Buying a Manufactured Home: Pros & Cons, Finance Options

A manufactured home (often called a mobile home) is built in a factory and moved to a permanent location. While the process required to buy a mobile home can be more complex than purchasing other types of homes, it could be a more affordable path to homeownership. Learn more about how you can finance a mobile home.

What is a manufactured home?

Manufactured homes are constructed in factories according to the safety standards set by the U.S. Department of Housing and Urban Development (HUD). The home is built on a chassis, also known as a permanent frame.

Once construction is finished, the manufactured home is taken to a new location in one or more sections. Usually, it’s transported either to a dealer’s lot, a plot of land or a manufactured home park. After the home reaches its permanent location, it’s typically attached to a foundation.

Note the following criteria for manufactured homes:

- They must be at least 320 square feet in size.

- To be considered a manufactured home, they were constructed after June 15, 1976.

- Manufactured homes built since 1976 must contain a certification label (commonly known as a HUD tag) to show that they meet current safety standards set by the HUD Code, including body and frame requirements, thermal protection, plumbing, electrical and fire safety.

Manufactured home vs. mobile home

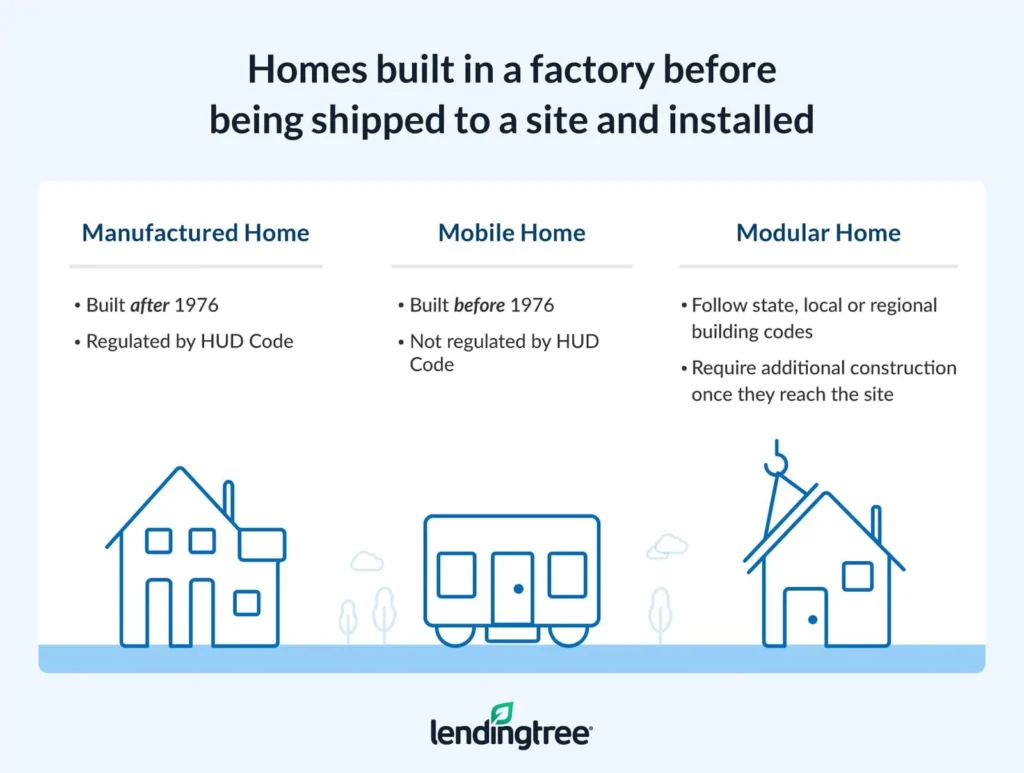

Manufactured homes are often referred to as “mobile homes,” but technically, that term is outdated.

Manufactured homes built before June 15, 1976 are mobile homes; those constructed after that date are manufactured homes. That date signifies when HUD implemented the Manufactured Home Construction and Safety Standards (also known as the “HUD Code”), which regulated mobile home construction.

Manufactured home vs. modular home

“Modular home” is another term closely associated with manufactured homes, but these types of structures aren’t identical. Like manufactured homes, modular homes are factory-built and then transported before being finished at the site. However, just as with site-built homes, modular homes follow state, local or regional building codes rather than federal requirements.

Pros and cons of buying a manufactured home

Manufactured homes represented about 9% of new single-family residential buildings in 2023, according to data from the U.S. Census Bureau’s most-recent Manufactured Housing Survey. But before you jump into any type of homeownership, it always pays to consider the pros and cons of buying a manufactured home.

Pros

- Affordability. Manufactured homes continue to offer a more affordable option compared with other types of homes. In 2023, the average price of a manufactured home was $124,300, while the average selling price of a single-family home was $514,000.

- Efficient construction. Because manufactured homes are made in factories, their construction isn’t affected by weather or other factors that might delay site-built homes.

- Multiple financing options. There are a wide range of ways to finance the purchase of a manufactured home. Many options allow you to finance both the land and the home, but it’s also relatively easy to finance or refinance just the manufactured home itself.

- Reasonably safe. Safety concerns around manufactured home parks are largely a myth — crime rates aren’t significantly different in or around these communities when compared to any other residential neighborhood, according to research.

Cons

- Higher interest rates. Borrowers typically encounter higher interest rates for manufactured home loans than with other loan types.

- Higher chances of loan denial. Only about 30% of manufactured home loan applications are approved, compared to more than 70% for site-built homes.

- Social stigma. Manufactured housing has come a long way in recent decades, but that doesn’t mean that everyone’s gotten the memo. You might receive negative opinions from friends, family or colleagues if you buy a manufactured home.

- Difficult resale. Manufactured homes aren’t easy to resell, and can pose especially expensive challenges if you want to sell only the home while keeping the land. It’ll likely cost thousands of dollars to move a manufactured home to a new site.

Want to learn more? Our mobile home values study will give you a better idea of what price tag to expect.

6 steps for buying a manufactured home

Buying a manufactured home entails a different process than purchasing other types of real estate. The exact method will vary by state, so contact the Manufactured Housing Association for information on regulations, permits and the process of buying a manufactured home in your state.

Here are six steps you’ll need to take when buying a manufactured home:

1. Decide on the location for your manufactured home

If you’re purchasing land, or placing the manufactured home on property you already own, study the zoning laws and any other guidelines you’ll need to follow.

2. Search for a manufactured home

Work with your manufactured home retailer to customize your manufactured home, unless you’re purchasing a standard model or an existing manufactured home.

3. Secure financing

Work directly with a lender, mortgage broker or your manufactured home retailer to weigh your options for manufactured home loans. Similarly, compare lenders and loan terms if you’re considering a personal loan or chattel loan.

4. Prepare the home site

Your retailer will work closely with you to make sure the site is ready for the installation of your home. This includes securing necessary permits, addressing any issues that affect the installation of the home and preparing utility hookups.

5. Arrange delivery and installation of your home

Your home is delivered and installed after the land or lot is ready.

6. Sign up for insurance

Before you can move in, you’ll likely need to insure the home and fulfill any other occupancy and maintenance requirements to avoid potential problems or delays.

How much does a manufactured home cost?

The average cost of a manufactured home was $83,100 in November 2024, the latest available figures. If you compare that to the $408,000 price tag of an existing single-family, site-built home, manufactured homes are clearly significantly cheaper — but is it just because they tend to be smaller? The answer is no, because a new manufactured home in the United States is around $79.32 cheaper per square foot than a site-built home, according to data from the U.S. Census Bureau.

However, manufactured home costs vary by location and size of the home, so expect to find a broad range in prices. Manufactured homes sell for the least amount in Indiana, Wyoming and Ohio, but are most expensive in Washington, California and Arizona, according to a recent LendingTree analysis.

4 types of loans for buying a manufactured home

You have several options for a loan to buy a manufactured home and land, but your choices will depend on how you hold title to your manufactured home. Here’s a look at the requirements side by side:

Conventional loans

Many private lenders offer manufactured home loans, including financing a manufactured home with land. However, in most cases, in order to qualify for a manufactured home mortgage, you’ll have to place the home on a permanent foundation and title it as real estate property. Here are some options for conventional loans on manufactured homes.

- Fannie Mae MH Advantage. To finance a manufactured home, it must be certified as an MH Advantage home. Homes that qualify typically have construction, design and features similar to site-built homes and are located in residential areas. These manufactured homes are built on a permanent chassis, installed on a permanent foundation on land and are titled as real estate. Loans can be fixed- or adjustable-rate mortgages with terms up to 30 years.

- Fannie Mae Standard MH. This loan option is for homes that don’t meet the eligibility requirements of the MH Advantage program, including traditional single-width manufactured homes. However, unless it’s in a co-op or condo project, the borrower must own the land the home is placed on. The manufactured home must be built on a permanent chassis, installed on a permanent foundation on land the borrower owns (with or without a mortgage) and titled as real estate. Loans may be fixed- or adjustable-rate, up to 30-year terms.

- Freddie Mac Manufactured Home Mortgage. These manufactured home mortgages are available in most states. Loan terms include both fixed- and adjustable-rate mortgages. Homes must be on a permanent foundation and can be placed on private property owned by the borrower, in a planned development or project or a condo complex.

Government-backed loans

FHA manufactured home loans

You can buy a manufactured home with a loan insured by the Federal Housing Administration (FHA). These loans are available to finance the purchase of a manufactured home only, a lot only or both at once. In addition, you can use an FHA manufactured home loan for a home installed on a leased lot.

VA loans for manufactured homes

Loans backed by the U.S. Department of Veterans Affairs (VA) provide financing options to military service members, veterans and surviving spouses. VA loans for manufactured homes require that the homes be attached to a permanent foundation on land owned by the borrower or a manufactured home and land together. The home must qualify as real property.

USDA manufactured home loans

Low- to moderate-income homebuyers in rural areas who want to finance a manufactured home, or a home and lot, may qualify for a USDA Single Family Housing Guaranteed Loan. These loans offer flexible qualification requirements, including no minimum down payment and no minimum credit score.

Personal loans for manufactured homes

Depending on the cost of the manufactured home you’re buying, a personal loan may be an option. Personal loans generally go up to $50,000 — however, some lenders issue loans for as much as $100,000.

These loans come with fixed rates and terms typically between two and five years (though some could be as long as seven years). However, personal loans typically have higher interest rates than mortgages and auto loans. The exact personal loan qualifications often vary, but most lenders will usually review your credit score, income and other financial details.

Chattel loans

Another way to buy a manufactured home is with a chattel loan — it’s like a mortgage, except it’s meant for high-price personal property, like boats, planes or heavy equipment (“chattel” is another word for “personal property”). Chattel loans for manufactured homes are common and typically have higher interest rates than mortgages. The loan will be secured by your manufactured home alone; as such, unlike with a traditional mortgage, if you default on the loan only the home can be repossessed — not the land.

View mortgage loan offers from up to 5 lenders in minutes