Mortgage Refinance Offers Have Jumped 42% Nationwide in Past Year

As the impacts of the COVID-19 pandemic subsided and inflation rose, interest rates also increased. Specifically, mortgage rates more than doubled from their record 2021 lows, with sub-3.00% interest rates giving way to rates closer to 8.00%.

Owing to this dramatic rise, demand for mortgage refinancing declined sharply, cratering from its highest level in around a decade to a more than 20-year low. However, that’s rapidly changing. Inflation has cooled, the Federal Reserve has begun making cuts to its benchmark rate, and average mortgage rates have fallen by dozens of basis points from their 2024 highs. This has put refinancing back on the radar for many U.S. homeowners.

With that in mind, LendingTree analyzed mortgage refinance offers given to users of our online marketplace and compared how they’ve changed since 2023. We found that the number of mortgage refinances offered across the U.S. increased by nearly 42% from September 2023 to September 2024. And this figure has increased even more dramatically in many states.

Key findings

- Nationwide, the share of 30-year, fixed-rate mortgage refinances offered to users of the LendingTree marketplace jumped by 41.59% from September 2023 to September 2024. This jump coincided with a dramatic decrease in mortgage rates brought about by factors such as cooling inflation and a Fed rate cut.

- APRs on offered mortgage refinances fell by 156 basis points from an average of 8.19% in September 2023 to an average of 6.63% in September 2024. This decline in rates helped reduce the average monthly payment on offered loans by $136, even though average loan amounts increased by $16,245.

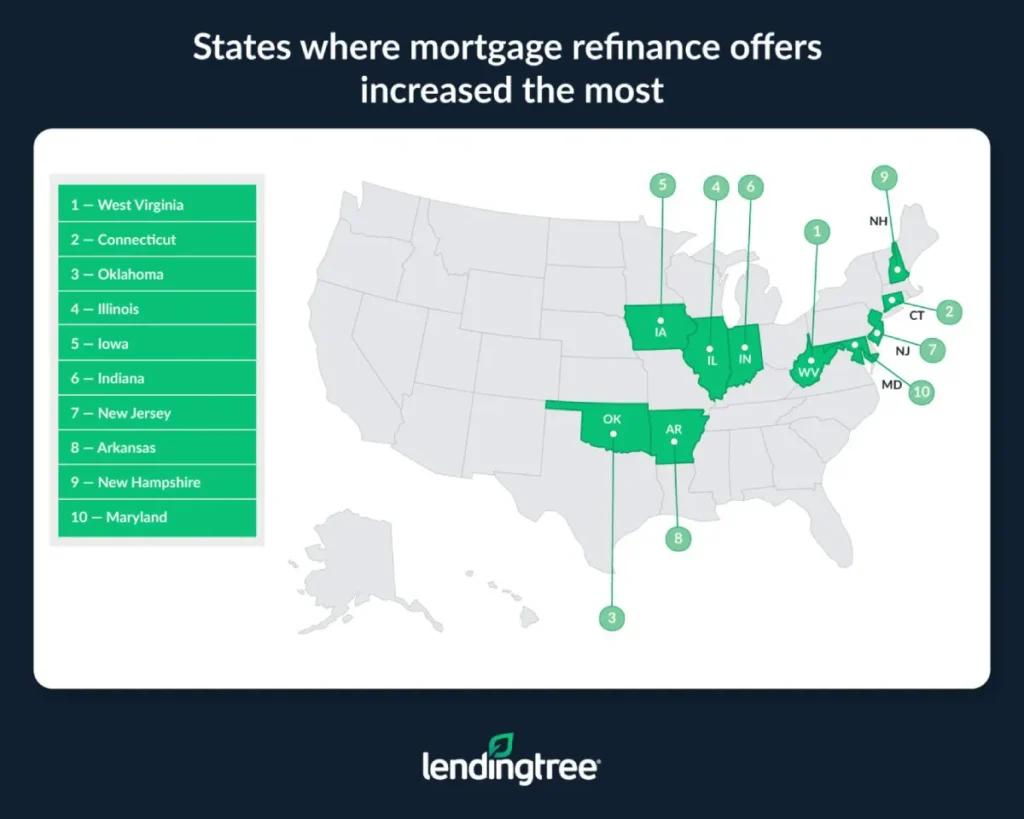

- The share of mortgage refinance offers increased by more than 100.0% (more than doubling) in 10 states — West Virginia, Connecticut, Oklahoma, Illinois, Iowa, Indiana, New Jersey, Arkansas, New Hampshire and Maryland. This diverse list highlights how refinancing in the face of falling rates has become more popular across areas with various geographical, social and economic features.

- Of the 10 states where refinance offers jumped the most, West Virginia, Connecticut and Oklahoma saw the largest increases. Refinance offers more than tripled from September 2023 to September 2024 in West Virginia, jumping by 235.69%. While more modest than in West Virginia, the 144.34% and 141.77% year-over-year increases in Connecticut and Oklahoma are still quite large.

States where mortgage refinance offers increased the most

No. 1: West Virginia

- Percentage change in number of mortgage refinance offers, September 2023 to September 2024: 235.69%

- Average refinance APR offered, September 2024: 6.29%

- Average refinance APR offered, September 2023: 8.39%

- Year-over-year basis point decline in average APR offered: -210

- Average refinance loan amount offered, September 2024: $216,116

- Average refinance loan amount offered, September 2023: $196,738

- Year-over-year dollar change in average loan amount offered: $19,378

- Average refinance monthly payment offered, September 2024: $1,335

- Average refinance monthly payment offered, September 2023: $1,438

- Year-over-year dollar change in average monthly payment offered: -$103

No. 2: Connecticut

- Percentage change in number of mortgage refinance offers, September 2023 to September 2024: 144.34%

- Average refinance APR offered, September 2024: 6.48%

- Average refinance APR offered, September 2023: 8.22%

- Year-over-year basis point decline in average APR offered: -174

- Average refinance loan amount offered, September 2024: $289,733

- Average refinance loan amount offered, September 2023: $269,034

- Year-over-year dollar change in average loan amount offered: $20,699

- Average refinance monthly payment offered, September 2024: $1,822

- Average refinance monthly payment offered, September 2023: $1,946

- Year-over-year dollar change in average monthly payment offered: -$124

No. 3: Oklahoma

- Percentage change in number of mortgage refinance offers, September 2023 to September 2024: 141.77%

- Average refinance APR offered, September 2024: 6.43%

- Average refinance APR offered, September 2023: 8.34%

- Year-over-year basis point decline in average APR offered: -191

- Average refinance loan amount offered, September 2024: $198,424

- Average refinance loan amount offered, September 2023: $224,976

- Year-over-year dollar change in average loan amount offered: -$26,552

- Average refinance monthly payment offered, September 2024: $1,242

- Average refinance monthly payment offered, September 2023: $1,635

- Year-over-year dollar change in average monthly payment offered: -$393

Refinancing is becoming more popular, but it’s not for everyone

As our study shows, refinancing — in the face of declining mortgage rates — has become much more popular. But not everyone will benefit from refinancing in today’s rate environment.

One main reason is that most current mortgage holders have a rate lower than what they could get by refinancing. While exact estimates vary, a majority of people who currently have a mortgage have a rate below 5.00% — with many holding loans with rates below 4.00% or even 3.00%

Even though average rates have dropped by dozens of basis points from their 2024 highs, the average rate on a new 30-year, fixed-rate mortgage is still more than 6.00%. While mortgage rates are declining, they’re still a far cry from where they were during the height of the pandemic when most mortgage borrowers either refinanced or bought a new home.

Ultimately, refinancing isn’t always possible for those who could potentially snag a lower rate. Closing costs can be difficult to contend with, while getting approved for a refinance can be challenging — especially for borrowers with less-than-stellar credit scores or a lot of other debt.

If mortgage rates continue their downward trend over the next six to 12 months, refinancing will likely remain a hot topic. While many people will be able to take advantage of falling rates and make their mortgages more affordable by refinancing, many won’t. We shouldn’t expect refinancing to become anywhere near as popular as it was just a few short years ago when mortgage rates were at record lows.

Tips for refinancing a mortgage

- Shop around for the best possible rate. Different lenders can offer different rates to the same borrowers. The first lender you go to may not be the lender who can offer you the lowest possible rate on your refinance. By shopping around for a mortgage refinance, you can increase your chances of snagging a lower rate and saving more money. Remember, your refinance lender doesn’t need to be the same lender with whom you originated your old mortgage, so you shouldn’t feel obligated to stay with your current lender if you find another one willing to offer you a lower rate.

- Remember that refinancing isn’t free. The cost to refinance a mortgage typically ranges from 2% to 6% of the loan value. Though you may be able to avoid paying these costs up front by rolling them into your new loan, you’ll still be responsible for paying them in the form of higher monthly payments. Because of this, you shouldn’t plan on refinancing unless you’re confident you can handle the costs associated with one. In that same vein, you should calculate your break-even point before you refinance to be sure you’ll be able to recoup whatever money you spend on closing costs.

- Consider different refinance terms and types. While this study focuses on 30-year, fixed-rate mortgage refinances, it’s important to remember that other refinancing options exist. For example, if you have a 30-year loan, you may be able to refinance to a 15-year mortgage. Doing so may result in your monthly payments going up, but it’ll also help you get an even lower interest rate and pay off your mortgage sooner. If you’d like to tap into your home’s equity, you could do so with a cash-out refinance that changes your current loan’s terms and gives you access to some of the money you’ve built into your property.

Methodology

Data in this study is derived from about 180,000 30-year, fixed-rate mortgage refinance offers given to users of LendingTree’s online marketplace in September 2023 and September 2024. To highlight where refinance demand is growing the most, this study focuses primarily on the 25 states that showed the largest year-over-year percentage increases in mortgage refinance offers. It also includes data aggregated at the national level.

While offers made on LendingTree’s platform don’t need to be accepted by borrowers, they are actual lender-proposed loans.

View mortgage loan offers from up to 5 lenders in minutes