Home Values in Most Expensive Towns Rival Those in Biggest Metros

Many Americans assume small towns offer more affordable housing than big cities, but that’s not always the case.

A LendingTree analysis of home values reveals that prices in some of the nation’s most expensive towns can rival those in major metros. The median home value in Nantucket, Mass., the priciest town in the U.S., is nearly $1.4 million — higher than in San Jose, Calif., the country’s most expensive metro.

Our study examines where small-town home values are highest, identifies affordable areas among the country’s most expensive towns and provides guidance on navigating the homebuying process in these high-cost areas.

Key findings

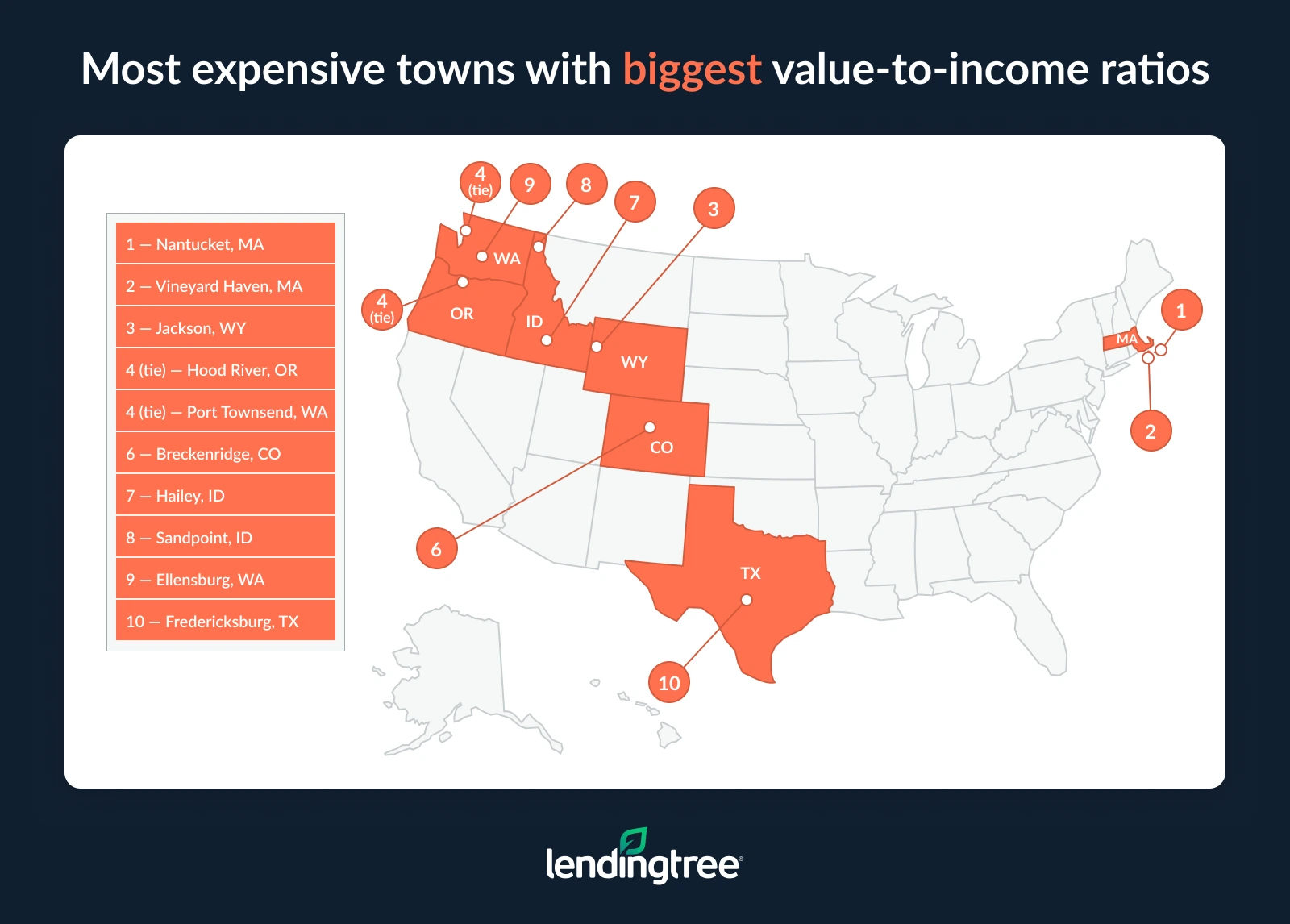

- Nantucket, Mass., Vineyard Haven, Mass., and Jackson, Wyo., are the most expensive U.S. towns. Their median home values are $1,387,000, $1,104,100 and $954,600, respectively. These towns’ housing costs rival those in some of the biggest metros, with Nantucket near San Jose ($1,342,700), Vineyard Haven near San Francisco ($1,113,800) and Jackson near Los Angeles ($825,300).

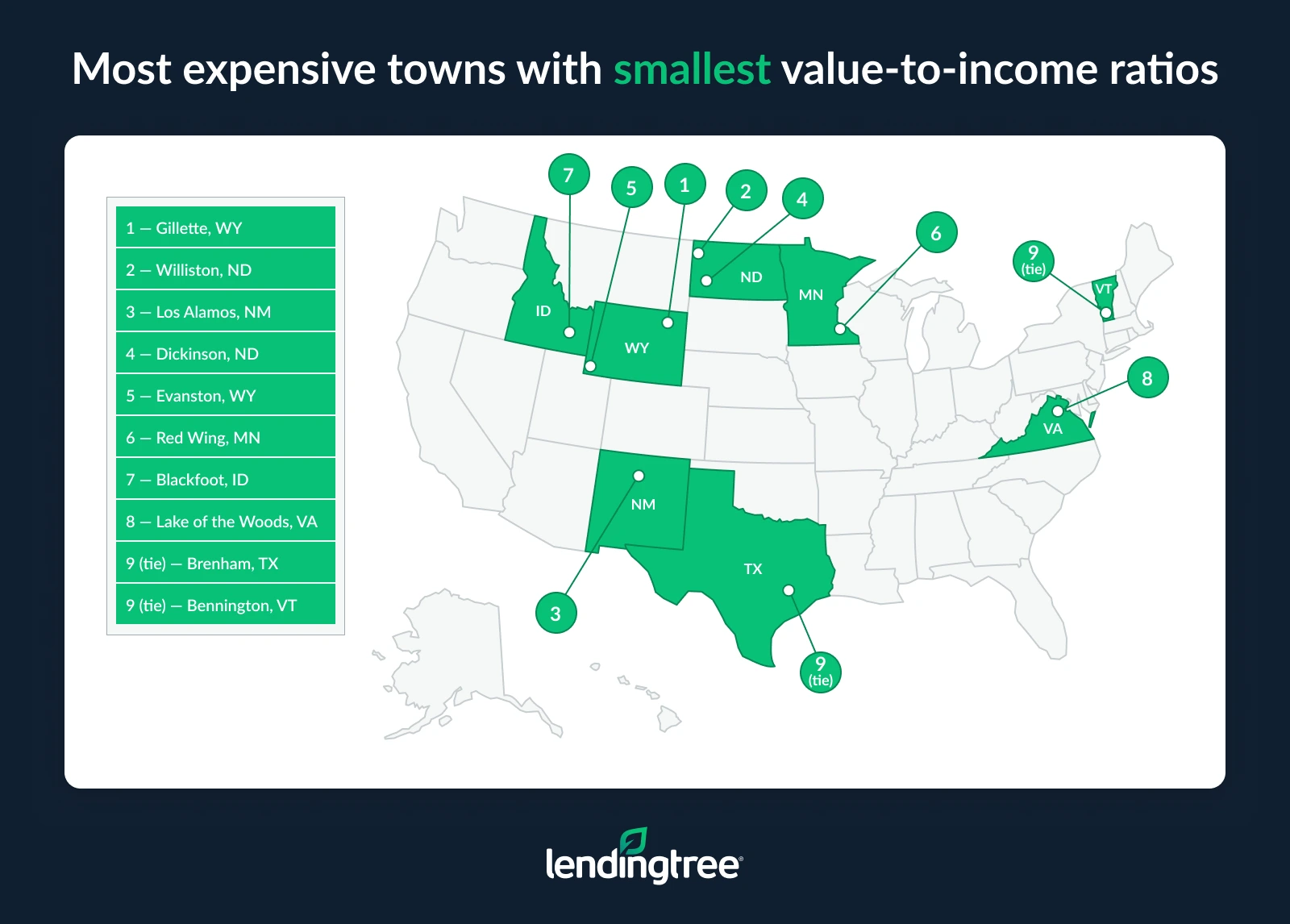

- While some of the featured towns have staggering housing prices, not all are sky-high. Bennington, Vt., Blackfoot, Idaho, and Evanston, Wyo., see more modest median home values of $257,400, $258,000 and $258,900, respectively. While more affordable than the other most expensive towns, these are still pricier than more than 250 micropolitan areas with 10,000 to 50,000 residents.

- Despite relatively high incomes, residents of Nantucket, Vineyard Haven and Jackson face severe affordability challenges. These towns have median value-to-income ratios of 11.58, 10.79 and 8.95, respectively. Homes are valued much higher than the median household incomes for these towns’ residents of $119,750, $102,348 and $106,679, respectively.

- Relative to earnings, Gillette, Wyo., and Williston, N.D., provide some of the most affordable housing opportunities among the most expensive towns. With median home values of $266,400 and $267,800 and value-to-income ratios of 2.80 and 2.97, respectively, these towns rank among the most financially accessible.

Homes in most expensive towns valued at $1 million-plus

Contrary to the common belief that towns and suburbs offer better home values, housing costs in some of the nation’s priciest towns rival those in major metros.

Two Massachusetts towns — Nantucket and Vineyard Haven — top the list. Nantucket’s median home value is $1,387,000, edging out San Jose, Calif., at $1,342,700. Vineyard Haven follows at $1,104,100, close to San Francisco’s $1,113,800. Jackson, Wyo., ranks third, with a median home value of $954,600 — higher than Los Angeles’ $825,300.

To arrive at our rankings and comparisons, our analysis used median home values from the U.S. Census Bureau 2023 American Community Survey (ACS) with five-year estimates. We only assessed towns with populations between 10,000 and 50,000, comparing them with the nation’s 50 largest metros.

Closer look: America’s 3 most expensive towns

| Stats | Nantucket, MA | Vineyard Haven, MA | Jackson, WY |

|---|---|---|---|

| Population | 14,299 | 20,751 | 35,459 |

| Median home value | $1,387,000 | $1,104,100 | $954,600 |

| Median household income | $119,750 | $102,348 | $106,679 |

| Median value-to-income ratio | 11.58 | 10.79 | 8.95 |

| Metro with comparable median home value | San Jose, CA | San Francisco, CA | Los Angeles, CA |

| Median home value (comparable metro) | $1,342,700 | $1,113,800 | $825,300 |

| Median household income (comparable metro) | $157,444 | $133,780 | $93,525 |

| Median value-to-income ratio (comparable metro) | 8.53 | 8.33 | 8.82 |

Despite their small size, Nantucket and Vineyard Haven have home prices that are anything but modest. Property values in these two island towns are driven by a combination of factors: wealthy second-home buyers, limited housing inventory and strong seasonal tourism.

For instance, 68% of homes in Nantucket are seasonally occupied, according to Nantucket Current. And in Martha’s Vineyard, where Vineyard Haven is located, the year-round population of 23,000 swells to as many as 200,000 during the summer months, according to its Chamber of Commerce. Their historic New England charm, beach access and exclusivity make them magnets for affluent buyers, pushing median home values well above $1 million — and out of reach for many year-round residents.

Out West, Jackson attracts ultra-wealthy residents seeking scenic beauty, outdoor adventure and tax advantages (Wyoming has no state income tax). With most of the surrounding land federally protected, the limited supply of available property has sent home values soaring.

“When housing prices are sky-high, it creates real challenges for people in that area,” says Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.”

“Money that goes to paying exorbitant mortgage bills or rent payments is money that can’t go toward building emergency funds, investing for retirement or college, or other financial goals,” he says. “Of course, if you’re as wealthy as some of the residents of Jackson and Nantucket, those things may not matter much. However, they do for most people.”

Among most expensive towns, home values as low as $257,400

While some of the country’s priciest towns have million-dollar homes, they don’t all have sky-high home values. In Bennington, Vt., Blackfoot, Idaho, and Evanston, Wyo., median home values are far more modest — $257,400, $258,000 and $258,900, respectively. They fall well below the national median sales price of homes sold in 2023 — $426,525 — despite ranking among the 50 most expensive towns.

These towns’ home values are comparable with San Antonio ($258,700), the nation’s 24th-largest metro. And while a price under $300,000 may seem affordable, these towns are still more expensive than more than 250 micropolitan areas with populations between 10,000 and 50,000.

Affordability a challenge in most expensive towns

To assess home affordability, our study compared median home values to median household incomes to calculate a value-to-income ratio for each town and metro. The higher the ratio, the greater the affordability challenge.

In addition to having the highest home values among small towns, Nantucket, Vineyard Haven and Jackson also have the highest value-to-income ratios: 11.58, 10.79 and 8.95, respectively. While median household incomes in these towns — $119,750, $102,348 and $106,679 — exceed the national figure ($80,610 in 2023), they fall well short of supporting home prices that approach or exceed $1 million.

“That means that homeownership isn’t within reach for the typical person in those areas,” Schulz says. “Even though those places have some of the highest median incomes in America, they’re not enough to be able to afford to buy a home there.”

Nantucket, Vineyard Haven and Jackson all have higher value-to-income ratios than their comparably priced large metros — San Jose (8.53), San Francisco (8.33) and Los Angeles (8.82).

Among the country’s most expensive towns, a few stand out for offering relatively good value. In Gillette, Wyo., the median home value is $266,400, with a median household income of $95,253 — resulting in a value-to-income ratio of just 2.80. Similarly, Williston, N.D., has a median home value of $267,800 and a median income of $90,224, yielding a ratio of 2.97. These figures indicate greater housing affordability compared to other towns in our rankings.

Full rankings: Most expensive towns

| Rank | Town | Population | Median home value | Median household income | Median value-to-income ratio | Metro with comparable median home value | Median home value (comparable metro) | Median household income (comparable metro) | Median value-to-income ratio (comparable metro) |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Nantucket, MA | 14,299 | $1,387,000 | $119,750 | 11.58 | San Jose, CA | $1,342,700 | $157,444 | 8.53 |

| 2 | Vineyard Haven, MA | 20,751 | $1,104,100 | $102,348 | 10.79 | San Francisco, CA | $1,113,800 | $133,780 | 8.33 |

| 3 | Jackson, WY | 35,459 | $954,600 | $106,679 | 8.95 | Los Angeles, CA | $825,300 | $93,525 | 8.82 |

| 4 | Breckenridge, CO | 38,268 | $706,800 | $102,233 | 6.91 | Seattle, WA | $673,500 | $112,594 | 5.98 |

| 5 | Hood River, OR | 23,958 | $571,200 | $82,095 | 6.96 | Denver, CO | $570,300 | $102,339 | 5.57 |

| 6 | Hailey, ID | 31,010 | $544,300 | $81,389 | 6.69 | Washington, DC | $553,000 | $123,896 | 4.46 |

| 7 | Port Townsend, WA | 33,313 | $495,100 | $71,143 | 6.96 | Riverside, CA | $493,600 | $86,031 | 5.74 |

| 8 | Steamboat Springs, CO | 38,248 | $482,300 | $93,984 | 5.13 | Salt Lake City, UT | $478,200 | $95,045 | 5.03 |

| 9 | Ellensburg, WA | 44,736 | $459,900 | $69,928 | 6.58 | Salt Lake City, UT | $478,200 | $95,045 | 5.03 |

| 10 | Los Alamos, NM | 19,374 | $452,500 | $143,188 | 3.16 | Austin, TX | $434,800 | $97,638 | 4.45 |

| 11 | Astoria, OR | 41,343 | $437,800 | $68,705 | 6.37 | Austin, TX | $434,800 | $97,638 | 4.45 |

| 12 | Sandpoint, ID | 49,456 | $433,400 | $65,168 | 6.65 | Austin, TX | $434,800 | $97,638 | 4.45 |

| 13 | Juneau, AK | 31,969 | $432,500 | $100,513 | 4.30 | Austin, TX | $434,800 | $97,638 | 4.45 |

| 14 | Fredericksburg, TX | 27,202 | $432,300 | $67,799 | 6.38 | Austin, TX | $434,800 | $97,638 | 4.45 |

| 15 | Kill Devil Hills, NC | 37,534 | $425,400 | $81,214 | 5.24 | Austin, TX | $434,800 | $97,638 | 4.45 |

| 16 | Easton, MD | 37,707 | $398,300 | $84,378 | 4.72 | Las Vegas, NV | $400,800 | $73,845 | 5.43 |

| 17 | Ketchikan, AK | 13,870 | $379,000 | $89,155 | 4.25 | Raleigh, NC | $381,000 | $96,066 | 3.97 |

| 18 | Cody, WY | 30,109 | $374,200 | $70,533 | 5.31 | Baltimore, MD | $373,300 | $97,300 | 3.84 |

| 19 | Brookings, OR | 23,463 | $366,700 | $64,769 | 5.66 | Fresno, CA | $363,300 | $71,897 | 5.05 |

| 20 | Montrose, CO | 43,272 | $357,900 | $66,072 | 5.42 | Minneapolis, MN | $354,400 | $98,180 | 3.61 |

| 21 | Taos, NM | 34,516 | $354,000 | $58,908 | 6.01 | Minneapolis, MN | $354,400 | $98,180 | 3.61 |

| 22 | Sheridan, WY | 31,585 | $352,200 | $70,855 | 4.97 | Minneapolis, MN | $354,400 | $98,180 | 3.61 |

| 23 | Moscow, ID | 40,315 | $342,500 | $65,179 | 5.25 | Orlando, FL | $338,500 | $75,611 | 4.48 |

| 24 | Bishop, CA | 18,803 | $338,400 | $72,432 | 4.67 | Orlando, FL | $338,500 | $75,611 | 4.48 |

| 25 | Lake of the Woods, VA | 37,208 | $337,300 | $94,175 | 3.58 | Orlando, FL | $338,500 | $75,611 | 4.48 |

| 26 | Brevard, NC | 33,243 | $336,100 | $64,523 | 5.21 | Atlanta, GA | $335,100 | $86,338 | 3.88 |

| 27 | The Dalles, OR | 26,603 | $332,500 | $63,602 | 5.23 | Dallas, TX | $330,300 | $87,155 | 3.79 |

| 28 | Pullman, WA | 47,042 | $323,300 | $52,893 | 6.11 | Richmond, VA | $325,800 | $84,405 | 3.86 |

| 29 | Laramie, WY | 37,713 | $322,100 | $59,881 | 5.38 | Charlotte, NC | $319,400 | $80,201 | 3.98 |

| 30 | Crescent City, CA | 27,293 | $319,600 | $66,780 | 4.79 | Charlotte, NC | $319,400 | $80,201 | 3.98 |

| 31 | Spearfish, SD | 26,574 | $310,800 | $66,766 | 4.66 | Jacksonville, FL | $308,900 | $77,013 | 4.01 |

| 32 | Fort Morgan, CO | 29,186 | $299,300 | $75,407 | 3.97 | Chicago, IL | $301,900 | $88,850 | 3.40 |

| 33 | Fallon, NV | 25,614 | $298,000 | $73,268 | 4.07 | Chicago, IL | $301,900 | $88,850 | 3.40 |

| 34 | Alexandria, MN | 39,354 | $291,700 | $77,264 | 3.78 | Milwaukee, WI | $283,800 | $76,404 | 3.71 |

| 35 | Cañon City, CO | 49,394 | $282,100 | $61,027 | 4.62 | Milwaukee, WI | $283,800 | $76,404 | 3.71 |

| 36 | Mountain Home, ID | 29,046 | $278,300 | $58,976 | 4.72 | Houston, TX | $275,200 | $80,458 | 3.42 |

| 37 | Petoskey, MI | 34,159 | $275,300 | $73,724 | 3.73 | Houston, TX | $275,200 | $80,458 | 3.42 |

| 38 | Vernal, UT | 36,458 | $270,200 | $69,861 | 3.87 | Columbus, OH | $274,300 | $79,847 | 3.44 |

| 39 | Brenham, TX | 36,156 | $270,100 | $75,085 | 3.60 | Columbus, OH | $274,300 | $79,847 | 3.44 |

| 40 | Red Wing, MN | 47,844 | $269,400 | $82,749 | 3.26 | Kansas City, MO | $265,400 | $81,927 | 3.24 |

| 41 | Williston, ND | 39,368 | $267,800 | $90,224 | 2.97 | Kansas City, MO | $265,400 | $81,927 | 3.24 |

| 42 | Detroit Lakes, MN | 35,260 | $266,900 | $71,117 | 3.75 | Kansas City, MO | $265,400 | $81,927 | 3.24 |

| 43 | Gillette, WY | 47,018 | $266,400 | $95,253 | 2.80 | Kansas City, MO | $265,400 | $81,927 | 3.24 |

| 44 | Brattleboro, VT | 45,913 | $265,100 | $68,021 | 3.90 | Kansas City, MO | $265,400 | $81,927 | 3.24 |

| 45 | La Grande, OR | 26,192 | $260,500 | $64,212 | 4.06 | Grand Rapids, MI | $261,600 | $80,296 | 3.26 |

| 46 | Dickinson, ND | 38,107 | $260,400 | $82,133 | 3.17 | Grand Rapids, MI | $261,600 | $80,296 | 3.26 |

| 47 | Susanville, CA | 31,177 | $259,500 | $64,395 | 4.03 | San Antonio, TX | $258,700 | $74,297 | 3.48 |

| 48 | Evanston, WY | 23,193 | $258,900 | $81,526 | 3.18 | San Antonio, TX | $258,700 | $74,297 | 3.48 |

| 49 | Blackfoot, ID | 48,993 | $258,000 | $76,842 | 3.36 | San Antonio, TX | $258,700 | $74,297 | 3.48 |

| 50 | Bennington, VT | 37,312 | $257,400 | $71,494 | 3.60 | San Antonio, TX | $258,700 | $74,297 | 3.48 |

Buying a home in an expensive town: Top expert tips

Even in high-priced markets, there are ways to make smart, strategic homebuying decisions. These tips will help you navigate the challenges of buying in an expensive town.

- Shop around. “Comparison shopping is a good idea regardless of where you live,” Schulz says. “The more expensive the home, the more important it is to rate shop. Even a tiny fraction of a percentage point saved on a million-plus-dollar home spread out over 30 years adds up.” Comparing offers from at least three lenders will help you identify the most competitive interest rate and loan terms, boosting your buying power.

- Explore local loan programs. Some high-cost areas offer special programs for first-time buyers or low- and moderate-income borrowers, which can help reduce down payments, lower closing costs or offset interest rates.

- Factor in total housing costs. Don’t focus solely on the sale price. Property taxes, home insurance and maintenance — especially in remote or seasonal markets — can significantly impact your monthly expenses. “Doing your homework to understand what you can afford is crucial, especially in towns with crazy-high costs of living,” Schulz says. “If you understand that, you’re far less likely to be swayed if a bank offers to lend you more. Sure, it can be flattering to be told by a lender that you can get a million-dollar mortgage, but that doesn’t mean you need it or can afford it.”

- Widen your search. Prices often drop just outside high-demand areas. Nearby communities may offer similar amenities and lifestyles with more affordable options. “Flexibility is incredibly important,” Schulz says. “As much as you may want to live in that amazing little town, it might not make financial sense. However, if you’re willing to live just outside that town or a short drive away, the cost could change dramatically.”

- Partner with a local real estate agent. A knowledgeable agent can help you spot overlooked opportunities, understand local pricing trends and negotiate effectively in competitive markets.

Sure, it can be flattering to be told by a lender that you can get a million-dollar mortgage, but that doesn’t mean you need it or can afford it.

Methodology

LendingTree researchers analyzed the U.S. Census Bureau 2023 American Community Survey (ACS) with five-year estimates. Analysts used micropolitan-level data for areas with populations ranging from 10,000 to 50,000 to approximate town-level data.

The home value-to-income ratio was calculated for each town and comparable metro by dividing an area’s median home value by its median household income. The larger the ratio, the more expensive homes are relative to an area’s median household income.

Towns were compared to the metro — among the 50 most populated — closest in median home value in 2023.

View mortgage loan offers from up to 5 lenders in minutes