Average Monthly Payment on New Mortgage in US Tops $2,300 — See How Your State Compares

Though mortgage rates have fluctuated over the past several months, they’re still relatively steep, especially compared to record lows during the height of the COVID-19 pandemic. Because of this and persistently high home prices, new homebuyers can shell out quite a bit for their mortgage payments.

To see how high payments can be and determine where borrowers can expect to spend the most and least amount of money on them, LendingTree analyzed mortgages offered to users of the LendingTree platform across the nation’s 50 states from Jan. 1 through March 31, 2023.

We found that recent borrowers in every state can expect to spend an average of at least $1,700 a month on their monthly mortgage payments.

Key findings

- Nationwide, the average payment on a new mortgage is $2,317 a month. Average monthly mortgage payments can range from as high as $3,696 in Hawaii to as low as $1,700 in West Virginia.

- Monthly mortgage payments are most expensive in Hawaii, California and Massachusetts. In these three states, average mortgage payments are $3,696, $3,399 and $3,021, respectively. To put that into perspective, mortgage payments in the states are $1,379, $1,082 and $704 more expensive than the national average.

- Mortgage payments are least expensive in West Virginia, Kentucky and Michigan. Average mortgage payments in these states are $1,700, $1,711 and $1,742, respectively. Borrowers in these states spend $617, $606 and $575 less than the national average on their payments each month.

- Relative to income, mortgage payments are highest in Hawaii, Montana and California. In Hawaii and California — two states where payments are over $3,000 — the average mortgage payment is equivalent to 39.69% and 33.72% of the state’s average monthly household income. Though mortgage payments are lower in Montana (averaging $2,453 a month), lower household incomes mean that the average mortgage payment in the state is equivalent to 33.80% of the state’s average monthly household income.

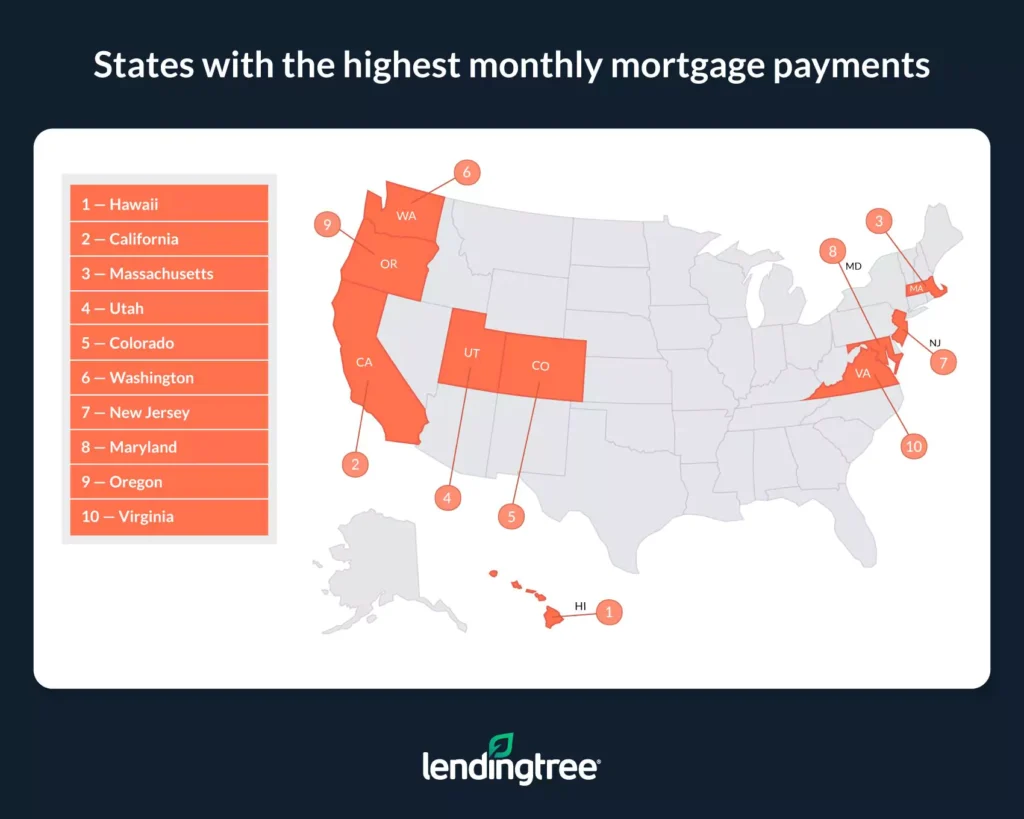

States with the highest monthly mortgage payments

No. 1: Hawaii

- Average monthly mortgage payment: $3,696

- Difference between state and national average monthly mortgage payment: $1,379

- Average monthly household income: $9,313

- Mortgage payment as a percentage of income: 39.69%

No. 2: California

- Average monthly mortgage payment: $3,399

- Difference between state and national average monthly mortgage payment: $1,082

- Average monthly household income: $10,079

- Mortgage payment as a percentage of income: 33.72%

No. 3: Massachusetts

- Average monthly mortgage payment: $3,021

- Difference between state and national average monthly mortgage payment: $704

- Average monthly household income: $10,399

- Mortgage payment as a percentage of income: 29.05%

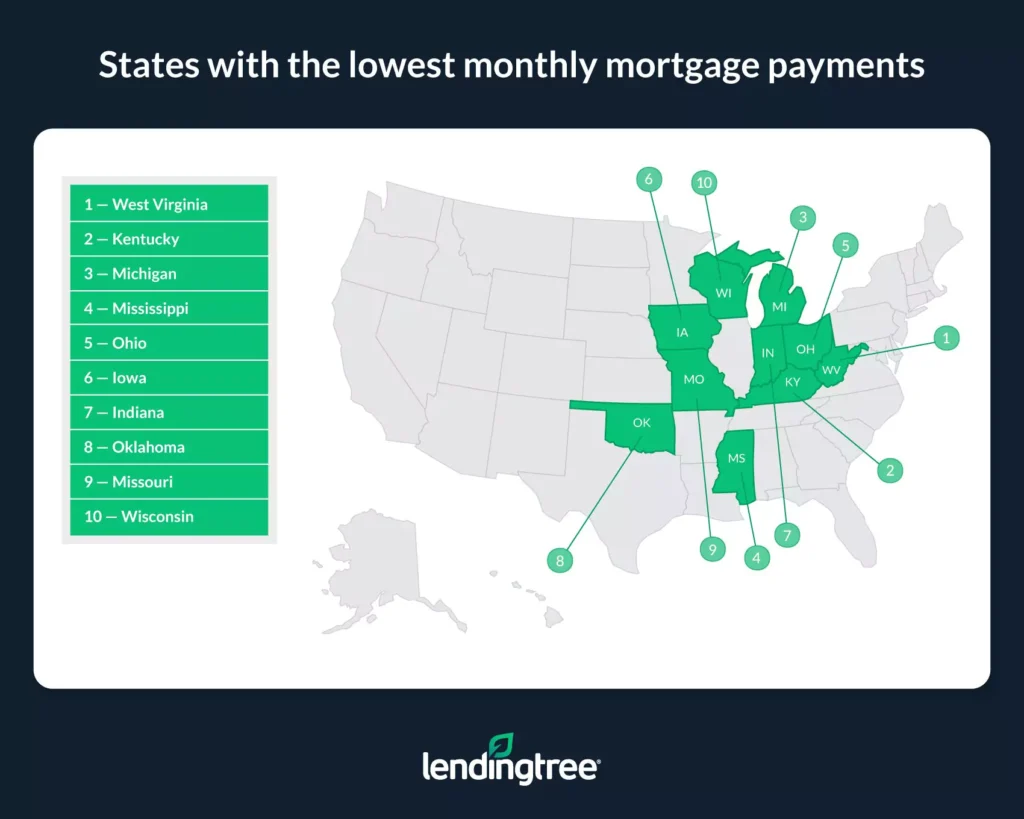

States with the lowest monthly mortgage payments

No. 1: West Virginia

- Average monthly mortgage payment: $1,700

- Difference between state and national average monthly mortgage payment: -$617

- Average monthly household income: $6,025

- Mortgage payment as a percentage of income: 28.22%

No. 2: Kentucky

- Average monthly mortgage payment: $1,711

- Difference between state and national average monthly mortgage payment: -$606

- Average monthly household income: $6,353

- Mortgage payment as a percentage of income: 26.93%

No. 3: Michigan

- Average monthly mortgage payment: $1,742

- Difference between state and national average monthly mortgage payment: -$575

- Average monthly household income: $7,174

- Mortgage payment as a percentage of income: 24.28%

Mortgage payments can be expensive, but not everyone spends an arm and a leg

Mortgage payments owed by borrowers seeking new loans in 2023 can be steep, but not everyone is shelling out in excess of $1,700 a month. Many borrowers make considerably lower payments.

Most people have fixed-rate mortgages. If they bought a new home or refinanced an old loan before rates started to dramatically rise in 2022, the monthly payments are unlikely to be as high as they would have been compared to a more recent loan.

To put into perspective, consider that median housing costs for homes with a mortgage in the U.S. are $1,672 a month, according to U.S. Census Bureau data. That figure includes other expenses like utilities and insurance fees and is much less than the national average monthly mortgage payment for loans offered in 2023 of $2,317.

Looking at the cost of new mortgages is important when gauging the overall state of the housing market, but it doesn’t tell the whole story. It does help illustrate that rising mortgage rates and payments don’t necessarily mean the housing market is on the verge of collapse. After all, even if new borrowers will likely have a tougher time making payments, homeowners with older loans or no loans are still in a good place to keep on top of their housing costs.

Tips for managing your mortgage payment

The unfortunate reality of today’s housing market is that borrowers seeking new mortgages will likely spend quite a bit on their monthly payments. By keeping the following tips in mind, homebuyers can make keeping up with their payments a bit easier.

- Boost your credit score before you buy. The higher your credit score is, the lower the interest rate you’ll likely be offered, and — in turn — the lower your monthly mortgage payments will be. Even though getting a mortgage with less-than-stellar credit is possible, borrowers can benefit tremendously from increasing their score before getting a loan.

- Aim for a larger down payment. Though saving for a bigger down payment may be easier said than done, especially with steep down payments, doing so can help you lower your monthly payments, get a lower rate and owe less interest over the lifetime of your mortgage.

- Don’t wait to ask for help. If you think you’re at risk of falling behind on your payments, reach out to your lender as soon as possible to ask about options. While your lender may be unable to alleviate every challenge, they could offer a mortgage modification to help you lower your monthly payments or make it easier to stay on top of what you owe.

Methodology

Average monthly mortgage payment data in this study is derived from more than 1.7 million mortgage offers given to users of the LendingTree platform from Jan. 1 through March 31, 2023.

Income data comes from the U.S. Census Bureau 2021 American Community Survey with one-year estimates — the latest available at the time of writing.

View mortgage loan offers from up to 5 lenders in minutes