Breaking the Bank: States Where Car Ownership Is Most Expensive

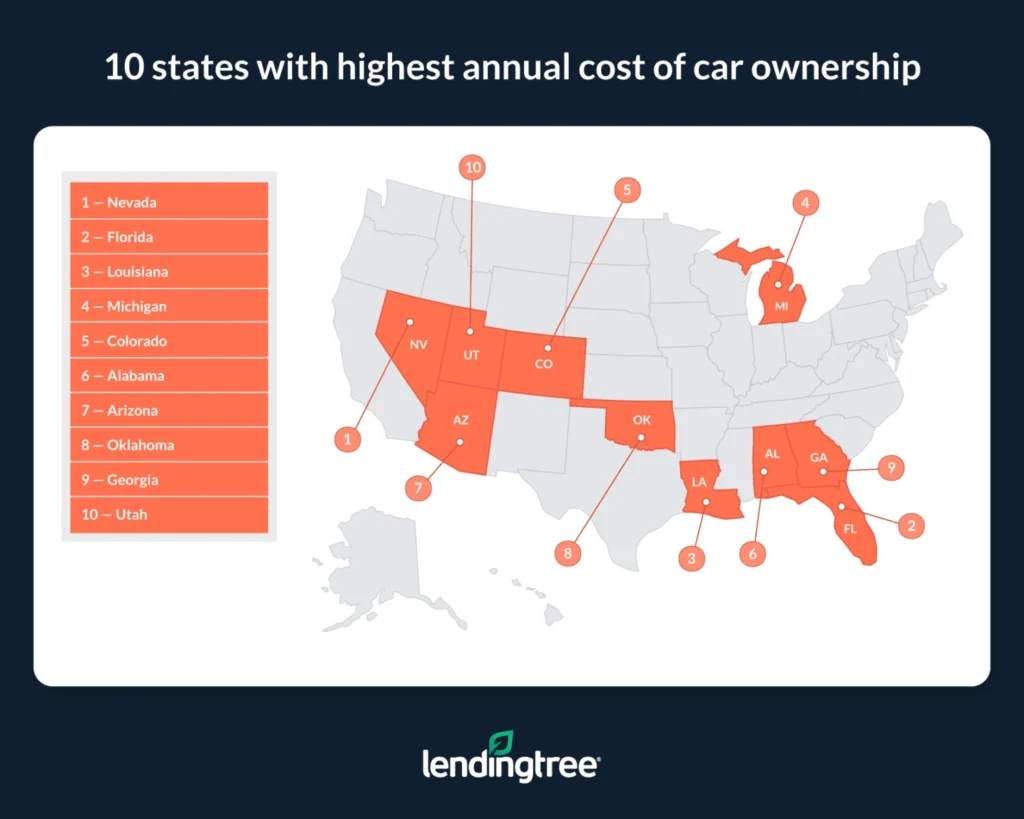

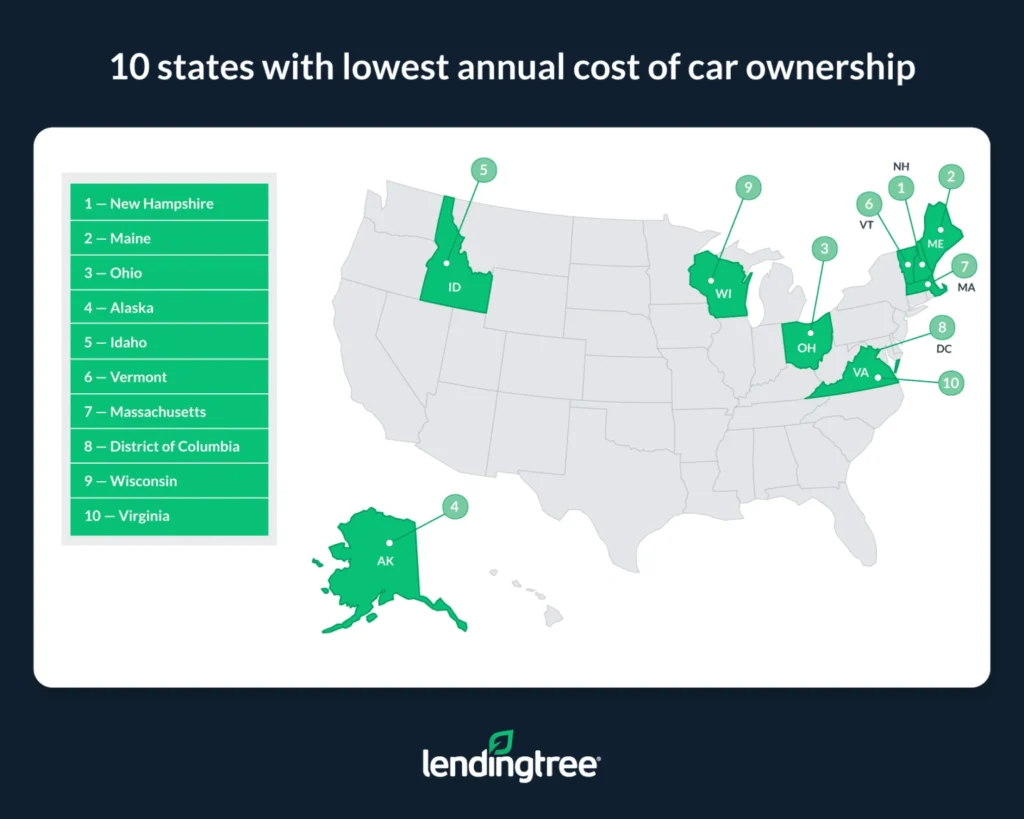

There’s no such thing as a free ride — especially if you live in Nevada, Florida or Louisiana. That’s where owning a car costs the most, according to the most recent LendingTree study. Conversely, drivers in New Hampshire, Maine and Ohio pay the least.

Why is the road rockier for some states? Auto insurance, mostly. Below, learn how much it costs to own a car in your state, and why. We also tapped a licensed insurance agent for some premium-saving tips.

Key findings

- Nevada, Florida and Louisiana drivers have the highest annual cost of car ownership. Nevada leads the way, with drivers paying $6,118.86 a year toward car ownership — primarily due to high average auto insurance costs. Florida ($5,681.58) and Louisiana ($5,663.40) follow.

- Car ownership is least expensive in New Hampshire, Maine and Ohio. At just $3,029.58 a year, annual car ownership costs in New Hampshire are by far the lowest of any state. Maine ($3,543.29) and Ohio ($3,544.16) are the next lowest.

- Auto insurance is most costly in Nevada. Nevada drivers pay an average of $3,439 a year for auto insurance. In second, Florida drivers pay an average of $3,267. Michigan ($3,151) ranks third.

- Annual fuel costs are highest in Wyoming, Indiana and Mississippi. Wyoming drivers shell out an average of $2,742.78 a year in fuel costs, ahead of Indiana ($2,570.05) and Mississippi ($2,135.64). That’s primarily because people in these states drive the most each year, traveling around 20,000 miles annually on average. Comparatively, the average across the U.S. is 14,050.

- Louisiana, Tennessee and Arkansas have the highest annualized sales tax costs. When annualized over the average amount of time a driver owns a car (6.5 years), Louisiana drivers pay the most in sales tax, shelling out an average of $400.13. Tennessee ($399.71) and Arkansas ($395.95) follow. Drivers pay $0 in sales tax in four states: Delaware, Montana, New Hampshire and Oregon.

LendingTree researchers calculated the cost of car ownership by analyzing data from various sources to determine the following averages per person, per state:

- Car insurance premiums

- Fuel expenses

- Annualized sales tax

- Car repair costs

The cost of car ownership assumes that the driver owns their vehicle outright and, as such, does not reflect car payments. For more information, please see our full methodology.

Which states are the most expensive to own a car?

No. 1: Nevada

- Average annual car insurance premiums: $3,439

- Average annual fuel costs: $1,937.41

- Average annualized sales tax: $344.52

- Average annual repair costs: $398.26

No. 2: Florida

- Average annual car insurance premiums: $3,267

- Average annual fuel costs: $1,725.90

- Average annualized sales tax: $292.68

- Average annual repair costs: $396.29

No. 3: Louisiana

- Average annual car insurance premiums: $2,989

- Average annual fuel costs: $1,885.90

- Average annualized sales tax: $400.13

- Average annual repair costs: $388.66

Which states are the least expensive to own a car?

No. 1: New Hampshire

- Average annual car insurance premiums: $1,278

- Average annual fuel costs: $1,380.65

- Average annualized sales tax: $0.00

- Average annual repair costs: $370.79

No. 2: Maine

- Average annual car insurance premiums: $1,243

- Average annual fuel costs: $1,721.30

- Average annualized sales tax: $229.96

- Average annual repair costs: $349.25

No. 3: Ohio

- Average annual car insurance premiums: $1,373

- Average annual fuel costs: $1,514.98

- Average annualized sales tax: $302.71

- Average annual repair costs: $353.76

Full rankings: Total average annual cost of car ownership by state

| Rank | State | Avg. cost of car ownership | Avg. insurance premium | Avg. fuel costs | Avg. sales tax | Avg. repair costs |

|---|---|---|---|---|---|---|

| 1 | Nevada | $6,118.86 | $3,439 | $1,937.41 | $344.52 | $398.26 |

| 2 | Florida | $5,681.58 | $3,267 | $1,725.90 | $292.68 | $396.29 |

| 3 | Louisiana | $5,663.40 | $2,989 | $1,885.90 | $400.13 | $388.66 |

| 4 | Michigan | $5,350.11 | $3,151 | $1,591.96 | $250.86 | $356.29 |

| 5 | Colorado | $5,150.85 | $2,892 | $1,515.61 | $326.54 | $417.14 |

| 6 | Alabama | $5,099.14 | $2,322 | $1,989.26 | $388.42 | $399.33 |

| 7 | Arizona | $5,059.78 | $2,618 | $1,702.71 | $350.37 | $388.92 |

| 8 | Oklahoma | $5,020.81 | $2,400 | $1,864.62 | $376.30 | $379.77 |

| 9 | Georgia | $5,014.20 | $2,194 | $2,102.39 | $310.24 | $407.71 |

| 10 | Utah | $4,976.79 | $2,266 | $2,005.26 | $303.55 | $401.65 |

| 11 | Arkansas | $4,947.37 | $2,314 | $1,855.01 | $395.95 | $382.61 |

| 12 | California | $4,899.74 | $2,017 | $2,099.37 | $367.93 | $415.66 |

| 13 | Kentucky | $4,861.69 | $2,378 | $1,848.40 | $250.86 | $384.76 |

| 14 | Wyoming | $4,859.02 | $1,491 | $2,742.78 | $227.45 | $397.79 |

| 15 | New Mexico | $4,855.13 | $2,037 | $2,106.58 | $319.02 | $392.53 |

| 16 | Missouri | $4,819.00 | $2,041 | $2,048.65 | $350.79 | $378.85 |

| 17 | Mississippi | $4,792.45 | $1,968 | $2,135.64 | $295.18 | $394.03 |

| 18 | Indiana | $4,787.15 | $1,560 | $2,570.05 | $292.68 | $364.76 |

| 19 | Rhode Island | $4,710.81 | $2,838 | $1,193.33 | $292.68 | $386.93 |

| 20 | Texas | $4,636.04 | $2,184 | $1,711.38 | $342.85 | $397.53 |

| 21 | Montana | $4,547.87 | $2,218 | $1,939.70 | $0.00 | $389.84 |

| 22 | Kansas | $4,542.21 | $2,099 | $1,702.17 | $367.10 | $374.44 |

| 23 | North Dakota | $4,539.79 | $1,897 | $1,984.16 | $294.35 | $364.62 |

| 24 | Delaware | $4,538.15 | $2,758 | $1,389.12 | $0.00 | $390.89 |

| 25 | Tennessee | $4,532.49 | $1,887 | $1,846.38 | $399.71 | $399.11 |

| 26 | Illinois | $4,520.55 | $2,146 | $1,624.02 | $370.86 | $379.23 |

| 27 | South Dakota | $4,493.17 | $2,070 | $1,790.56 | $255.46 | $377.64 |

| 28 | Minnesota | $4,435.36 | $2,060 | $1,681.68 | $339.50 | $377.68 |

| 29 | Connecticut | $4,419.38 | $2,325 | $1,410.64 | $265.50 | $418.37 |

| 30 | New Jersey | $4,413.18 | $2,384 | $1,353.50 | $275.95 | $399.61 |

| 31 | Oregon | $4,339.99 | $2,218 | $1,728.38 | $0.00 | $393.94 |

| 32 | Nebraska | $4,306.91 | $1,933 | $1,707.59 | $291.42 | $374.53 |

| 33 | Washington | $4,305.76 | $1,909 | $1,609.69 | $395.11 | $392.46 |

| 34 | Maryland | $4,301.50 | $2,034 | $1,617.81 | $250.86 | $399.07 |

| 35 | New York | $4,253.21 | $2,274 | $1,236.52 | $356.65 | $386.55 |

| 36 | Pennsylvania | $4,181.27 | $2,060 | $1,471.99 | $265.08 | $384.33 |

| 37 | South Carolina | $4,175.67 | $1,812 | $1,654.37 | $313.58 | $395.83 |

| 38 | North Carolina | $4,157.38 | $1,672 | $1,790.24 | $292.68 | $402.61 |

| 39 | Iowa | $4,146.09 | $1,901 | $1,594.63 | $290.17 | $359.96 |

| 40 | Hawaii | $4,114.36 | $1,484 | $2,060.98 | $188.15 | $381.23 |

| 41 | West Virginia | $4,102.03 | $1,788 | $1,655.73 | $274.70 | $383.43 |

| 42 | Virginia | $4,061.25 | $1,684 | $1,734.72 | $241.25 | $401.17 |

| 43 | Wisconsin | $3,963.24 | $1,616 | $1,748.09 | $238.32 | $361.11 |

| 44 | District of Columbia | $3,924.94 | $2,371 | $891.74 | $250.86 | $411.00 |

| 45 | Massachusetts | $3,833.89 | $1,740 | $1,446.48 | $261.32 | $386.20 |

| 46 | Vermont | $3,829.15 | $1,283 | $1,905.12 | $266.33 | $374.45 |

| 47 | Idaho | $3,780.74 | $1,330 | $1,809.68 | $252.12 | $389.05 |

| 48 | Alaska | $3,681.95 | $1,694 | $1,524.81 | $76.10 | $387.05 |

| 49 | Ohio | $3,544.16 | $1,373 | $1,514.98 | $302.71 | $353.76 |

| 50 | Maine | $3,543.29 | $1,243 | $1,721.30 | $229.96 | $349.25 |

| 51 | New Hampshire | $3,029.58 | $1,278 | $1,380.65 | $0.00 | $370.79 |

- Annual cost of car ownership: $4,507.11

- Annual cost of car insurance: $2,096

- Annual fuel costs: $1,748.23

- Annualized sales tax: $276.17

- Annual car repair costs: $387.03

High car insurance premiums are mostly to blame for the higher cost of car ownership

In the states where it costs the most to own a car, auto insurance premiums are usually the culprit. In fact, car insurance is so high in Nevada, Florida and Michigan that it makes up more than half of the cost of car ownership (56.2%, 57.5% and 58.9%, respectively).

Maine, New Hampshire and Vermont have the cheapest average car insurance. Not coincidentally, they’re also some of the least expensive states for car ownership. New Hampshire is cheapest overall, followed by Maine. Vermont is sixth-cheapest.

Full rankings: Average annual car insurance rates by state

| Rank | State | Avg. insurance premium |

|---|---|---|

| 1 | Nevada | $3,439 |

| 2 | Florida | $3,267 |

| 3 | Michigan | $3,151 |

| 4 | Louisiana | $2,989 |

| 5 | Colorado | $2,892 |

| 6 | Rhode Island | $2,838 |

| 7 | Delaware | $2,758 |

| 8 | Arizona | $2,618 |

| 9 | Oklahoma | $2,400 |

| 10 | New Jersey | $2,384 |

| 11 | Kentucky | $2,378 |

| 12 | District of Columbia | $2,371 |

| 13 | Connecticut | $2,325 |

| 14 | Alabama | $2,322 |

| 15 | Arkansas | $2,314 |

| 16 | New York | $2,274 |

| 17 | Utah | $2,266 |

| 18 | Montana | $2,218 |

| 18 | Oregon | $2,218 |

| 20 | Georgia | $2,194 |

| 21 | Texas | $2,184 |

| 22 | Illinois | $2,146 |

| 23 | Kansas | $2,099 |

| 24 | South Dakota | $2,070 |

| 25 | Pennsylvania | $2,060 |

| 26 | Missouri | $2,041 |

| 27 | New Mexico | $2,037 |

| 27 | Minnesota | $2,037 |

| 29 | Maryland | $2,034 |

| 30 | California | $2,017 |

| 31 | Mississippi | $1,968 |

| 32 | Nebraska | $1,933 |

| 33 | Washington | $1,909 |

| 34 | Iowa | $1,901 |

| 35 | North Dakota | $1,897 |

| 36 | Tennessee | $1,887 |

| 37 | South Carolina | $1,812 |

| 38 | West Virginia | $1,788 |

| 39 | Massachusetts | $1,740 |

| 40 | Alaska | $1,694 |

| 41 | Virginia | $1,684 |

| 42 | North Carolina | $1,672 |

| 43 | Wisconsin | $1,616 |

| 44 | Indiana | $1,560 |

| 45 | Wyoming | $1,491 |

| 46 | Hawaii | $1,484 |

| 47 | Ohio | $1,373 |

| 48 | Idaho | $1,330 |

| 49 | Vermont | $1,283 |

| 50 | New Hampshire | $1,278 |

| 51 | Maine | $1,243 |

Why do car insurance premiums vary from state to state?

Insurance is high in some states and low in others because insurance requirements and regulations, crash rates and the costs of medical treatment and car repairs vary widely across states and regions.

Some states require different types of car insurance coverage. Michigan and Florida, for example, require personal injury protection (PIP), while most states don’t. These additional coverages lead to additional premiums.

Also, when car accidents rise in your area, so does your risk of filing a claim. When your risk goes up in the eyes of your insurance company (regardless of whether you’ve filed a claim), it will increase your rate.

We asked LendingTree auto insurance expert and licensed agent Rob Bhatt for further insight.

“Crash rates tend to be higher in densely populated areas, so we often see higher insurance rates in big cities and many suburbs,” he says. “Nevada is particularly interesting. Even though it has a lot of wide-open areas, most of its residents live in one of its major population centers, like Las Vegas, Reno and Carson City.”

Crash rates tend to be higher in densely populated areas, so we often see higher insurance rates in big cities and many suburbs.

Finally, inflation can make it difficult to afford your bills, including car insurance premiums. When repair and medical costs increase, so do the costs of claims. How much your insurance company pays for claims directly impacts how much you pay for coverage.

As the cost of living soars, the number of cars per household largely remains flat

Although the cost of living has climbed steadily over the past decade, the number of cars per household hasn’t budged much. A higher percentage of households had three or more cars available in 2023 compared to 2014, but only by 1.8 percentage points, according to an analysis of the U.S. Census Bureau 2023 American Community Survey with one-year estimates.

2014

- No vehicles available: 9.1%

- 1 vehicle available: 33.7%

- 2 vehicles available: 37.3%

- 3 or more vehicles available: 19.9%

2023

- No vehicles available: 8.4%

- 1 vehicle available: 33.3%

- 2 vehicles available: 36.5%

- 3 or more vehicles available: 21.7%

Other costs of car ownership

The expenses below don’t impact the cost of owning a car as much as insurance does, but they still add up.

Fuel costs

Drivers in Wyoming have the highest average annual fuel costs. That’s surprising, considering that it’s historically a top 10 state for oil production (No. 8 in 2023). But fuel costs aren’t high here due to gas prices. Wyomingites pay more for fuel because of how much they drive (21,588 miles per year, on average).

It’s obvious why the District of Columbia is the cheapest for average annual fuel costs: ample public transportation, walkability and snail’s-pace traffic. Drivers there spend just 6,695 miles on the road each year.

Full rankings: Average annual fuel costs by state

| Rank | State | Avg. gas price | Avg. miles per driver | Avg. fuel costs |

|---|---|---|---|---|

| 1 | Wyoming | $3.10 | 21,588 | $2,742.78 |

| 2 | Indiana | $3.05 | 20,560 | $2,570.05 |

| 3 | Mississippi | $2.67 | 19,517 | $2,135.64 |

| 4 | New Mexico | $2.89 | 17,786 | $2,106.58 |

| 5 | Georgia | $2.93 | 17,508 | $2,102.39 |

| 6 | California | $4.49 | 11,409 | $2,099.37 |

| 7 | Hawaii | $4.58 | 10,980 | $2,060.98 |

| 8 | Missouri | $2.70 | 18,514 | $2,048.65 |

| 9 | Utah | $3.21 | 15,242 | $2,005.26 |

| 10 | Alabama | $2.77 | 17,523 | $1,989.26 |

| 11 | North Dakota | $2.97 | 16,301 | $1,984.16 |

| 12 | Montana | $3.05 | 15,518 | $1,939.70 |

| 13 | Nevada | $3.78 | 12,506 | $1,937.41 |

| 14 | Vermont | $3.12 | 14,899 | $1,905.12 |

| 15 | Louisiana | $2.77 | 16,612 | $1,885.90 |

| 16 | Oklahoma | $2.61 | 17,432 | $1,864.62 |

| 17 | Arkansas | $2.71 | 16,702 | $1,855.01 |

| 18 | Kentucky | $2.81 | 16,050 | $1,848.40 |

| 19 | Tennessee | $2.74 | 16,442 | $1,846.38 |

| 20 | Idaho | $3.21 | 13,756 | $1,809.68 |

| 21 | South Dakota | $2.92 | 14,962 | $1,790.56 |

| 22 | North Carolina | $2.92 | 14,960 | $1,790.24 |

| 23 | Wisconsin | $2.82 | 15,125 | $1,748.09 |

| 24 | Virginia | $3.01 | 14,062 | $1,734.72 |

| 25 | Oregon | $3.58 | 11,780 | $1,728.38 |

| 26 | Florida | $3.05 | 13,807 | $1,725.90 |

| 27 | Maine | $3.04 | 13,816 | $1,721.30 |

| 28 | Texas | $2.69 | 15,523 | $1,711.38 |

| 29 | Nebraska | $2.84 | 14,671 | $1,707.59 |

| 30 | Arizona | $3.19 | 13,024 | $1,702.71 |

| 31 | Kansas | $2.72 | 15,269 | $1,702.17 |

| 32 | Minnesota | $2.94 | 13,957 | $1,681.68 |

| 33 | West Virginia | $3.03 | 13,333 | $1,655.73 |

| 34 | South Carolina | $2.80 | 14,417 | $1,654.37 |

| 35 | Illinois | $3.25 | 12,193 | $1,624.02 |

| 36 | Maryland | $3.06 | 12,900 | $1,617.81 |

| 37 | Washington | $4.00 | 9,819 | $1,609.69 |

| 38 | Iowa | $2.80 | 13,896 | $1,594.63 |

| 39 | Michigan | $3.15 | 12,331 | $1,591.96 |

| 40 | Alaska | $3.54 | 10,510 | $1,524.81 |

| 41 | Colorado | $3.07 | 12,046 | $1,515.61 |

| 42 | Ohio | $2.81 | 13,155 | $1,514.98 |

| 43 | Pennsylvania | $3.28 | 10,950 | $1,471.99 |

| 44 | Massachusetts | $3.03 | 11,648 | $1,446.48 |

| 45 | Connecticut | $3.05 | 11,285 | $1,410.64 |

| 46 | Delaware | $2.96 | 11,451 | $1,389.12 |

| 47 | New Hampshire | $2.98 | 11,305 | $1,380.65 |

| 48 | New Jersey | $2.91 | 11,349 | $1,353.50 |

| 49 | New York | $3.16 | 9,548 | $1,236.52 |

| 50 | Rhode Island | $2.94 | 9,904 | $1,193.33 |

| 51 | District of Columbia | $3.25 | 6,695 | $891.74 |

Sales tax

Louisiana has the highest sales tax in the U.S., so it’s only natural that drivers in this state pay the most annualized sales tax on their cars (an average of $400.13 per year).

On the flip side, Delaware, Montana, New Hampshire and Oregon don’t charge sales tax at all.

Full rankings: Average annualized sales tax by state

| Rank | State | Avg. sales tax |

|---|---|---|

| 1 | Louisiana | $400.13 |

| 2 | Tennessee | $399.71 |

| 3 | Arkansas | $395.95 |

| 4 | Washington | $395.11 |

| 5 | Alabama | $388.42 |

| 6 | Oklahoma | $376.30 |

| 7 | Illinois | $370.86 |

| 8 | California | $367.93 |

| 9 | Kansas | $367.10 |

| 10 | New York | $356.65 |

| 11 | Missouri | $350.79 |

| 12 | Arizona | $350.37 |

| 13 | Nevada | $344.52 |

| 14 | Texas | $342.85 |

| 15 | Minnesota | $339.50 |

| 16 | Colorado | $326.54 |

| 17 | New Mexico | $319.02 |

| 18 | South Carolina | $313.58 |

| 19 | Georgia | $310.24 |

| 20 | Utah | $303.55 |

| 21 | Ohio | $302.71 |

| 22 | Mississippi | $295.18 |

| 23 | North Dakota | $294.35 |

| 24 | Florida | $292.68 |

| 24 | Indiana | $292.68 |

| 24 | North Carolina | $292.68 |

| 24 | Rhode Island | $292.68 |

| 28 | Nebraska | $291.42 |

| 29 | Iowa | $290.17 |

| 30 | New Jersey | $275.95 |

| 31 | West Virginia | $274.70 |

| 32 | Vermont | $266.33 |

| 33 | Connecticut | $265.50 |

| 34 | Pennsylvania | $265.08 |

| 35 | Massachusetts | $261.32 |

| 36 | South Dakota | $255.46 |

| 37 | Idaho | $252.12 |

| 38 | Kentucky | $250.86 |

| 38 | Maryland | $250.86 |

| 38 | Michigan | $250.86 |

| 38 | District of Columbia | $250.86 |

| 42 | Virginia | $241.25 |

| 43 | Wisconsin | $238.32 |

| 44 | Maine | $229.96 |

| 45 | Wyoming | $227.45 |

| 46 | Hawaii | $188.15 |

| 47 | Alaska | $76.10 |

| 48 | Delaware | $0.00 |

| 48 | Montana | $0.00 |

| 48 | New Hampshire | $0.00 |

| 48 | Oregon | $0.00 |

Repair expenses

Catalytic converter replacement is the most requested car repair in Connecticut, according to CarMD. That may be why this state also has the highest average annual car repair costs, at $418.37. Catalytic converters are made of precious metals, making them pricey and enticing for thieves.

Drivers in Maine have the lowest car repair costs, paying an average of $349.25 per year.

Full rankings: Average annual car repair costs by state

| Rank | State | Avg. repair costs |

|---|---|---|

| 1 | Connecticut | $418.37 |

| 2 | Colorado | $417.14 |

| 3 | California | $415.66 |

| 4 | District of Columbia | $411.00 |

| 5 | Georgia | $407.71 |

| 6 | North Carolina | $402.61 |

| 7 | Utah | $401.65 |

| 8 | Virginia | $401.17 |

| 9 | New Jersey | $399.61 |

| 10 | Alabama | $399.33 |

| 11 | Tennessee | $399.11 |

| 12 | Maryland | $399.07 |

| 13 | Nevada | $398.26 |

| 14 | Wyoming | $397.79 |

| 15 | Texas | $397.53 |

| 16 | Florida | $396.29 |

| 17 | South Carolina | $395.83 |

| 18 | Mississippi | $394.03 |

| 19 | Oregon | $393.94 |

| 20 | New Mexico | $392.53 |

| 21 | Washington | $392.46 |

| 22 | Delaware | $390.89 |

| 23 | Montana | $389.84 |

| 24 | Idaho | $389.05 |

| 25 | Arizona | $388.92 |

| 26 | Louisiana | $388.66 |

| 27 | Alaska | $387.05 |

| 28 | Rhode Island | $386.93 |

| 29 | New York | $386.55 |

| 30 | Massachusetts | $386.20 |

| 31 | Kentucky | $384.76 |

| 32 | Pennsylvania | $384.33 |

| 33 | West Virginia | $383.48 |

| 34 | Arkansas | $382.61 |

| 35 | Hawaii | $381.23 |

| 36 | Oklahoma | $379.77 |

| 37 | Illinois | $379.23 |

| 38 | Missouri | $378.85 |

| 39 | Minnesota | $377.68 |

| 40 | South Dakota | $377.64 |

| 41 | Nebraska | $374.53 |

| 42 | Vermont | $374.45 |

| 43 | Kansas | $374.44 |

| 44 | New Hampshire | $370.79 |

| 45 | Indiana | $364.76 |

| 46 | North Dakota | $364.62 |

| 47 | Wisconsin | $361.11 |

| 48 | Iowa | $359.96 |

| 49 | Michigan | $356.29 |

| 50 | Ohio | $353.76 |

| 51 | Maine | $349.25 |

Managing car insurance costs: Advice from a licensed agent

Balancing an ever-increasing car insurance rate can seem impossible when you’re already juggling a higher cost of living. Bhatt, our auto insurance expert, shares what drivers can do to lower their premiums. He recommends:

- Considering your mileage: Several companies offer a low-mileage discount to customers who drive less than a certain amount, usually about 7,500 miles a year. This is a good discount to ask about if you work from home or have recently retired. Some companies also offer pay-per-mile insurance, which may help you save even more.

- Upping your deductible: Raising your collision deductible can help bring your rate down without sacrificing other coverages, like liability. This whole idea of a $500 car insurance deductible goes back to the ’80s or so, when $500 was worth a lot more than today. You can save money by increasing your collision deductible to $1,000, or even $2,000.

- Shopping around: Shopping around is always a good way to avoid overpaying for insurance. In recent years, some companies have raised their rates more than others. It’s possible that a company that quoted you a higher rate even just a few years back may be a better deal for you now.

Methodology

LendingTree researchers analyzed various sources to calculate the states with the highest annual car ownership costs. Factors included auto insurance, fuel, sales tax and repair costs.

Auto insurance rate data from Quadrant Information Services was analyzed in October 2024. These costs reflect the average of premiums available for full-coverage policies for a 30-year-old male driver with a clean record, good credit and a 2015 Honda Civic EX. Uninsured-motorist coverage and/or personal injury protection (PIP) are included in states where these coverages are required. Full-coverage policies include the following coverages, limits and deductibles:

- Bodily injury liability: $100,000 per person and $300,000 per accident

- Property damage liability: $100,000

- Collision: $500 deductible

- Comprehensive: $500 deductible

- Uninsured motorist: Minimum limits where required

- Personal injury protection: Minimum limits where required

Gas price data via AAA from Nov. 13, 2024, was combined with Federal Highway Administration 2022 miles traveled and licensed drivers data to calculate annual fuel costs. A state’s annual miles traveled was divided by a state’s number of licensed drivers to calculate the average annual miles per driver. This was divided by the national average miles per gallon — 24.4 (via Alternative Fuels Data Center January 2024 fuel economy data) — and multiplied by the cost per gallon in each state to calculate each state’s annual fuel costs.

Repair cost data from 2021 was sourced from CarMD. Annual repair costs assume a driver has one repair a year.

Finally, 2024 sales tax data was analyzed from the Tax Foundation. Each state’s combined state and local tax percentage was multiplied by the average cost of buying a used car, $27,177 (via Edmunds, as of the third quarter of 2024). The resulting amount of sales tax was then divided by the length, in years, an owner typically keeps a car — 6.5 years (via Edmunds). This was done to annualize the sales tax a driver pays to calculate annual car ownership costs.