Best Large Metros for Single People

Whether they’re unlucky in love and constantly searching for a partner or they’re happiest by themselves, millions of American adults are single. And though not all singles will look for the same things in the area in which they want to live, a few key factors tend to make places more appealing.

With that in mind, LendingTree considered seven variables to help determine which of the nation’s 50 largest metros are the best for single people:

- Median single-person household income

- Median monthly housing costs for homes with a mortgage

- Median gross rent

- Percentage of households where the householder lives alone

- Percentage of the population that isn’t married

- Average round-trip commute time to and from work (in minutes)

- Percentage of non-family households that are owner-occupied

Though these factors aren’t all-encompassing, each tends to directly impact single people. As a result, areas strong in these categories are more likely to be better for singles than areas weak in them. For more on why we chose these variables, see the methodology.

Key findings

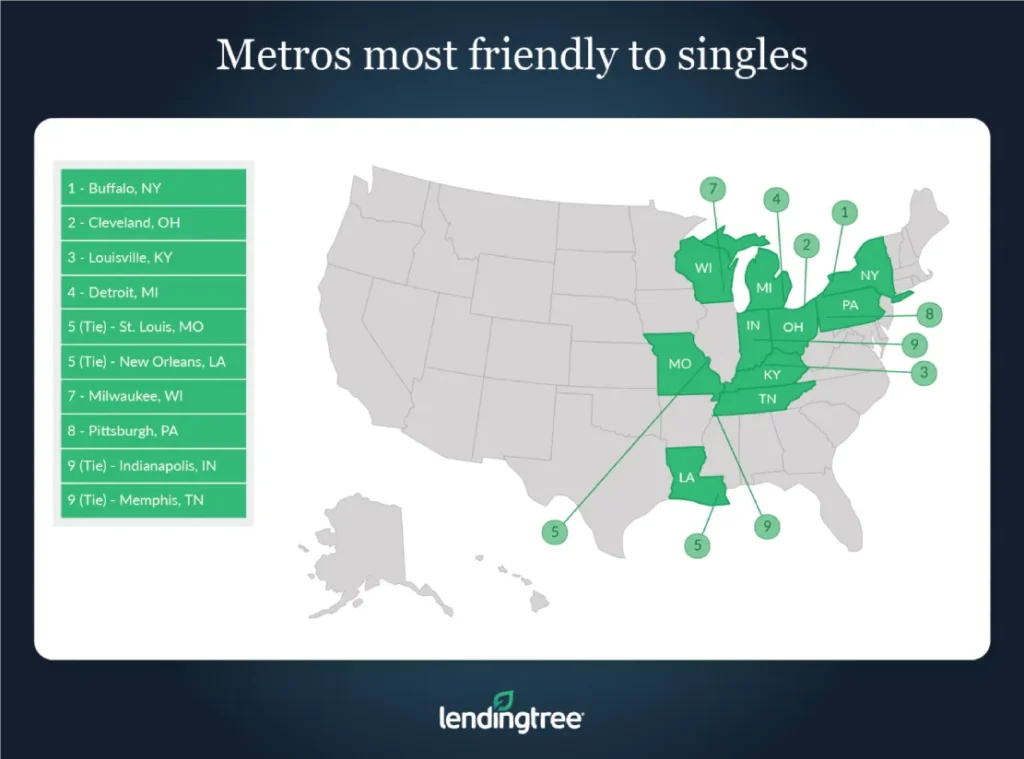

- The metro most friendly to singles is Buffalo, N.Y. Though incomes in Buffalo are relatively low, the area ranks highly across the rest of the board. For example, it comes in first in the average commute time category, second in the median monthly housing costs for homes with a mortgage and the median gross rent categories, and third among the percentage of homes where the householder lives alone.

- Cleveland and Louisville, Ky., are the next best metros for singles. Cleveland boasts the lowest median gross rent out of the nation’s 50 largest metros, as well as the largest share of households where the householder lives alone. Louisville doesn’t rank first in any individual category, but strong showings in categories related to home cost, commute time and the share of non-family households that are owner-occupied help it clinch the No. 3 spot.

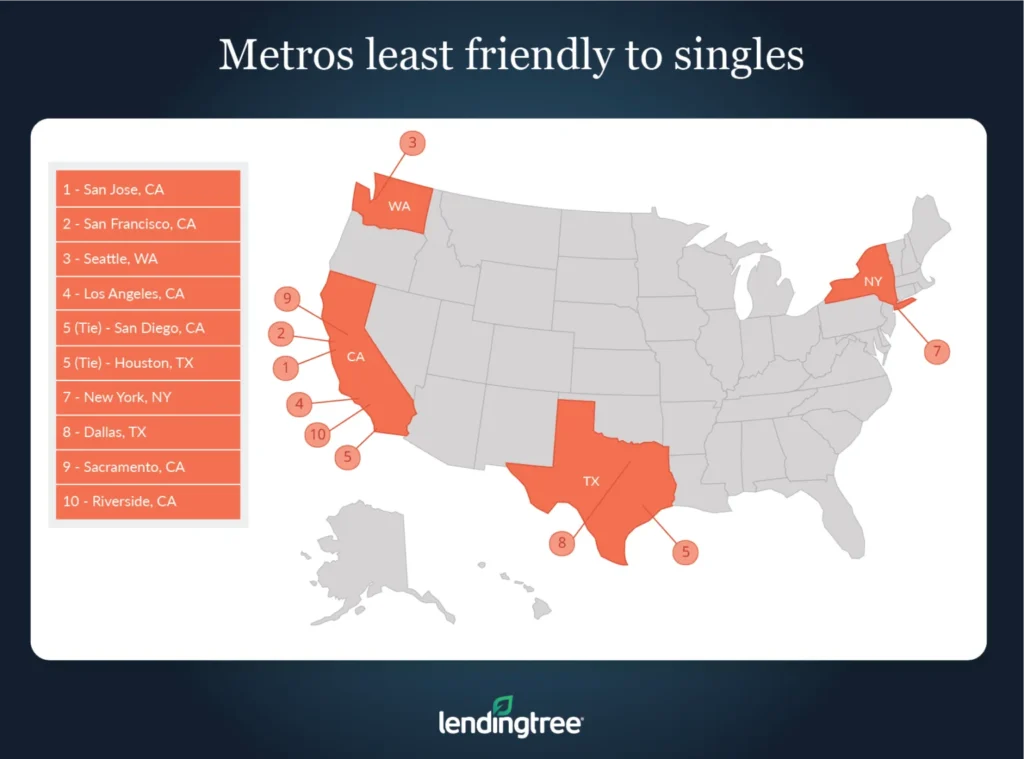

- High-cost metros — San Jose, Calif., San Francisco and Seattle — are least friendly to singles. Though single people in these metros tend to earn quite a bit of money relative to people in other parts of the country, factors like high housing costs, low single-person homeownership rates and long commute times keep these metros at the bottom of our ranking.

- Metros don’t have to be perfect to rank highly, nor do they have to be universally lackluster to rank poorly. Because the overall rankings are based on multiple equally weighted factors, areas lacking in some aspects may still rank highly, while areas that rank poorly overall may still have some appealing qualities. Because of this, a place like San Jose, Calif., can have a positive trait like the second-highest income — while ultimately ranking last. On the flip side, it’s the reason why Buffalo can rank first despite having the fourth-lowest income of any metro in the study.

Metros most friendly to singles

No. 1: Buffalo, N.Y.

- Median single-person household income: $31,187

- Median monthly housing costs for homes with a mortgage: $1,287

- Median gross rent: $828

- Percentage of households where the householder lives alone: 34.1%

- Percentage of the population that isn’t married: 55.4%

- Average round-trip commute time to and from work: 43.4 minutes

- Percentage of non-family households that are owner-occupied: 50.3%

No. 2: Cleveland

- Median single-person household income: $31,564

- Median monthly housing costs for homes with a mortgage: $1,316

- Median gross rent: $813

- Percentage of households where the householder lives alone: 35.6%

- Percentage of the population that isn’t married: 55.8%

- Average round-trip commute time to and from work: 49.8 minutes

- Percentage of non-family households that are owner-occupied: 49.7%

No. 3: Louisville, Ky.

- Median single-person household income: $32,288

- Median monthly housing costs for homes with a mortgage: $1,296

- Median gross rent: $880

- Percentage of households where the householder lives alone: 30.1%

- Percentage of the population that isn’t married: 52.7%

- Average round-trip commute time to and from work: 48.4 minutes

- Percentage of non-family households that are owner-occupied: 52.5%

Metros least friendly to singles

No. 1: San Jose, Calif.

- Median single-person household income: 61,459

- Median monthly housing costs for homes with a mortgage: $3,533

- Median gross rent: $2,374

- Percentage of households where the householder lives alone: 21.0%

- Percentage of the population that isn’t married: 48.1%

- Average round-trip commute time to and from work: 60.6 minutes

- Percentage of non-family households that are owner-occupied: 38.4%

No. 2: San Francisco

- Median single-person household income: $56,538

- Median monthly housing costs for homes with a mortgage: $3,237

- Median gross rent: $2,057

- Percentage of households where the householder lives alone: 27.4%

- Percentage of the population that isn’t married: 51.5%

- Average round-trip commute time to and from work: 70.4 minutes

- Percentage of non-family households that are owner-occupied: 37.9%

No. 3: Seattle

- Median single-person household income: $48,155

- Median monthly housing costs for homes with a mortgage: $2,359

- Median gross rent: $1,621

- Percentage of households where the householder lives alone: 27.4%

- Percentage of the population that isn’t married: 49.9%

- Average round-trip commute time to and from work: 63.2 minutes

- Percentage of non-family households that are owner-occupied: 41.3%

Look at positives, negatives before deciding to move to new area

While moving to a metro because it has one or two appealing elements can work out well for some, ignoring an area’s other features can end up making living in it a chore.

For example, a single person may decide to move to Washington, D.C., because individuals tend to earn more money there than they do in many other parts of the country. Unfortunately, though incomes are usually higher in D.C., the area also has plenty of potential negatives that a person should consider, from high housing costs to long commute times.

For this reason, individuals can often benefit from taking a more balanced approach to deciding where to live. By looking at multiple categories important to them, people can generally be better prepared for what an area offers. Not only that, but some may find that a place that appears like a great fit for them on the surface is not that appealing upon closer inspection. They may also find the opposite and realize that an area they had initially written off is much better than it first appeared.

Tips for finding place to live when single

When you’re single, it can sometimes be difficult to balance your priorities when finding a house. Fortunately, there are a few things you can keep in mind to help you figure out how to best meet your needs:

- When it comes to finding a house, renting is usually among your cheapest options. More often than not, renting a home is likely to be much less expensive than owning one. Because individuals tend to earn less money than couples or families do, this can make renting an especially appealing option for single people.

- Buying may not be impossible. Though it’ll likely cost more than renting, single people in some instances can still afford to buy a home all on their own. This is especially true if they’re willing to take advantage of different loan options, like Federal Housing Administration (FHA) loans — even in the face of rising mortgage rates and home prices. If you can afford it, buying when you’re single can be a good investment for the future.

- A roommate can make housing much more affordable. Though sharing your space may not be ideal, a roommate can make renting a home much more affordable. It can also make buying more affordable. Though, if you do decide to buy a house with a friend or roommate, be sure you understand your legal obligations to repay your mortgage should one of you choose to move.

Methodology

The data in the LendingTree study comes from the U.S. Census Bureau 2019 American Community Survey (the latest year available). The seven variables that make up the overall ranking were all weighted equally. We chose them for the following reasons:

- Median single-person household income: Higher incomes can help make it easier for single people to afford necessities.

- Median monthly housing costs for homes with a mortgage: Though single people often don’t own their homes, some do. The less expensive it is to own a home, the more money a single homeowner will have left over for other expenses.

- Median gross rent: Even if single people can’t afford to buy a house, they still need somewhere to live. The less expensive rent is in an area, the more money a single renter will be able to use for other expenses.

- Percentage of households where the householder lives alone: If many people in an area live alone, it suggests that single people may have an easier time affording the cost of living in that area.

- Percentage of the population that isn’t married: Areas with lower marriage rates can appeal to singles for a few reasons. First, the fewer married people, the larger the dating pool is likely to be. Second, even for those who aren’t looking to date, single people may find it easier to fit into a community where their peers are unmarried.

- Average round-trip commute time to and from work: Smaller commute times can give single people more free time.

- Percentage of non-family households that are owner-occupied: Though some non-family households can include people who are in a relationship or have roommates, having a larger share of owner-occupied, non-family households suggests that housing in an area is easier for a single person to afford.

View mortgage loan offers from up to 5 lenders in minutes