48% of Newlywed Homeowners Asked for Down Payment Help Instead of Wedding Gifts

Marriage isn’t just about starting a life together. For many newlyweds, it’s also about finding a place to call home.

But balancing wedding plans with homeownership dreams is no easy task. High wedding costs mean many couples delay homebuying plans. Still, some aren’t afraid to ask for financial help.

We surveyed 1,050 U.S. newlyweds to learn how couples balance homebuying and wedding planning. Here’s a closer look.

Key findings

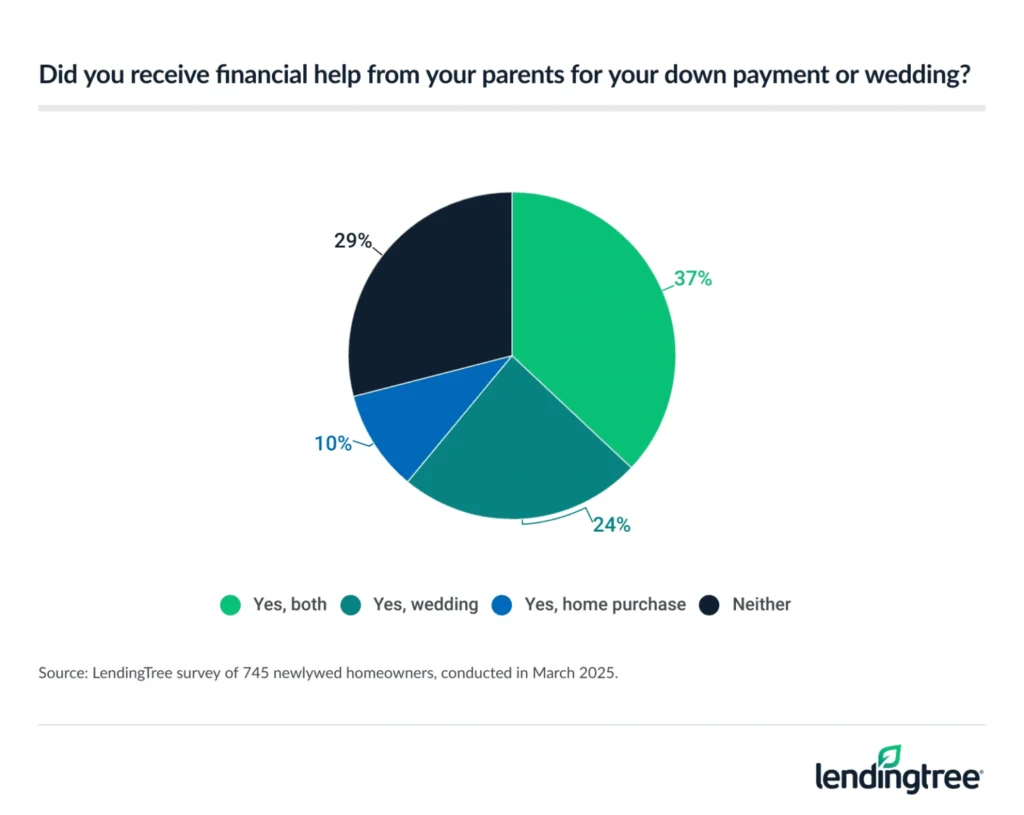

- Newlyweds aren’t afraid to ask for homebuying help. Among homeowners married in the past two years who made a down payment, 48% requested money to help pay for their down payment instead of wedding gifts. Across newlywed homeowners, 71% received help from parents to pay for their wedding and/or down payment.

- Weddings affect homebuying plans for many. 35% of newlywed homeowners say their wedding delayed homebuying plans, and 36% say they put down less of a down payment due to their nuptials. Among newlywed homeowners who put money down, 41% wish they had put down more, while just 16% wish they had put down less.

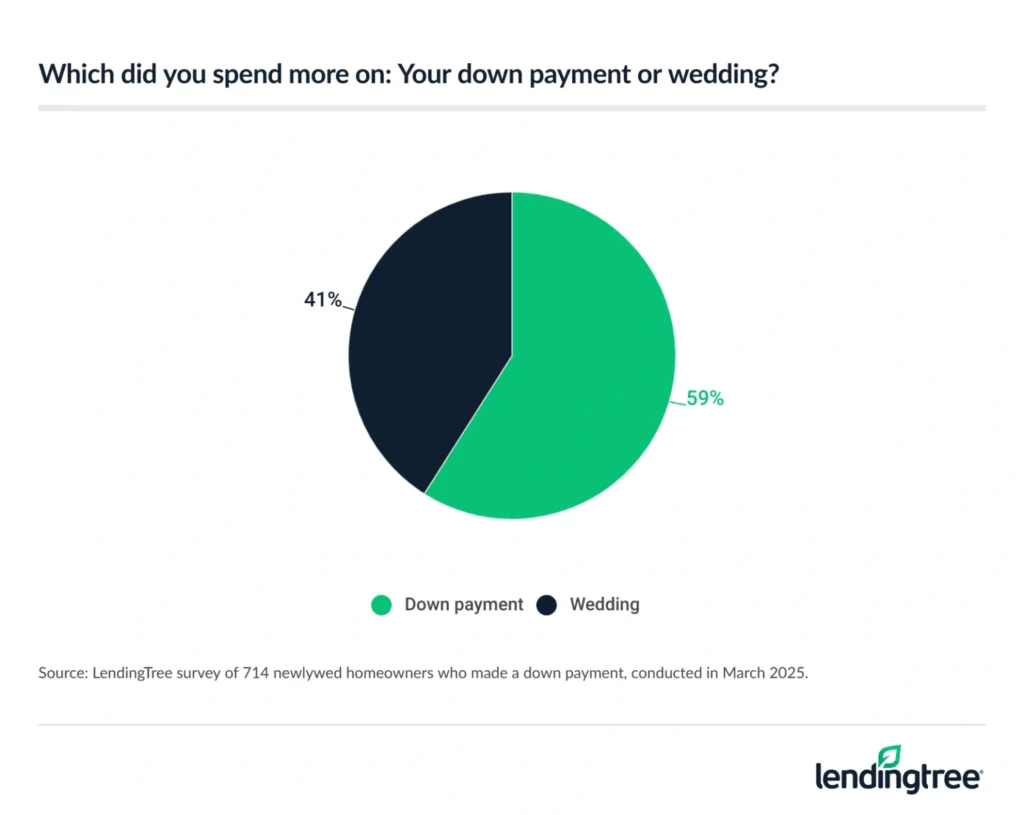

- Many prefer to invest their wedding budget in their home. Over half (52%) of newlywed homeowners say they had a smaller wedding to afford a bigger home, and 59% who made a down payment say they spent more on that than their wedding. Overall, the average down payment for newlywed homeowners is $46,741.

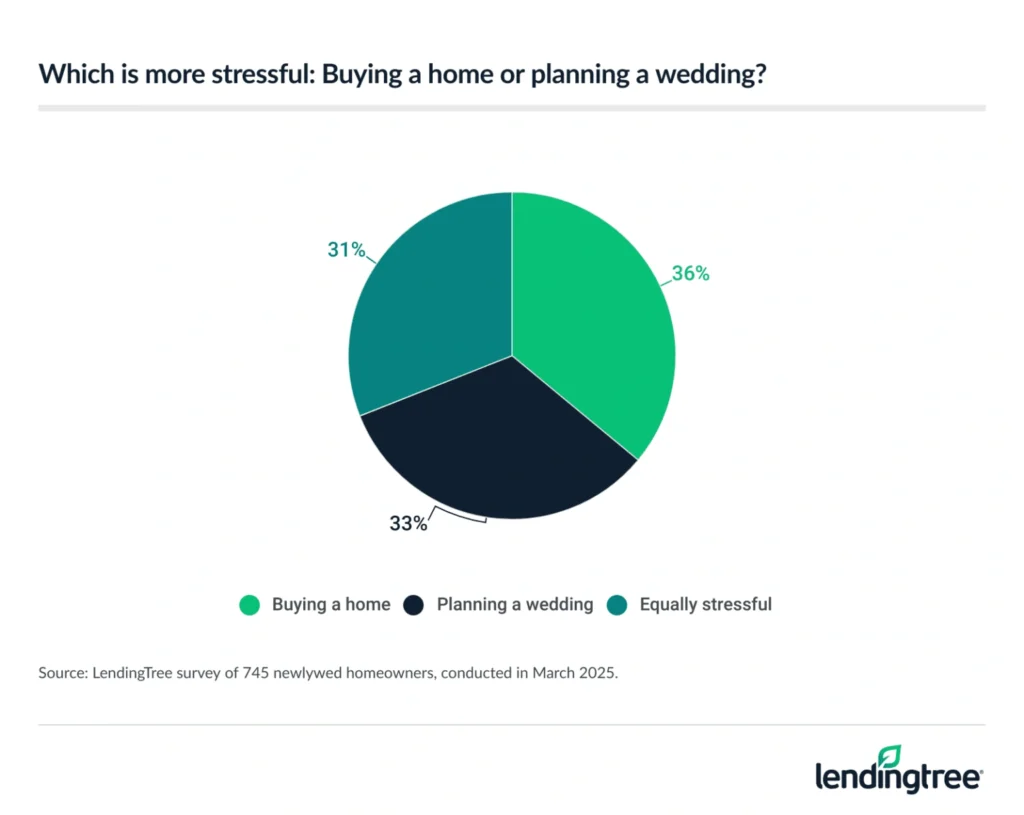

- There’s no doubt both life events are stressful. 36% of newlywed homeowners say they found buying a home more stressful, while 33% say wedding planning was more stressful. Another 31% say they were equally stressful. When asked which process caused more arguments, more respondents (36%) said wedding planning.

Many newlyweds prefer homebuying help over wedding gifts

For many couples tying the knot, “something borrowed” may be a home loan, and guests may play a big role in reducing the amount they need to take out.

Among homeowners married in the past two years who made a down payment, 48% requested money to help pay for their down payment rather than wedding gifts. That figure is especially high among men (57%), those with children younger than 18 (53%) and those married in the past six months (53%).

Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — generally thinks that’s good.

“Wedding gifts used to be dinnerware, silverware, candlesticks and other things that would sit in a box or cabinet and maybe get used once a year,” he says. “Now, there’s less stigma in asking for money toward a down payment or a honeymoon. That’s good for the newlyweds, and it’s good for those giving the gift because they know their gifts won’t be stashed and collect dust.”

Now, there’s less stigma in asking for money toward a down payment or a honeymoon.

It’s not just the guests chipping in. Across all newlywed homeowners, 71% received help from parents to pay for their wedding and/or down payment, with many (37%) saying their parents helped with both.

By age group, Gen Z newlyweds ages 18 to 28 are the most likely to have gotten help from their parents, at 81%. Millennials ages 29 to 44 follow at 76%. Meanwhile, just 66% of Gen X newlyweds ages 45 to 60 say similarly, though their parents would generally be far older.

All in all, 71% of surveyed newlyweds are homeowners.

Weddings delay homebuying plans and affect down payments

First comes love, then comes a mortgage, though the latter may be delayed because of the former. In fact, 35% of newlywed homeowners say their wedding delayed homebuying plans.

“In recent years, there has been an unmistakable shift in focus from spending on things to spending on experiences, and this is a prime example,” Schulz says. “And weddings are incredibly expensive today. For most Americans, that means choosing between a big wedding or a decent mortgage down payment.”

Given how expensive a wedding can be, 36% put less money toward their down payment due to their wedding. However, asking for cash over having a registry may have helped some, as 26% say they put more money down because of their wedding. Another 34% say their wedding didn’t affect their down payment.

That may lead to regret among some. Among newlywed homeowners who put money down, 41% wish they had put down more and just 16% wish they had put down less.

“People regret their spending when it doesn’t align with priorities,” Schulz says. “If you’re trying to choose between a bigger, more elaborate wedding and putting a bigger down payment on a home, it’s important to ask yourself and your partner tough questions about what matters most. This may make for challenging conversations, but it’s better to talk through what you believe earlier than later. Once you’ve paid out all that money for your wedding, you can’t get it back.”

Newlyweds prefer putting more money toward down payment

Many newlywed homeowners prioritize the keys over the cake. In fact, 52% of newlywed homeowners say they had a smaller wedding to afford a bigger home — particularly Gen Zers (56%), those with children younger than 18 (56%) and men (55%).

Of those who put money down, 59% spent more on their down payment than their wedding.

To put that in perspective, the average down payment for newlywed homeowners is $46,741. More broadly, the median down payment for first-time homebuyers was 9% in 2024, according to National Association of Realtors (NAR) data.

“Given that the median home sales price is more than $400,000 today, that means that most newlywed homebuyers — and homebuyers in general — aren’t putting down anywhere near a full 20% down payment,” Schulz says. “That is not surprising, nor should anyone expect that to change anytime soon.”

Overall, 67% of newlywed homeowners say their dream home is more important than their dream wedding.

Homebuying and wedding planning are stressful

Homebuying and wedding planning are two of the biggest life milestones, and they’re understandably stressful for couples. Among newlywed homeowners, 36% found buying a home more stressful, while 33% said wedding planning was more stressful.

Another 31% say they were equally stressful.

Still, 36% say wedding planning caused the most arguments with their partner — more than the 33% who say homebuying.

While there’s no way to avoid all the stress around buying a home, Schulz says there are a few ways to help ease the process.

“One of the best ways to reduce homebuying stress is to control what you can control,” he says. “Take the time to shop around for the best rate. Communicate clearly with your partner about what matters to you most in a home. Crunch the numbers as best you can to clearly understand what you can afford. If you use a real estate agent, vet several of them to make sure you’re comfortable with who you choose. While there is so much in homebuying that’s out of your control, doing the work to get a handle on what you do control can make a huge difference.”

Balancing home shopping and wedding planning: Top expert tips

If you’re going from just married to just mortgaged in a short period, you may be under a lot of stress — and understandably so. To help balance home shopping with wedding planning, Schulz offers the following tips:

- Communicate. It sounds simple, but it’s one of the biggest keys to navigating wedding planning and homebuying without going mad. “Don’t assume what your partner is thinking, feeling or expecting,” Schulz says. “And it isn’t just about talking with your partner: It’s about speaking with your wedding planner, a financial planner, a real estate agent and anyone else involved in these processes and asking what you might think are dumb questions until you fully understand what’s going on.”

- Know yourself. “Ultimately, you have the greatest possibility of happiness when your decisions align with your values, goals and priorities,” he says. “You probably won’t be able to do everything how you would like to, but getting clear with your partner on what matters most to you is a great way to ensure you stay on the right path.”

- Take your time. Whether that means having a longer engagement or putting off homebuying for a few years, giving your timeline some grace can allow you to save more money. That can be a massive stress reducer.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,050 U.S. newlyweds ages 18 to 79 from March 12 to 19, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Newlyweds are those who got married within the past two years at the time the survey was conducted.

View mortgage loan offers from up to 5 lenders in minutes