38% of Americans Think Housing Market at Risk of Crashing in Next Year — 51% Say It’s More Likely Under Trump Administration

Though homebuyer demand has stalled in the face of high mortgage rates, home prices have continued to climb in many parts of the country. To some, this trend doubtlessly appears counterintuitive and alarming, with many beginning to suspect that today’s high prices will soon lead to a housing market crash.

More specifically, the latest LendingTree survey of over 2,000 respondents found that 38% of Americans think the housing market is at risk of crashing in the next year. What’s more, 36% actively want a crash to happen.

Read on to learn more about what Americans think about today’s housing market, their worries for the future and why some appear to be champing at the bit while waiting for a downturn.

Key findings

- While many Americans fear a housing crash, confidence is up from 2023. 38% of consumers think the housing market is at risk of crashing in the next year, down from 44% last year. However, when asked before the election which administration would make a housing market crash more likely, 51% answered incoming President Trump.

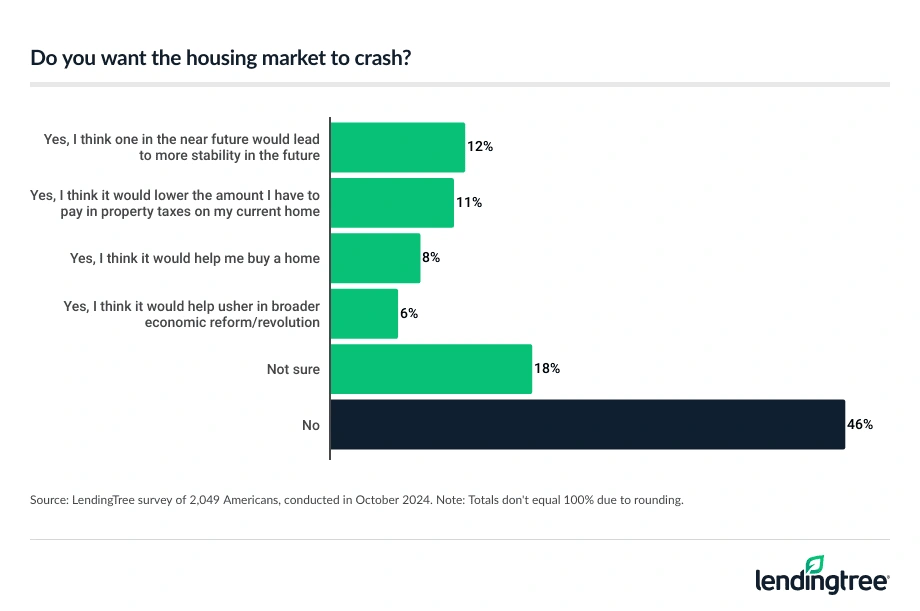

- Despite this, some Americans hope for a crash. 36% of Americans say they want the housing market to crash, with 12% thinking it would lead to future stability, 11% thinking it would lower their property taxes and 8% thinking it would help them buy a home. While some would welcome a crash, 55% of Americans believe home prices will increase in the next year.

- Some renters believe their road to homeownership is paved by a crash. 29% of renters say they think a housing crash is the only way they can afford to buy, while 35% say they’re unsure if a crash is their only path to homeownership. When nonhomeowners were asked what they’re worried about with the housing market, 42% said high home prices, 34% said homelessness and 33% said high mortgage rates.

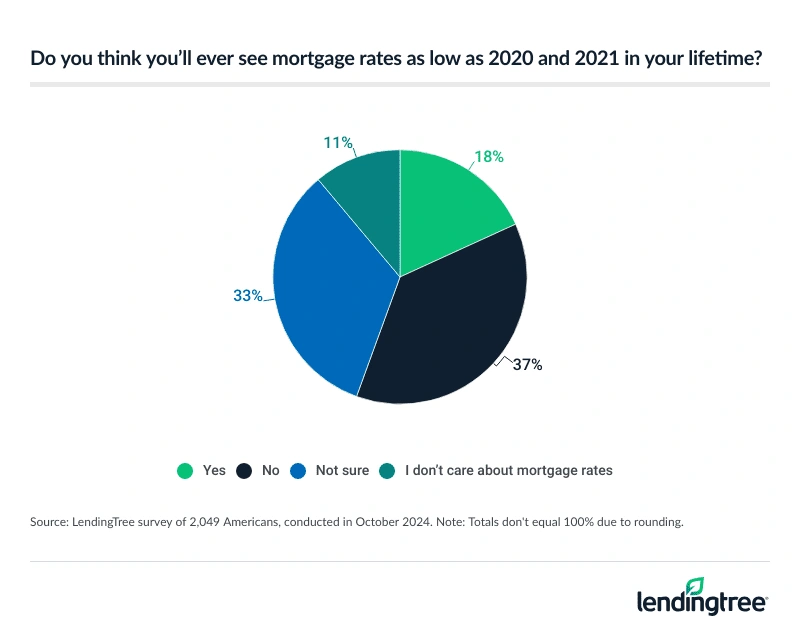

- Many homeowners secured low rates — and now they’re stuck. 46% of homeowners say low interest rates on their current mortgage are keeping them from selling, as just 14% of homeowners have an interest rate of 5.00% or higher. Additionally, 22% of homeowners say they’ll never look to buy another home, while 14% don’t think they’ll ever be able to buy again. Overall, 37% of Americans don’t think they’ll ever see rates as low as those in 2020 and 2021 again.

While unlikely, many Americans worry housing market at risk of collapsing

Though today’s housing market can be tough to contend with, the good news is it doesn’t seem to be on the precipice of a collapse. The reasons are plentiful. For example, despite high home prices and mortgage rates, mortgage delinquencies and foreclosure filings remain low.

What’s more, a majority of homeowners are sitting on rates much lower than what they could get if they bought a house today. Because mortgages in the U.S. tend to come with fixed rates, even if rates continue to climb, most people’s mortgage payments will remain more or less stable. The more stable a homeowner’s payments are, the lower their risk of being buried under rising housing costs and losing their home.

Unfortunately, the market’s strong fundamentals aren’t enough to assuage everyone’s concerns. On the contrary, 38% of Americans say the housing market is at risk of crashing in the next year. About 33% say they’re unsure about the risk, and only 29% are confident the housing market isn’t at risk of crashing in the next year.

- 2023: 44% of Americans think the housing market is at risk of crashing in the next year — and 35% hope it does

- 2022: 41% of Americans expect the housing market to crash in the next year, with the majority blaming inflation

Depending on their demographics, some Americans worry more about a crash than others.

Generationally, Gen Zers (ages 18 to 27) are the most fearful, with 44% saying the housing market is at risk of crashing in the next year. Millennials (ages 28 to 43) and Gen Xers (ages 44 to 59) are similarly worried, with 43% and 40% saying they’re concerned about a market meltdown. Baby boomers (ages 60 to 78) are more zen, however, as only 24% say they think the housing market risks collapsing in the next year.

Parents with children younger than 18 are more worried about a crash than those whose kids are grown or those who don’t have children. Respectively, 50%, 29% and 33% of respondents from these groups say the market is at risk of collapsing soon. At the same time, homeowners (43%) are more worried about a crash than nonhomeowners (32%).

Even if they’re unsure about one actively being on the horizon, 36% of Americans say they want the housing market to crash.

As for why some are eager for a market collapse, that depends. Among buyers and renters, 12% say it’s because they think one will lead to more stability. Another 11% say it’s because one will help lower the amount they pay in property taxes, while 8% believe a crash will make it easier for them to buy a home and 6% think a crash will help usher in broader economic reforms, if not an outright economic revolution.

For renters, 29% go so far as saying that a crash is the only way they’ll be able to buy a home.

Regardless of why they want one, those eager for a housing crash would almost certainly be in for a rude awakening if one happens. While the lower home prices that a serious housing market slump would bring may sound good on paper, a crash is far from ideal. As evidenced by the Great Recession, a cratering housing market would likely bring down the economy with it. This would result in unemployment rising, wage growth weakening and lenders becoming much pickier about who they lend to.

For the most part, this would mean that only those with near-perfect credit, extremely stable jobs and a lot of cash on hand would be able to take advantage of lower property values in a collapsed housing market. Put another way, barring a few possible exceptions, a crash probably wouldn’t make it easier for those struggling in today’s housing market so much as it would benefit those already well-off.

Impending crash or not, today’s housing market is anything but all sunshine and rainbows

Whether homeowners or renters, Americans are concerned about plenty of things in the current housing market.

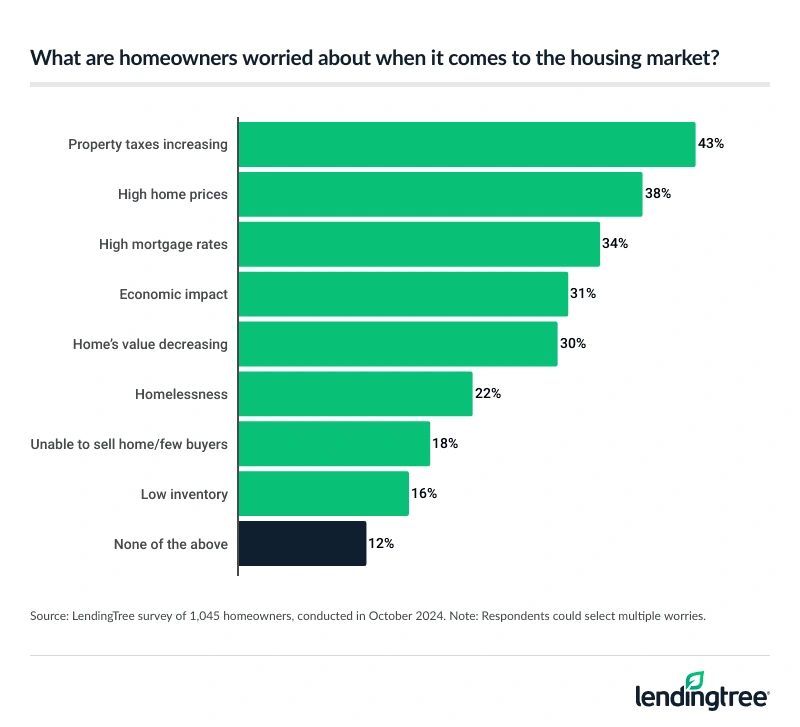

Across the board, common worries include high home prices (cited as a concern by 40% of respondents), steep mortgage rates (33%) and rising property taxes (31%). Other top-of-mind worries are the impact that today’s market is having on the broader economy (29%) and homelessness (28%).

For those who own a home, the biggest concerns are rising property taxes (43%), high home prices (38%) and steep mortgage rates (34%). Given how much more expensive the market has gotten in recent years, it makes sense that these cost-centric worries are so prevalent.

For nonhomeowners, high home prices (42%), homelessness (34%) and high mortgage rates (33%) are the biggest concerns.

Amid some optimism, Americans have plenty of worries about housing market’s future

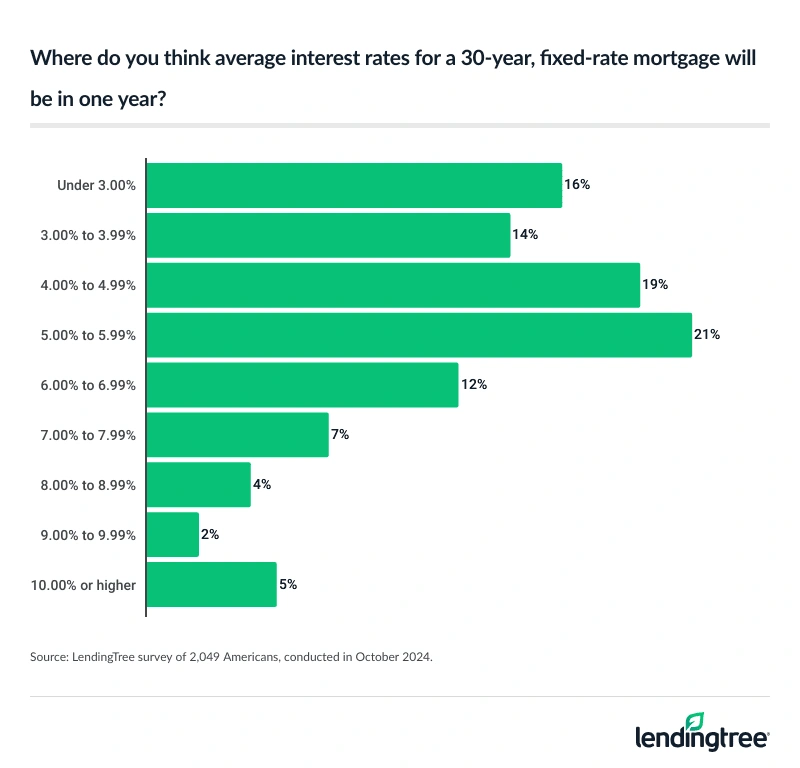

More than half (55%) of Americans think home prices will increase next year, while 30% expect that the average interest rate on a 30-year, fixed-rate mortgage will remain above 6.00% in 12 months.

A majority (70%) think mortgage rates will trend lower after a year, but 37% remain unconvinced they’ll ever see mortgage rates as low as they were in 2020 and 2021 again.

Our survey (fielded before the election) also indicates that Americans are more pessimistic about how the future Trump administration will impact the housing market and the broader economy than they are optimistic.

In fact, 53% of respondents said they thought the housing market and the economy would’ve done better under a potential Harris administration. Meanwhile, 51% said the housing market would be more likely to crash under the upcoming Trump administration.

55% of Republicans thought the housing market was more likely to crash under Harris, versus 45% who thought it was more likely to crash under Trump. That’s compared with 58% of Democrats who thought a crash was more likely under Trump, and 42% who thought it was more likely under Harris.

This shows that even when accounting for political parties, Americans are still relatively split on which candidate would have been more likely to usher in a housing market downturn. Of course, Americans aren’t completely without hope.

As mentioned, a majority of Americans think that mortgage rates will fall over the coming year. On top of that, even though 46% of current homeowners say the low rate on their current mortgage is keeping them in their home, 47% of the nation’s homeowners think they’ll still be able to buy again at some point in the future.

Feelings aside, it’s important to remember that nobody can predict the future. While there are plenty of causes for concern — high rates may be here to stay, and economic shocks resulting from mass deportations and high tariffs might put 2025’s economy on shakier ground than 2024’s — that doesn’t mean the sky is necessarily going to fall.

Tips for those thinking about a housing market downturn

If you’re losing sleep thinking about an impending housing market crash or rooting for one to happen, the following tips can help you better understand and prepare for what the future might bring.

- If you think you want the housing market to crash, reconsider. As mentioned, while the potential for lower prices may seem tantalizing at first glance, a housing crash is much more likely to make your life more difficult than it is to improve it. The broader economic turmoil born out of a crash will make it more difficult for you to keep your current home and harder to get a mortgage on a new property. Remember, lower home prices are unlikely to benefit you if you don’t have a job and/or can’t get a mortgage.

- Know that your choices today can help you prepare for an uncertain future. The more time you give yourself to shore up your savings, pay down other debts and strengthen your credit score, the better off you’ll likely be regardless of what the economy is doing a year from now. It’s also worth remembering that crashes don’t last forever, and that many of the struggles brought about by a serious housing market downturn would probably only be temporary.

- Remember, housing is local. Though national trends exist, housing markets have their quirks, and what happens in one local market may not happen in other areas. With that in mind, know that even if home prices in a given area are coming down, that a) doesn’t mean that that individual market is outright crashing and b) doesn’t mean that home prices across the country will soon trend down. Crash or not, the better you understand your local housing market’s quirks and trends, the more easily you’ll be able to navigate through it.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,049 U.S. consumers ages 18 to 78 from Oct. 14 to 15, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

View mortgage loan offers from up to 5 lenders in minutes