LendingTree Finds That Google Searches for ‘Homes for Sale’ Have Grown from April in Most Areas

Since the start of the COVID-19 crisis, millions of Americans have modified their spending habits, with many putting their plans to buy a home on hold. However, as states begin to reopen and stay-at-home orders expire, some house hunters may be eager to resume their search.

One way to gauge people’s interest in purchasing homes is to measure internet searches, especially since many homebuyers start the process online. With that in mind, LendingTree analyzed Google search data to see how popular the search term “homes for sale” is in 50 of the nation’s largest metros. Google defines search popularity using “search-interest values.” These values exist on a scale of 0 to 100; 100 means the search term is at peak popularity.

LendingTree found that searches for the term “homes for sale” have increased from their 2020 lows in each metro featured in this study. Furthermore, interest in the term also rose from April to May in all but five metros.

Key findings

- Searches for “homes for sale” rose from their 2020 lows in each metro featured in this study. The average lowest search-interest value in 2020 for all 50 metros was about 55. By the end of May, that number grew by 78.39%, to 97.

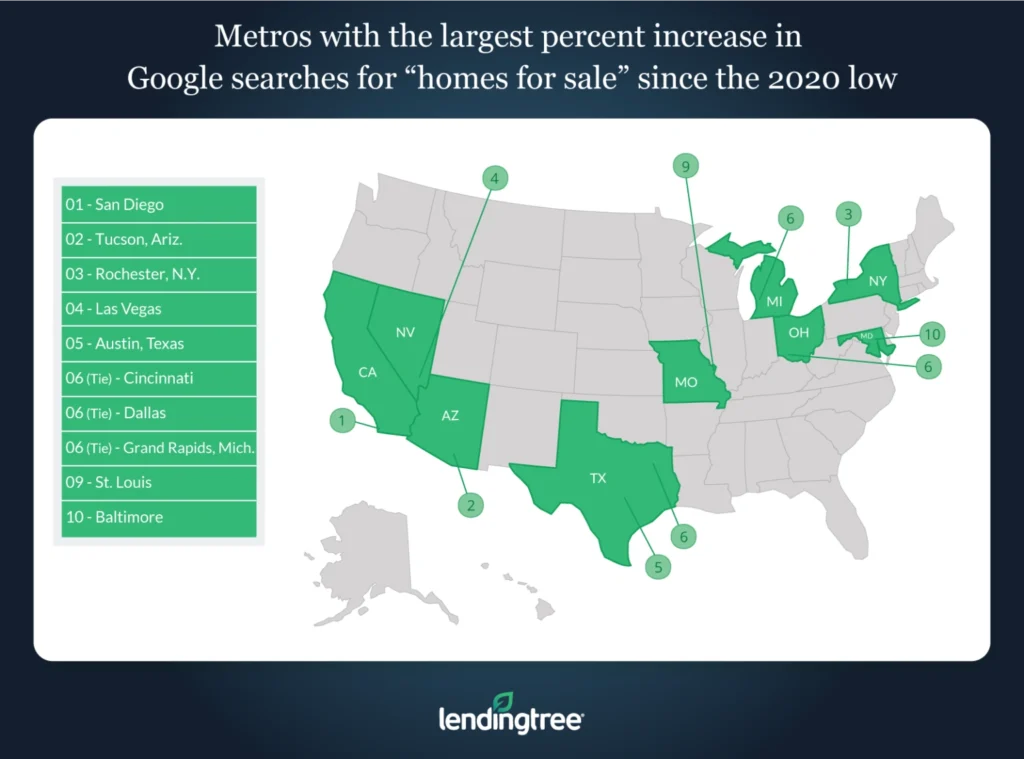

- San Diego, Tucson, Ariz. and Rochester, N.Y., saw the largest increases in search interest since their lowest points this year. On average, the search-interest values in these areas surged by 128.95% from their 2020 lows.

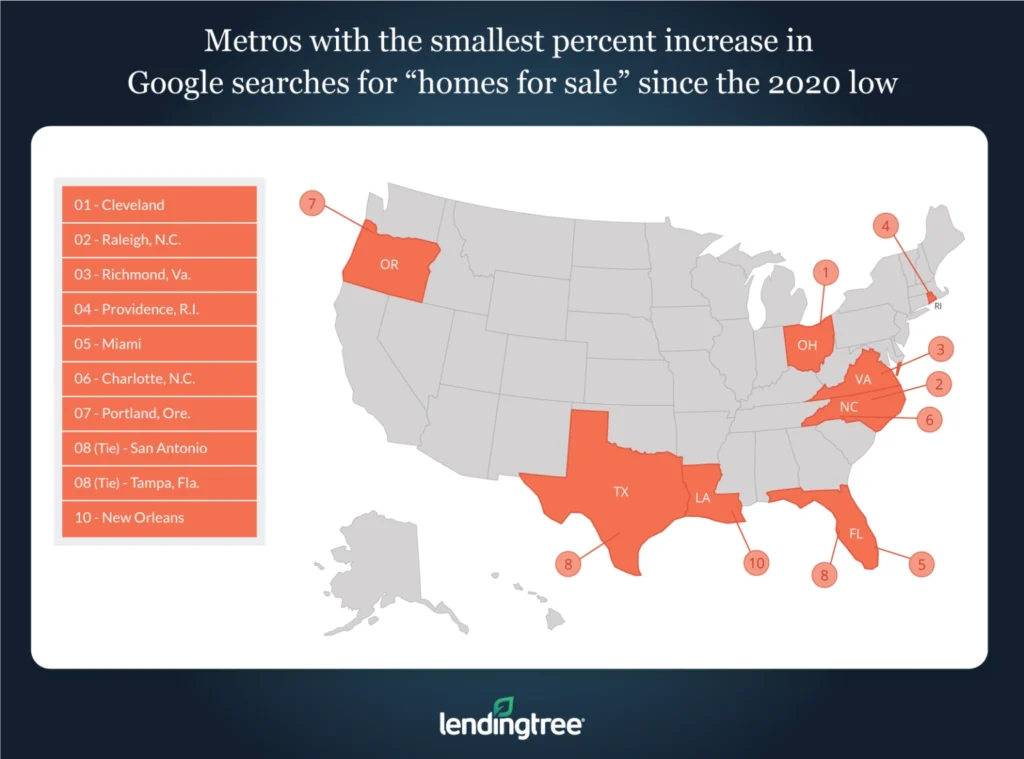

- Cleveland, Raleigh, N.C. and Richmond, Va., have seen the smallest growth in searches since their low points this year. In these three metros, the popularity of the search term increased by 49.77% from its lowest value.

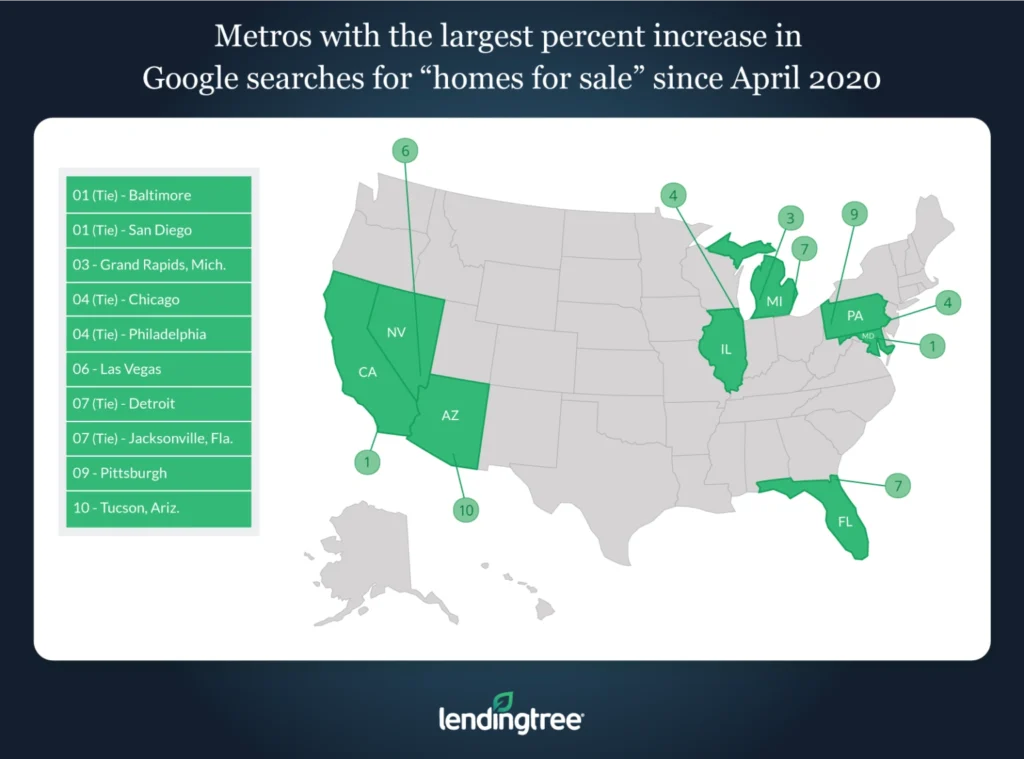

- Baltimore, San Diego and Grand Rapids, Mich., are the metros with the largest month-over-month search growth. Search-interest values in these metros grew an average of 44.99% from the end of April to the end of May.

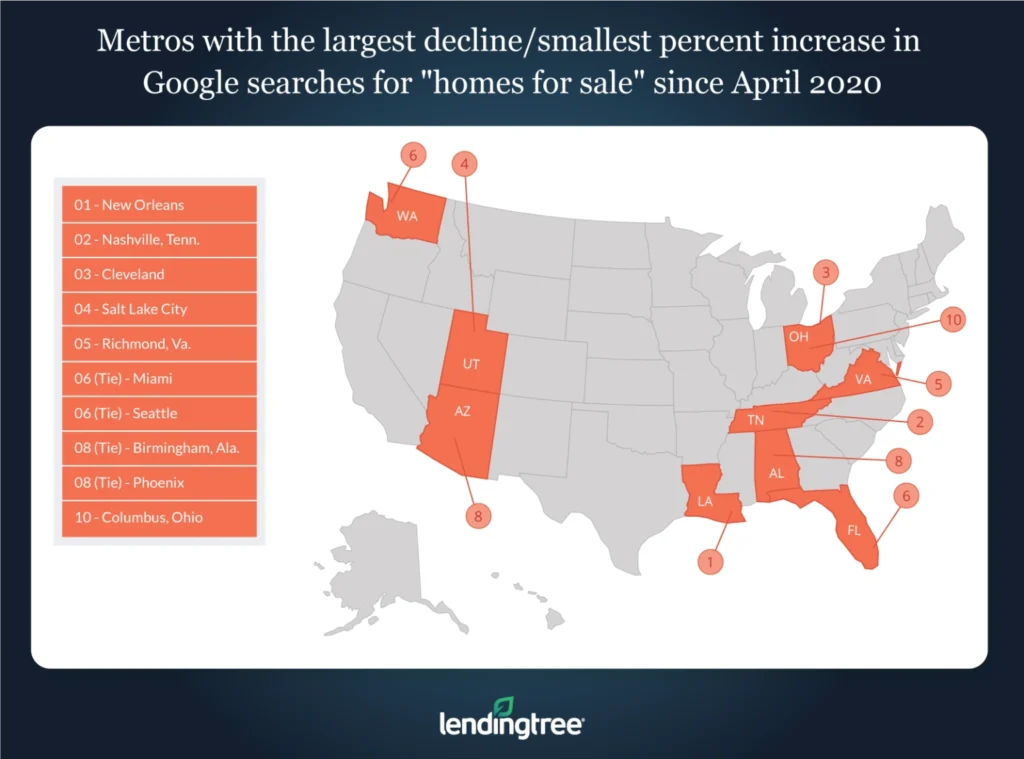

- New Orleans, Nashville, Tenn. and Cleveland saw the largest dip in searches from April to May. These metros were three of the five that saw month-over-month declines. New Orleans saw the largest decline of 12.09%, while Nashville, Tenn., and Cleveland searches for “homes for sale” fell 8% and 4.35%, respectively. Nonetheless, each metro’s search-interest value is still 80 or higher.

Metros with largest percent increase in Google searches for ‘homes for sale’ since 2020 low

No. 1: San Diego

- End of May 2020 search interest-value: 100

- 2020 search-interest value low: 39

- Percent increase in search-interest value from 2020 low to the end of May: 156.41%

No. 2: Tucson, Ariz.

- End of May 2020 search interest-value: 100

- 2020 search-interest value low: 46

- Percent increase in search-interest value from 2020 low to the end of May: 117.39%

No. 3: Rochester, N.Y.

- End of May 2020 search interest-value: 98

- 2020 search-interest value low: 46

- Percent increase from 2020 search-interest value low to the end of May: 113.04%

Metros with smallest percent increase in Google searches for ‘homes for sale’ since 2020 low

No. 1: Cleveland

- End of May 2020 search interest-value: 88

- 2020 search-interest value low: 59

- Percent increase in search-interest value from 2020 low to the end of May: 49.15%

No. 2: Raleigh, N.C.

- End of May 2020 search interest-value: 100

- 2020 search-interest value low: 67

- Percent increase in search-interest value from 2020 low to the end of May: 49.25%

No. 3: Richmond, Va.

- End of May 2020 search interest-value: 83

- 2020 search-interest value low: 55

- Percent increase in 2020 search-interest value low to the end of May: 50.91%

Metros with largest percent increase in Google searches for ‘homes for sale’ since April 2020

No. 1 (tie): Baltimore

- End of May 2020 search interest-value: 100

- End of April 2020 search interest-value: 68

- Percent increase in search-interest value from April to May: 47.06%

No. 1 (tie): San Diego

- End of May 2020 search interest-value: 100

- End of April 2020 search interest-value: 68

- Percent increase in search-interest value from April to May: 47.06%

No. 3: Grand Rapids, Mich.

- End of May 2020 search interest-value: 100

- End of April 2020 search interest-value: 71

- Percent increase in search-interest value from April to May: 40.85%

Metros with largest decline in Google searches for ‘homes for sale’ since April 2020

No. 1: New Orleans

- End of May 2020 search interest-value: 80

- End of April 2020 search interest-value: 91

- Percent increase in search-interest value from April to May: -12.09%

No. 2: Nashville, Tenn.

- End of May 2020 search interest-value: 92

- End of April 2020 search interest-value: 100

- Percent increase in search-interest value from April to May: -8%

No. 3: Cleveland

- End of May 2020 search interest-value: 88

- End of April 2020 search interest-value: 92

- Percent increase in search-interest value from April to May: -4.35%

Methodology

The data for this piece comes from Google Trends. The “search-interest numbers/values” are defined by Google in the following way: “Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term.”

The search-interest value at the end of May is defined as the search-interest value for the week beginning on May 24, 2020, while the value at the end of April is defined as the search-interest value for the week beginning April 26, 2020.

LendingTree research analyst Jacob Channel contributed to this study.

View mortgage loan offers from up to 5 lenders in minutes