Mortgage Rate Lock Guide: How to Secure Your Interest Rate

Once you’ve shopped around and found the best interest rate for your home loan, there’s one more important step to take: getting a mortgage rate lock. Also known as a “lock-in,” this is a guarantee from your lender that your interest rate won’t increase between your purchase offer and closing.

We’ll cover how long you can lock in a mortgage rate, how to do it and what it means for you. A rate lock doesn’t guarantee you’ll get the absolute lowest rate possible, but it can offer security and protection against higher rates.

What is a mortgage rate lock?

A mortgage rate lock is a commitment from a lender that they’ll offer you a specific mortgage rate for a set period of time. As long as there are no changes to your loan application and you close on your home before the lock-in period expires, your interest rate should be the same at closing as it was on your loan estimate.

What happens if I lock in a mortgage rate and it goes down?

It’s important to understand that if rates go down a rate lock could prevent you from taking advantage of those lower rates — however, your options will depend on your lender. You may be able to purchase a “float down” from your lender, which is a rate lock add-on that allows you to lock in the lower rate. The float down fee is usually calculated as a percentage of your loan amount, somewhere in the ballpark of 0.25% to 1%.

However, if your lender doesn’t offer a float down option, you can either stick with your original locked-in rate or move on to a new lender.

You’ll typically need to meet the following criteria to be eligible for a float-down option:

- Your loan must be conditionally approved. Lender float-down policies usually only apply to loans that have received an approval based on a review of your credit, income and assets.

- Your rate must drop by a certain amount. In most cases, you can’t float down your rate unless it drops a quarter- to half-percentage point (0.25% to 0.50%).

- You’ll need to pay a fee. Because the lender has to renegotiate your lock with the investor you already committed to, you’re usually charged a fee of up to 0.50% of your loan amount.

What doesn’t a rate lock protect against?

The only time your interest rate could change during the lock period is if any of the details you put in your loan application change, including:

- Your down payment

- Your closing costs

- Your home’s appraised value

- Your credit score

- Your loan program (e.g. conventional, FHA or VA)

In addition to financial details, a mortgage rate lock is usually tied to a specific property address. If you’re buying a home and the purchase contract is canceled, your lock is also canceled. You’ll need to get a new rate quote based on current mortgage rates once you find a new home.

How long can you lock in a mortgage rate?

Most rate locks are available for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau (CFPB).

When you buy a home, your purchase contract sets the timeline for locking your loan. Try to give yourself an extra cushion in case the home needs repairs. Lenders often offer lock periods in 15-day increments — and an extra two weeks may give you wiggle room if any last-minute delays pop up with your closing date.

If you underestimate how much time you need, however, you may be able to extend your rate lock — if you’re willing to pay a fee.

When can you get a mortgage rate lock?

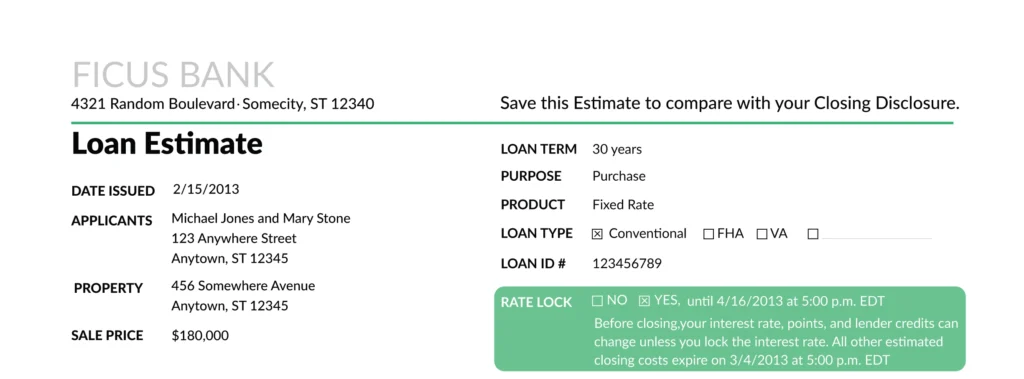

Most lenders allow you to lock your rate once they’ve received your loan application, pulled your credit report and issued a loan estimate. You’ll see the rate lock details on Page 1, which we’ve highlighted on the example below:

If you’re buying a home, lenders typically can’t lock your loan rate until you have an accepted purchase contract. However, some lenders offer options that allow you to lock before you’ve found a home, and then apply the lock to a home once you’re under contract.

Get a breakdown of your loan estimate and compare mortgage offers. If we can’t beat your rate, you get $250.

Should I lock my mortgage rate today?

If you’ve compared rates with at least three to five lenders and reviewed all the closing costs on each loan estimate, it’s best to get a mortgage rate lock as soon as possible.

The reason is that without one, you could be stuck with a higher rate — and that can have several negative effects on your journey to homeownership:

- Higher monthly payments. A higher rate means higher monthly payments, which in turn reduces your buying power.

- Higher loan costs. A slightly higher rate can mean thousands, or even hundreds of thousands, of dollars in extra interest charges over the life of your loan.

- Loan denial. A sudden spike in your interest rate during the loan process could flip a loan approval to a loan denial if your debt-to-income (DTI) ratio exceeds your lender’s or loan program’s mortgage requirements. We’ll run through an example of how this could happen below.

Mortgage rate lock example

Let’s assume two borrowers making $90,000 per year are each approved for a mortgage on June 1, with an Aug. 1 closing date. One borrower locked their mortgage rate right away at 6.10% in June, while the other borrower floated their rate until August, when rates jumped to 6.91%.

In this example, both borrowers have a $690 per month car payment and a $300 per month student loan payment, and are buying a $400,000 home with a 20% down payment. The loan program allows borrowers a maximum 40% debt-to-income (DTI) ratio.

| Date locked | Interest rate | PITI

PITI stands for principal, interest, taxes and insurance. All four are included in monthly mortgage payments.

| DTI

Lenders calculate your DTI ratio by dividing your total monthly expenses (including your mortgage payment) by your before-tax income.

| Approved or denied based on DTI |

|---|---|---|---|---|

| Homebuyer #1 | ||||

| June 1 | 6.10% | $1,939.18 | 39% | Approved |

| Homebuyer #2 | ||||

| Aug 1 | 6.91% | $2,109.66 | 41% | Denied |

Essentially, the homebuyer that locked in their rate right away will be just fine when it comes time to close their loan — but the homebuyer that didn’t get a rate lock in June no longer qualifies for their home in August. The extra $170 each month puts them over the lender’s 40% DTI ratio maximum.

How much does a mortgage rate lock cost?

In many cases a mortgage rate lock is free, though your lender may also charge you around 0.25% of the loan amount. On a median-priced home in today’s market ($420,400), a rate lock would cost about $1,051.

3 steps to lock your mortgage rate

- Compare loan estimates. Within three business days of receiving a loan application, lenders must provide you with a loan estimate detailing your estimated interest rate and fees.

- Discuss how long you should lock. Your loan officer will give you a lock recommendation based on your closing date or the type of refinance you’re applying for.

- Keep track of your lock expiration date. Once your rate is locked, you’ll receive an updated loan estimate with a lock expiration date. The cost of extending a lock in a fluctuating financial market could be very expensive and may vary from lender to lender.

Your loan officer will make sure you lock in your interest rate at the appropriate time (when you apply, once you’re approved or after), based on your lender’s rate lock policy.

Most conventional, and all renovation and cash-out refinance loans, require a full appraisal, which could make your closing date unpredictable — or even result in a change to your rate lock if the value comes in lower than you expected. It’s best to choose a longer rate lock period for these mortgage types.

Frequently asked questions

Interest rates are like stocks: They can fluctuate based on market conditions that change daily, and sometimes even hourly.

You’ll have to pay a relock fee or a lock extension fee. Typically the longer you need to extend, the more it will cost. If you have to relock, your new rate will be based on current rates or your original lock, whichever is higher.

The standard lock timeline is between 30 and 60 days with most lenders. However, locks as long as one year may be available for construction loans if you’re building a home.

In most cases, no. However, some lenders offer programs that allow you to lock for up to 90 days while you’re house hunting.

You can, but it’s not usually a good idea. If you’re paying for the locks, you’ll be spending money to lock at least one rate that you know you won’t end up using. Or, let’s say you lock in your rate with two different mortgage brokers who do business with the same lender — you’ll just end up getting a phone call telling you to cancel one.

Yes and no. If you decide you don’t want to proceed with that lender, you can walk away from the deal. But if you do, you’ll have to forfeit any lock fees or good faith deposits you paid, and may even have to pay additional fees. You’ll also need to restart the mortgage process all over again.

View mortgage loan offers from up to 5 lenders in minutes