How Does Mortgage Amortization Work? Calculate Yours Now To Find Out

Amortization is a blueprint for how you’ll pay off your mortgage in equal installments over a set term. You can use our amortization calculator to generate an amortization schedule, which will show you exactly how much principal and interest you’re paying in each mortgage payment, as well as what your loan balance will be on any given date during your loan term.

These details can help you make informed decisions about your financial future, like whether to refinance, tap your home equity or switch to a shorter loan term.

- Amortization is the process of paying off a mortgage over a set time period using equal installments that cover both principal and interest.

- While the total payment amount doesn’t change over time, the portion of each payment dedicated to interest decreases over time, and the portion dedicated to principal increases.

- A mortgage amortization schedule provides a detailed breakdown of each payment, when it is due, its interest and principal components, and the remaining loan balance as it decreases over time.

What is amortization?

Amortization is a financial term describing how you’ll pay off your loan completely — “mort” means “to kill” — by making payments over your loan’s term.

Amortization dictates that your total mortgage payment amount won’t change month to month, but the portions of that payment going to interest and principal will. A mortgage amortization schedule shows exactly how much goes toward interest and principal in each payment, and what your principal balance is after each payment.

Overview: How amortization works

There are two main concepts built into amortization:

- Your principal balance. This is the amount you borrowed and it’s reduced after each payment, as you chip away at the total amount.

- The amount of interest you owe. For a fixed-rate mortgage, this is based on the interest rate you locked in and covers the interest accrued during the previous month. Think of it like paying rent, except you pay at the end of the month instead of at the beginning.

As a result, your amortization schedule will show that:

- You’ll pay less interest each month.

- You’ll pay more principal each month.

- Your loan balance decreases with each payment.

- Your monthly principal and interest payment is always the same.

- Fixed-rate mortgages are “fully amortizing,” which means that you’ll have paid the balance in full once you make all of your payments.

Mortgage amortization calculator

The easiest way to calculate amortization is to use a mortgage amortization calculator that will create an amortization schedule for you. The schedule tracks:

- The month and year of each payment

- The amount of principal paid

- The amount of interest paid

- How much interest is paid as time goes on

- How the loan balance adjusts with each monthly payment

How to use this amortization calculator

You’ll need to enter your:

- Loan amount

- Interest rate

- Loan term

Once you’ve done that, the calculator will generate an amortization schedule. Click on each year to view the exact amounts of principal and interest in each payment, as well as your total interest paid and your loan balance.

How to calculate amortization (without a special calculator)

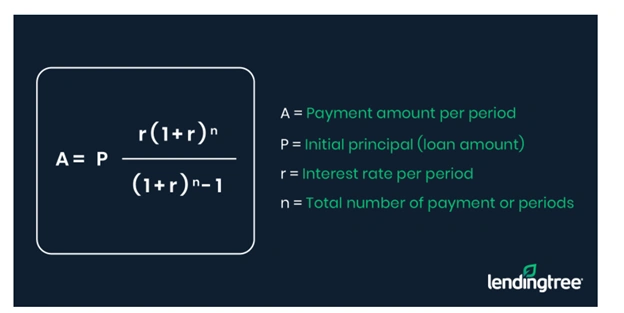

Everything in a loan’s amortization schedule is based on the interest rate, loan amount and loan term. If you’re a math whiz or just interested in the mechanics of how amortization works, we’ve given you the formulas needed below.

Calculating mortgage interest by hand

To calculate mortgage interest, let’s use the example of a 30-year, $400,000 loan with a 6.4% fixed rate:

To calculate the monthly interest percentage, divide your interest rate by 12 (0.064/12), which equals 0.0053.

Multiply that result by the $400,000 loan balance (0.0053 x $400,000), which equals $2,133.33. That’s your monthly interest amount on that $400,000 loan balance.

You can use this same calculation to find out how much you will pay or have paid in mortgage interest over the year. This can come in handy because of a tax benefit known as the home mortgage interest deduction, which allows homeowners to deduct the amount they’ve paid in mortgage interest over the year from their taxable income.

Calculating mortgage amortization by hand

To understand how an entire mortgage amortization schedule is calculated, here’s a mortgage amortization formula to study:

The good news is that you don’t have to calculate your own mortgage amortization by hand unless you’d like to!

How to use a mortgage amortization schedule

You can accomplish many different things using a mortgage amortization schedule, such as:

- Paying off your mortgage early. Making one extra payment a year shaves nearly four years off your loan term on a 30-year mortgage, saving you thousands of dollars in interest. To see the impact, use an extra payment mortgage calculator to try different amounts until you find the sweet spot for paying off your mortgage early based on your budget and savings goals.

- Tracking when PMI drops off. Private mortgage insurance (PMI) protects lenders if you default on a loan with less than a 20% down payment. However, it drops off automatically after you’ve paid your balance down to 78% of your home’s original value, and you can request cancellation even earlier.

- Determining if a shorter loan term makes sense. Using amortization schedules to compare 30- and 15-year fixed-rate mortgages can help you see how much you could save in interest charges — provided you can afford a higher monthly payment.

- Calculating when an ARM will reset. Adjustable-rate mortgages (ARMs) give you temporary savings for a set time because these loans often have lower initial interest rates than fixed-rate loans. However, once the fixed-rate period ends, an amortization schedule can show you how much your payment might spike. This is especially true if interest rates increase. You can also find this information in the “projected payments” section on Page 1 of your loan estimate.

- Deciding whether to refinance. When you refinance, you get a totally new loan, which restarts the amortization process. Since home equity is built far more gradually at the beginning of a loan term, it’s worth considering whether slowing the rate at which you build equity is in line with your financial goals. If you’re planning on moving, a mortgage refinance calculator can help you determine whether a refinance makes sense based on when you’ll “break even” (recoup your refinance closing costs).

- Deciding whether to recast your mortgage. A mortgage recast is a way of reducing your monthly payments without refinancing. Instead, you make a lump-sum payment, and your payments are recalculated. An amortization schedule can show you how much you stand to save.

- Estimating your future home equity. It’s pretty simple to calculate how much equity you have now, but what if you want to know exactly how much you may have in the future? An amortization schedule makes this far simpler to figure out by providing you with the projected loan balance over time.

Negative amortization and interest-only loans

Not all loans are amortizing loans. Here’s a look at two loan types that won’t have a standard mortgage amortization schedule.

Interest-only loans

Interest-only mortgage loans allow you to make lower monthly payments that only cover interest, and don’t reduce your principal balance.

For example, if you take out a home equity line of credit (HELOC), you’ll likely have the option to make interest-only payments during the initial draw period (usually 10 years).

Once the draw period ends, however, you’ll pay the remaining loan balance using an installment plan based on the typical mortgage amortization schedule. The main difference is that, since many HELOCs are variable-rate, your payment amounts can change from month to month as HELOC rates fluctuate.

Reverse mortgages

If you’re 62 or older, you may be eligible for a reverse mortgage. Unlike a regular mortgage, a reverse mortgage is a negative amortizing loan, which means the loan balance grows instead of shrinking each month. That’s because, as you draw on your home equity, the lender makes payments to you instead of you making payments to the lender.

One of the benefits of a reverse loan is tapping your equity without making a monthly principal and interest payment for as long as you live in the home. That said, you’ll still have to pay homeowners insurance premiums and property taxes and maintain the home — and the loan will have to be repaid eventually. With a reverse mortgage, that point comes when you die or move out of the home.

Frequently asked questions

You’ll prepay a small amount of interest (the exact amount will be listed in your closing disclosure) and then begin making regular payments. Your first payment is typically due on the first day of the second month after you close.

If your lender allows you to make extra payments on your mortgage, you can specify that those funds go toward the principal balance. In that case, they’ll reduce the amount of interest you have to pay each month by shrinking the principal balance.

However, you’ll continue to make the same payment each month going forward; instead of lowering your future payment amounts, your extra payments speed up how fast you’ll pay off your loan. If you want to recalculate your amortization schedule and reduce your payments going forward, you’d need to seek a mortgage recast or refinance rather than simply making extra payments.

Unlike traditional mortgages, which are fully amortizing loans, balloon mortgages are only partially amortizing. What this means is the final amortized payment on a balloon loan doesn’t pay off the loan in full. Instead, there is remaining debt that needs to be paid off — this is the “balloon” payment, and it’s at least two times larger than the regular payments were.

A “five-year term, 25-year amortization” means the loan has a five-year repayment term but the payments are structured as if the loan will be paid off over 25 years. Since the loan term is shorter than the amortization period, the payments will be lower than if the payment schedule was calculated with a five-year loan term that also has a five-year amortization period.

Of course, this means that when you come to the end of those five years, the loan won’t be fully paid off. At that point, the remaining loan balance will be due in a lump sum (balloon payment).

View mortgage loan offers from up to 5 lenders in minutes