How to Read a Mortgage Statement

Your monthly mortgage statement provides valuable information about your home loan. Knowing how to read your mortgage statements can help you keep track of how quickly you’re paying off your loan, as well as help you spot any updated information — for example, changes to your payment amount or who you should make your payments to.

What is a mortgage statement?

A mortgage statement is an accounting of all of the details about your mortgage, including the current balance owed, interest charges, interest rate changes (if you have an adjustable-rate mortgage) and a breakdown of your current and past payments.

Mortgage lenders are required by law to provide you with a mortgage statement for each billing cycle during the life of your loan. The document includes specific loan information in a standard format, so you know how each dollar of your mortgage payment is spent.

A mortgage statement is a document important to most homeowners who are still paying off a home loan, since it tells you how much you owe and other vital loan information. On the other hand, a mortgage interest statement is a document you may need for your taxes.

A mortgage interest statement is a tax form. Also known as Form 1098, it lists how much you paid in mortgage interest to a given source during the tax year. The IRS requires each lender to send you a separate form.

Reviewing these forms can help you decide whether you should itemize your deductions and claim the home mortgage interest deduction, or go with the standard deduction.

What does a mortgage statement look like?

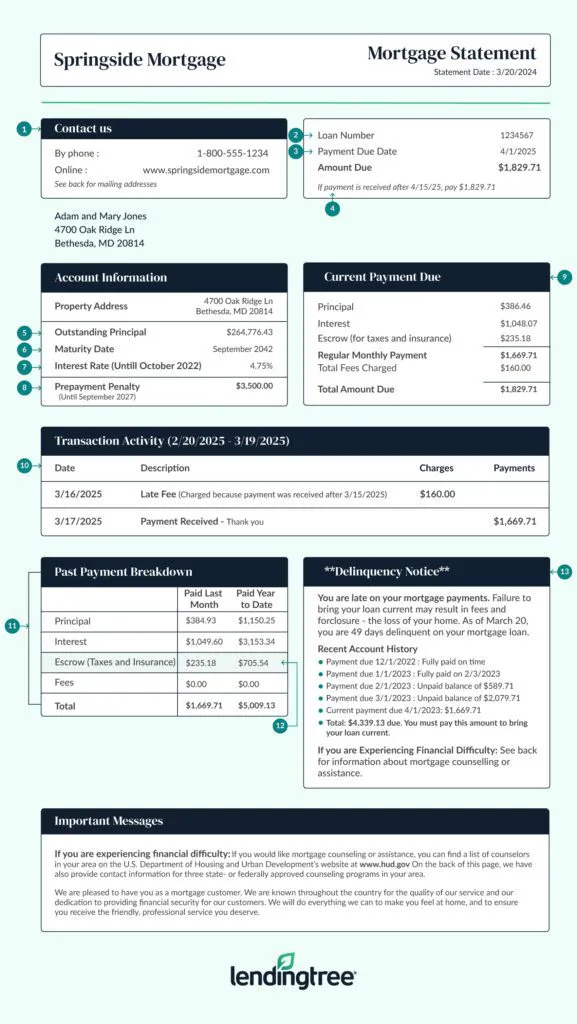

Follow the numbers in the graphic below for a section-by-section breakdown of what our sample mortgage statement tells you.

1. Mortgage servicer information

A mortgage servicer is the company that collects your payments and prepares your monthly statements. (Note that it may not be the same company you closed your loan with.) The servicer’s contact information should be displayed here, so you can reach them with any questions about the statement.

2. Account number

Your account or loan number is tied to your name and the home that’s financed by the loan. You’ll need to have the loan number handy if you’re contacting your loan servicer with questions about your mortgage.

3. Payment due date and amount due

Mortgage payments are typically due on the first of any given month, although most servicers give you a grace period of two weeks past the due date before you’re charged a late fee. However, as long as you make the payment within 30 days of the due date, your credit report won’t show the payment as late.

4. Late payment date

Your mortgage payment is technically late if you don’t pay it by the due date. Your statement will include an “if paid after” amount that includes a late fee, which is typically charged if you make your payment 15 or more days late.

5. Outstanding principal amount

This is the amount you still owe on your mortgage after making your monthly payment. Each payment you make reduces your principal, and you can make extra payments to pay off your mortgage earlier. However, you may need to notify your servicer in writing that you want the extra funds applied to your principal balance.

6. Maturity date

Some statements may include your maturity date, so you’ll know how close or far you are from paying your balance in full. Keep in mind that if you make extra payments, the date will be sooner since you’re paying off the loan faster.

7. Interest rate

Interest is the cost you pay to borrow money, and it’s based on the mortgage rate you locked in before you closed on your loan. If you look at the amortization schedule you should have received with your closing papers, you’ll notice that most of your payment goes toward interest in the early years of your loan.

Keep an eye on this section if you have an adjustable-rate mortgage (ARM), so you’re aware of rate changes. Your loan servicer is required to send you notice of upcoming changes at least 60 days before the payment due date tied to the first and subsequent rate adjustments. Paying attention to this information may help you decide if it’s time to refinance from an ARM to a fixed-rate loan.

8. Prepayment penalty

Prepayment penalties aren’t allowed on most standard loan programs. However, if you took out a non-QM loan, there’s a chance your lender may have added a requirement that you pay a fee if your loan is paid off within a set time period (usually three to five years).

9. Current payment due

This section gives you the itemized breakdown of each component of your monthly payment. You’ll see how much principal and interest is being applied to your loan, as well as how much is being allocated to pay your property taxes and insurance — if you have an escrow account. Any late fees you owe are also included in this breakdown.

10. Transaction activity

You can see how last month’s payment was applied in this section, and whether you were charged a late fee. If you’re refinancing your loan, your new lender may need a copy of your mortgage statement to confirm you’ve made your most recent payment on time.

11. Past payments breakdown

You can track how much money you spent on each part of your most recent mortgage payment, as well as the total dollar amount you’ve spent so far this year on all of the payments you’ve made.

12. Escrow

If your lender pays your property tax and homeowners insurance bills when they come due, then you have an escrow account. The funds in an escrow account are yours, but your lender or servicer pays these bills out of your escrow account in order to ensure timely payments.

13. Delinquency information

Although lenders generally report a payment to the credit bureaus if it’s at least 30 days late, you won’t get a delinquency notice until after your loan is 45 days late. A late mortgage payment damages your credit score, and the effects may be felt for up to three years. In addition, although it’s possible to refinance a mortgage loan with late payments listed in your payment history, it can be harder to do if the late payments are within the last 12 months.

Other items you may see on a mortgage statement

-

Important information and resources for struggling borrowers

Loan servicers often include additional details at the end of the mortgage statement, which could cover anything from more detail about how to make partial payments to how to find a housing counselor if you’re having difficulty making your payments. -

Escrow balance

Lenders aren’t required to list your escrow account’s current balance on your mortgage statements. However, you should receive an escrow account statement annually that details whether you have too much, too little or enough to cover future payments. If your account balance is too low, you might need to pay extra for a few months or cover the difference with a lump-sum payment. If you have enough extra in the account, you could receive a refund check.

Checklist: What to do when you read your monthly mortgage statement

It may be easy to just put your monthly payment on autopay and ignore your monthly mortgage statements — but there are some good reasons to pay attention to it. Here’s what you should do each month with the information in your most recent statement:

- Check for mistakes. With millions of loans to track every year, mortgage servicers sometimes make mistakes. Checking your monthly statement will help you spot errors so you can get them fixed as soon as possible.

- See if your loan servicer is changing. You’ll typically get a separate notice at least 15 days before your loan servicing is switched to a new company, but your mortgage statement may also give you a heads up about an upcoming change. This helps you avoid scrambling at the last minute because you sent money to a company that’s no longer processing your payments.

- Plan for increases in your payment. Whether it’s an increase in property taxes or an upcoming ARM adjustment, you can tweak your budget to make sure you have the funds necessary to cover a higher payment.

- Consider shopping for new homeowners insurance. If your payment is on the rise due to a jump in your home insurance, it may be time to shop around for a better premium.

How to make a mortgage payment

Most lenders provide multiple ways of making your mortgage payments, including:

- Online: The simplest way to make payments is online through your loan servicer’s website. Consider setting up automatic payments to ensure you pay on time. You can also set up the payment through your bank’s bill pay system. Just keep an eye on your mortgage statements for any changes to the address or loan number if your loan servicing is sold, so your payments go to the right place.

- By mail: Your mortgage statement will probably have a portion that you can detach and return by mail with your payment. If paying by mail, allow enough time before your mortgage due date. If you’re close to the due date or the end of the grace period, get a receipt from the post office or consider using next-day delivery.

- By phone: Some lenders provide an option to call and make your mortgage payments over the phone. Just be sure your loan servicer doesn’t charge a fee for this service.

- In person: If your lender or bank has brick-and-mortar locations, you can make your mortgage payments in person. And you should be sure to get a receipt: The law requires your payment to be credited the day you make it, so if your servicer charges a late fee, the receipt is your proof to reverse the late charge.

View mortgage loan offers from up to 5 lenders in minutes