Americans Using BNPL to Make Ends Meet, With 27% of Users Bridging Paycheck Gaps and 21% Buying Groceries

Buy now, pay later (BNPL) loans aren’t only for fancy shoes, kitchen appliances and gaming systems. Millions of Americans use these loans as lifelines.

The newest LendingTree survey finds that 27% of BNPL users say they use these loans as a bridge to their next paycheck, which can help them make ends meet amid rampant inflation, rising interest rates and headline-making layoffs. The loans are also being used to purchase basic necessities. Case in point: 21% of BNPL users say they’ve used one of the loans to buy groceries.

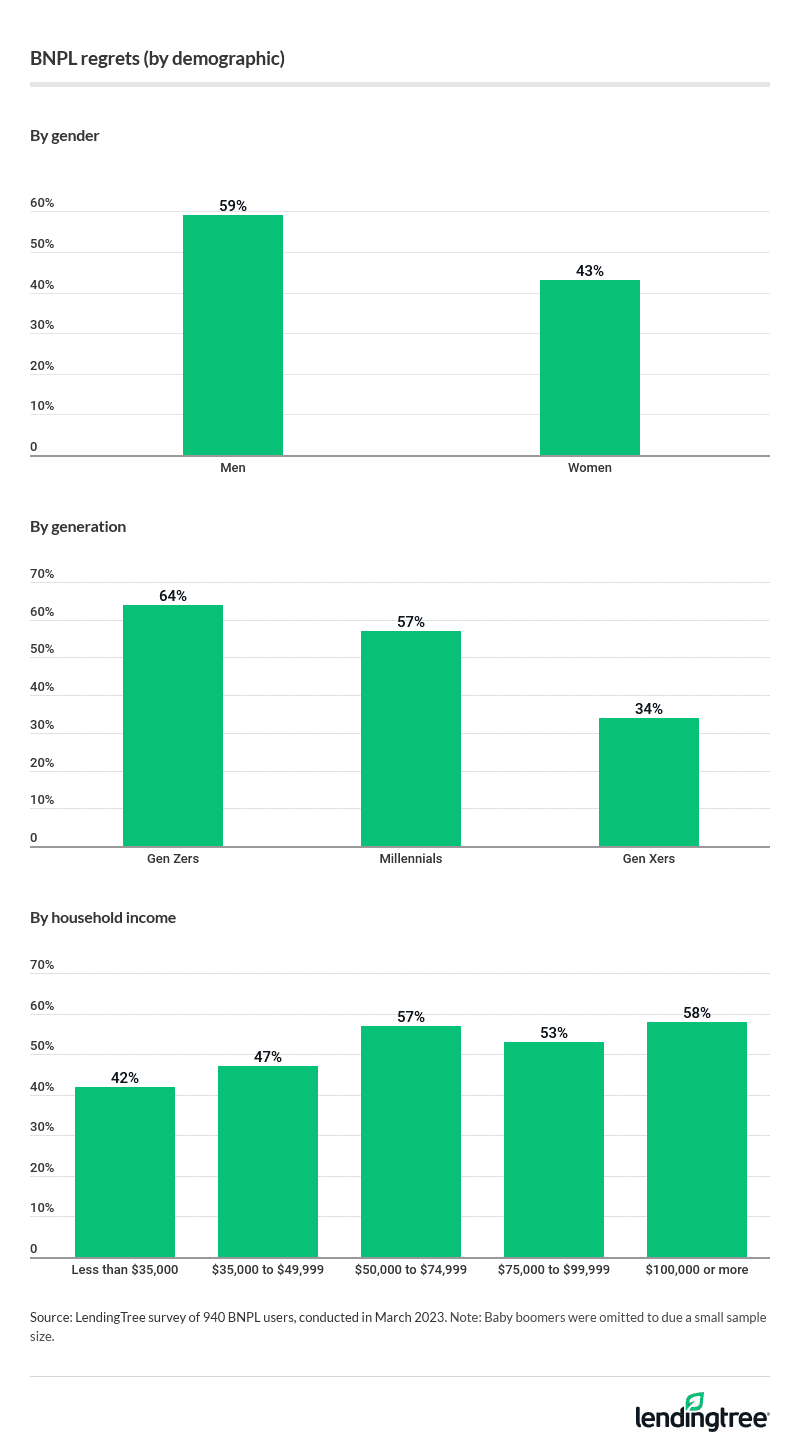

But things don’t always work out. More than half of users — including almost two-thirds of Gen Zers — say they’ve regretted a BNPL-financed purchase, and 40% of these users have paid late on one of the loans.

Despite those warning signs, BNPL use is still on the rise, with 46% of Americans saying they’ve used one of the loans — up from 43% a year ago. That growth has led other companies to jump in the fray alongside BNPL firms like Klarna and Cash App Afterpay— including Apple, which introduced Apple Pay Later in late March. However, the meteoric growth in BNPL popularity and usage of these loans in recent years appears to be slowing.

Key findings

- 46% of Americans say they’ve used a buy now, pay later service, up from 43% a year ago and 31% the year before that. That includes nearly two-thirds of Gen Zers (65%) and 55% of millennials.

- More than 1 in 4 BNPL users say they use the loans as a bridge to their next paycheck. 27% of BNPL users cite this. Among BNPL users, this rate is even higher for Gen Zers (35%), six-figure earners (32%) and men (32%).

- More than 1 in 5 BNPL users say they’ve used the loans to buy groceries. 21% of users say they’ve done so. Clothing, shoes and accessories are, by far, the most common items users have bought with BNPL at 46%.

- 40% of BNPL users say they’ve paid late on a BNPL purchase. Nearly half (49%) of BNPL users with kids younger than 18 say they’ve paid late, as have 45% of users making $100,000 or more a year.

- More than half of BNPL users (51%) say they’ve regretted financing a purchase with BNPL. Almost two-thirds of Gen Z users (64%) say they’ve done so, as have 59% of men and 58% of those making $100,000 or more a year.

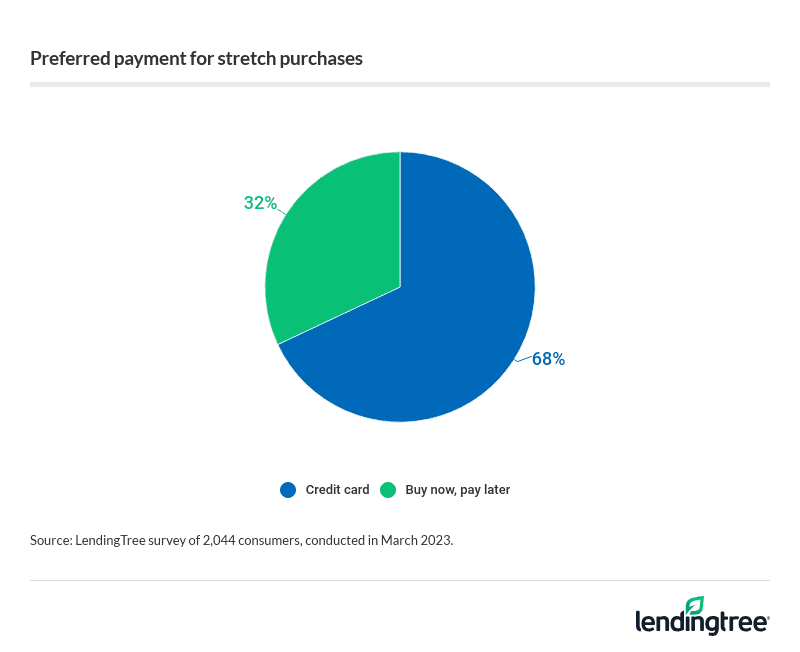

- More than two-thirds of consumers prefer credit cards to BNPL for stretch purchases. 68% of Americans say so, including 72% of men. Generally, the higher your income, the more likely you are to prefer credit cards.

Nearly half of Americans say they’ve used a BNPL loan, but growth is slowing

About 46% of Americans say they’ve used buy now, pay later to finance a purchase. That’s up 3 percentage points from a year ago and 15 points from 2021. That’s tremendous growth in two years, indicative of how the BNPL phenomenon has taken hold in the U.S.

Still, the growth between 2022 and 2023 was significantly lower than between 2021 and 2022. It’s unclear whether that means BNPL growth is beginning to plateau or if rising inflation has had a cooling effect on demand (or if other things are at play), but it bears watching going forward.

The younger you are and the higher your income, the more likely you are to use these loans, generally speaking. One exception: Those making $100,000 or more a year are the second-least likely to have used the loans, ahead of only those making less than $35,000 a year.

It’s clear, however, that BNPL loans are firmly established as viable for all types of Americans. Men and women are similarly likely to use them (48% of men, versus 44% of women). Even baby boomers ages 59 to 77 have begun to embrace these tools, with 24% of them saying they’ve used one of the loans.

BNPL loans being used for groceries, other basic expenses

There’s very little that you can’t use BNPL services to pay for, and Americans are willing to take advantage of that.

By far, the most common items financed with BNPL are clothing, shoes and accessories. Nearly half of users (46%) say they’ve bought those items with a BNPL loan. Home decor, furniture and appliances are a strong second, bought by 34% of BNPL users, followed by tech devices such as laptops and gaming systems (27%) and beauty products (26%). Further down the list are splurges like event tickets, fitness equipment, travel and dining out.

In fifth, however, is something very different: groceries.

More than 1 in 5 BNPL users say they’ve used BNPL to buy groceries. That’s eye-opening.

Buying groceries differs greatly from buying a designer purse, refrigerator or PlayStation 5. It’s part of every American household’s routine, something that we do all the time — and people are using buy now, pay later loans to buy them.

The fact that buying groceries with BNPL has become so common is surprising. We knew it was happening but didn’t realize it was widespread. A deeper look at the survey data shows a large number of Americans are relying on these loans to get by. About 27% of BNPL users say they use the loans as a bridge to their next paycheck — and no demographic is immune.

The above graphic contains perhaps the most surprising stat: 32% of BNPL users who make $100,000 or more a year say they use the loans as a bridge from paycheck to paycheck. That’s the highest percentage of any income group, though at least a quarter of users at every income level say the same.

Late payments, regrets common among BNPL users

With so many using BNPL as a tool to stretch their budgets, it shouldn’t be surprising that many BNPL users have struggled with late loan payments. Unfortunately, that’s exactly what we’ve seen.

A deeper dive into these numbers shows that parents of kids younger than 18 are among the most likely BNPL users to have paid late at 49%, as well as Gen Zers ages 18 to 26 and millennials ages 27 to 42 (both 45%) and men (43%). Also, 45% of those making $100,000 or more a year have paid late — the highest of any age group.

With late payments being that common, it shouldn’t surprise that regrets are, too. The groups most likely to have paid late are generally more likely to have regretted using a BNPL loan.

Again, we see higher-income BNPL users leading the way, along with Gen Z and men borrowers.

Credit cards heavily preferred above BNPL for stretch purchases

Even with the growing popularity of BNPL loans across gender, age and income, they still trail well behind credit cards when it comes to stretch purchases — things that consumers can’t quite afford and may need a little extra time to pay for.

Generally, the higher your income, the more likely you are to prefer credit cards over BNPL. Men are more likely to prefer credit cards (73%, versus 68% of women), as are baby boomers. About 3 in 4 boomers prefer cards, while 68% of Gen Zers, 67% of millennials and 65% of Gen Xers ages 43 to 58 say the same.

The bottom line: Proceed with caution on BNPL

Buy now, pay later has been nothing short of a phenomenon in the past few years, embraced by millions of Americans. While they can be a great tool — they’re predictable, finite, often easier to get than other types of loans and often interest-free — they’re not without warts. They can stack up quickly, making it hard to keep up with payments. They can lead to overspending.

Rewards, if available, typically don’t match what credit cards can offer. Returns can be challenging. Rate and fee disclosures aren’t always clear. They typically don’t help your credit. They don’t come with some of the consumer protections you’d find with credit cards.

With that in mind, a credit card may be a better choice for some BNPL users. Credit cards aren’t perfect either, especially given today’s sky-high interest rates. However, if you typically only carry over your balances for a month or two, the interest you pay can be outweighed by the extra benefits, such as rewards, consumer protections and credit-building.

Ultimately, no one-size-fits-all answer on the right financial product exists, so explore BNPL alternatives. What’s important is that you take the time to do your homework about whatever loan you’re entering into and shop around to find the best one for you. That way, you can make the most informed decision about which loan best suits you and your needs.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,044 U.S. consumers ages 18 to 77 from March 7 to 8, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Get personal loan offers from up to 5 lenders in minutes