When Is My First Mortgage Payment Due?

Your first mortgage payment will typically come due on the first day of the second month after you close on your home loan. If that sounds confusing, don’t worry — it’s fairly simple to calculate.

We’ll cover everything you need to know, including how your closing date can affect both your closing costs and how long you’ll have before your first payment is due.

- Your first mortgage payment is typically due on the first day of the second month after you close on the loan.

- If you close early in a month, you’ll have less time before your first payment is due compared to if you closed later. The difference is slight, however — a matter of weeks, not months.

- Your mortgage payments cover the interest your loan accrued during the previous month.

- The timing of your closing date won’t technically save you money, but choosing a date strategically can help ease the burden of a tight budget.

When is my first mortgage payment due after closing?

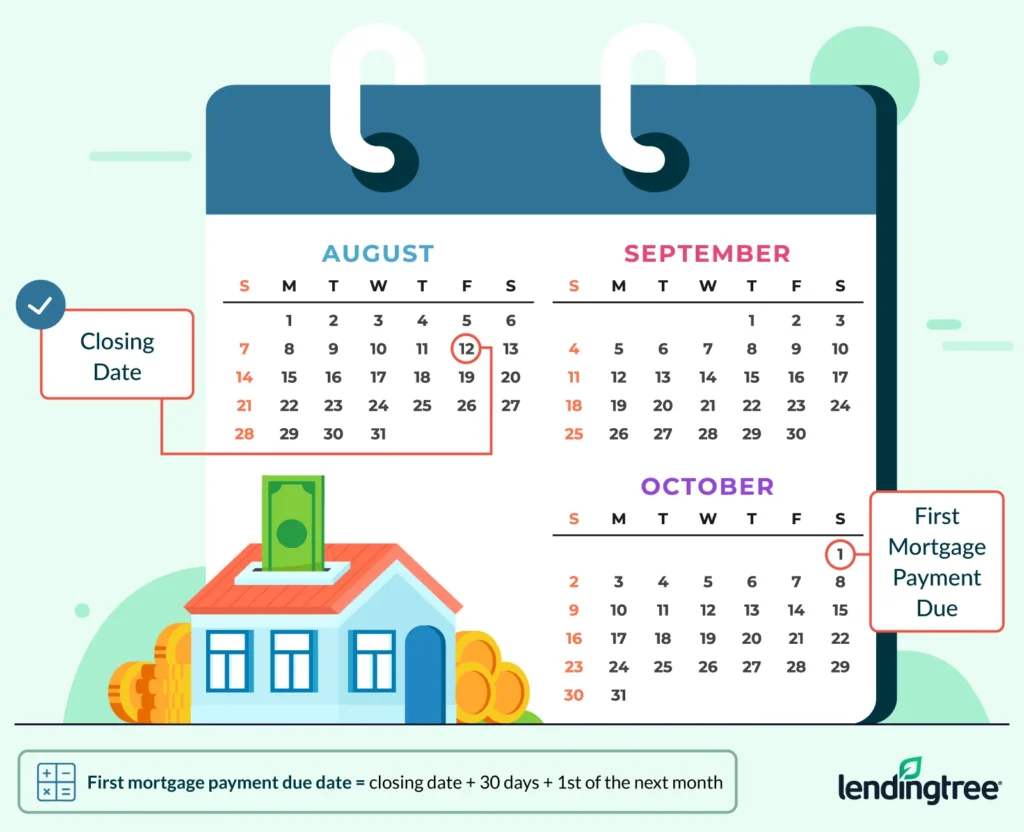

Your first mortgage payment is traditionally due on the first day of the second month after your mortgage loan closing. To calculate this date, simply add 30 days to your closing date and, from there, jump ahead to the first day of the next calendar month.

For example, if you closed on your house on Aug. 12, you can expect your first mortgage payment to be due on Oct. 1.

Just be sure to check your closing documents, as this tradition isn’t set in stone — it’s just a guideline. Your first payment due date will be listed in your promissory note, along with other details like the time, place and amounts of your payments.

What’s included in my first mortgage payment?

You probably already know that mortgage payments are made up of principal and interest. However, there are two additional things you need to understand about mortgages that will clarify why your first payment is scheduled the way it is and what it includes:

- You pay interest in arrears, meaning after it has accrued. The portion of your mortgage payment that covers interest is paying for the interest accrued during the previous month.

- You pay principal in advance. The portion of your monthly mortgage payment that covers the principal balance is paying what’s owed for the month ahead.

Therefore, your first mortgage payment will include interest owed 30 days “backwards” and principal owed 30 days “forwards.”

Following our earlier example, an Aug. 12 closing date means your first payment is due Oct. 1. That first payment would include interest owed for Sept. 1 through Sept. 30, plus the principal payment owed for the month of October.

Interest starts accruing the day you close, and will continue accruing until you pay off the entire loan. The loan balance will slowly shrink as you pay it down, so each month you’ll pay more in principal and less in interest than you did the previous month.

Our example didn’t include costs you may pay monthly beyond interest and principal. Typically, these costs include:

- Homeowners insurance

- Property taxes

- Mortgage insurance

- Homeowners association fees (if applicable)

If you’d like to calculate your subsequent mortgage payments including these types of costs, LendingTree’s home loan calculator allows you to enter these costs and will automatically add private mortgage insurance (PMI) if you plan to make less than a 20% down payment.

Adjustable-rate mortgages (ARMs) are a notable exception to the rule that your mortgage payments will remain the same over the life of your loan. If you have an ARM, once your loan’s initial fixed-rate period ends, your interest rate has the potential to rise or fall and change your monthly payment amount in response.To be on the safe side, though, you should expect your payments to rise rather than fall. In fact, due to the complexities of the rules that govern ARMs, the deck is stacked against your payments dropping. When interest rates do fall, your payments may not actually drop by much — and even when interest rates aren’t on the rise, your payments could still increase.

When is the best time to close on a house?

There’s no single best time to close on a house — but if you know your priorities you can choose to close on a date that creates a timeline that works well for you:

| Closing date | Prepaid interest | How soon after closing your mortgage payment is due |

|---|---|---|

| Beginning of the month | $$$ | Around 60 days |

| Middle of the month | $$ | Around 45 days |

| End of the month | $ | Around 30 days |

Payment due date vs. closing date explained

Your loan closing date has a direct relationship to your first mortgage payment’s due date, which in turn determines your prepaid interest cost. Choosing a closing date strategically won’t technically save you money on overall costs but it can allow you to:

- Reduce how much cash you need to bring to the closing table, or

- Give yourself more time to prepare for that first mortgage payment

An earlier closing date shifts more of that first month’s interest into your closing costs, which could create more room in your budget for movers, new furniture and other moving costs.

A later closing date places more of that burden in your mortgage payments, which means you’ll bring a bit less cash to the closing table.

Since interest starts accruing the day you close, you’ll prepay some amount of prorated interest as part of your closing costs. Precisely how many days of interest that accounts for is determined by how many days you need to “jump ahead” to reach the first day of the next calendar month. If you closed on Aug. 12, the interest for Aug. 12 through Aug. 31 will be prorated and prepaid as a part of your closing costs.

Your closing disclosure will list how much prepaid interest is included in your closing costs. Look for the section on Page 2 titled “Prepaids” under the heading “Other Costs.”

To return to our earlier example, you would owe 19 days worth of interest to cover the time from Aug. 12 (the closing date) to Aug. 31 (the last day of the month).

Frequently asked questions

Keeping in mind that your first mortgage payment is typically due on the first day of the second month after you close on the loan, if you close on June 1 your first mortgage payment should come due on Aug.

Your first payment shouldn’t be significantly different from your future payments, since mortgages are amortized — meaning the total you need to pay is divided into equal payments over your loan term. However, amortization only applies to the principal and interest owed on your loan. Other parts of your monthly payments, like homeowners insurance and property taxes, can fluctuate from year to year.

Most lenders offer a grace period on late mortgage payments — meaning that if you miss your due date, you won’t be penalized as long as you’re able to make that payment within a set time period (usually 15 days). After the grace period ends, your mortgage payment is considered “late.”

You may owe fees if you don’t make the payment within your grace period, and these fees will typically run you around 4% to 5% of the total overdue balance.

If 30 days go by and you still haven’t made your payment, your loan will be considered delinquent and the missed payment will be reported to the credit bureaus. Past the 30-day mark, you’ll enter mortgage default and, if three to six months pass, your lender will likely initiate the foreclosure process.

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles