Mortgage Statistics: 2026

The U.S. housing market has slowed in recent years, mainly due to elevated mortgage rates and high home prices that have limited affordability. Despite these challenges, housing remains central to the economy, as it strongly impacts construction, consumer spending and household wealth. Understanding these dynamics is key to grasping the broader economic landscape.

Learning about the current housing market offers insights into the wider economy. For example, Americans collectively owe $13.07 trillion in mortgage debt, accounting for 70.3% of consumer debt. Additionally, the low serious delinquency rate of 0.83% despite economic challenges may ease concerns about a collapse.

LendingTree analyzed various data sources to create an overview of mortgage and housing market statistics. In the following sections, you’ll discover how much mortgage debt Americans have, how they manage and use that debt, and how the broader market is faring amid economic uncertainty.

Key mortgage statistics in 2025

- Americans owe $13.07 trillion on 86.67 million mortgages. That comes to an average of $150,802 per person with a mortgage on their credit report. Mortgages represent 70.3% of U.S. consumer debt.

- Additionally, Americans owe $422 billion on 13.10 million home equity lines of credit (HELOCs). That equates to an average of $32,214 per account. Outstanding HELOC debt represents 2.3% of U.S. consumer debt.

- The average interest rate for a 30-year, fixed-rate mortgage in 2025 was 6.63% as of the week ending Dec. 4. Rates have ranged from a low of 6.17% the week ending Oct. 30 to a high of 7.04% the week ending Jan. 16.

- Americans originated $1.40 trillion in new mortgage debt through the first three quarters of 2025. 80.1% was issued to super-prime borrowers with credit scores of at least 720, while 4.2% was issued to subprime borrowers with scores below 620.

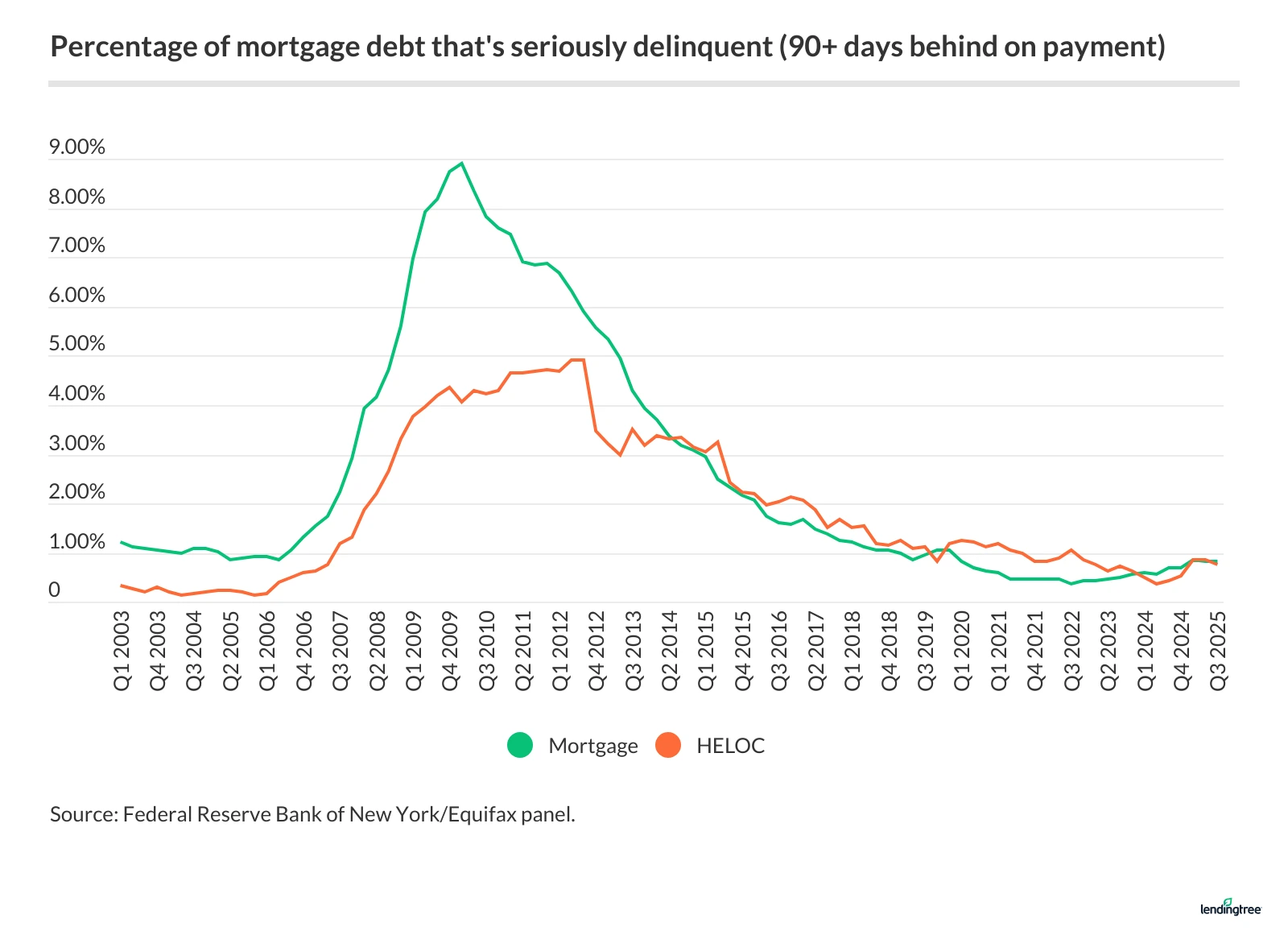

- 0.83% of all mortgage debt in the U.S. was seriously delinquent in the third quarter of 2025, up from 0.82% in Q2 2025. While serious delinquencies have grown recently, they’re lower than in Q1 2020 at the start of the COVID-19 pandemic.

- In Q3 2025, there were 54,760 foreclosures, a 3.7% increase from Q2. In the first three quarters of 2025, 169,220 consumers experienced new foreclosures, close to 2024’s total of 174,100. Both numbers remain far lower than the 1,755,860 new foreclosures in 2008, during the late 2000s housing market crash.

- In Q3 2025, only 2.2% of mortgaged properties were “underwater.” This figure is far below a record high of 26.0% in 2009.

- Through Q2 2025 (the latest available data), American households held $35.8 trillion, or 72.6% of the total value of residential real estate assets in the U.S., in real estate equity. That’s a $200 billion increase from Q2 2024 and a $3.8 trillion increase from Q2 2023, when American homeowners held $32.0 trillion in equity.

Outstanding mortgages

Spurred by a housing market frenzy fueled by record-low mortgage rates during the height of the COVID-19 pandemic, outstanding mortgage debt has grown by about $3.5 trillion since the end of 2019.

The massive increase can largely be attributed to two factors: an increase in the number of people with active mortgages and larger mortgage amounts.

Though mortgage rates have since climbed higher, many buyers were able to lock in record-low rates during the height of the pandemic. This allowed them to increase their purchase prices — or take advantage of cash-out refinances — while maintaining similar monthly payments to those they might have had before 2020.

Outstanding mortgages

| Quarter | Accounts* (millions) | Balances ($ trillions) | Avg. size per account |

|---|---|---|---|

| Q3 2025 | 86.67 | $13.07 | $150,802 |

| Q4 2024 | 85.10 | $12.61 | $148,120 |

| Q4 2023 | 84.17 | $12.25 | $145,539 |

| Q4 2022 | 83.42 | $11.92 | $142,927 |

| Q4 2021 | 80.96 | $10.93 | $135,005 |

| Q4 2020 | 80.60 | $10.04 | $124,603 |

| Q4 2019 | 80.94 | $9.56 | $118,075 |

| Q4 2018 | 79.35 | $9.12 | $114,984 |

| Q4 2017 | 79.99 | $8.88 | $111,039 |

| Q4 2016 | 79.90 | $8.48 | $106,133 |

| Q4 2015 | 80.61 | $8.25 | $102,332 |

| Q4 2014 | 81.43 | $8.17 | $100,332 |

Outstanding HELOCs

| Quarter | Accounts* (millions) | Balances ($ trillions) | Avg. size per account |

|---|---|---|---|

| Q3 2025 | 13.10 | $0.42 | $32,214 |

| Q4 2024 | 13.16 | $0.40 | $30,091 |

| Q4 2023 | 13.12 | $0.36 | $27,439 |

| Q4 2022 | 13.12 | $0.34 | $25,610 |

| Q4 2021 | 12.75 | $0.32 | $24,941 |

| Q4 2020 | 13.75 | $0.35 | $25,382 |

| Q4 2019 | 14.99 | $0.39 | $26,017 |

| Q4 2018 | 15.41 | $0.41 | $26,736 |

| Q4 2017 | 15.68 | $0.44 | $28,316 |

| Q4 2016 | 16.26 | $0.47 | $29,090 |

| Q4 2015 | 16.68 | $0.49 | $29,197 |

| Q4 2014 | 17.26 | $0.51 | $29,548 |

Mortgage rates

Mortgage interest rates for 30-year fixed loans peaked at 18.63% in 1981, with averages remaining above 10.00% from 1979 through 1985.

Over the past 50-plus years, rates dropped below 5.00% for the first time in 2009, following the Federal Reserve’s aggressive lowering of target rates to combat the Great Recession of 2007-09. Rates dipped below 4.00% for the first time in late 2011 and below 3.00% for the first time in 2020.

Average mortgage rates in the U.S. reached their lowest level in history (2.65%) during the first week of 2021. But they quickly rebounded, climbing in 2022 to their highest weekly point since 2002. While they ebbed and flowed from 2022 to the present, reaching a high of 7.79% in 2023, they have yet to fall back below 6.00%.

Here’s a look at historic mortgage rates dating to 1972:

Historic interest rates for 30-year conventional mortgages

| Year | Annual weekly avg. | High | Low |

|---|---|---|---|

| 2025 | 6.63% | 7.04% | 6.17% |

| 2024 | 6.72% | 7.22% | 6.08% |

| 2023 | 6.81% | 7.79% | 6.09% |

| 2022 | 5.34% | 7.08% | 3.22% |

| 2021 | 2.96% | 3.18% | 2.65% |

| 2020 | 3.11% | 3.72% | 2.66% |

| 2019 | 3.94% | 4.51% | 3.49% |

| 2018 | 4.54% | 4.94% | 3.95% |

| 2017 | 3.99% | 4.30% | 3.78% |

| 2016 | 3.65% | 4.32% | 3.41% |

| 2015 | 3.85% | 4.09% | 3.59% |

| 2014 | 4.17% | 4.53% | 3.80% |

| 2013 | 3.98% | 4.58% | 3.34% |

| 2012 | 3.66% | 4.08% | 3.31% |

| 2011 | 4.45% | 5.05% | 3.91% |

| 2010 | 4.69% | 5.21% | 4.17% |

| 2009 | 5.04% | 5.59% | 4.71% |

| 2008 | 6.03% | 6.63% | 5.10% |

| 2007 | 6.34% | 6.74% | 5.96% |

| 2006 | 6.41% | 6.80% | 6.10% |

| 2005 | 5.87% | 6.37% | 5.53% |

| 2004 | 5.84% | 6.34% | 5.38% |

| 2003 | 5.83% | 6.44% | 5.21% |

| 2002 | 6.54% | 7.18% | 5.93% |

| 2001 | 6.97% | 7.24% | 6.45% |

| 2000 | 8.05% | 8.64% | 7.13% |

| 1999 | 7.44% | 8.15% | 6.74% |

| 1998 | 6.94% | 7.22% | 6.49% |

| 1997 | 7.60% | 8.18% | 6.99% |

| 1996 | 7.81% | 8.42% | 6.94% |

| 1995 | 7.93% | 9.22% | 7.11% |

| 1994 | 8.38% | 9.25% | 6.97% |

| 1993 | 7.31% | 8.07% | 6.74% |

| 1992 | 8.39% | 9.03% | 7.84% |

| 1991 | 9.25% | 9.75% | 8.35% |

| 1990 | 10.13% | 10.67% | 9.56% |

| 1989 | 10.32% | 11.22% | 9.68% |

| 1988 | 10.34% | 10.77% | 9.84% |

| 1987 | 10.21% | 11.58% | 9.03% |

| 1986 | 10.19% | 10.99% | 9.29% |

| 1985 | 12.43% | 13.29% | 11.09% |

| 1984 | 13.88% | 14.68% | 13.14% |

| 1983 | 13.24% | 13.89% | 12.55% |

| 1982 | 16.04% | 17.66% | 13.57% |

| 1981 | 16.64% | 18.63% | 14.80% |

| 1980 | 13.74% | 16.35% | 12.18% |

| 1979 | 11.20% | 12.90% | 10.38% |

| 1978 | 9.64% | 10.38% | 8.98% |

| 1977 | 8.85% | 9.00% | 8.65% |

| 1976 | 8.87% | 9.10% | 8.70% |

| 1975 | 9.05% | 9.60% | 8.80% |

| 1974 | 9.19% | 10.03% | 8.40% |

| 1973 | 8.04% | 8.85% | 7.43% |

| 1972 | 7.38% | 7.46% | 7.23% |

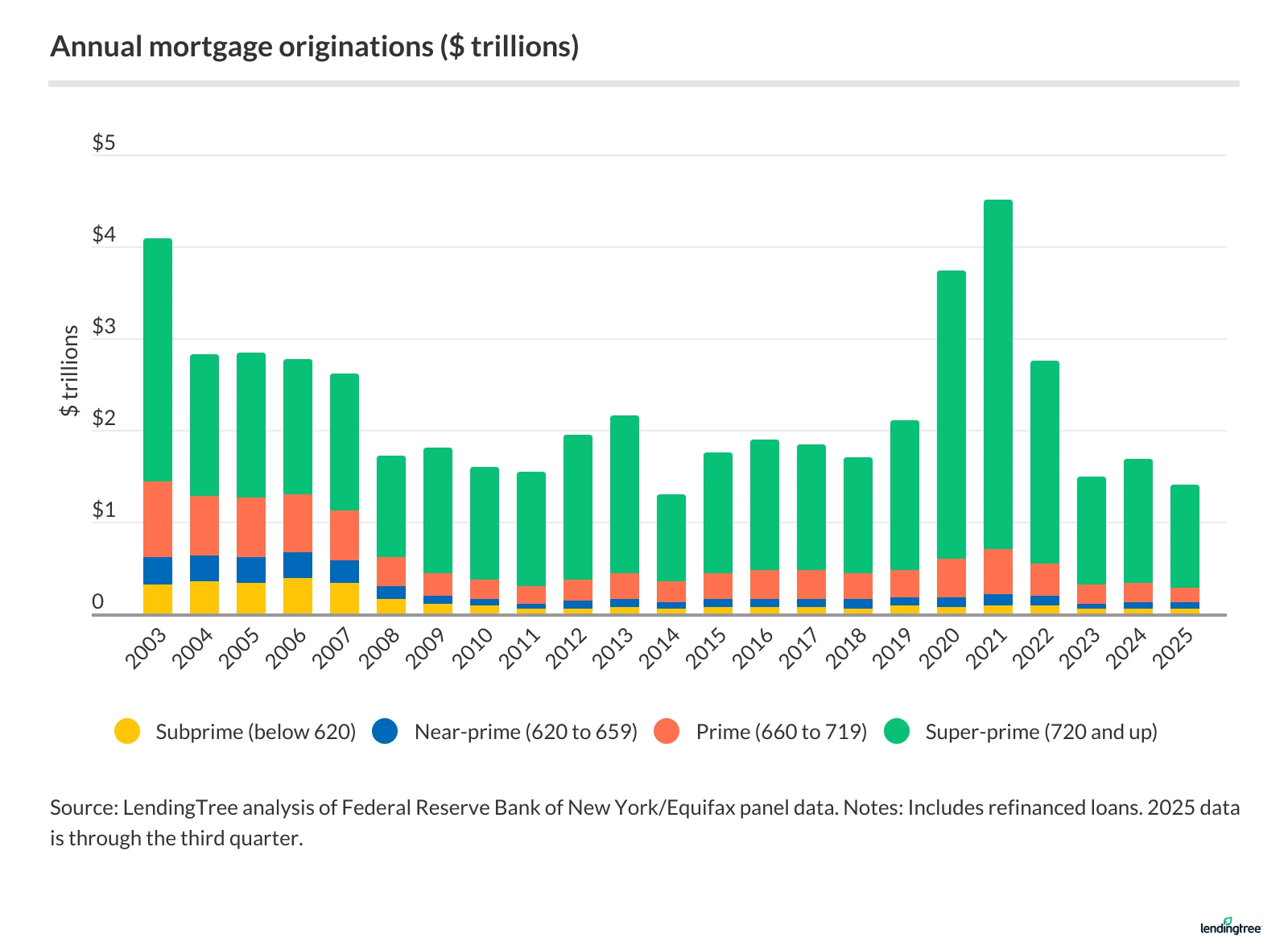

Mortgage originations

Mortgage originations dropped off dramatically as rates rose from their 2021 historic lows to their highest point in 20 years. In fact, mortgage originations totaled $2.75 trillion in 2022, compared with $4.51 trillion in 2021. Originations continued to drop in 2023 to $1.50 trillion. However, originations rose to $1.69 trillion in 2024 — a 12.9% increase from the previous year. (Through the first three quarters of 2025, originations totaled $1.40 trillion.)

At $4.51 trillion, 2021 marked the largest annual origination volume in any year for which data is available. Historically low rates that year meant that borrowers could take out bigger loans for similar monthly payments, and it also drew many people to refinance their existing mortgages.

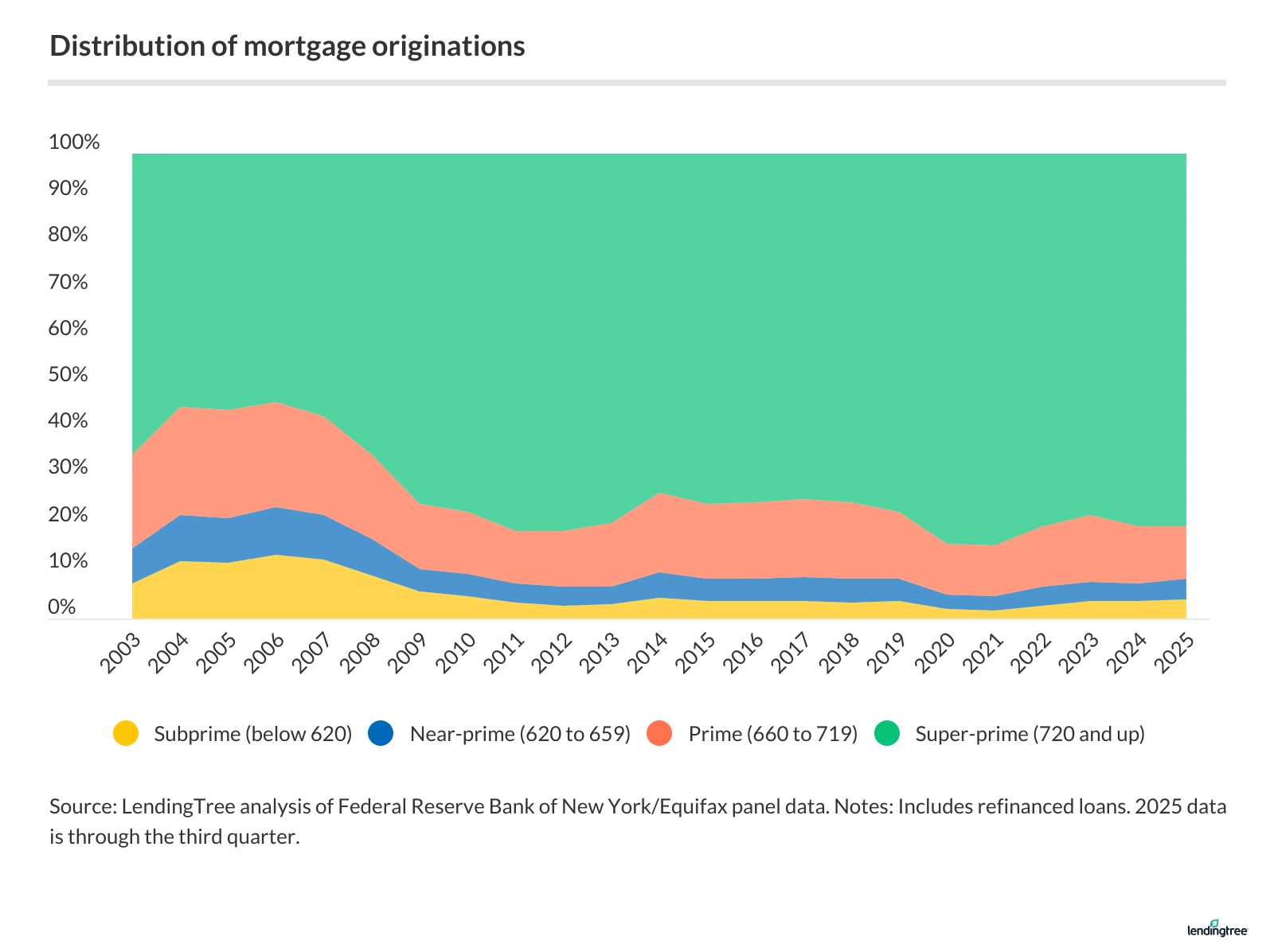

Origination volume was also elevated in the years leading up to the housing market crash and the Great Recession of the late 2000s, with subprime borrowers with credit scores below 620 taking up an unusually large share of the new debt.

Subprime borrowing as a share of origination volume peaked in 2006 at 13.6%, while super-prime borrowers with scores of at least 720 held their smallest share that year (53.5%). In 2024, subprime borrowers accounted for 3.6% of mortgage origination volume. Super-prime borrowers, on the other hand, comprised 80.3%.

Through Q3 2025, super-prime borrowers made up 80.1% of origination volume, while 4.2% went to subprime borrowers.

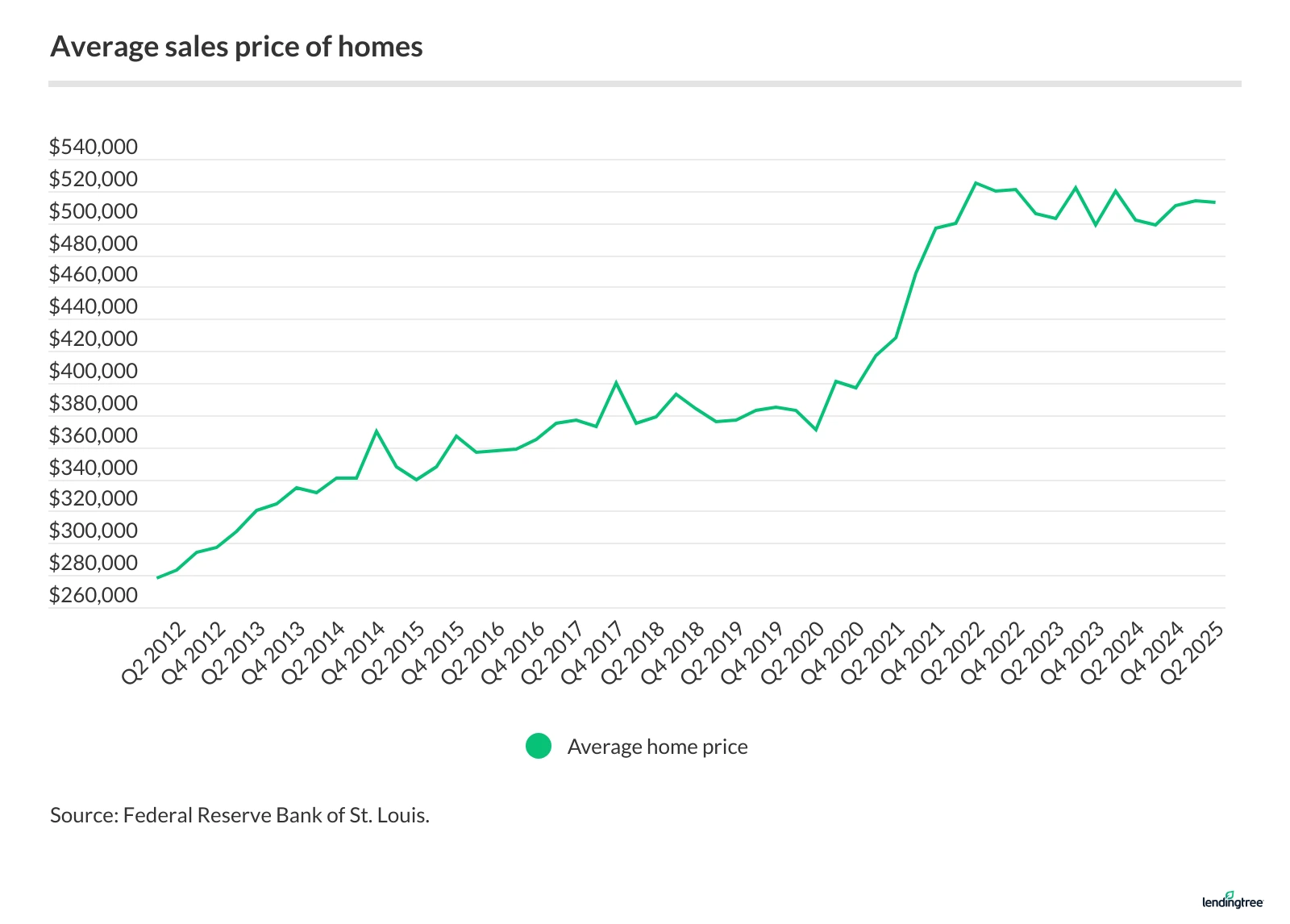

Average sales price

The average purchase price for a home in the U.S. was $512,800 in Q2 2025 — the latest available data.

Driven largely by lower mortgage rates, home prices rose dramatically after the start of the pandemic. Despite initially dipping from an average of $383,000 in Q1 2020 to $371,100 in Q2 2020, prices climbed to a record high of $525,100 in Q2 2022 — an increase of $142,100, or 37.1%, from Q1 2020.

Prices have since decreased by $12,300 nationally but remain elevated and at or above highs in some areas.

Delinquencies and foreclosures

According to the Federal Reserve Bank of New York, 0.83% of all mortgage debt as of Q3 2025 was seriously delinquent by 90 days or more. Although this percentage increased compared to the same period last year, the rate of mortgage debt that’s seriously delinquent is still lower than it was before the pandemic.

Like serious delinquencies, foreclosures remain rare, though they’re more common than during the pandemic, when they were at historic lows. In 2024, 174,100 foreclosures were reported, the highest since 2019, but still lower than any year from 2003 through 2019. In Q3 2025, there were 54,760 foreclosures, a 3.7% increase from the previous quarter’s 52,800. The total in the first three quarters of 2025 was 169,220 — nearly matching 2024’s full-year figure with one quarter to go.

As discussed, 2021 saw a significant surge in the total volume of dollars originated as mortgage debt, with a historically high proportion of that going to super-prime borrowers who were able to lock in at or near record-low mortgage rates. For this reason, delinquencies and foreclosures haven’t increased dramatically since the pandemic. And they’re unlikely to do so, even in the face of economic headwinds.

Number of new foreclosures

| Year | Foreclosures |

|---|---|

| 2025 | 1,69,220 |

| 2024 | 1,74,100 |

| 2023 | 1,50,820 |

| 2022 | 1,22,140 |

| 2021 | 38,040 |

| 2020 | 1,29,000 |

| 2019 | 2,77,560 |

| 2018 | 2,84,360 |

| 2017 | 3,14,220 |

| 2016 | 3,39,200 |

| 2015 | 4,04,180 |

| 2014 | 4,95,620 |

| 2013 | 7,08,140 |

| 2012 | 4,51,340 |

Sources

- Federal Reserve

- Federal Reserve Bank of New York/Equifax panel

- Federal Reserve Bank of St. Louis

- Cotality

View mortgage loan offers from up to 5 lenders in minutes