Nearly 7.4 Million American Families Live in Poverty — 41% of Whom Are Homeowners

Homeowners typically have higher net worths and are more financially well-off than renters, but that doesn’t mean they’re wealthy. In fact, some homeowners — just like some renters — live in poverty.

To be more exact, a LendingTree analysis of the latest U.S. Census Bureau American Community Survey data reveals that more than 3 million families who live in owner-occupied homes in the U.S. earn incomes below the poverty threshold for their family. (See methodology.)

This shows that while homeownership can be a pathway to long-term wealth creation, it’s far from the only thing needed to secure a family’s financial security.

Key findings

- 7,386,335 families across the nation’s 50 states earn incomes below their poverty threshold. That equates to 8.88% of families living in poverty.

- Of the families in poverty, 41.09% live in owner-occupied housing units. Meanwhile, 58.91% live in renter-occupied housing units.

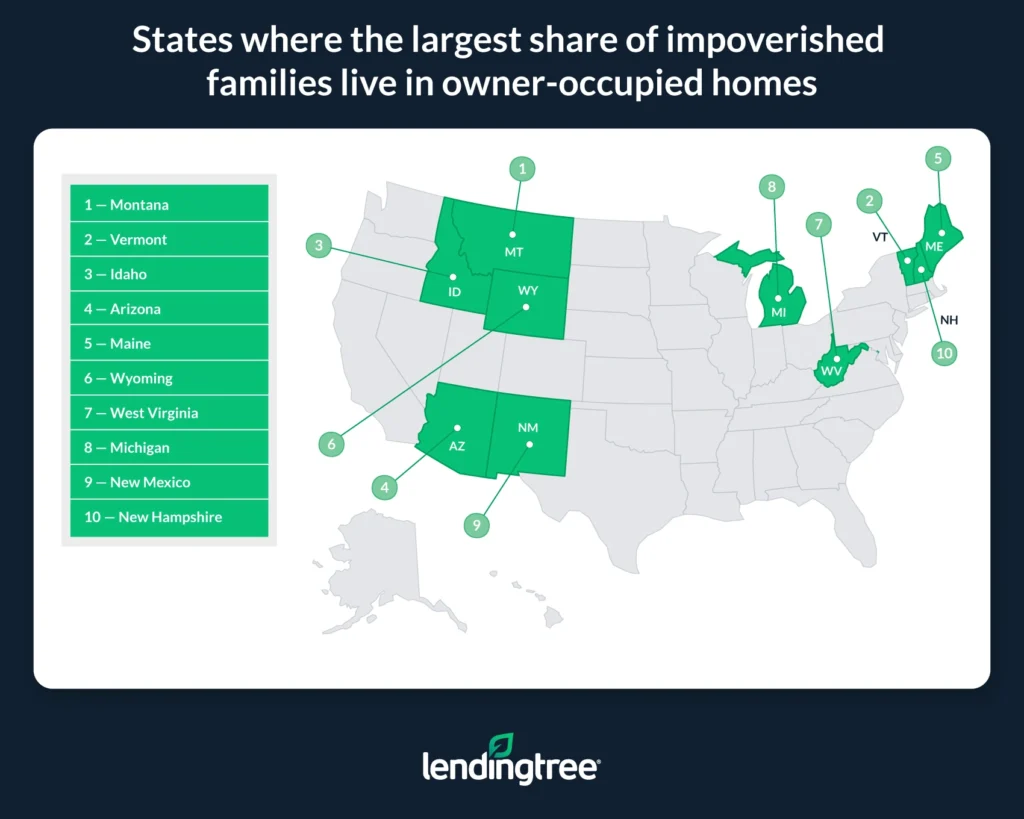

- Montana, Vermont and Idaho have the largest share of impoverished families living in owner-occupied homes. On average, 55.46% of families living in poverty in these states reside in homes occupied by their owners. While exceptions exist, impoverished families are more likely to be homeowners in more rural parts of the country. Lower home prices and greater availability of lower-cost housing options, like manufactured homes, likely help fuel this trend.

- Impoverished families are more likely to be homeowners in only eight states. Besides the aforementioned Montana, Vermont and Idaho, a majority of families below the poverty level in Arizona, Maine, Wyoming, West Virginia and Michigan live in owner-occupied homes. New Mexico is the only state where the share of impoverished families living in owner-occupied homes is the same as the share of impoverished families living in renter-occupied homes.

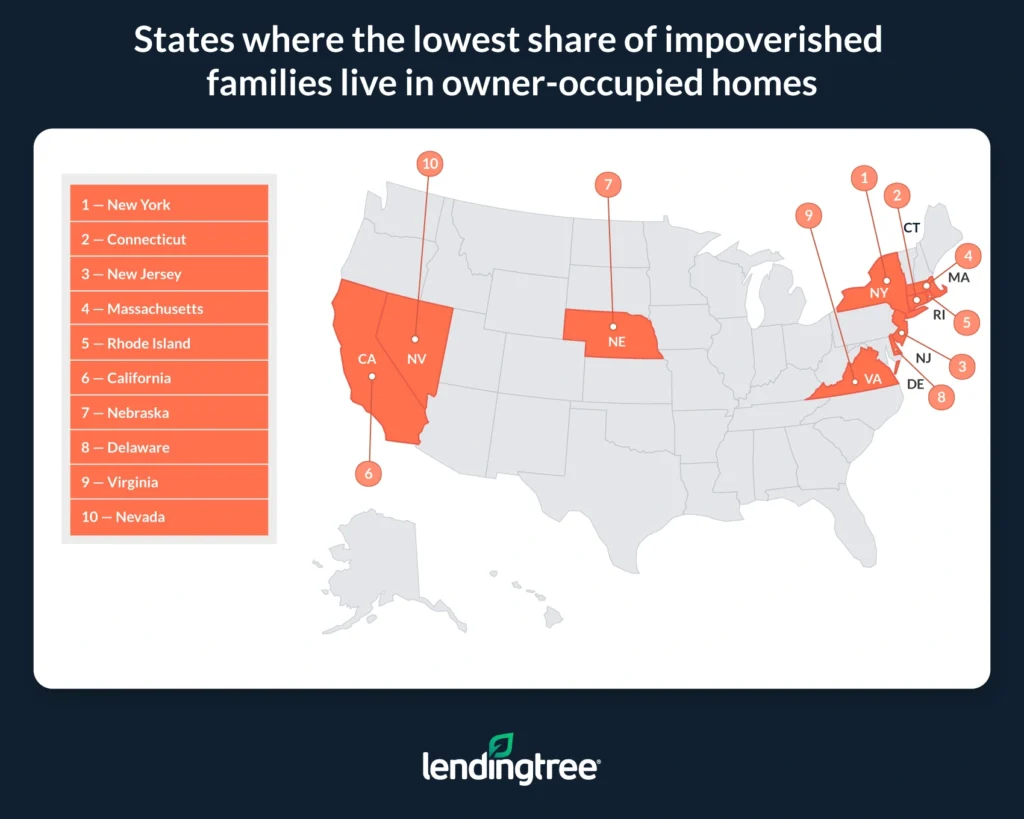

- New York, Connecticut and New Jersey have the smallest share of impoverished families living in owner-occupied homes. Across these states, an average of 29.06% of families who earn incomes below their poverty threshold live in owner-occupied housing units.

States where the largest share of impoverished families live in owner-occupied homes

No. 1: Montana

- Total number of families: 282,216

- Number of families with incomes below their poverty threshold: 20,540

- Share of families with incomes below their poverty threshold: 7.28%

- Share of families who live below their poverty threshold in an owner-occupied home: 57.75%

- Share of families who live below their poverty threshold in a renter-occupied home: 42.25%

No. 2: Vermont

- Total number of families: 164,496

- Number of families with incomes below their poverty threshold: 10,853

- Share of families with incomes below their poverty threshold: 6.60%

- Share of families who live below their poverty threshold in an owner-occupied home: 54.36%

- Share of families who live below their poverty threshold in a renter-occupied home: 45.64%

No. 3: Idaho

- Total number of families: 491,073

- Number of families with incomes below their poverty threshold: 33,282

- Share of families with incomes below their poverty threshold: 6.78%

- Share of families who live below their poverty threshold in an owner-occupied home: 54.27%

- Share of families who live below their poverty threshold in a renter-occupied home: 45.73%

States where the smallest share of impoverished families live in owner-occupied homes

No. 1: New York

- Total number of families: 4,738,232

- Number of families with incomes below their poverty threshold: 489,664

- Share of families with incomes below their poverty threshold: 10.33%

- Share of families who live below their poverty threshold in an owner-occupied home: 25.96%

- Share of families who live below their poverty threshold in a renter-occupied home: 74.04%

No. 2: Connecticut

- Total number of families: 902,539

- Number of families with incomes below their poverty threshold: 58,372

- Share of families with incomes below their poverty threshold: 6.47%

- Share of families who live below their poverty threshold in an owner-occupied home: 30.16%

- Share of families who live below their poverty threshold in a renter-occupied home: 69.84%

No. 3: New Jersey

- Total number of families: 2,378,459

- Number of families with incomes below their poverty threshold: 162,630

- Share of families with incomes below their poverty threshold: 6.84%

- Share of families who live below their poverty threshold in an owner-occupied home: 31.06%

- Share of families who live below their poverty threshold in a renter-occupied home: 68.94%

Owning a home doesn’t guarantee wealth

Owning a home has long been touted as a cornerstone of the American dream, in no small part because homeownership is usually seen as an effective pathway toward building long-term wealth. But owning a property doesn’t necessarily guarantee prosperity. As this study shows, plenty of families in the U.S. own their houses but live in poverty.

One reason is that while a home can be treated as an investment, maintaining a property is often expensive. Typical recurring costs like mortgages or utility payments can quickly add up. Further, surprise costs like those associated with emergency repairs can be anything but cheap.

Though homeowners are typically aware of these expenses before buying a house, it can be difficult for some to realize how much money owning property can require. On top of that, some homeowners, like those who lose their jobs or see their incomes fall, can find themselves quickly overwhelmed by once-manageable housing costs.

All this is to say that being a homeowner doesn’t mean someone is well off. Like anyone else, those who own property can face financial hardships. Unfortunately, in some instances, property ownership can exacerbate those hardships. It’s important for would-be homebuyers to carefully consider whether purchasing a house will put them in a financially stressful position. Don’t assume your life will necessarily get better or that it’ll be worth it to stretch your finances to their breaking point to purchase a house.

Homeownership is a great goal for many people, but it isn’t an automatic pathway to wealth — nor does it erase poverty.

Tips for those struggling with poverty

Homeowner or not, poverty is a serious problem that can be extraordinarily difficult to overcome. The following tips could help families struggling financially prevent their difficulties from multiplying and eventually help them recover.

- Take advantage of public and private aid programs. Numerous aid options, from the Supplemental Nutrition Assistance Program (SNAP) to the Temporary Assistance for Needy Families (TANF) program, are designed to help those struggling financially make ends meet. If you’re a homeowner, mortgage forbearance programs offered by some lenders can help give you time to recover after suffering a financial setback. A forbearance won’t erase your mortgage, but it can make it easier to manage in the short term.

- Consider moving. While packing your bags and moving into a new home is often easier said than done, doing so can help you reduce your cost of living. For example, because renting is usually cheaper than owning a home, selling a property you’re struggling to afford and moving into a cheaper rental unit can help you save money and get your finances back on track.

- Budget wisely. A sometimes overlooked but nonetheless extremely powerful tool that can help you save money is creating a budget. A detailed budget that you closely follow can help you better keep track of your income and expenses and give you ideas for how you could cut back and save. A budget probably won’t take you from destitute to wealthy overnight, but don’t underestimate how helpful one can be.

Methodology

LendingTree analyzed U.S. Census Bureau 2022 American Community Survey data with one-year estimates (the latest survey available).

This study primarily focuses on the share of families living in owner-occupied housing units with incomes below poverty thresholds as defined by the Census Bureau. According to the Census Bureau: “Poverty thresholds are the dollar amounts used to determine poverty status. The Census Bureau assigns each person or family one out of 48 possible poverty thresholds.”

Poverty thresholds are based on factors including family size and the age of members. The same thresholds are used across the U.S. and don’t vary based on geography. They’re adjusted annually based on inflation data from the consumer price index (CPI) for all urban consumers.

According to the Census Bureau, “Although the thresholds in some sense reflect a family’s needs, they are intended for use as a statistical yardstick, not as a complete description of what people and families need to live.”

While the data analyzed for this study looks broadly at families in the U.S. experiencing poverty, some families aren’t included. Specifically, those whose poverty status can’t be determined — such as those living in places like prisons, nursing homes, college dorms and military barracks, as well as people who are otherwise not living in conventional housing — aren’t included in this study’s analysis. For this reason, all families referenced in this study live in either a renter- or owner-occupied housing unit.

More information on how the Census Bureau measures and defines poverty can be found on its website. Specific poverty thresholds are available, too.

View mortgage loan offers from up to 5 lenders in minutes