Almost 40% of Insured Drivers in Incidents Have Chosen to Pay Out of Pocket for Repairs

Dealing with insurance after an accident can be a nightmare — and some drivers try to avoid it altogether.

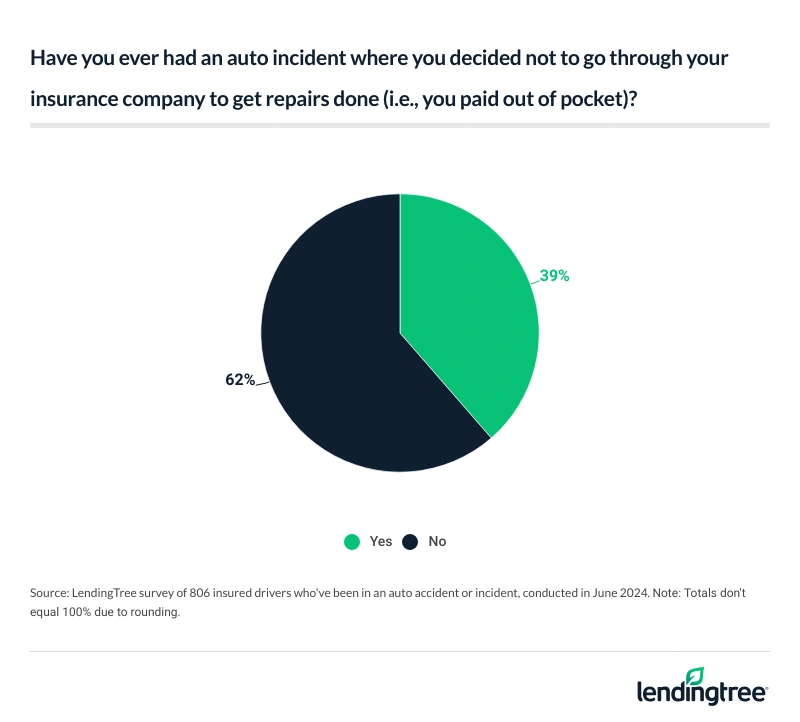

According to the latest LendingTree survey of 2,000 U.S. consumers, 39% of insured drivers who’ve been in an auto accident or incident have bypassed their insurance for repairs. What’s more, 24% have filed a claim and later regretted it.

Here’s what else we found.

Key findings

- Many prefer to pay out of pocket for auto damage. Among insured drivers in an accident or incident, 39% have bypassed their auto insurance for repairs. When asked why, 59% said the damage was minimal, 44% said their deductible was higher than the cost and 42% didn’t want their insurance to increase.

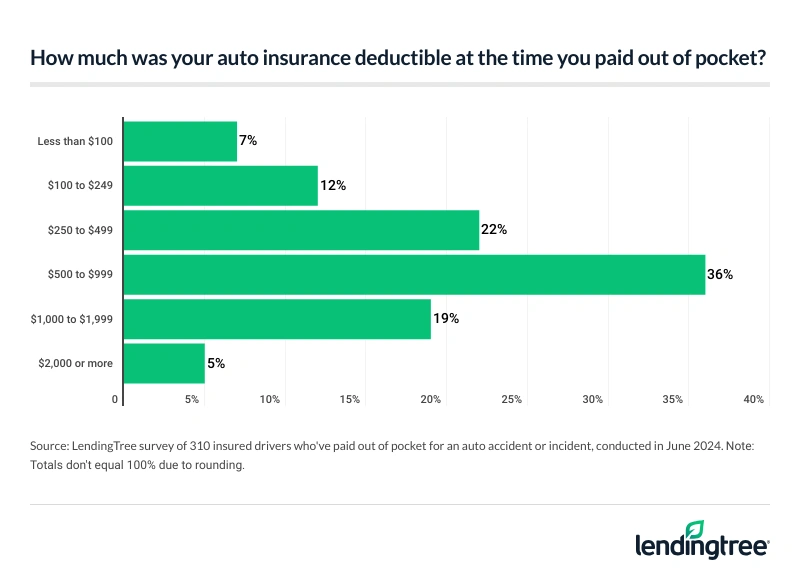

- Some keep these incidents to themselves. 57% of those who’ve paid out of pocket didn’t disclose the incident to their insurer. A high deductible doesn’t appear to be a barrier for many drivers since 76% had a deductible of less than $1,000 when they paid out of pocket, and 65% spent less than $1,000 on repairs.

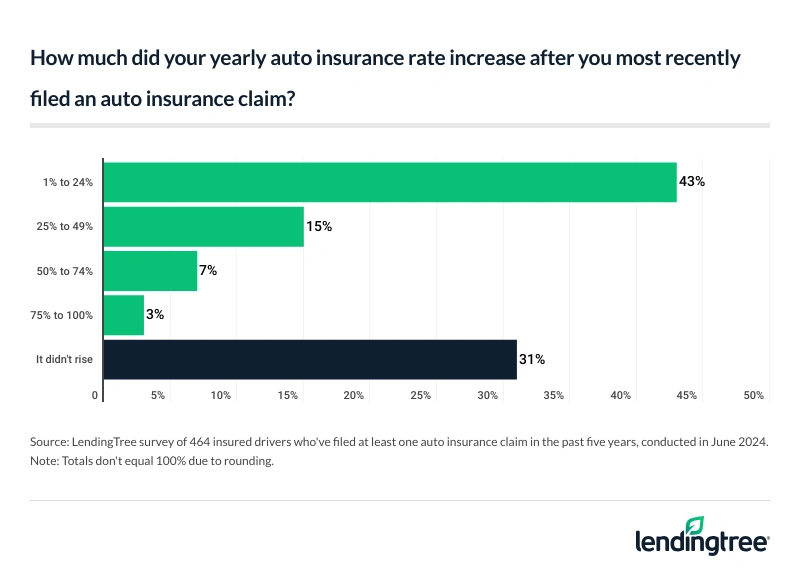

- Filing claims has led to regret for some drivers. Almost a quarter (24%) of insured drivers in an accident or incident have filed a claim and later regretted doing so. The top reasons for post-claim regret are significantly higher insurance rates (59%), a decreased vehicle value (36%) and an expensive deductible (33%). Among drivers who’ve filed a claim in the past five years, 26% said their annual insurance rate increased by at least 25%.

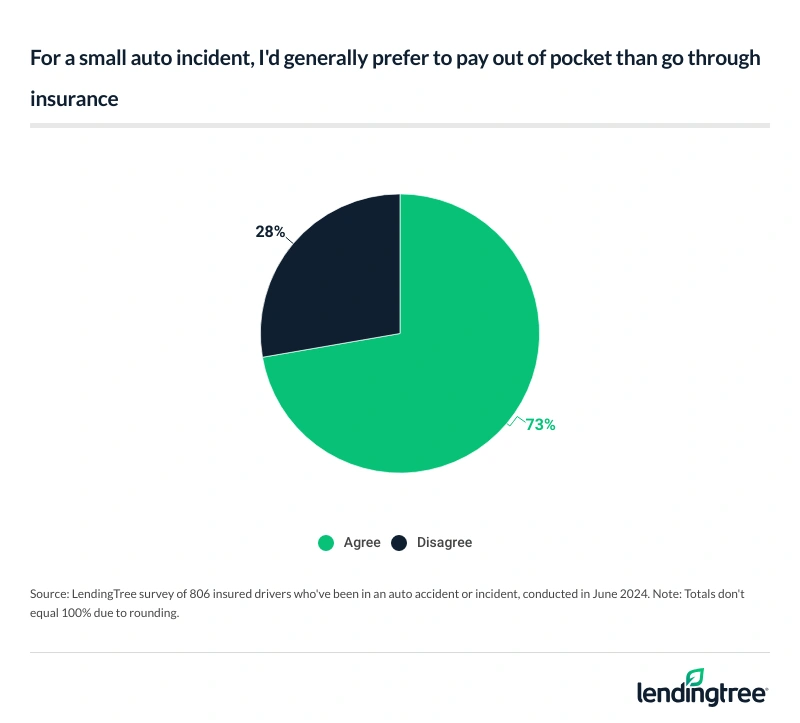

- Overall, most drivers want to avoid insurance. Almost three-quarters (73%) of insured drivers in an incident would generally prefer to pay out of pocket for a small issue rather than go through insurance, and 49% have repaired damage their insurance would have covered.

Many insured drivers prefer to pay out of pocket

Although insurance is designed to protect drivers in accidents, many don’t utilize it when they occur. Among insured drivers who’ve been in an accident or incident, 39% have at some point chosen not to use their insurance for repairs. That rises to 45% among male drivers, versus 32% for female drivers.

Younger consumers are also more likely to skip using insurance. While 43% of millennials ages 28 to 43 have bypassed their insurance after an accident or incident, just 29% of baby boomers ages 60 to 78 say the same. Meanwhile, 49% of those with children younger than 18 have bypassed their insurance, compared with 32% of those with children 18 or older.

When asked why, 59% said the damage was minimal, 44% said their deductible was higher than the cost and 42% didn’t want their insurance to increase.

According to LendingTree auto insurance expert and licensed insurance agent Rob Bhatt, paying for minor repairs and saving insurance for the big stuff is generally best, especially if you cause the damage.

“A claim for an at-fault accident almost always increases your rates,” he says. “If someone else causes the damage, their policy’s liability coverage is supposed to cover your repairs with no deductible. If the at-fault driver is uninsured, your policy’s uninsured motorist or collision coverage kicks in — if you have either. These coverages can also pay for repairs after a hit-and-run.”

If you file a claim with the other driver’s insurance company or yours, the accident usually shows up in the industry database most insurance companies use. Most won’t increase your rates for a no-fault accident, unless you have multiple no-fault accidents within two or three years.

57% didn’t tell their insurer about the incident

Bypassing insurance is one thing, but not telling your insurer about an accident is another. Nearly 3 in 5 (57%) of those who’ve paid out of pocket didn’t disclose the incident to their insurer. According to Bhatt, these drivers might be breaking the law.

“You need to be honest with your insurance company, but you don’t need to overshare,” he says. “If you’re not getting any money from your insurance company for an accident, you don’t need to tell them about it. That said, you still need to follow your state’s accident reporting laws, whether you file an insurance claim or not. These laws require you to notify law enforcement of any accident that results in injury or significant damage.”

Deductibles don’t seem to make much difference, as just over three-quarters (76%) had a deductible of less than $1,000 when they paid out of pocket, which lines up with the 65% who spent less than $1,000 on repairs.

Some paid a little more, though. Nearly a quarter (23%) of men paid $1,000 to $1,999 out of pocket, and 14% paid $2,000 to $4,999. Meanwhile, those figures are 10% and 9%, respectively, for women.

24% have filed a claim and then regretted it

For those who choose to file a claim, regret can be an issue. In fact, 24% of insured drivers who’ve been in an accident or incident have filed a claim and later regretted it. Regret is common among younger drivers, at 37% for millennials and just 5% for baby boomers. Meanwhile, 41% of those with children younger than 18 have regretted filing, while just 10% of those with children 18 or older say similarly.

Men (30%) are also more likely to have post-claim regret than women (19%).

Why the regret? Of those who wish they hadn’t filed, 59% say they had significantly higher insurance rates after filing — the most common response. Following that:

- 36% say their vehicle value fell

- 33% had an expensive deductible

- 22% say filing the claim was a hassle

- 5% lost their “no claims” bonus

A rise in rates is a valid reason, as 26% of those who’ve filed a claim say their annual insurance rate increased by at least 25% after their most recent claim. However, 43% saw a much milder increase of 1% to 24%, and 31% didn’t see any rate increases.

Bhatt says an increase of 25% is about in line with expectations. “Once you’ve been involved in an accident of any type, insurance companies see you as riskier to insure,” he says. “Your rates will eventually come down if you avoid claims for three to five years, depending on your insurance company. But you’re going to feel a financial squeeze until then.”

How many claims are drivers filing? Generally, most drivers who’ve been in an accident or incident haven’t filed recently, with 42% not filing any claims in the past five years. Meanwhile, 48% have filed one to two and 9% three or more.

Drivers generally prefer avoiding insurance

Regardless of whether they filed for their most recent incident, drivers would generally like to avoid insurance when possible. Among insured drivers, 73% of those in an incident would generally prefer to pay out of pocket for a small issue than involve their insurance.

That rises to 77% among men, while 68% of women say similarly.

Meanwhile, 49% have repaired damage their insurance would have covered. Those with children younger than 18 (59%), millennials (56%) and men (54%) are the most likely to have done so.

To file or not to file? Top expert tips

If you’ve been in an accident, should you file a claim or pay out of pocket? According to Bhatt, you should foot the bill if you caused the damage and the repair costs are less than your deductible or slightly more.

“If someone else caused the damage, you should at least inquire about a claim with your insurance company after you get a repair estimate,” he says. “Just make sure to emphasize the word inquire. Inquiring allows you to find out if the incident is covered, your out-of-pocket costs and whether the incident will make your rate go up. This information can help you decide what’s best for your budget.”

Bhatt says it’s usually worth filing a claim for repairs that’ll cost a few thousand dollars more than your deductible, even if you get higher insurance rates for a few years. “The whole point of having car insurance is to prevent an accident from leaving you in financial hardship,” he says.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 78 from June 13 to 14, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78