23% of Americans Report Neighborhood Home Break-Ins in Past 5 Years, With 46% Saying Local Officials and Officers Don’t Do Enough to Help

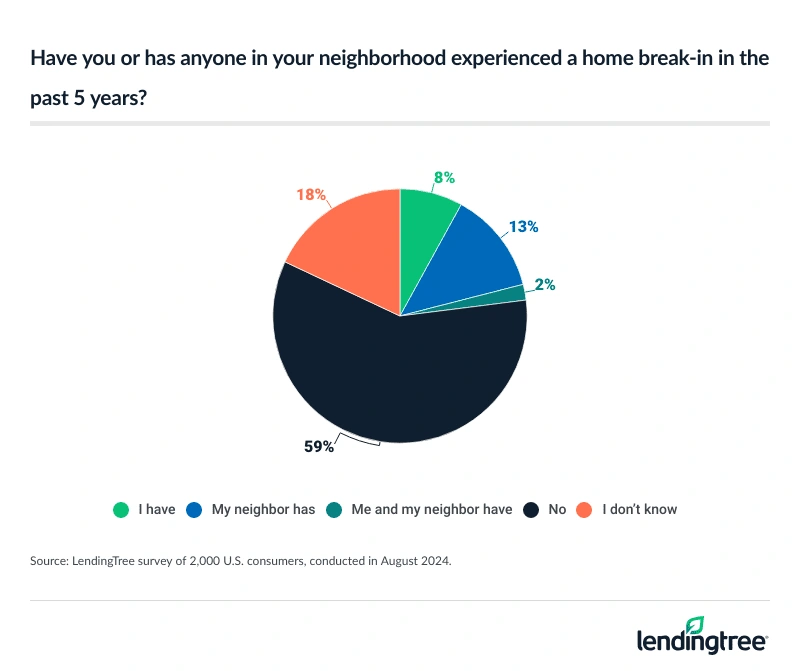

A locked door isn’t always enough. According to the latest LendingTree survey of 2,000 U.S. consumers, nearly a quarter (23%) of Americans say their home or a neighbor’s home has been broken into in the past five years.

Here’s a look at how these break-ins affect Americans and what they do to prevent them.

Key findings

- As Americans experience home break-ins, many don’t feel protected by law enforcement. 23% of Americans say their home or a neighbor’s home has been broken into in the past five years, and 46% don’t believe their local government and law enforcement do enough to protect them. In fact, 31% of Americans regularly have stress or anxiety over break-ins, especially Gen Zers (49%) and millennials (39%).

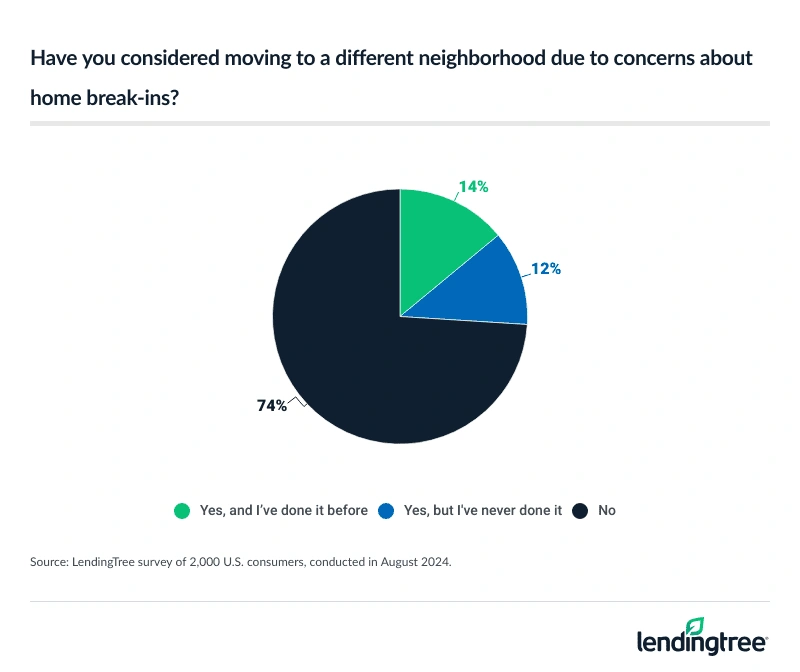

- These fears have some Americans moving. Over a quarter (26%) have considered moving due to break-in concerns, with Gen Zers (49%) and urban dwellers (39%) among the most likely to at least consider it. Some are improving safety in their current residence, as 29% have enhanced their home security within the past year, while another 25% intend to.

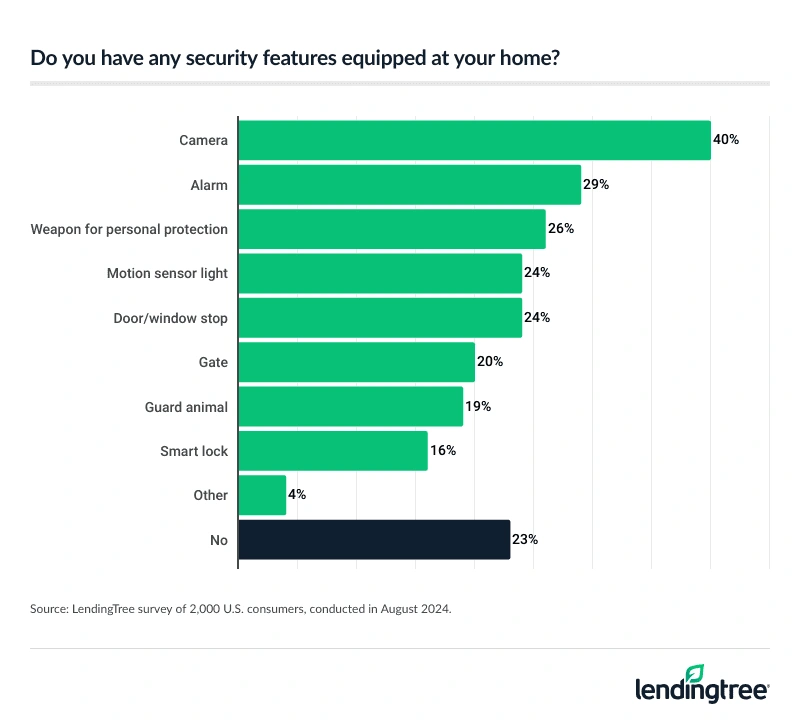

- Most already have their home prepped. 77% of Americans have some sort of security feature at their home, most commonly cameras (40%), alarms (29%) and weapons for personal protection (26%). However, not everyone favors all measures, as 30% think technology, such as a doorbell camera, invades privacy.

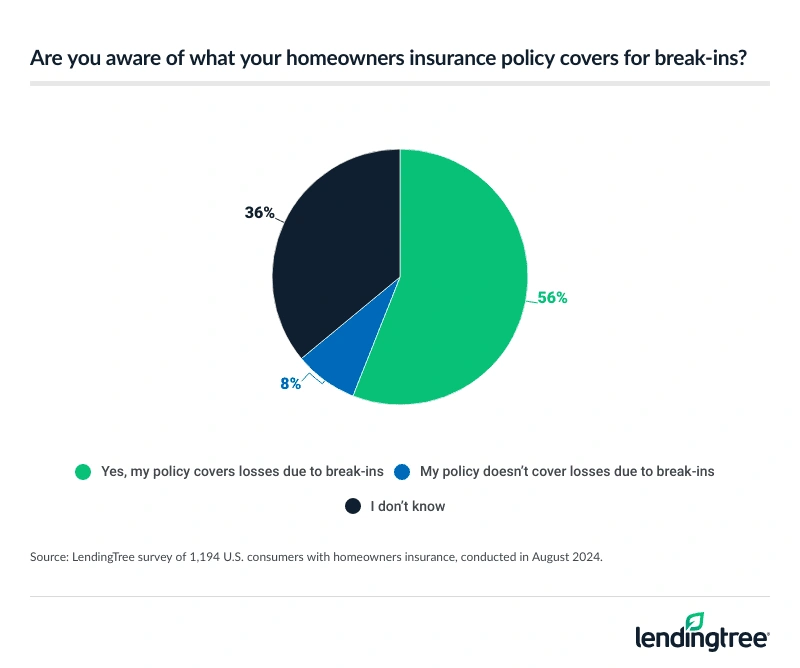

- Many aren’t confident about their insurance coverage and protection. Among Americans with homeowners insurance, 36% are unaware of what their policy covers if there’s a break-in. Additionally, 22% of Americans don’t feel informed about ways to prevent break-ins, and 23% with home security measures never review or update them.

Home break-ins leave Americans distrusting of the law

Exposure to break-ins may leave Americans feeling apprehensive. In fact, nearly 1 in 4 (23%) Americans say their home or a neighbor’s home has been broken into in the past five years, with Gen Zers ages 18 to 27 (40%), those with children younger than 18 (33%) and millennials ages 28 to 43 (29%) among the most likely to have this experience.

With that in mind, 46% of Americans don’t believe their local government and law enforcement do enough to protect them against home break-ins. Those concerns may even affect mental health, as 31% of Americans regularly experience stress or anxiety over break-ins.

Demographics with a lot of exposure to break-ins are also among the most likely to experience stress or anxiety over them, at 49% among Gen Zers, 45% among those with children younger than 18 and 39% among millennials.

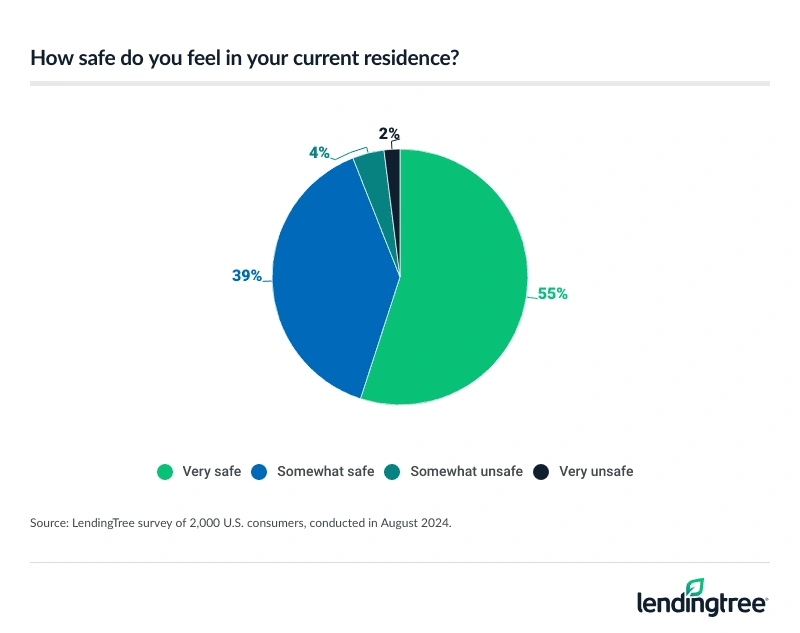

That being said, most (94%) Americans feel at least somewhat safe in their current residence. Those living in apartments (90%) and urban areas (91%) are slightly less likely to feel safe.

26% have considered moving due to break-ins

Some are taking action over their concerns. Overall, 26% have considered moving due to break-in concerns, with 14% having done so.

Gen Zers (49%), those with children younger than 18 (39%) and urban dwellers (39%) are among the most likely to have at least considered moving due to break-in concerns.

Some who’ve considered moving may be more exposed to crimes like home break-ins than others. According to LendingTree home insurance expert and licensed insurance agent Rob Bhatt, that can impact insurance rates.

“You’ll pay more for insurance in an area with a lot of break-ins,” he says. “Insurance companies continuously analyze claims data to see how much they pay customers after break-ins and incidents. They use this information to determine how risky it is to insure customers in each area they serve. The riskier the area, the higher the rate.”

You don’t always have to pack it up to ease break-in concerns. Some are improving safety in their current residence, too. Nearly 3 in 10 (29%) have enhanced their home security within the past year, with six-figure earners (42%) the most likely to do so.

Meanwhile, 25% intend to improve home security in the future.

Majority of Americans utilize safety features

While some are upgrading their home security, many already have their home prepped. Overall, 77% of Americans have some sort of security feature at home, with particularly high rates among six-figure earners (89%) and Gen Zers (88%).

Most commonly, Americans have cameras (40%), alarms (29%) and weapons for personal protection (26%).

Bhatt says security cameras and alarms are a great start. “Home invaders tend to be opportunists,” he says. “Seeing cameras or a sign letting them know about your alarm often encourages them to keep walking. Cameras are particularly useful because they can provide valuable evidence to law enforcement.”

Some additional simple measures to help lower your likelihood of being a target include making sure you have secure dead-bolt locks for all your doors and locking windows an intruder could use to get into your home when you’re away or asleep. Additionally, Bhatt says to keep areas on your property appropriately lit and visible to others.

Notably, 25% of those with security features say they’ve received home or renters insurance discounts for them. Of those with home security features, 36% say they update or review these features annually — the most common response. Meanwhile, 34% update them every few years and 23% never do.

Some measures leave Americans apprehensive, though, as 30% think technology like doorbell cameras invades privacy. Gen Zers (43%) are particularly likely to hold this belief.

Many aren’t knowledgeable about their insurance coverage

Nobody likes to imagine being the victim of a home break-in, but that doesn’t mean you shouldn’t be prepared for the aftermath of one. Still, 36% of homeowners with home insurance are unaware of what their policy covers if there’s a break-in.

Those who do know are set, as 56% of those with homeowners insurance say their policy covers losses due to break-ins.

While Bhatt says it’s hard to find time to read through your insurance policy or learn about different home security options, not knowing your coverage could have consequences.

“Unfortunately, if you don’t know how your insurance covers break-ins, you may not receive your full payment — or any payment — for lost property and damage after a break-in,” he says. “Or you might not realize how affordable and easy it is to get basic security measures to protect your home.”

Overall, 78% of Americans feel well-informed about ways to prevent break-ins.

Protecting against home invasion: Top expert tips

Across Americans with home insurance, 16% have filed a claim for a break-in. While you may never have to file one, being prepared is important. Particularly, Bhatt recommends:

- Create a home inventory. This is an itemized list of your possessions with their value and other relevant purchase data. If your items are ever stolen or damaged, having this info handy will help you get a fair settlement from your insurance company quickly. With spreadsheets and smartphone cameras, putting one of these together is easier than ever.

- If you’re comfortable with it, place security cameras at your front door and other areas where people may enter your home or property. “Advances in technology have made good cameras affordable,” Bhatt says. “You can usually sync them to your smartphone with an app. Just keeping an eye on them can bring you peace of mind.”

- Monitored alarm systems usually require a monthly subscription, but utilizing them may be worth it. These generally run from $10 to $60 a month depending on where you live and which company you use. Although no one wants an added expense, the extra layer of security these services provide is often worth it.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 78 from Aug. 12 to 14, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78