Florida Is Most Desired Destination for Out-of-State Home Shoppers

As housing markets fluctuate, it’s not uncommon for interested homebuyers to look beyond their state — whether it’s to buy a first (or second) home or invest.

According to the latest LendingTree study, 13.7% of home shoppers looked to buy property out of state in 2024. Alaska had the highest rate of shoppers considering going elsewhere, while Texas had the lowest. By the numbers, Florida was the most desired location.

Here’s what else we found.

Key findings

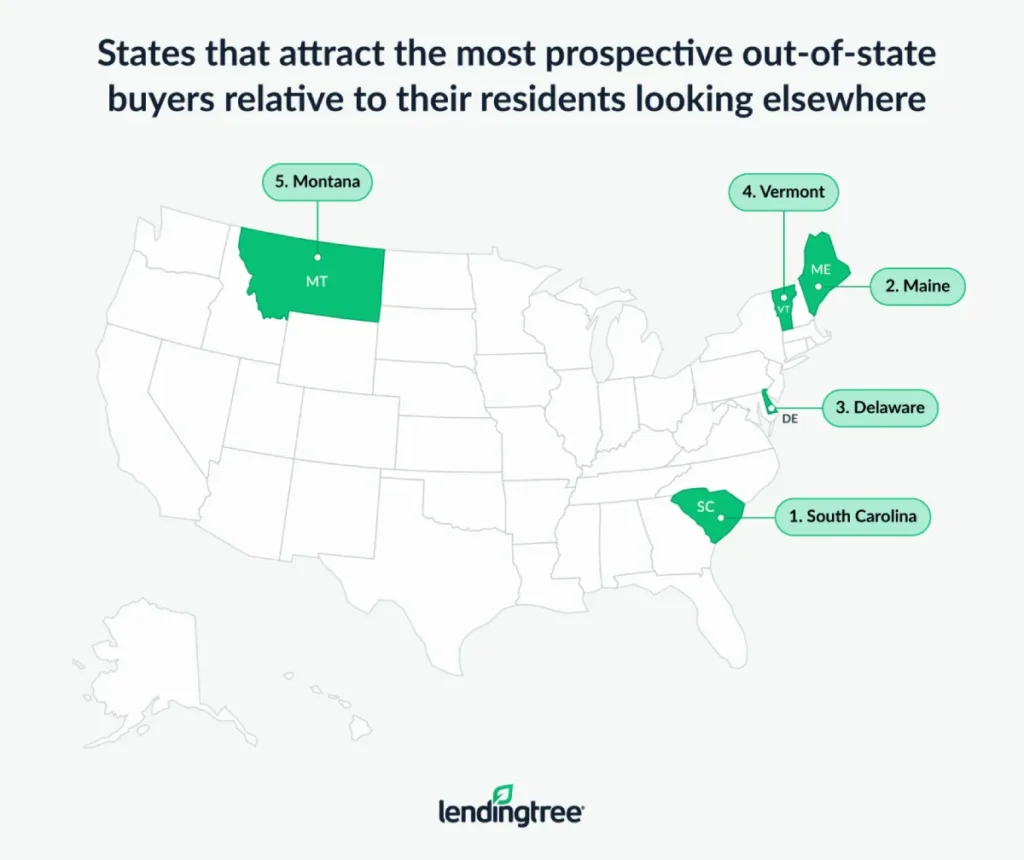

- Of any state, out-of-state residents were more interested in South Carolina than its residents were in buying elsewhere. For every 100 South Carolinians interested in buying out of state, 255 out-of-staters were interested in buying in the state — a ratio of 2.55. The next highest ratios were in Maine (2.09) and Delaware (2.08).

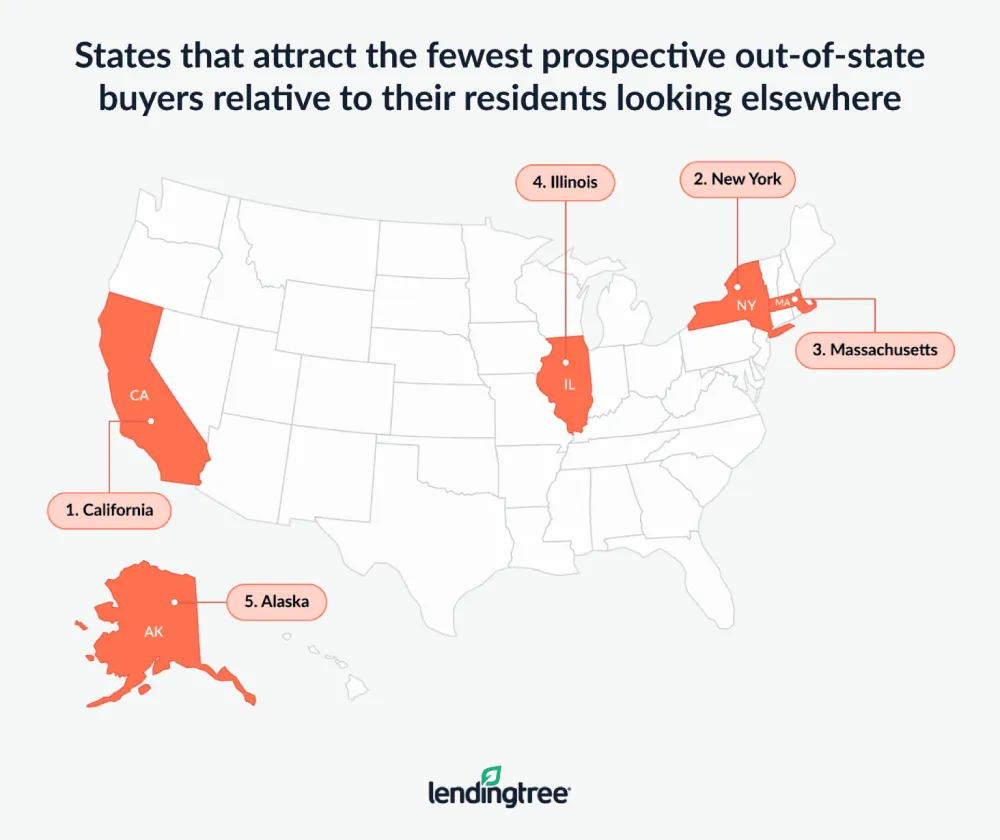

- Conversely, California, New York and Massachusetts attracted the fewest out-of-staters. For every 100 Californians interested in buying out of state, only 30 out-of-staters expressed interest in buying in the state — a ratio of 0.30. The next lowest ratios were in New York (0.37) and Massachusetts (0.48).

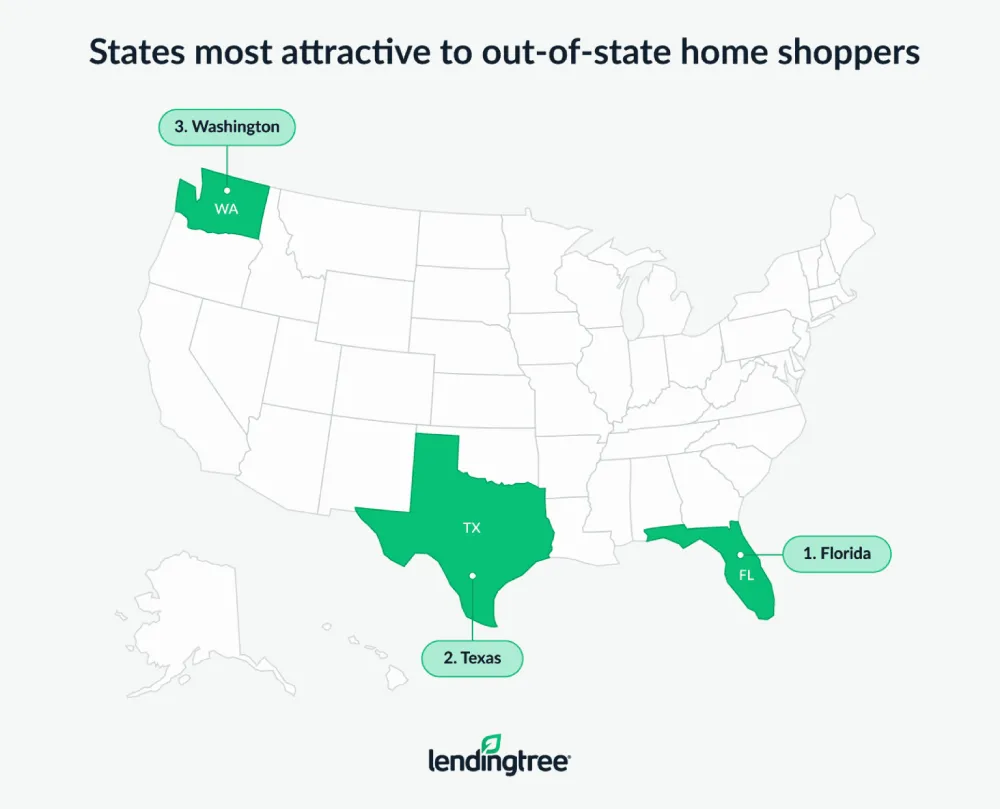

- Out-of-state shoppers most desired Florida, Texas and Washington. Florida was the top destination for nine states’ residents (including Texans) looking to buy elsewhere, while Texas was the top choice for seven states’ residents (including Californians). Washington state was the preferred destination by another four.

- 13.7% of home shoppers planned to buy out of state. Alaska (28.5%), Hawaii (27.9%) and Rhode Island (24.1%) shoppers were most likely to seek out-of-state homes. Conversely, shoppers in Texas (8.1%), Michigan (8.8%) and Wisconsin (9.1%) were least likely to consider real estate outside their state.

- 24.4% of baby boomer shoppers searched for homes in other states. Gen Xers (15.0%), millennials (11.9%) and Gen Zers (10.3%) followed. Among shoppers looking outside their state, 10.3% were interested in second homes and 4.0% considered investment properties. The other 85.7% intended to buy homes in which they would live.

Out-of-staters far more interested in South Carolina than in-staters were interested elsewhere

South Carolina attracted the most out-of-state shoppers compared to those in the state looking elsewhere. In fact, for every 100 South Carolinians looking at buying out of state, 255 out-of-staters were interested in buying homes in South Carolina — a ratio of 2.55.

The average monthly mortgage payment in South Carolina is $296 less than the national average of $2,317, according to a 2023 LendingTree study. As a coastal state, South Carolina is home to many desirable beach towns like Charleston and Myrtle Beach, which may boost its desirability for those looking for investment or second homes.

Maine ranked second, with a ratio of 2.09. Maine also has a lower-than-average monthly mortgage payment, costing $175 less. Delaware, with a 2.08 ratio, rounded out the top three.

“When you have a big influx of interest from out-of-state buyers, this demand can send house prices through the roof,” says Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.”

He adds: “That’s good news for people who already have a home and want to build equity. It’s not as great for those getting into the market and looking for deals. Rising prices and high interest rates have pushed homeownership out of reach for many. A tidal wave of out-of-staters coming in and looking to buy doesn’t make that any easier.”

Far more Californians looked to buy elsewhere than out-of-staters looked to buy there

Perhaps unsurprisingly, California was the least popular state for out-of-state shoppers compared to residents looking to buy elsewhere. For every 100 Californians interested in purchasing outside of their state, only 30 out-of-state buyers expressed interest in California property — a ratio of 0.30.

Of course, California is famously expensive for homebuying. In fact, the average monthly mortgage payment is $3,399 — $1,082 higher than the national average and the second-highest by state. With an average monthly household income of $10,079, mortgage payments take up 33.72% of homeowners’ incomes — the third-highest by state. That may be why consumers here may be more interested in homes elsewhere.

Meanwhile, for every 100 New Yorkers looking to buy out of state, the state only attracted 37 out-of-state buyers — a ratio of 0.37. Massachusetts (0.48) followed. Both states have higher monthly mortgage payments than the national average, with Massachusetts third-highest by state.

“These are high-income, high-cost-of-living areas,” Schulz says. “They’re not going to be where people search for a relatively inexpensive vacation home or investment property. The opposite is more likely: Residents of these states will look to warmer, less expensive areas, such as Florida and Texas, for buying opportunities.” (More on this soon.)

Full rankings: Highest/lowest out-of-state interest relative to those in state being interested elsewhere

| Rank | State | Out-of-state vs. in-state interest (ratio) |

|---|---|---|

| 1 | South Carolina | 2.55 |

| 2 | Maine | 2.09 |

| 3 | Delaware | 2.08 |

| 4 | Vermont | 2.00 |

| 5 | Montana | 1.72 |

| 6 | Idaho | 1.71 |

| 7 | Florida | 1.59 |

| 8 | Arkansas | 1.58 |

| 8 | New Hampshire | 1.58 |

| 10 | Nevada | 1.51 |

| 11 | Tennessee | 1.49 |

| 11 | West Virginia | 1.49 |

| 13 | Alabama | 1.48 |

| 14 | Wyoming | 1.45 |

| 15 | Oklahoma | 1.44 |

| 16 | Mississippi | 1.43 |

| 17 | North Carolina | 1.41 |

| 18 | Missouri | 1.31 |

| 19 | Georgia | 1.28 |

| 20 | Oregon | 1.27 |

| 21 | Minnesota | 1.24 |

| 21 | Texas | 1.24 |

| 23 | Wisconsin | 1.22 |

| 24 | Michigan | 1.20 |

| 25 | Arizona | 1.19 |

| 26 | New Mexico | 1.16 |

| 27 | South Dakota | 1.09 |

| 28 | Kentucky | 1.05 |

| 29 | Iowa | 1.01 |

| 29 | Rhode Island | 1.01 |

| 31 | Colorado | 0.97 |

| 32 | Connecticut | 0.96 |

| 33 | Indiana | 0.94 |

| 34 | Utah | 0.92 |

| 34 | Washington | 0.92 |

| 36 | Pennsylvania | 0.91 |

| 37 | Hawaii | 0.90 |

| 38 | Ohio | 0.88 |

| 39 | New Jersey | 0.79 |

| 39 | Virginia | 0.79 |

| 41 | North Dakota | 0.78 |

| 42 | Nebraska | 0.77 |

| 43 | Kansas | 0.75 |

| 44 | Maryland | 0.73 |

| 45 | Louisiana | 0.67 |

| 46 | Alaska | 0.59 |

| 47 | Illinois | 0.54 |

| 48 | Massachusetts | 0.48 |

| 49 | New York | 0.37 |

| 50 | California | 0.30 |

Florida most attractive for out-of-state shoppers

Looking more broadly, Florida was the most popular destination for out-of-state shoppers. Florida was the top state for consumers looking to buy elsewhere in nine states, including populous Texas.

Meanwhile, Texas was the second most popular destination, topping the list for seven states, including California, Arizona and Colorado. Washington followed as the top destination for four states: Oregon, Idaho, Alaska and Montana.

“These three states have no state personal income tax,” he says, referencing Florida, Texas and Washington. “That’s a big deal. They’re also relatively large states by area that feature a mix of big urban cities and rural areas. That sort of diversity can be appealing.”

13.7% of U.S. home shoppers planned to buy out of state, led by baby boomers

Among those making mortgage purchase inquiries on the LendingTree platform, 13.7% of home shoppers planned to buy property out of state in 2024. Alaska had the highest rate of shoppers looking to leave, with 28.5% inquiring about out-of-state homes.

That could be because Alaska has a high cost of living. Additionally, parts of Alaska get 24 hours of sunlight in the summer and significantly long periods of darkness in the winter — which may be too disruptive for many.

Hawaii (27.9%) and Rhode Island (24.1%) shoppers were the next most likely to seek out-of-state purchases, though that likely boils down to high living and mortgage costs.

Conversely, shoppers in Texas (8.1%), Michigan (8.8%) and Wisconsin (9.1%) were the least likely to consider real estate outside of their state.

By generation, baby boomer home shoppers ages 60 to 78 were the most likely to look out of state, at 24.4%. Meanwhile, Gen X shoppers ages 44 to 59 (15.0%), millennial shoppers ages 28 to 43 (11.9%) and Gen Z shoppers ages 18 to 27 (10.3%) were less likely.

Percentage of shoppers looking out of state (by generation)

| Generation | % looking to buy out of state |

|---|---|

| Gen Zers | 10.3% |

| Millennials | 11.9% |

| Gen Xers | 15.0% |

| Baby boomers | 24.4% |

Those inquiring about out-of-state homes were most likely to do so for personal occupancy, at 85.7%. Another 10.3% were interested in purchasing a second home and 4.0% wanted to do so for investment purposes.

Full rankings: Highest/lowest percentage of shoppers looking out of state (by state) — and most popular destinations

| Rank | State | % looking to buy in state | % looking to buy out of state | Top destination state |

|---|---|---|---|---|

| 1 | Alaska | 71.5% | 28.5% | Washington |

| 2 | Hawaii | 72.1% | 27.9% | Nevada |

| 3 | Rhode Island | 75.9% | 24.1% | Massachusetts |

| 4 | Delaware | 78.3% | 21.7% | Maryland |

| 5 | Vermont | 78.4% | 21.6% | New Hampshire |

| 6 | New York | 78.5% | 21.5% | New Jersey |

| 7 | Maryland | 80.0% | 20.0% | Virginia |

| 8 | New Mexico | 80.3% | 19.7% | Texas |

| 9 | Connecticut | 80.4% | 19.6% | Florida |

| 9 | New Hampshire | 80.4% | 19.6% | Massachusetts |

| 9 | West Virginia | 80.4% | 19.6% | Ohio |

| 12 | Nevada | 80.7% | 19.3% | California |

| 13 | Massachusetts | 80.8% | 19.2% | New Hampshire |

| 14 | Wyoming | 81.0% | 19.0% | Colorado |

| 15 | South Dakota | 81.5% | 18.5% | Minnesota |

| 16 | North Dakota | 82.5% | 17.5% | Minnesota |

| 17 | Kansas | 82.6% | 17.4% | Missouri |

| 18 | Colorado | 82.9% | 17.1% | Texas |

| 19 | Virginia | 83.0% | 17.0% | North Carolina |

| 19 | Illinois | 83.0% | 17.0% | Wisconsin |

| 19 | New Jersey | 83.0% | 17.0% | Pennsylvania |

| 22 | Idaho | 83.4% | 16.6% | Washington |

| 23 | Washington | 84.7% | 15.3% | Oregon |

| 24 | Arizona | 84.8% | 15.2% | Texas |

| 25 | California | 84.9% | 15.1% | Texas |

| 26 | Utah | 85.2% | 14.8% | Idaho |

| 27 | Maine | 85.5% | 14.5% | Florida |

| 27 | Pennsylvania | 85.5% | 14.5% | New Jersey |

| 29 | Louisiana | 86.4% | 13.6% | Texas |

| 30 | Montana | 86.5% | 13.5% | Washington |

| 31 | Tennessee | 86.6% | 13.4% | Florida |

| 32 | Mississippi | 86.7% | 13.3% | Alabama |

| 33 | North Carolina | 86.9% | 13.1% | South Carolina |

| 34 | Oregon | 87.0% | 13.0% | Washington |

| 35 | Kentucky | 87.1% | 12.9% | Ohio |

| 36 | South Carolina | 87.3% | 12.7% | North Carolina |

| 37 | Nebraska | 87.8% | 12.2% | Iowa |

| 38 | Florida | 88.2% | 11.8% | Georgia |

| 39 | Alabama | 88.5% | 11.5% | Florida |

| 39 | Georgia | 88.5% | 11.5% | Florida |

| 41 | Indiana | 88.7% | 11.3% | Florida |

| 42 | Arkansas | 88.8% | 11.2% | Texas |

| 43 | Iowa | 89.2% | 10.8% | Nebraska |

| 44 | Missouri | 89.5% | 10.5% | Kansas |

| 45 | Oklahoma | 90.1% | 9.9% | Texas |

| 46 | Minnesota | 90.3% | 9.7% | Wisconsin |

| 47 | Ohio | 90.5% | 9.5% | Florida |

| 48 | Wisconsin | 90.9% | 9.1% | Minnesota |

| 49 | Michigan | 91.2% | 8.8% | Florida |

| 50 | Texas | 91.9% | 8.1% | Florida |

Buying out-of-state homes: Top expert tips

Regardless of why you’re looking for an out-of-state property, buying one adds additional challenges to an already difficult process. Schulz offers the following advice:

- Know yourself. “Purchasing a new home in another state is a big deal and should be done with caution,” he says. “Before you buy, ask yourself if you’re willing to commit to owning and managing the property. As exciting as it can be to buy that second home, it comes with very real financial risk and can require an awful lot of work. If you feel ready for that and confident that you’ve found the right property, go for it. If you’re unsure on either count, it may make sense to wait.”

- Visit in person and explore the area. Photos and virtual tours can be helpful, but they don’t always tell the story about the home or its neighborhood. If possible, visit the property in person to get a feel, check for red flags and confirm it meets your expectations. The same is true for the surrounding community. If visiting isn’t an option, consider hiring a trusted local real estate agent to provide an unbiased assessment.

- Shop around for rates. “Whether you’re buying your first home or your 17th, this advice doesn’t change,” he says. “Taking the time to get multiple offers from lenders can help you get the best rate, which can save you tens of thousands of dollars on that mortgage. That’s always important, but never more so than in a high interest rate environment like we find ourselves in today.”

Methodology

LendingTree researchers analyzed mortgage purchase inquiries made on the LendingTree platform in all 50 states (excluding the District of Columbia and U.S. territories) from Jan. 1 through Dec. 31, 2024.

Analysts calculated the percentage of shoppers who inquired about mortgage purchases outside of their home state and identified the top destination state based on the majority of inquiries from each state. We also calculated the percentage by generation nationally.

Additionally, we calculated a ratio for each state that represents the number of shoppers who don’t live in the state but want to buy property there versus those who live in the state but want to buy property elsewhere. The higher the number of shoppers not in the state who wanted to buy property there, the higher the ratio.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

View mortgage loan offers from up to 5 lenders in minutes