Loan Seekers Plagued by Unwanted Calls and Texts, and They Don’t Know Why They’re Receiving Them — Here’s Why

Somehow, it’s always just when you sit down to dinner with your family — or at the conference table for an important meeting at work. The phone rings, dings or otherwise notifies you that someone needs your attention right now. When you check, that someone turns out to be a salesperson offering “the best deal ever” on a product you never even asked for.

The latest LendingTree survey investigates exactly these kinds of unwanted communications — which nearly three-quarters of those who’ve applied for a new financial product or service say they’ve received. Below, we’ll look at the prevalence of these pings and consumers’ responses to them. (Spoiler: They’re both annoyed and confused.)

Key findings

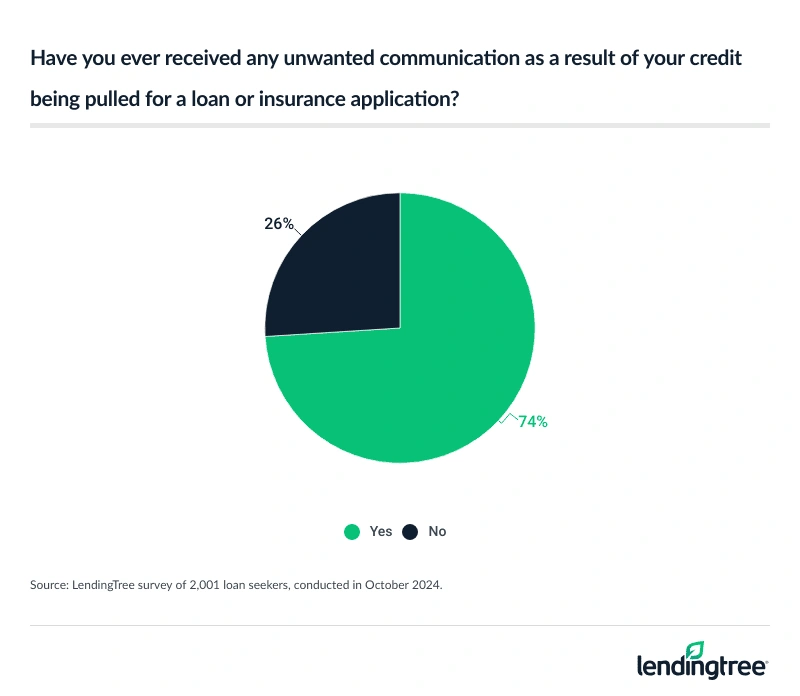

- The majority of loan or insurance policy seekers aren’t strangers to unwanted communication. Among Americans who’ve applied for a financial loan or insurance policy, 74% say they’ve received unwanted communication (phone calls, text messages, email, etc.) after their credit was pulled. And 56% say they received between 10 and 50 individual instances of unwanted communication.

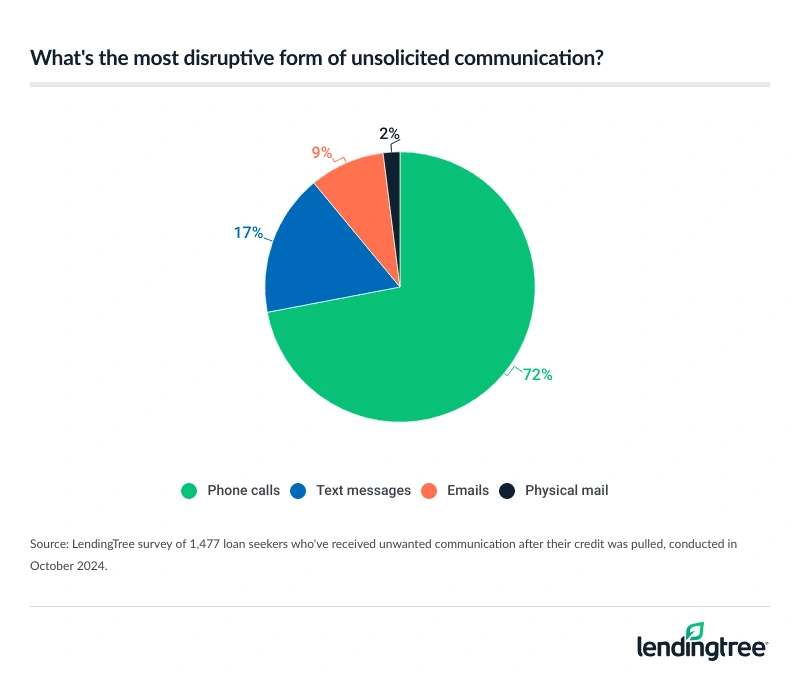

- This unwanted contact — also known as a trigger lead — can be an overwhelming nuisance. In fact, 83% who’ve received the unsolicited communication say it was bothersome, and 54% say it created confusion as they were trying to make financial decisions. When asked about the most disruptive form of contact, 72% said phone calls, followed by text messages (17%) and emails (9%).

- Despite the severity of these disturbances, most consumers don’t know who to blame. When asked who’s responsible for the unwanted communication, 84% pointed to marketplaces, financial institutions and/or the federal government. But only 16% realize it’s from credit bureaus selling your information as a marketing tool.

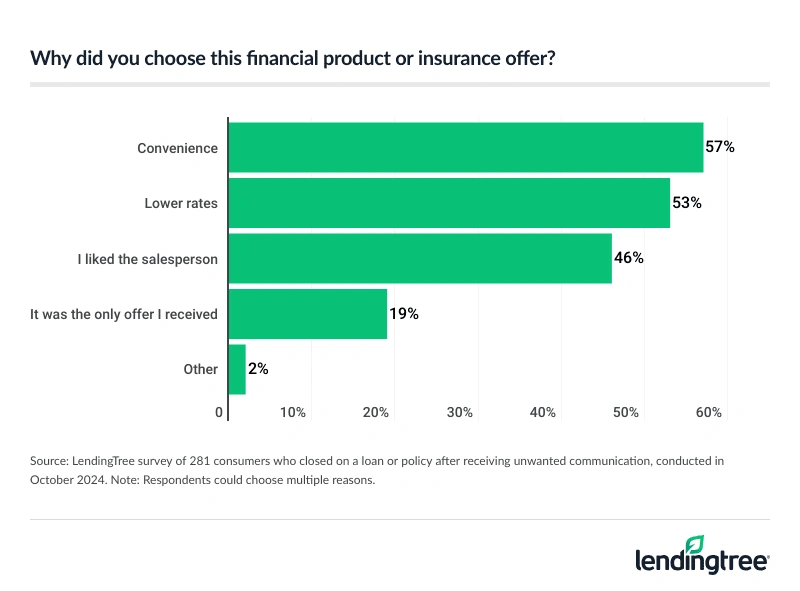

- Still, convenience drives a small percentage of consumers to close after these surprise calls. 14% of customers who’ve applied for a financial product say they’ve closed on a loan or a policy from a trigger lead. When asked why, 57% said convenience, 53% said lower rates and 46% liked the salesperson.

When you apply for a new financial product or service, the lender pulls your credit report — which the reporting agency can then sell to other service providers. Your application “triggers” this action since it indicates you’re in the market for a specific type of loan or insurance policy — it’s a “lead” for the companies that use the information to solicit you.

Most loan seekers not strangers to unwanted communication

Of the 2,001 survey respondents who’ve ever applied for financial loans (including mortgages, personal loans, auto loans and others) or insurance policies, 74% report they’ve received unwanted phone calls, text messages, email or snail mail as a result. That’s just shy of three-quarters.

Of those who received such unwanted solicitations, most (66%) received at least 10, and 10% received more than 50. Which is to say, the communications aren’t just common — they’re prolific.

Given the familiarity of targeted advertising these days — most of us have observed the way our phone and internet browsers seem able to predict our next purchase — these calls and texts might not come as a surprise.

“I think most people understand that when you apply for a loan or an insurance quote, you’re going to have lenders and insurers reach out to you,” LendingTree chief consumer finance analyst Matt Schulz says. After all, “that’s kind of the point” — to field multiple offers in hopes of getting the best deal.

Still, he admits, “there’s little that drives people crazier than a tidal wave of spam calls, regardless of whether you apply through an online marketplace, loan officer at your local bank branch or most anywhere else.”

Unwanted contact can be overwhelming nuisance

Given their lack of clear information as well as their sheer volume, it makes sense that these trigger leads can raise consumers’ frustrations — and indeed, 83% of respondents who’ve experienced them agree they’re at least somewhat bothersome. (More than half — 52% — say they found the communications very bothersome, indeed.) Plus, 54% of such respondents report the unsolicited communications created confusion amid their financial decision-making process.

And while the communications are frustrating in general, certain types are more annoying than others. The largest share of recipients, 72%, agree phone calls are the most disruptive type of unwanted contact, though 17% say text messages take the cake in this regard.

Tellingly, among all survey respondents (not just those who’ve received unwanted contact after applying for a new financial product), 56% of loan seekers say unsolicited financial communications are more annoying even than unsolicited political ones.

Unwanted contact — especially from companies advertising a different type of financial service than the one you originally applied for — is “just an awful user experience,” Schulz says. “It leads to angry customers.”

Consumers desperately want calls to stop

Recipients of unwanted solicitations are frustrated by them enough to take action: 74% of such respondents say they did something to try to make the communications stop.

Many say they asked to be removed from call lists or blocked callers, but more than a dozen say they changed their phone number to make the calls stop. A handful went so far as to contact the police. (So long as they comply with regulations in the Fair Credit Reporting Act, trigger leads are legal in all 50 states.)

Between clearer opt-in (and opt-out) options being built into financial applications and a cooling-off period (a required space of time between the application and the first unsolicited communication), the vast majority of loan seekers — 76% — say they’d prefer the former. Meanwhile, only 6% say they think the situation is fine as is.

Most consumers don’t know who to blame

While consumers know they’re frustrated, they’re not quite sure where to cast the blame for the problem. Although the credit bureaus are technically the ones responsible for trigger leads, 84% of those on the receiving end think the blame lies elsewhere.

“The consumer confusion is understandable,” Schulz says. “There are a lot of different entities involved, and the average consumer has no idea what role each is playing.”

Affected parties might not know who to blame — but consumers do seem united in their desire for the federal government to step in and help. A whopping 89% of loan seekers say they wish the federal government would do more to stop these unwanted forms of communication.

As mentioned, though, trigger leads are legal under current legislation — though a bill aimed at reducing them (specifically as a result of mortgage loan inquiries) was recently approved by the Senate and introduced to the House of Representatives.

Convenience drives small percentage to close after trigger lead

As frustrating as unwanted communications can be, they are, at least sometimes, successful — otherwise, companies would likely desist.

Indeed, nearly a third — 30% — of survey respondents who say they’ve been subject to unsolicited contact from financial companies also admit they have pursued an offer at least once. And once the chase is initiated, it often comes to fruition: Of that group, 64% went on to close on a deal.

Those who closed on deals as a result of unsolicited communications most commonly did so for financial products (55%), though 36% followed this route to a new insurance policy. One in 10 say they’ve accepted unsolicited offers in both categories.

The reasons that won this group over, even with the annoyance factor? Convenience (57%), lower rates (53%) and simply liking the salesperson they were connected with (46%) are at the top.

Though an onslaught of communications can indeed be annoying, the majority of surveyed loan seekers — 52% — say they’re willing to hear from lenders and service providers they may not be aware of in the hopes of finding the most competitive offer available to them.

Another 21% say they want to hear from such companies provided there’s a cap on how many will contact them, while 27% prefer to receive communications only from brands they already recognize.

Sick of calls? Here’s how to protect yourself

If you fall into the “please do not call” category, there are steps you can take to reduce the noise — though many consumers don’t know about them.

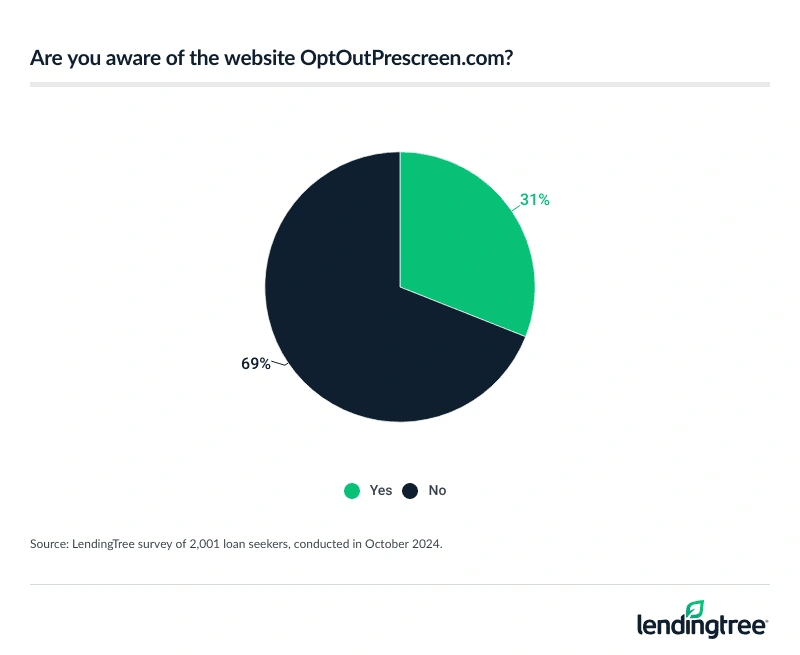

For instance, the website OptOutPrescreen.com allows you to, as its name suggests, opt out of firm credit or insurance offers — either for a temporary five-year period or permanently. You can also use the website to opt back in to such offers if you’re ready to shop the market. (Although it’s a powerful tool, 69% of survey respondents say they haven’t heard of it.)

Another important tool for those sick of spam phone calls: the National Do Not Call Registry. When you add your number to the list, legitimate companies will know not to call you on telemarketing campaigns — though it won’t stop illegal scammers from trying.

Still, like OptOutPrescreen.com, the National Do Not Call Registry is free to use — and if you do get a call from a salesperson 31 days after sign-up, you can report the company to the Federal Trade Commission (FTC) for breaching the list.

You can also find more information about how to avoid annoying robocalls from the CTIA, a U.S. wireless communications industry group. Tools and services available to you — as well as instructions on how to use them — are broken down by wireless service provider.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,001 U.S. consumers ages 18 to 78 from Oct. 21 to 23, 2024, who’ve applied for a financial loan (mortgage, auto loan, personal loan, etc.) or insurance policy. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles