92% of Insured Americans Who Switched Auto Insurance Companies Saved Money

Auto insurance is a necessity for drivers, and an increasingly expensive one. But there are ways to cut costs, including shopping around.

According to the latest LendingTree survey of nearly 2,000 U.S. consumers, an overwhelming 92% with auto insurance saved money when switching carriers, which was their primary goal.

Here’s what else we found.

Key findings

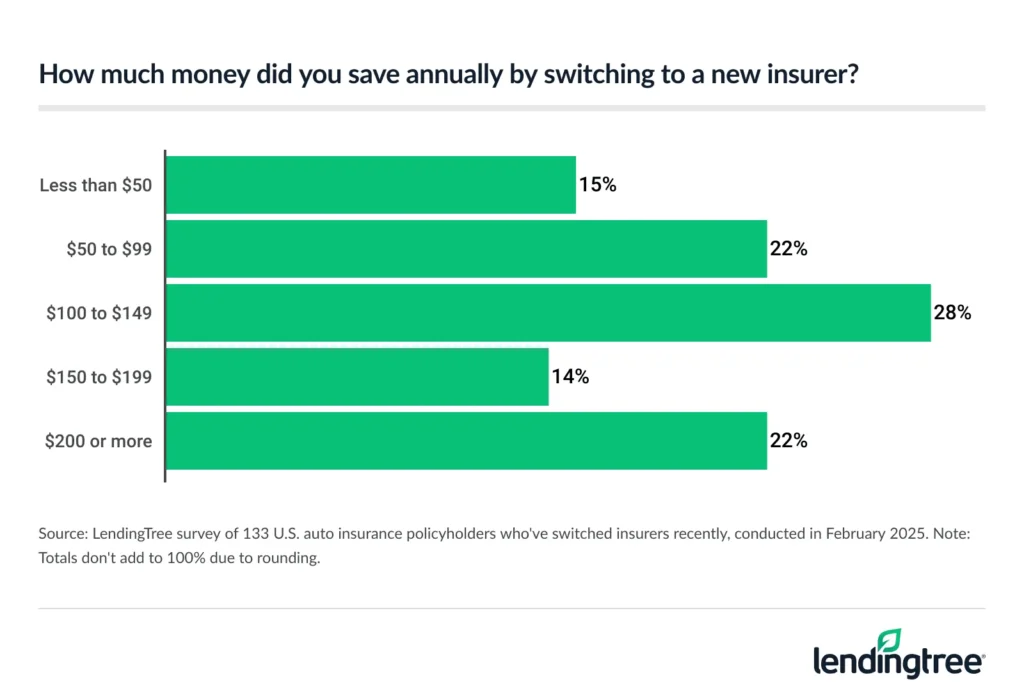

- It pays to shop for auto insurance. Among insured Americans who switched carriers, an overwhelming 92% saved money — and 63% said it was at least $100 annually. Money was the main driver for switching (79%), followed by positive reviews of the new insurer (25%) and dissatisfaction with the old insurer (20%).

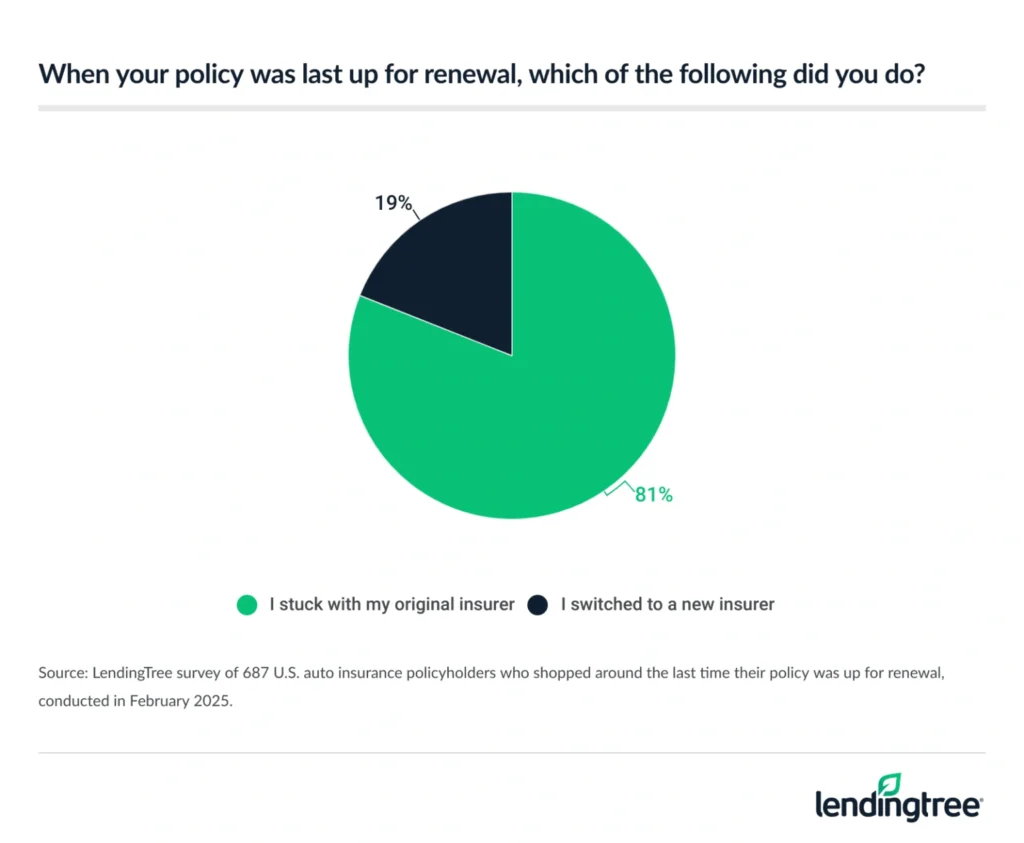

- Many with auto insurance miss out on potential savings. Among those who’ve renewed policies, 54% didn’t seek additional quotes when they were last up for renewal. Among those who got at least one additional quote, 81% still stuck with their insurer.

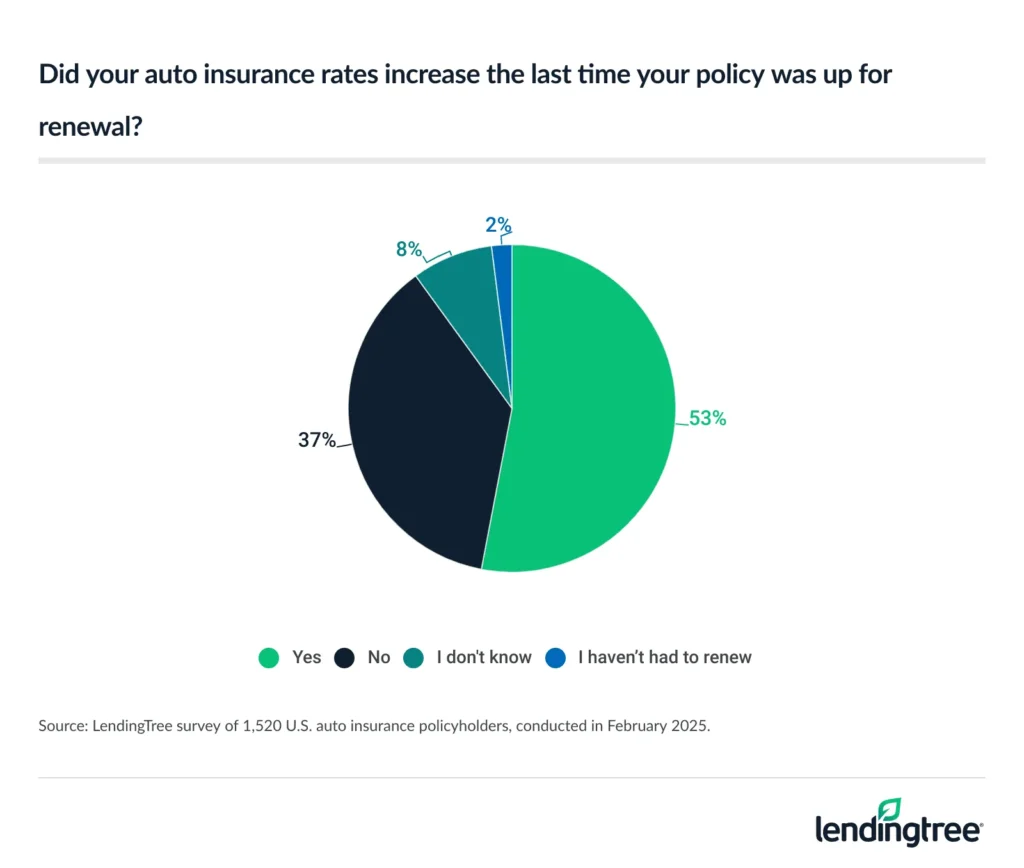

- Rate hikes are common for auto insurance policyholders when they renew. Over half (53%) report increased rates during their last renewal, significantly impacting the 61% somewhat or completely struggling to afford their auto insurance premiums.

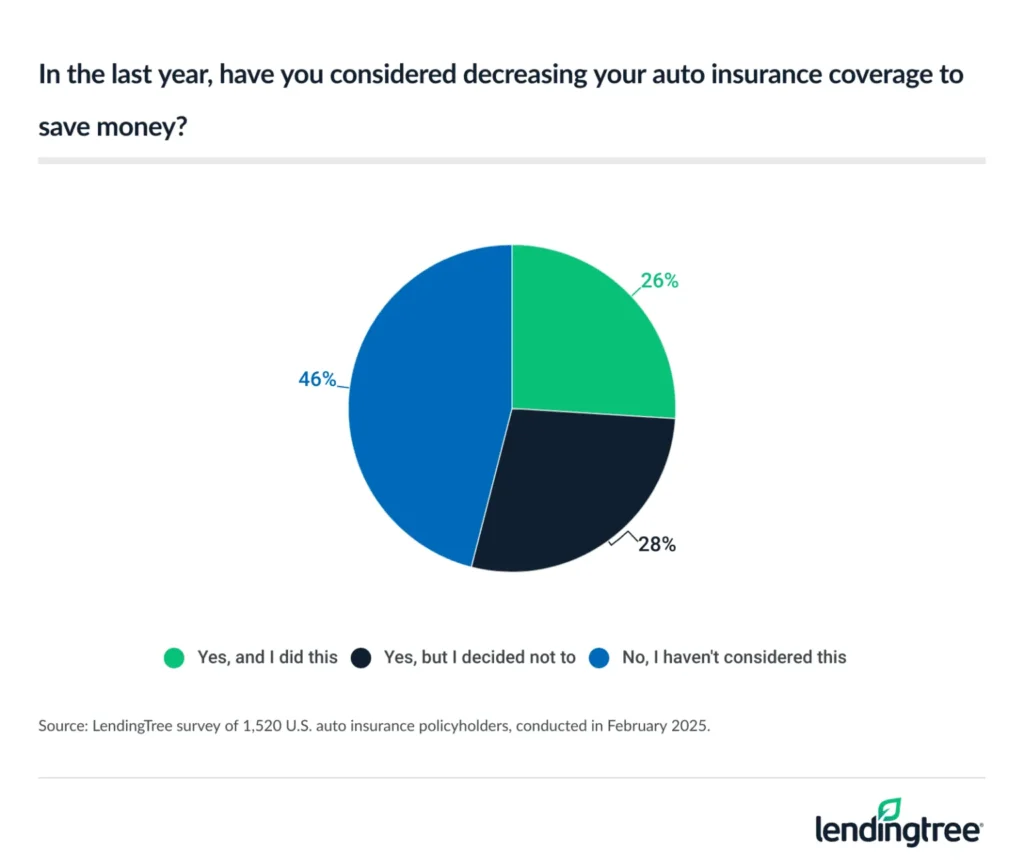

- A significant chunk of policyholders downgrade coverage to save money. Over half (54%) of policyholders have considered decreasing their coverage to save money, with 26% taking the plunge. Younger generations are more likely to consider downgrading coverage, at 73% of Gen Zers and 66% of millennials.

How much policyholders save by shopping around

Shopping around is a proven way to save on auto insurance. In fact, an overwhelming 92% of insured Americans saved money when switching carriers.

Nearly two-thirds (63%) who switched saved at least $100 annually, including 22% who pocketed at least $200.

While $100 a year is less than $10 a month, it’s a good start, says Rob Bhatt, LendingTree auto insurance expert and a licensed insurance agent.

“After a few years of sharp rate increases, many insurance companies are trying to win back customers by lowering rates a little,” he says. “A company that quoted you a higher rate before may give you a cheaper rate today.”

As far as why policyholders switched, 79% did so to save money. Meanwhile, a quarter (25%) said they heard positive reviews about their new insurer and 20% were dissatisfied with their old insurer’s customer service. Another 14% wanted to try something new and 8% decided to bundle their car insurance with their home or renters insurance.

More than half didn’t shop around at last renewal

Conversely, policyholders who don’t shop around may lose out on savings. Among policyholders who’ve renewed policies, more than half (54%) didn’t seek additional quotes the last time.

More policyholders should consider getting additional quotes, Bhatt says.

“Finding a way to save money is always wise,” he says. “But cheaper rates aren’t the only factor to consider when choosing an insurance company.”

Finding a way to save money is always wise. But cheaper rates aren’t the only factor to consider when choosing an insurance company.

If your insurance agent is responsive and provides sound advice, it may be worth a little more to stick with the company, Bhatt says. Similarly, he says, if you’ve had a good claims experience in the past without your rates shooting up, your company may be a better choice. But if your company isn’t treating you well and charges a high rate, it could be a great time to shop around.

Younger policyholders up for renewal are more likely to shop around for insurance quotes, at 59% of Gen Zers ages 18 to 28 and 54% of millennials ages 29 to 44. That compares with just 40% of baby boomers ages 61 to 79 and 38% of Gen Xers ages 45 to 60.

Those with children younger than 18 (55%) are more likely to get additional quotes than those with no children (42%) and those with children 18 or older (40%). Men (50%) are also more likely to do so than women (42%).

Still, getting a quote doesn’t directly provide savings. Among those who got at least one additional quote, just over 4 in 5 (81%) stuck with their original insurer.

Bundling home and auto can make it harder to leave. Among those who stuck with their auto insurance carrier, 40% said they bundled. Meanwhile, 39% said their insurer offers the best price, 39% liked their insurer’s customer service and 18% said switching seems like too much work.

This comes as 60% of policyholders bundle their insurance — and those who do often prioritize their auto coverage. While 54% of this group equally value their home and auto insurance, 30% would rather have better auto insurance. Comparatively, 17% prioritize home insurance.

Policyholders struggle to afford insurance as prices rise

Rate hikes are increasingly common among auto insurers, with 53% of policyholders reporting higher rates when they last renewed. That’s especially true among six-figure earners (60%) and baby boomers (59%). Men (57%) are also more likely to experience this than women (48%).

With that in mind, 61% of policyholders are somewhat or completely struggling to afford their auto insurance, particularly Gen Zers (76%), those earning less than $30,000 a year (73%) and millennials (68%).

Bhatt says it’s generally good to shop around for car insurance every few years, or when your company raises your rate unreasonably.

“Shopping around for insurance is easier than most people think,” he says. “Quotes are free, and you can usually get them online — or at least start the process online.”

Those with insurance downgrade to save money

Affordability is a large concern, and many policyholders are cutting back. Across policyholders, 54% have considered decreasing their coverage to save money in the last year, with just over a quarter (26%) already making the plunge.

Younger policyholders are the most likely age group to at least consider downgrading their coverage, at 73% among Gen Zers and 66% among millennials. Additionally, nearly 2 in 5 (38%) Gen Z policyholders have already decreased their insurance coverage to save.

But there are risks to downgrading, Bhatt cautions.

“The biggest is not having enough coverage if you have an accident or claim,” he says. “Raising your deductible is a good first step to lower your insurance rate. If you have an older car with a low resale value, it may be time to remove the collision and comprehensive coverage.”

Bhatt doesn’t recommend reducing coverage limits for liability and uninsured motorist protection because these coverages can provide you with the most protection. He also cautions against removing rental car reimbursement. However, you don’t need towing coverage if you already have a roadside assistance membership with a company like AAA or Good Sam. Many credit cards also provide roadside assistance, albeit limited.

Shopping around: Top tips for those unexperienced

If you’re struggling to afford auto insurance but have never shopped around, there are a few things to keep in mind to make the process smooth. Particularly, Bhatt recommends:

- Have your current policy’s declarations page handy when you shop. It gives you a good starting point to decide the coverages and limits you need.

- Ask questions. “It’s good to ask questions about anything that doesn’t make sense to you,” Bhatt says. “The extra time this adds to the process is worth it because it’s important to make sure you have the right coverage. No one likes to think about this, but the potential expenses from a car accident can be financially devastating.”

- Don’t be shy about sharing your declarations page or quotes you’ve received from other companies. Insurance companies expect you to shop around. Sharing a quote or your current declarations with other agents helps them get you their quotes more quickly.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,999 U.S. consumers ages 18 to 79 from Feb. 20 to 21, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79