Millennials Account for Nearly Half of Mortgage Inquiries in 50 Largest Metros

Buying a home is a major life milestone for many Americans, and millennials are squarely in the age range to reach that goal. Our analysis of mortgage inquiries finds that millennials accounted for 49.7% of purchase requests in the nation’s 50 largest metros in 2024.

Although this share is down slightly from 2023, millennials continue to be a driving force in the housing market. Our study reveals where prospective millennial homebuyers are most active, the size of the loans they’re seeking, their average down payments and how their buying power varies across the country.

Key findings

- Millennials account for nearly half of mortgage purchase inquiries in the U.S.’s 50 largest metros. 49.7% of mortgage inquiries in 2024 were from potential millennial borrowers ages 28 to 43, down 5.0% from 52.3% in 2023. In 16 of the 50 largest metros, millennials account for the majority of purchase inquiries.

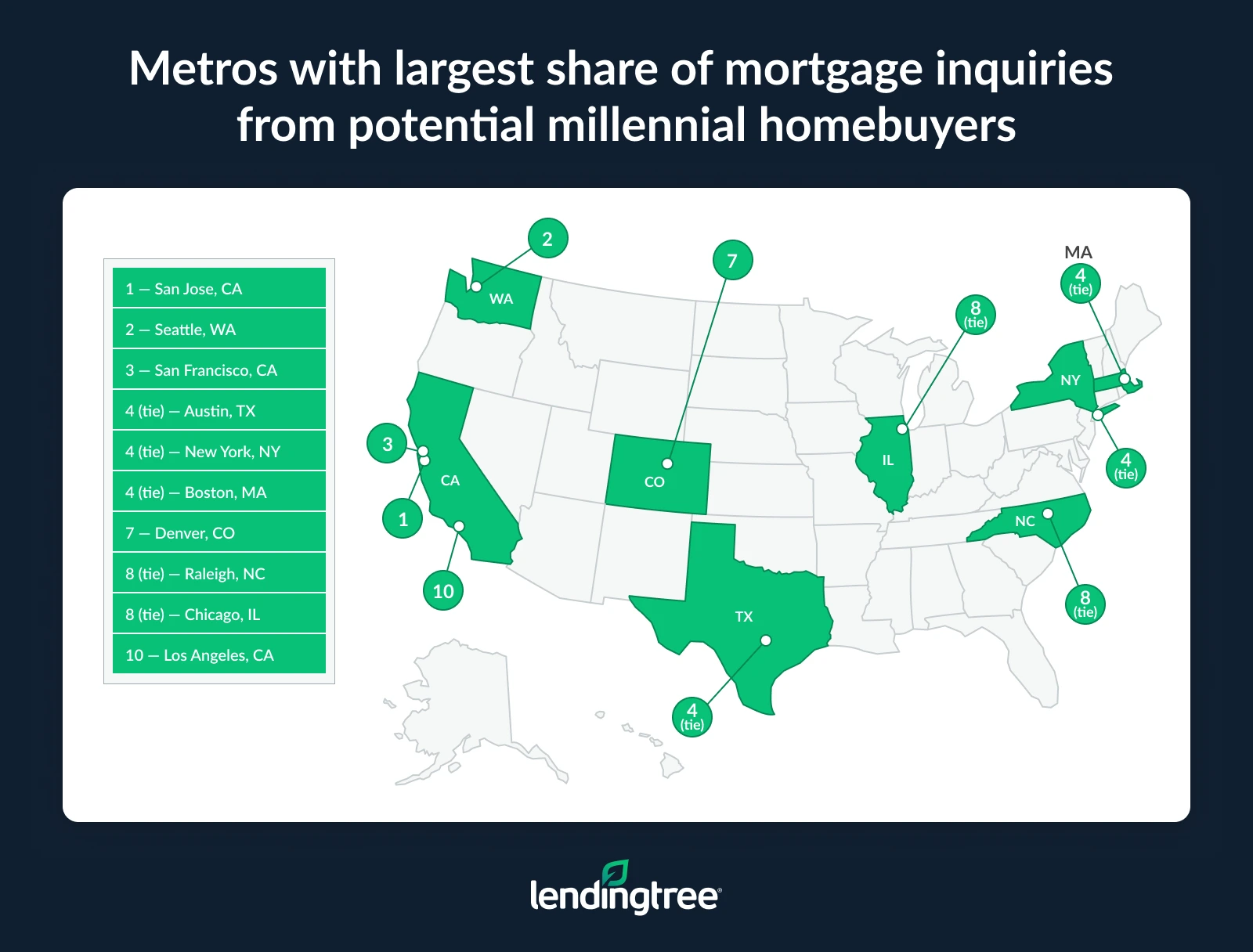

- San Jose, Calif., Seattle and San Francisco have the highest share of potential millennial homebuyers. Millennials in these metros account for 62.6%, 57.1% and 56.9% of mortgage inquiries, respectively.

- Millennials in Louisville, Ky., Tampa, Fla., and Jacksonville, Fla., make up the smallest share of potential buyers — though still substantial. In these metros, 41.5%, 41.7% and 42.4% of purchase inquiries, respectively, are from millennials.

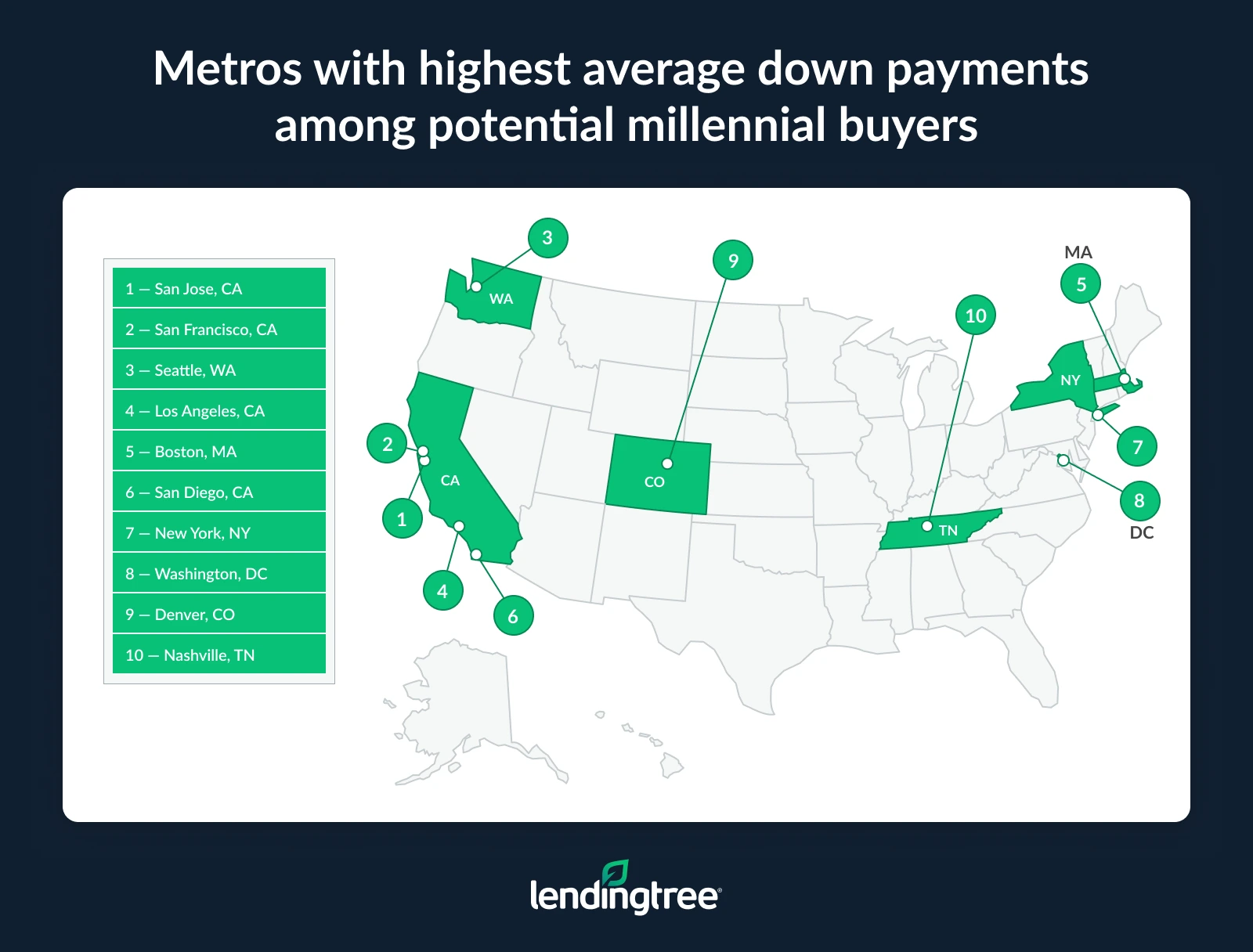

- San Jose, San Francisco and Seattle have the highest average down payments among potential millennial homebuyers. San Jose leads at $212,901. Conversely, the average down payment in Virginia Beach, Va., is $43,582 — nearly five times lower. Of the 50 largest metros, eight have average down payments under $50,000, while seven exceed $100,000.

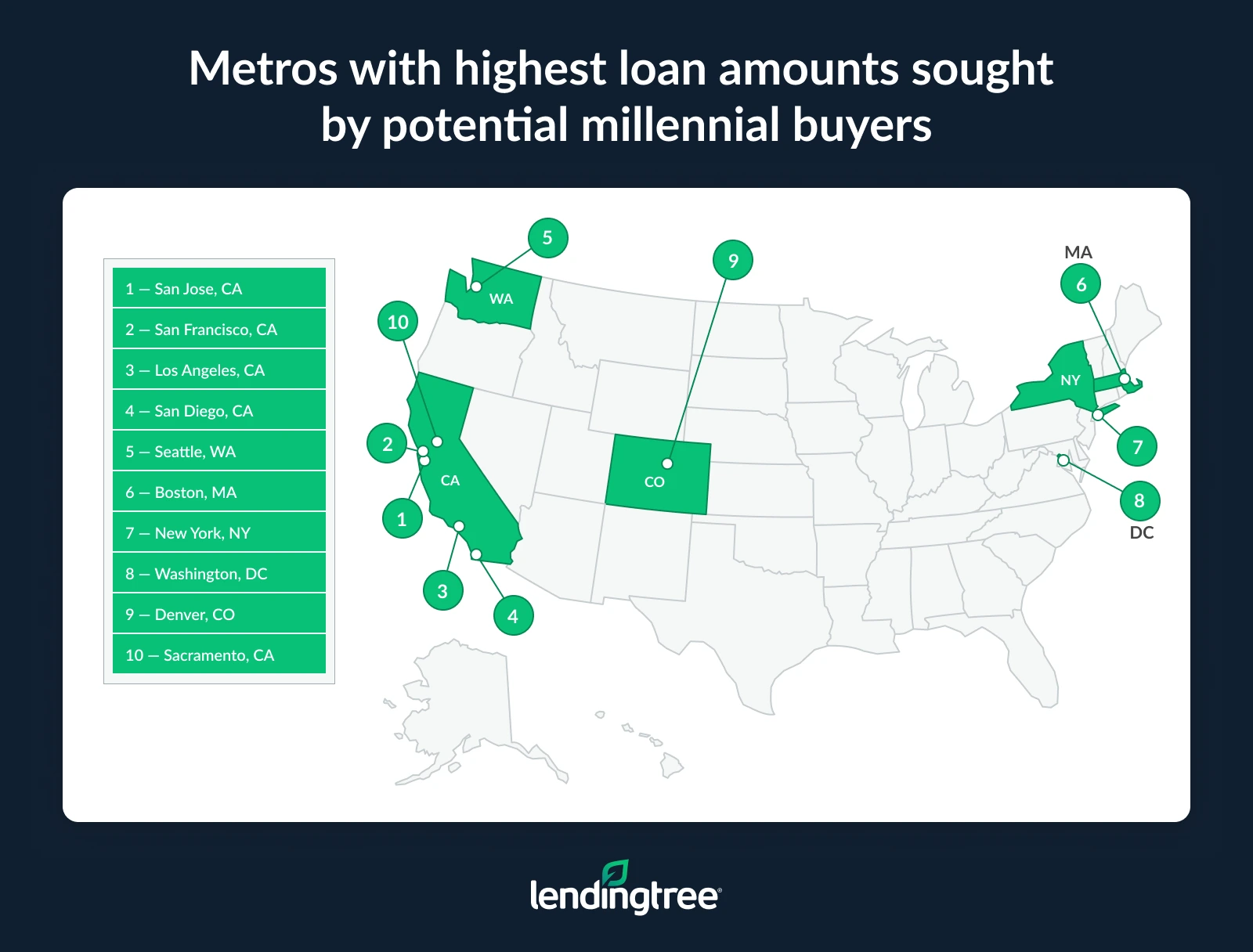

- Potential millennial buyers in San Jose, San Francisco and Los Angeles seek the highest loan amounts. Loan inquiries in these metros average $793,636, $735,780 and $634,215, respectively. In contrast, the lowest average loan inquiries are in Buffalo, N.Y. ($260,511), Cleveland ($276,311) and Oklahoma City ($280,459).

49.7% of mortgage inquiries in largest metros from millennial borrowers

Nearly half of prospective homebuyers in the 50 largest metros are millennials, responsible for 49.7% of mortgage quote requests in 2024.

Millennials, born between 1981 and 1996, were ages 28 to 43 in 2024, placing them firmly in their prime homebuying years. Many have reached milestones — steady careers, growing families and a desire for long-term stability — that typically align with purchasing a home.

According to the National Association of Realtors 2024 Profile of Home Buyers and Sellers, the median age of first-time buyers is 38. Freddie Mac data shows that first-time homebuyers made up 53% of its purchase loans in the second quarter of 2024, reinforcing the heavy representation of millennials in mortgage inquiries.

Share of millennial homebuyer inquiries in 50 largest metros

| Share, 2024 | 49.7% |

| Share, 2023 | 52.3% |

| % change | -5.0% |

Notably, the share of prospective millennial homebuyers has decreased from the previous year. In 2023, millennials, who were 27 to 42, made up 52.3% of mortgage inquiries. The 5.0% decline from 2023 to 2024 could be attributed to an increase in Gen Z buyers entering the market — the eldest of whom were 27 in 2024.

Another factor could be the current interest rate environment, says Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.”

“Millennials who are already in a home may not want to move if they have a really low rate on their current home,” he says. “Millennials who don’t have a home yet may not want to dive in because they’re biding their time waiting for rates to fall.”

While millennials account for nearly half of mortgage purchase inquiries in the 50 largest metros, they make up the majority of requests in 16 of these areas.

62.6% of mortgage inquiries from millennials in top-ranking metro

San Jose, Calif., has the largest share of potential millennial homebuyers (62.6%); the average age among them is 35. Seattle and San Francisco follow with 57.1% and 56.9% of mortgage inquiries coming from millennials, respectively.

San Jose and the broader Bay Area — including San Francisco — are epicenters of the U.S. tech industry, offering some of the highest average salaries in the nation — about $164,000 in Silicon Valley alone in 2023. The concentration of high-paying tech jobs in the area attracts many millennials who have the financial capacity to enter one of the most expensive housing markets in the country.

Similarly, Seattle’s status as a hub for tech, education and urban amenities makes it an attractive destination for millennials seeking career and lifestyle benefits. The city boasts one of the highest concentrations of residents with bachelor’s degrees — and a high median household income (about $120,000) — making it both desirable and feasible for younger professionals to pursue homeownership.

“Millennials in these metros are making good money and many are growing their families, leaving them in need of more space and pushing them to shop for new homes,” Schulz says. “Residents of these metros also tend to have high credit scores, which, when combined with high incomes, means that you likely have a lot of options when getting a loan.”

Notably, the share of millennial mortgage shoppers in San Jose dipped slightly (1.4%) from the previous year, from 63.5% in 2023 to 62.6% in 2024. Similarly, the share dropped 2.1% in Seattle, while it was a more pronounced 4.1% decline in San Francisco.

Metros with lowest shares of millennial homebuyers

Conversely, some metros stand out for having the lowest share of millennial mortgage shoppers. Louisville, Ky., has the smallest share, though it’s still sizable at 41.5%. Florida’s Tampa and Jacksonville follow with 41.7% and 42.4% of purchase inquiries coming from millennials, respectively. The average age among potential millennial borrowers in the three Southern metros is 35.

In Louisville, the share of potential millennial buyers declined significantly from 2023 to 2024, dropping 12.3% from 47.3% to 41.5%. Tampa and Jacksonville also experienced above-average declines of 8.5% and 8.8%, respectively.

Average down payment for potential millennial buyers tops $212,900 in San Jose

Our study shows that millennial mortgage shoppers in the 50 largest metros plan to make an average down payment of $83,799, although this figure is significantly higher in many metros.

San Jose has the highest average down payment among potential millennial homebuyers — $212,901. San Francisco and Seattle follow with average down payments of $190,342 and $146,948, respectively.

In a few metros, millennials are making above-average down payments despite making up a smaller percentage of prospective mortgage shoppers. Nashville has the 10th-highest average down payment ($81,735) while ranking 31st for the share of potential millennial buyers.

Similarly, Sacramento, Calif., has the 11th-highest average down payment ($79,761) but ranks 25th for its share of millennial shoppers. Miami has the 12th-highest average down payment ($77,150) while ranking 40th for its share of millennial borrowers.

Where average down payments among potential millennial buyers are lowest

The average down payment in Virginia Beach, Va., is $43,582 — nearly five times lower than in San Jose. San Antonio and Buffalo, N.Y., have the next lowest average down payments among millennial shoppers — $44,437 and $44,441, respectively. Notably, Buffalo ranks 15th for the largest share of millennial borrowers while having one of the lowest average down payments.

Of the 50 largest metros, eight have average down payments under $50,000, while seven exceed $100,000.

Schulz offers his thoughts on the benefits and drawbacks of making an above-average down payment:

“If you can make a big down payment, it can make a huge difference. Right off the bat, it can mean that you have a better chance of getting approved for the mortgage. That’s a big deal. It can mean lower monthly payments and better interest rates. It means you can avoid private mortgage insurance (PMI). It means that you’ll pay less in interest in the long run, and it means that you can have more home equity from the start.

“Still, a high down payment can create challenges. Money put toward a down payment is money that can’t go toward building an emergency fund, knocking down other types of debt, investing for retirement or working toward other long-term financial goals. It can leave you cash-strapped, which can be a big deal when the inevitable unexpected costs of homeownership emerge.”

Where potential millennial buyers seek biggest mortgages

The average mortgage amount requested among millennial buyers in the 50 largest metros is $433,505, although loan amounts exceed this figure significantly in some areas. Millennial buyers in three California metros — San Jose, San Francisco and Los Angeles — seek the highest loan amounts: $793,636, $735,780 and $634,215, respectively.

San Jose is the country’s most expensive metro to buy a home, with a current median sale price of about $1.5 million. San Francisco and Los Angeles also sit firmly in the high-cost tier, with median listing prices of about $1.4 million and $1.1 million, respectively, far above the national median of $410,800. These staggering price points naturally translate into larger mortgages.

Where millennial buyers seek smallest mortgages

In contrast, the lowest average loan inquiries are in Buffalo ($260,511), Cleveland ($276,311) and Oklahoma City ($280,459).

Buffalo is one of the nation’s more affordable major housing markets. As of mid-2025, the median home sale price in Buffalo hovered around $230,000 — significantly lower than the national median ($410,800).

Cleveland and Oklahoma City are similarly budget-friendly, with median sales prices of $128,000 and $275,000, respectively. Consequently, prospective homebuyers in these metros naturally request much smaller loan amounts.

Full rankings: 50-metro look at mortgage inquiries from potential millennial homebuyers

| Rank | Metro | Share of inquiries | Avg. age | Avg. down payment | Avg. loan amount |

|---|---|---|---|---|---|

| 1 | San Jose, CA | 62.6% | 35 | $212,901 | $793,636 |

| 2 | Seattle, WA | 57.1% | 35 | $146,948 | $620,616 |

| 3 | San Francisco, CA | 56.9% | 36 | $190,342 | $735,780 |

| 4 | Austin, TX | 55.3% | 35 | $72,533 | $418,149 |

| 4 | New York, NY | 55.3% | 35 | $118,406 | $519,969 |

| 4 | Boston, MA | 55.3% | 34 | $122,121 | $535,589 |

| 7 | Denver, CO | 53.9% | 34 | $85,221 | $478,555 |

| 8 | Raleigh, NC | 53.3% | 35 | $73,385 | $408,867 |

| 8 | Chicago, IL | 53.3% | 35 | $72,417 | $377,059 |

| 10 | Los Angeles, CA | 52.8% | 35 | $131,205 | $634,215 |

| 11 | Philadelphia, PA | 52.5% | 35 | $70,246 | $371,332 |

| 12 | Pittsburgh, PA | 52.3% | 35 | $53,089 | $297,021 |

| 13 | San Diego, CA | 51.6% | 35 | $120,751 | $624,781 |

| 14 | Salt Lake City, UT | 51.4% | 34 | $53,111 | $437,879 |

| 15 | Buffalo, NY | 50.3% | 34 | $44,441 | $260,511 |

| 16 | Washington, DC | 50.2% | 35 | $96,817 | $510,532 |

| 17 | Dallas, TX | 49.7% | 35 | $63,071 | $392,422 |

| 18 | Portland, OR | 49.6% | 35 | $74,006 | $433,122 |

| 19 | Richmond, VA | 49.3% | 35 | $55,890 | $359,521 |

| 19 | Milwaukee, WI | 49.3% | 34 | $53,541 | $319,643 |

| 21 | Providence, RI | 49.1% | 35 | $68,761 | $396,016 |

| 22 | Columbus, OH | 48.9% | 35 | $58,622 | $326,711 |

| 23 | Baltimore, MD | 48.6% | 35 | $66,743 | $392,161 |

| 24 | Houston, TX | 48.5% | 35 | $59,287 | $355,698 |

| 25 | Sacramento, CA | 48.4% | 35 | $79,761 | $475,453 |

| 26 | Charlotte, NC | 47.1% | 35 | $73,396 | $386,741 |

| 27 | Birmingham, AL | 46.9% | 35 | $53,991 | $317,218 |

| 27 | Atlanta, GA | 46.9% | 35 | $72,265 | $391,191 |

| 29 | Detroit, MI | 46.8% | 34 | $46,144 | $290,220 |

| 30 | Minneapolis, MN | 46.6% | 35 | $69,550 | $355,824 |

| 31 | Nashville, TN | 46.5% | 35 | $81,735 | $411,704 |

| 32 | Oklahoma City, OK | 46.4% | 35 | $45,644 | $280,459 |

| 32 | Grand Rapids, MI | 46.4% | 35 | $47,712 | $283,901 |

| 34 | Cleveland, OH | 46.3% | 34 | $48,020 | $276,311 |

| 35 | Kansas City, MO | 45.9% | 35 | $54,279 | $309,013 |

| 36 | St. Louis, MO | 45.6% | 35 | $51,619 | $295,475 |

| 37 | Cincinnati, OH | 45.2% | 35 | $53,278 | $298,853 |

| 37 | Riverside, CA | 45.2% | 35 | $63,733 | $452,703 |

| 39 | Indianapolis, IN | 45.0% | 35 | $54,591 | $307,261 |

| 40 | Virginia Beach, VA | 44.7% | 35 | $43,582 | $337,571 |

| 40 | Miami, FL | 44.7% | 35 | $77,150 | $433,226 |

| 42 | Orlando, FL | 44.6% | 35 | $59,506 | $363,754 |

| 42 | Memphis, TN | 44.6% | 35 | $50,580 | $323,486 |

| 42 | San Antonio, TX | 44.6% | 35 | $44,437 | $321,372 |

| 45 | Las Vegas, NV | 44.4% | 35 | $62,805 | $411,385 |

| 45 | Fresno, CA | 44.4% | 35 | $52,140 | $369,177 |

| 47 | Phoenix, AZ | 42.9% | 35 | $68,577 | $414,715 |

| 48 | Jacksonville, FL | 42.4% | 35 | $56,015 | $339,036 |

| 49 | Tampa, FL | 41.7% | 35 | $60,640 | $363,246 |

| 50 | Louisville, KY | 41.5% | 35 | $48,568 | $286,802 |

Full rankings: Change in share of millennial homebuyer inquiries in 50 largest metros, 2023-24

| Rank | Metro | Share, 2024 | Share, 2023 | % change |

|---|---|---|---|---|

| 1 | Birmingham, AL | 46.9% | 45.0% | 4.2% |

| 2 | Las Vegas, NV | 44.4% | 43.2% | 2.9% |

| 3 | Salt Lake City, UT | 51.4% | 51.3% | 0.1% |

| 4 | Sacramento, CA | 48.4% | 48.6% | -0.4% |

| 5 | San Jose, CA | 62.6% | 63.5% | -1.4% |

| 5 | New York, NY | 55.3% | 56.1% | -1.4% |

| 7 | Providence, RI | 49.1% | 49.9% | -1.6% |

| 7 | Riverside, CA | 45.2% | 45.9% | -1.6% |

| 9 | Seattle, WA | 57.1% | 58.3% | -2.1% |

| 10 | Buffalo, NY | 50.3% | 51.7% | -2.6% |

| 11 | Raleigh, NC | 53.3% | 54.8% | -2.8% |

| 12 | Detroit, MI | 46.8% | 48.4% | -3.3% |

| 13 | Memphis, TN | 44.6% | 46.3% | -3.7% |

| 14 | Austin, TX | 55.3% | 57.5% | -3.8% |

| 14 | Portland, OR | 49.6% | 51.6% | -3.8% |

| 14 | San Antonio, TX | 44.6% | 46.3% | -3.8% |

| 17 | Los Angeles, CA | 52.8% | 54.9% | -3.9% |

| 17 | Richmond, VA | 49.3% | 51.3% | -3.9% |

| 19 | San Francisco, CA | 56.9% | 59.3% | -4.1% |

| 20 | Chicago, IL | 53.3% | 55.7% | -4.3% |

| 20 | Miami, FL | 44.7% | 46.7% | -4.3% |

| 22 | Atlanta, GA | 46.9% | 49.2% | -4.6% |

| 23 | Dallas, TX | 49.7% | 52.1% | -4.7% |

| 24 | Phoenix, AZ | 42.9% | 45.1% | -4.8% |

| 25 | Pittsburgh, PA | 52.3% | 55.0% | -4.9% |

| 26 | Milwaukee, WI | 49.3% | 51.9% | -5.0% |

| 26 | Orlando, FL | 44.6% | 47.0% | -5.0% |

| 28 | Houston, TX | 48.5% | 51.1% | -5.1% |

| 29 | Columbus, OH | 48.9% | 51.6% | -5.2% |

| 30 | Philadelphia, PA | 52.5% | 55.8% | -5.8% |

| 30 | Virginia Beach, VA | 44.7% | 47.4% | -5.8% |

| 32 | San Diego, CA | 51.6% | 55.1% | -6.3% |

| 33 | Boston, MA | 55.3% | 59.3% | -6.7% |

| 34 | Baltimore, MD | 48.6% | 52.4% | -7.3% |

| 34 | Oklahoma City, OK | 46.4% | 50.0% | -7.3% |

| 36 | Kansas City, MO | 45.9% | 49.9% | -7.9% |

| 37 | Tampa, FL | 41.7% | 45.6% | -8.5% |

| 38 | Denver, CO | 53.9% | 59.1% | -8.8% |

| 38 | Jacksonville, FL | 42.4% | 46.5% | -8.8% |

| 40 | Nashville, TN | 46.5% | 51.1% | -9.0% |

| 41 | St. Louis, MO | 45.6% | 50.3% | -9.4% |

| 41 | Cincinnati, OH | 45.2% | 49.9% | -9.4% |

| 43 | Minneapolis, MN | 46.6% | 51.5% | -9.5% |

| 44 | Grand Rapids, MI | 46.4% | 51.3% | -9.6% |

| 45 | Washington, DC | 50.2% | 55.6% | -9.7% |

| 46 | Charlotte, NC | 47.1% | 52.3% | -10.0% |

| 47 | Indianapolis, IN | 45.0% | 50.0% | -10.1% |

| 48 | Cleveland, OH | 46.3% | 52.0% | -11.0% |

| 49 | Louisville, KY | 41.5% | 47.3% | -12.3% |

| 50 | Fresno, CA | 44.4% | 51.9% | -14.5% |

Homebuying as a millennial: Top expert tips

With millennials making up nearly half of mortgage purchase inquiries in the nation’s largest metros, many are navigating a competitive housing market characterized by high prices, elevated interest rates and tight inventory. Whether you’re buying your first home or upgrading to fit a growing household, smart strategies can help you compete and make financially sound decisions.

- Get preapproved before shopping. Seeking mortgage preapproval before starting your search will give you a clear budget and strengthen your home offers. It can also help you move faster in competitive markets like San Jose or Seattle, where homes sell quickly.

- Compare lenders and loan offers. Shopping around for your mortgage can save you thousands of dollars in interest over the life of your loan. Compare interest rates and terms from at least three lenders to identify the most competitive offer.

- Improve or maintain your credit. Your credit score and history will determine which loan programs you qualify for, and they’ll also affect your interest rate and mortgage terms. Naturally, the better your score, the more favorable loan options you have and the better terms lenders will offer. Check your credit reports at AnnualCreditReport.com to see where you stand; make all your loan and credit card payments on time and avoid taking on new debt as you prepare to apply for a mortgage.

- Maintain a low debt-to-income (DTI) ratio. Lenders typically want a DTI ratio of 43% or less. Paying down student loans, auto loans or credit cards before applying can improve your chances of approval and better interest rates.

- Research first-time buyer programs. Many state and local governments offer first-time homebuyer programs that provide down payment assistance, grants or favorable loan terms. Similarly, review all loan types for which you qualify. Some mortgages — Fannie Mae’s HomeReady and Freddie Mac’s Home Possible, for example — offer low minimum down payments for first-time and low- and moderate-income buyers. Other options, such as Federal Housing Administration (FHA) loans, offer lenient terms for borrowers with lower credit scores.

“Control what you can control, and be flexible,” Schulz advises. “You don’t know when housing prices will fall or when the Federal Reserve will reduce interest rates, but you can make a real difference in what you pay by comparing rates from multiple lenders, considering different types of mortgages, expanding the area in which you’re searching for homes and leaving your options as open as reasonably possible. Putting in that work can lead to very real savings.”

Control what you can control, and be flexible.

Methodology

LendingTree researchers analyzed about 140,000 mortgage purchase inquiries in the 50 largest U.S. metros on the LendingTree platform between Jan. 1 and Dec. 31, 2024. We focused on inquiries from potential millennial borrowers ages 28 to 43 in 2024. We compared this to about 230,000 mortgage purchase inquiries in the 50 largest metros on the LendingTree platform between Jan. 1 and Dec. 31, 2023.

Metro-level rankings were determined by calculating the share of mortgage purchase inquiries from millennials as a percentage of mortgage purchase inquiries in each metro.

Researchers used the U.S. Census Bureau 2023 American Community Survey (ACS) with five-year estimates to identify the 50 largest metros.

View mortgage loan offers from up to 5 lenders in minutes