOC | 3% | 8% |

| Pay with a credit card | 9% | 10% |

| Delay expense or not pay it | 2% | 3% |

| Adding a new roof | ||

| Savings | 39% | 31% |

| Existing earnings/cash flow | 22% | 24% |

| Finance with a home equity loan | 13% | 14% |

| Finance with a personal loan | 9% | 14% |

| Finance with a HELOC | 6% | 6% |

| Pay with a credit card | 9% | 7% |

| Delay expense or not pay it | 2% | 4% |

| Installing new siding | ||

| Savings | 37% | 31% |

| Existing earnings/cash flow | 26% | 21% |

| Finance with a home equity loan | 12% | 15% |

| Finance with a personal loan | 9% | 12% |

| Finance with a HELOC | 6% | 12% |

| Pay with a credit card | 7% | 8% |

| Delay expense or not pay it | 2% | 2% |

| Installing a new water heater | ||

| Savings | 31% | 32% |

| Existing earnings/cash flow | 28% | 29% |

| Finance with a home equity loan | 8% | 10% |

| Finance with a personal loan | 8% | 11% |

| Finance with a HELOC | 6% | 6% |

| Pay with a credit card | 19% | 10% |

| Delay expense or not pay it | 2% | 3% |

| Upgrading electrical wiring | ||

| Savings | 39% | 32% |

| Existing earnings/cash flow | 32% | 31% |

| Finance with a home equity loan | 10% | 9% |

| Finance with a personal loan | 6% | 6% |

| Finance with a HELOC | 3% | 9% |

| Pay with a credit card | 8% | 14% |

| Delay expense or not pay it | 2% | 1% |

| Installing a security system | ||

| Savings | 32% | 34% |

| Existing earnings/cash flow | 33% | 32% |

| Finance with a home equity loan | 8% | 7% |

| Finance with a personal loan | 7% | 8% |

| Finance with a HELOC | 4% | 5% |

| Pay with a credit card | 14% | 12% |

| Delay expense or not pay it | 1% | 2% |

| Adding insulation | ||

| Savings | 33% | N/A |

| Existing earnings/cash flow | 29% | N/A |

| Finance with a home equity loan | 9% | N/A |

| Finance with a personal loan | 14% | N/A |

| Finance with a HELOC | 8% | N/A |

| Pay with a credit card | 6% | N/A |

| Delay expense or not pay it | 2% | N/A |

| Adding a new fireplace | ||

| Savings | 29% | N/A |

| Existing earnings/cash flow | 23% | N/A |

| Finance with a home equity loan | 16% | N/A |

| Finance with a personal loan | 12% | N/A |

| Finance with a HELOC | 6% | N/A |

| Pay with a credit card | 11% | N/A |

| Delay expense or not pay it | 3% | N/A |

| Taking on a solar panel project | ||

| Savings | 27% | 25% |

| Existing earnings/cash flow | 24% | 25% |

| Finance with a home equity loan | 18% | 17% |

| Finance with a personal loan | 12% | 14% |

| Finance with a HELOC | 5% | 7% |

| Pay with a credit card | 13% | 12% |

| Delay expense or not pay it | 2% | 0% |

Of the projects with the highest percentage of consumers paying with savings, adding a new roof has the highest expected cost. Those who started or completed a new roof plan to pay an average of $10,994, while consumers planning to do so in the next 12 months expect to pay an average of $9,525.

It’s not the highest-costing project, though. Solar panel projects take the lead here. Those who started or completed a solar panel project paid an average of $11,536, and those who plan to do so in the next 12 months expect to pay $10,843. Following that, the next most expensive project is remodeling or updating the kitchen. Those who started or completed a kitchen remodel paid an average of $8,153, and those who plan to do so in the next 12 months expect to pay $8,106.

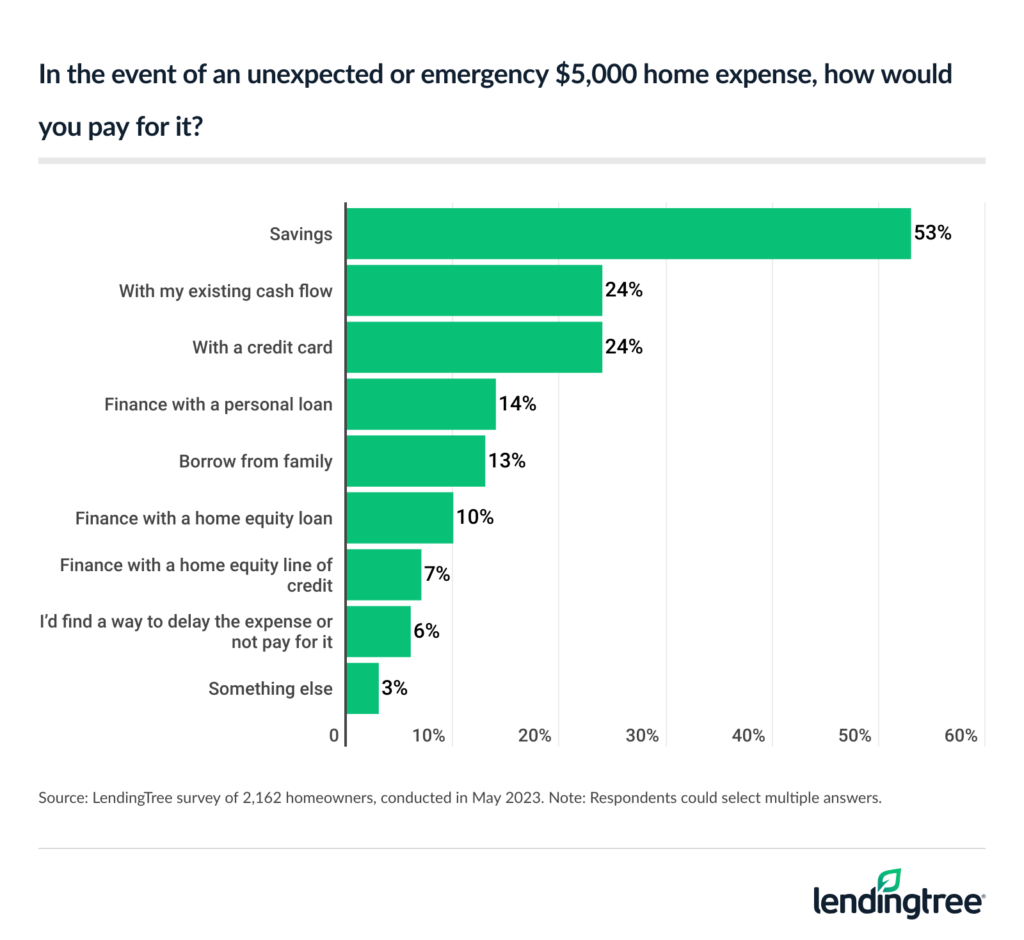

Majority of homeowners have enough savings to pay for a $5,000 emergency home expense

Homeowners don’t just have enough cash on hand to pay for improvements — the majority say their bank accounts are padded enough to pay for a large home emergency. If they encountered a $5,000 emergency expense, 53% of homeowners say they’d pay for it with their savings.

Tying for the second most common response, 24% would pay for it with an existing cash flow or a credit card.

By age group, baby boomers are the most likely to pay for a home emergency with cash at 59%. Meanwhile, men (57%) are more likely to pay this way than women (48%). On the other hand, Gen Zers are the most likely to borrow money from family, at 21%.

Full rankings

Home improvement projects started or completed over the past 12 months with the highest average costs

| Rank | Project | Avg. cost per project |

|---|---|---|

| 1 | Solar panel project | $11,536 |

| 2 | Adding a new roof | $10,994 |

| 3 | Kitchen update/remodel | $8,153 |

| 4 | Updating HVAC system | $6,757 |

| 5 | Adding a deck or patio | $6,249 |

| 6 | Upgrading bathroom(s) | $6,113 |

| 7 | Installing new windows | $5,743 |

| 8 | Remodel unused living space or basement | $5,717 |

| 9 | Installing new siding | $5,398 |

| 10 | Upgrading electrical wiring | $3,616 |

| 11 | Installing/replacing flooring | $3,469 |

| 12 | Adding a new fireplace | $3,354 |

| 13 | Landscaping project | $2,811 |

| 14 | Adding insulation | $2,691 |

| 15 | Adding storage space | $2,667 |

| 16 | Installing a new water heater | $2,608 |

| 17 | Exterior painting project | $2,536 |

| 18 | Installing a security system | $2,429 |

| 19 | Installing a new front door | $2,087 |

| 20 | Interior painting project | $1,704 |

| 21 | Updating lighting fixtures | $1,582 |

Home improvement projects starting in the next 12 months with the highest average costs

| Rank | Project | Avg. cost per project |

|---|---|---|

| 1 | Solar panel project | $10,843 |

| 2 | Adding a new roof | $9,525 |

| 3 | Kitchen update/remodel | $8,106 |

| 4 | Remodel unused living space or basement | $6,226 |

| 5 | Adding a deck or patio | $6,180 |

| 6 | Installing new windows | $5,935 |

| 7 | Upgrading bathroom(s) | $5,208 |

| 8 | Installing a new water heater | $4,218 |

| 9 | Updating HVAC system | $4,179 |

| 10 | Installing new siding | $4,071 |

| 11 | Installing/replacing flooring | $3,711 |

| 12 | Exterior painting project | $3,558 |

| 13 | Upgrading electrical wiring | $3,554 |

| 14 | Installing a security system | $3,340 |

| 15 | Landscaping project | $3,093 |

| 16 | Installing a new front door | $2,603 |

| 17 | Adding storage space | $2,377 |

| 18 | Updating lighting fixtures | $2,040 |

| 19 | Interior painting project | $2,031 |

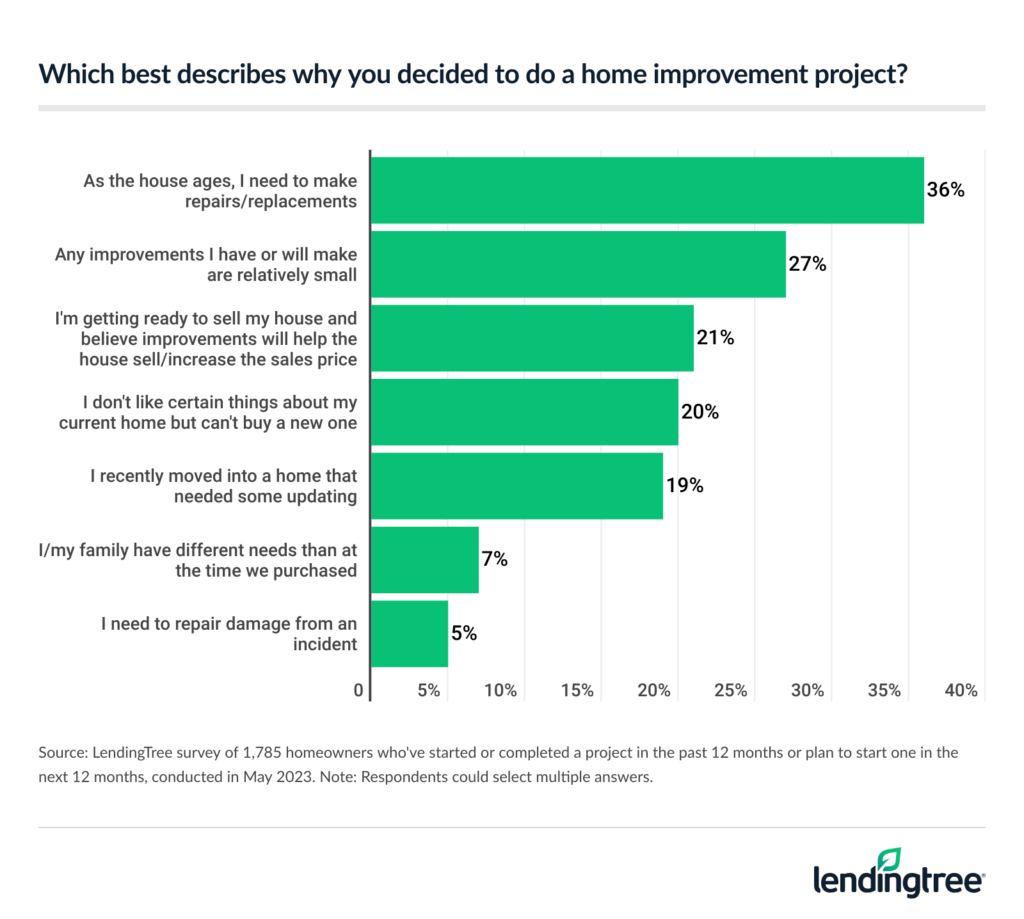

36% are taking on improvement projects to repair an aging house

When asked why they’ve worked on a project in the past year or plan to work on one in the next year, 36% say they need to make repairs as their house ages — making it the most common response. Meanwhile, 27% say their improvements are relatively small and 21% say they’re doing the repairs in preparation for selling their home.

Across generations, millennials are most likely to be preparing to sell, with 29% citing this reason. Meanwhile, baby boomers (10%) are the least likely to make improvements because they’re preparing to sell.

According to Channel, it’s certainly worthwhile for homeowners to make upgrades for this reason — particularly as projects like remodeling a bathroom or sprucing up landscaping can add more value to a home.

“For the most part, the better shape that a home is in, the more likely it is to sell and the more money it’ll be worth,” he says. “Of course, a botched or unfinished project is going to have the opposite effect. A buyer might be willing to pay more for a home with a recently remodeled kitchen, but they’re probably going to ask for a discount if the kitchen remodel is only half done or done poorly.”

By demographic, some other findings include:

- Men (27%) are more likely than women (13%) to undergo projects because they’re preparing to sell the house.

- Those with children younger than 18 (29%) are significantly more likely to be preparing to sell the house than those without children (16%) and those with children older than 18 (11%).

- Gen Xers (30%) are the most likely to make relatively small improvements.

- Baby boomers (54%) are the most likely to say they need to make repairs as the house ages.

- Women (39%) are more likely than men (33%) to say they need to make repairs as the house ages.

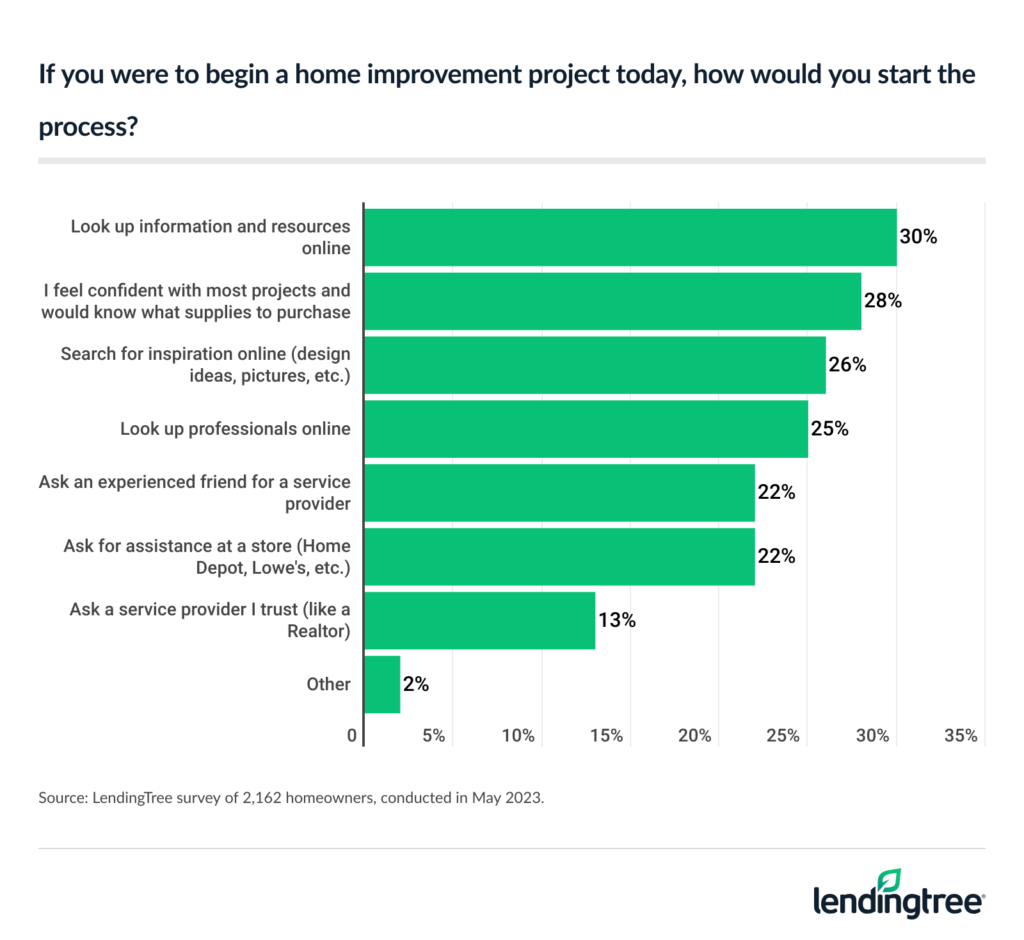

Homeowners likely to rely on the internet to start home improvement projects

The internet offers unlimited access to information — and homeowners are willing to rely on it as they undergo home improvements. When asked how they would start a home improvement project, 30% say they’d begin by looking up information and resources online. After that, 28% say they feel confident they know which supplies to purchase.

The internet also offers inspiration, though some websites and publications offer more ideas than others. Overall, 39% of homeowners say they turn to Home Depot for ideas, inspiration and information, making it the most common response. That’s followed by:

- Lowe’s (37%)

- Pinterest (36%)

- Instagram (24%)

- HGTV (19%)

- HomeAdvisor (17%)

- Better Homes and Gardens (17%)

- Good Housekeeping (11%)

- Country Living (10%)

- Architectural Digest (8%)

- This Old House (8%)

- Houzz (7%)

- Other (6%)

- House Beautiful (6%)

- Elle Decor (5%)

Meanwhile, just over a quarter (26%) say they’d just do a Google image search.

Top expert tips for undergoing home improvement projects

While home improvement projects can be costly and time-consuming, they don’t have to drain your wallet entirely. If you’re undergoing a new project, Channel recommends the following:

- Plan and don’t bite off more than you can chew. “It might be fun to dream about what your house could look like if you gave it a gut renovation,” he says. “But if you start ripping out flooring or knocking down walls without a clear plan for how to remake whatever you break, you’re going to make your life harder than it needs to be. Before you start a home improvement project, be sure it’s something you can complete without killing yourself in the process.”

- Budget accordingly. “Before taking on a project, thoroughly research how much it’ll cost, and don’t start a project if you won’t be able to afford seeing it through to completion,” Channel says. “On top of that, you should set aside some extra money if something goes wrong and your project costs more than anticipated. At the end of the day, the more you plan and the more you stick to said plan, the easier it will be for you to minimize costs and stay within your budget.”

- Be willing to hire a professional if the need arises. “Sometimes you might take on a project that looks doable, but in the end requires know-how you don’t have,” he says. “If you run into a major issue that you can’t fix on your own, hire a professional to fix it for you. It might cost more than you’d like, but leaving a project undone — especially if it involves important infrastructural elements of your house — can be a recipe for disaster. Not only can failure to call in a pro when one is necessary make your home unsafe to live in, but it can also cost you even more money in the long run.”

- Consider a home equity loan. “Americans are sitting on a ton of home equity right now, so there are plenty of opportunities for homeowners to tap into their equity to pay for a big project,” Channel says. “The biggest benefit of a home equity loan is that it can help owners access more cash than they would if they relied solely on their savings.” However, keep in mind that you have to pay back what you borrow plus interest and additional fees like closing costs. Failure to repay what you borrow can seriously hurt your credit score, and, in some cases, can result in losing your home.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,162 U.S. homeowners ages 18 to 77 from May 17-19, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

View mortgage loan offers from up to 5 lenders in minutes