LendingTree Ranks the Most Popular Metros for Baby Boomer Homebuyers

Baby boomers are the wealthiest generation of Americans alive today, according to the latest Federal Reserve data. While some may no longer be active in the housing market, plenty are still looking to buy homes.

But where are baby boomers looking to buy? To answer this question, LendingTree analyzed mortgage purchase requests made in 2020 on the LendingTree platform across the nation’s 50 largest metropolitan areas (metros).

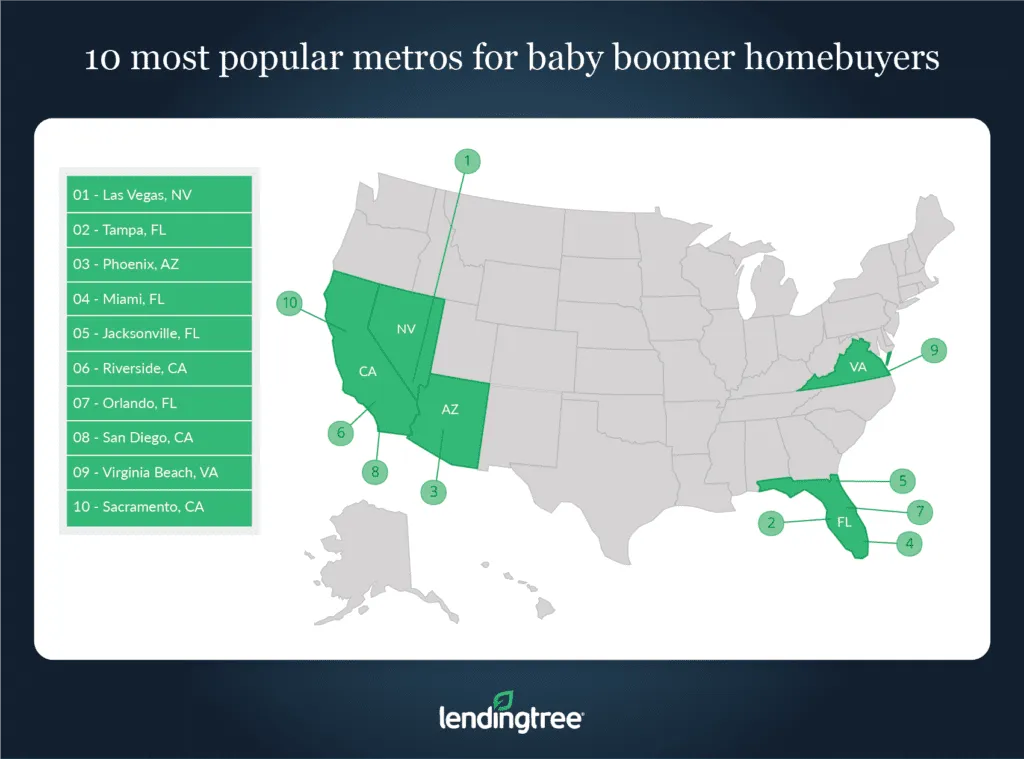

What LendingTree found was that baby boomers (defined as anyone born between 1946 and 1964) make up a significant portion of potential homebuyers in many of the country’s largest metros, including Las Vegas, Tampa, Fla., and Phoenix.

Key findings

- Las Vegas, Tampa, Fla., and Phoenix are the metros where baby boomers make up the largest share of mortgage purchase requests. In Las Vegas, 19.97% of purchase requests came from baby boomers. In Tampa and Phoenix, the numbers are 17.33% and 16.36%, respectively.

- San Jose, Calif., San Francisco and Minneapolis have the lowest percentages of baby boomers making purchase requests among the metros. Baby boomers made just 6.93% of the purchase requests in San Jose, 7.55% in San Francisco and 7.68% of the purchase requests in Minneapolis.

- Across all 50 of the nation’s largest metros, the average credit score for baby boomer homebuyers was 683. Average credit scores were highest in San Jose at 713 and lowest in Memphis at 662.

- Baby boomers requested the largest loan amounts in California metros like San Jose, San Francisco and Los Angeles. In San Jose, the average requested loan amount among baby boomers was the highest out of the nation’s largest metros at $523,180. That’s about $371,000 more than the average amount requested in Cleveland where the average loan size was the smallest at $152,204.

- Unsurprisingly, down payments were the largest in the metros where the biggest mortgage loans were being requested. For example, in San Jose the average down payment among baby boomers was $128,194, more than double the average down payment amount across all 50 of the nation’s largest metros, $52,102.

Most popular metros for baby boomer homebuyers

No. 1: Las Vegas

- Share of mortgage requests coming from baby boomers: 19.97%

- Average baby boomer age: 63.2

- Average credit score among baby boomers: 681

- Average down payment amount among baby boomers: $52,262

- Average requested loan amount among baby boomers: $263,256

No. 2: Tampa, Fla.

- Share of mortgage requests coming from baby boomers: 17.33%

- Average baby boomer age: 62.9

- Average credit score among baby boomers: 690

- Average down payment amount among baby boomers: $41,341

- Average requested loan amount among baby boomers: $196,524

No. 3: Phoenix

- Share of mortgage requests coming from baby boomers: 16.36%

- Average baby boomer age: 63.2

- Average credit score among baby boomers: 693

- Average down payment amount among baby boomers: $54,342

- Average requested loan amount among baby boomers: $246,800

Least popular metros for baby boomer homebuyers

No. 1: San Jose, Calif.

- Share of mortgage requests coming from baby boomers: 6.93%

- Average baby boomer age: 61.8

- Average credit score among baby boomers: 713

- Average down payment amount among baby boomers: $128,194

- Average requested loan amount among baby boomers: $523,180

No. 2: San Francisco

- Share of mortgage requests coming from baby boomers: 7.55%

- Average baby boomer age: 62.5

- Average credit score among baby boomers: 701

- Average down payment amount among baby boomers: $121,767

- Average requested loan amount among baby boomers: $518,364

No. 3: Minneapolis

- Share of mortgage requests coming from baby boomers: 7.68%

- Average baby boomer age: 62.2

- Average credit score among baby boomers: 697

- Average down payment amount among baby boomers: $56,425

- Average requested loan amount among baby boomers: $235,182

Tips for baby boomer homebuyers

In general, baby boomers tend to have stronger financial profiles than those of younger generations, but that doesn’t mean that they don’t need to carefully plan before buying a home.

Here are some tips for baby boomers looking to buy a home:

- Consider how it will impact your retirement. If you’re thinking about buying a house while you’re nearing or at retirement age, you’ll want to carefully consider how costs associated with that house will impact you when you’re no longer working. For example, if you pay with cash, ask yourself if you will be able to afford property taxes or other annual fees. If you decide to take out a loan, consider whether or not you’ll be able to make your monthly payments.

- Look into different loan programs. There are many different loan programs that could be beneficial to you depending on your financial profile. For example, if you’re an older baby boomer you might be able to qualify for a retirement mortgage, which can help you get around income requirements that you’re likely to find with other loans.

- Pay down your monthly debts. If you decide to purchase a home with a loan, lenders look carefully at your debt-to-income (DTI) ratio, the percentage of your gross monthly income that goes toward recurring debts. Maximum DTI ratios vary by loan program, however, so it’s a good idea to keep your total DTI ratio (which includes your monthly mortgage and all debt payments) at 43% or less. Even if you plan on paying with cash, it’s a good idea to pay off as much debt as you can so you have extra money for housing-related costs.

Methodology

LendingTree used generational definitions, from the Pew Research Center, to define the age range for baby boomers as being born between 1946 and 1964.

Metropolitan statistical area (MSA) rankings were generated by looking at the percentage of total purchase mortgage requests received by LendingTree from baby-boomer borrowers. The larger the share of requests from baby boomers, the higher ranking a metro area received.

Borrower data was derived from mortgage requests and offers given to users of the LendingTree mortgage shopping platform across the nation’s 50 largest metropolitan areas from Jan. 1, 2020, to Dec. 31, 2020.

LendingTree senior research analyst Jacob Channel contributed to this report.

View mortgage loan offers from up to 5 lenders in minutes