BNPL Tracker: 41% of Users Late in Past Year, More Using Loans for Groceries

More than 4 in 10 (41%) users of buy now, pay later (BNPL) loans say they paid late on one of them in the past year, up from 34% just a year ago, according to a LendingTree survey.

That’s just one of several troubling findings from our survey, which asked people about their behaviors and perspectives regarding these popular loans. Along with increased late payments, we found that many borrowers who take out these loans use them to buy groceries or takeout and believe that successfully managing one will boost their credit score. (Spoiler: It doesn’t … at least not yet.)

There’s some good news, however. A separate survey fielded in January 2026 found that BNPL lenders are highly likely to waive a late fee on a BNPL loan if you’re willing to ask.

Here’s what else we found.

Key findings

- An increasing percentage of BNPL users pay late. 41% of BNPL users say they paid late in the past year, up from 34% the previous year, though 76% of late payers were late by no more than a week or so. Surprisingly, high-income borrowers are among the most likely to pay late, along with men, young people and parents of young kids. The good news, however, is that a separate January 2026 survey found that 84% of those who asked to have a BNPL late fee waived were successful in at least getting it reduced.

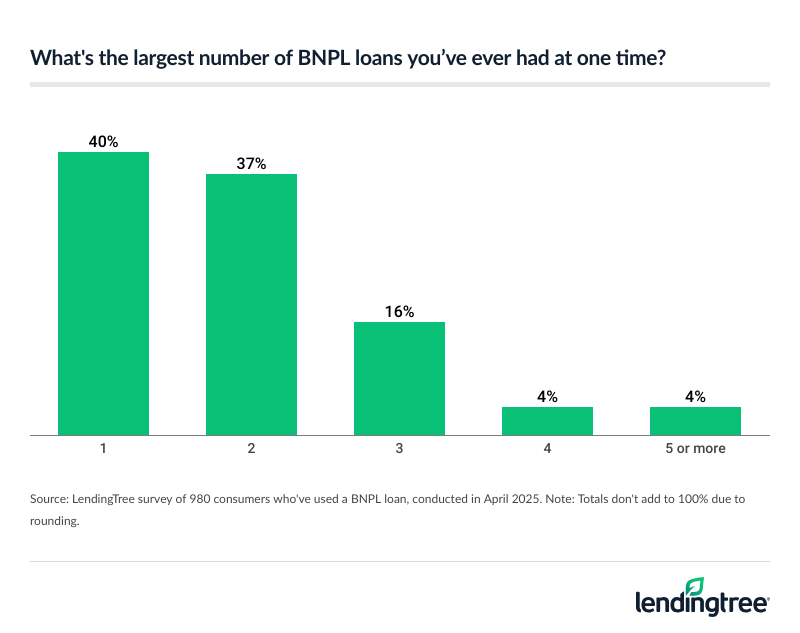

- Nearly 1 in 4 BNPL users (23%) say they’ve had three or more active BNPL loans at one time. High-income people are the most likely income bracket to say so. Additionally, Gen Zers and millennials are twice as likely as baby boomers to say so. Meanwhile, 40% say they’ve never had more than one at a time.

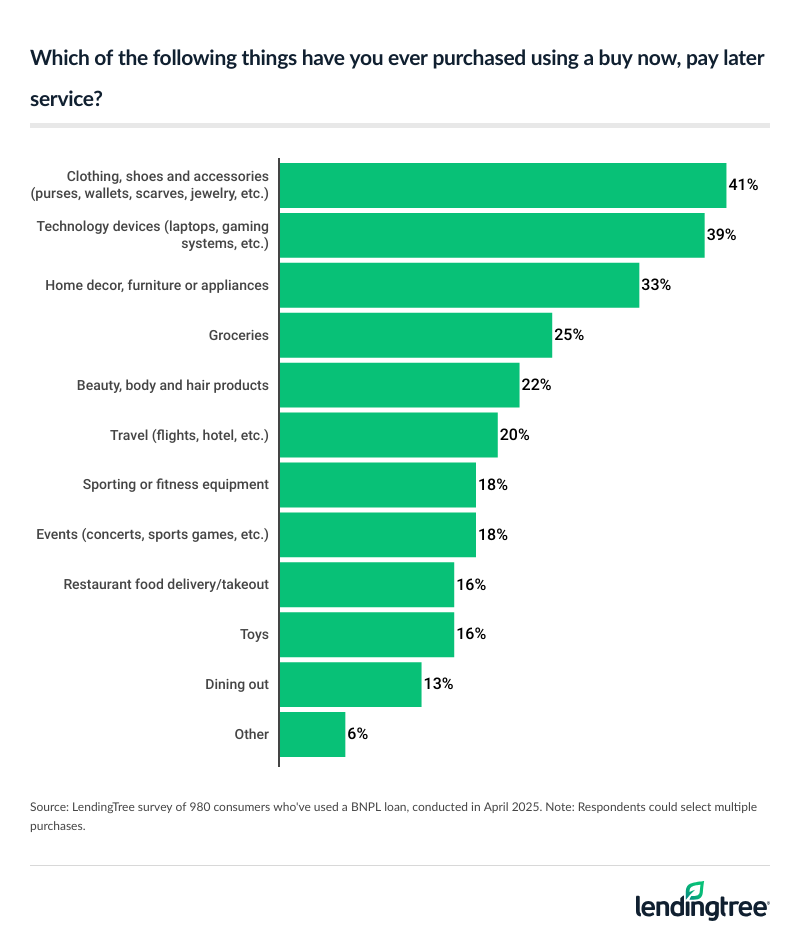

- More users buy groceries with BNPL. 25% of BNPL users say they’ve used the loans to buy groceries. That’s up from 14% just a year ago, amid rising prices at the supermarket. One-third of Gen Z BNPL users report having done so, making it the fourth-most common BNPL purchase for that age group, trailing clothing, technology and home decor.

- Two-thirds of BNPL users say they’d consider using it for food delivery, and many are putting their money where their mouth is. DoorDash and BNPL giant Klarna announced a partnership that lets customers pay for DoorDash deliveries with BNPL. However, we found that 16% of BNPL users say they’ve already used BNPL for restaurant food delivery or takeout.

- More users see BNPL as a “bridge” to their next paycheck. 33% say this, up from 30% last year and 27% the year before. High earners, men, younger Americans and parents of young kids are among the most likely to say so.

- More than 6 in 10 BNPL users (62%) incorrectly believe that making on-time payments on BNPL loans helps their credit score. Only 13% say they don’t help your credit score, which is correct (for now), while 26% aren’t sure. Men and high-income earners are among the most likely to believe this falsehood. Younger Americans are more likely to think it than their older counterparts, but even 54% of boomers do.

How many Americans have used a buy now, pay later loan?

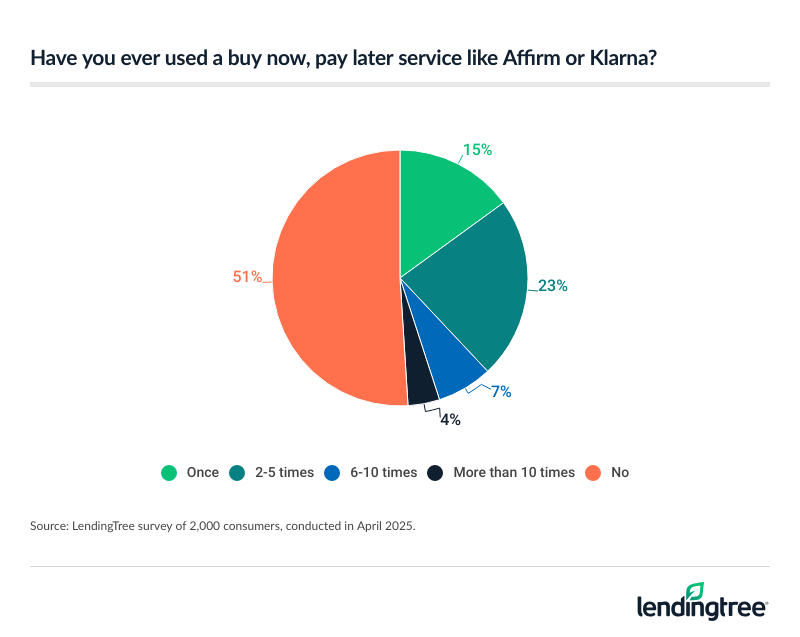

BNPL is everywhere. Almost half of our survey’s respondents say they’ve used a BNPL loan service such as Affirm or Klarna, including 11% who report using them at least six times.

Men are more likely than women (53% versus 46%) to have used a BNPL loan. Also, the younger you are, the more likely you are to have used one: 64% of Gen Zers (ages 18 to 28 in 2025) say they’ve used one, compared with 29% of baby boomers (ages 61 to 79 in 2025). That 64% includes 16% who’ve used them six or more times.

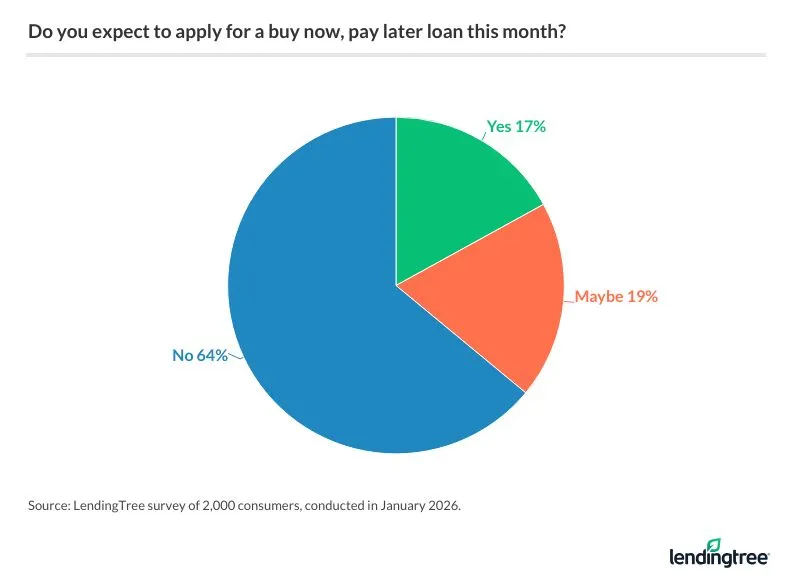

LendingTree’s January 2026 BNPL Tracker, which is fielded separately, shows that 36% of Americans are at least considering applying for BNPL this month. That’s down 12 points from December as Americans ease up on shopping after the holiday season, and is the lowest since July.

Gen Zers (ages 18 to 29 in 2026) are the most likely age group to at least consider applying for a BNPL loan this month, with 50% indicating this. Millennials (ages 30 to 45 in 2026) and Gen Xers (ages 46 to 61 in 2026) are the next most likely (at 44% and 35%, respectively), while baby boomers (ages 62 to 80 in 2026) are the least likely to consider one of these loans (17%).

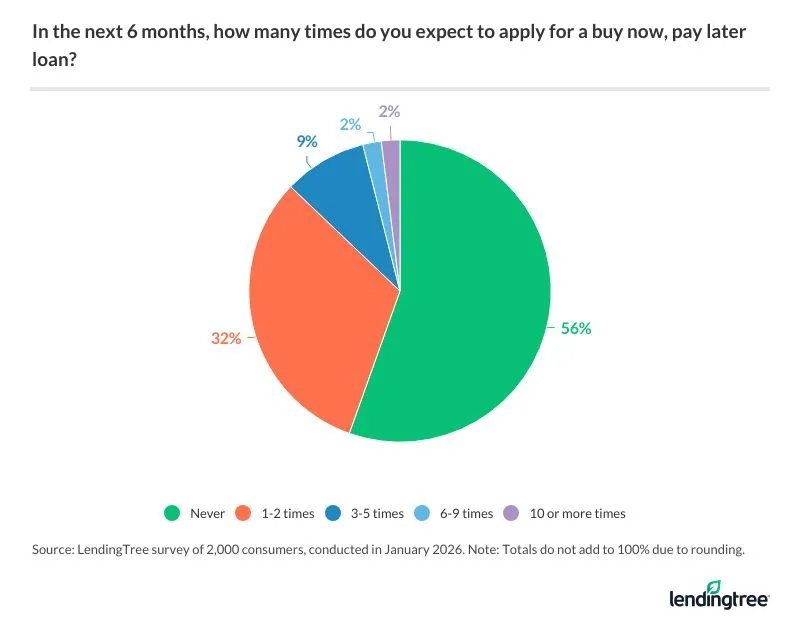

Additionally, 45% of Americans say they expect to apply for a BNPL loan in the next six months, down 11 points from December. That’s the lowest number since July, likely a result of shopping slowing down after the holidays.

How many Americans have been late with a payment on a buy now, pay later loan?

More than half of BNPL users (54%) say they’ve paid late on a BNPL loan in the past, including 41% who paid late on one in the past year. That 41% is up from 34% the previous year.

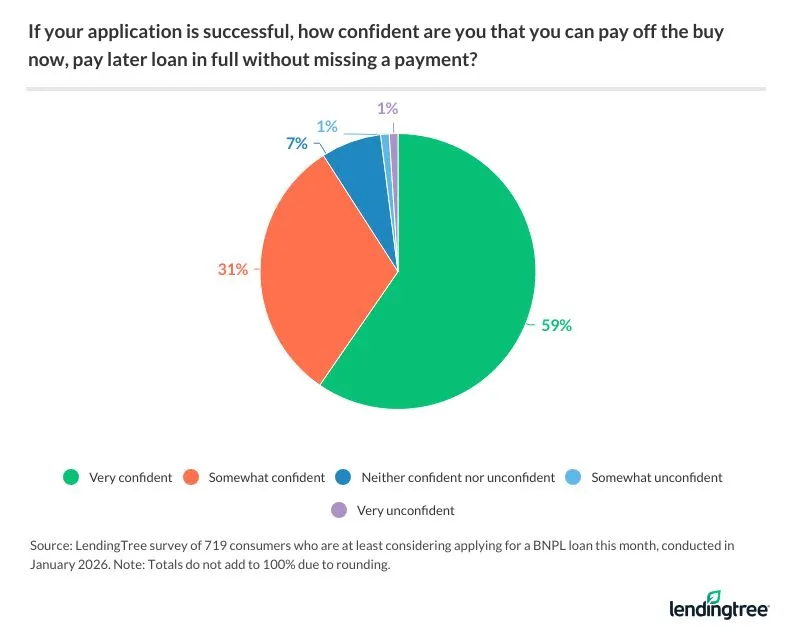

That’s a big percentage of BNPL users paying late, but it might make sense based on consumer confidence levels in our monthly BNPL Tracker. According to January’s BNPL Tracker, 59% of respondents at least considering getting a BNPL loan this month say they’re very confident they could pay off that loan without missing a payment. That’s unchanged from December. Meanwhile, 31% say they’re only somewhat confident, down four points from December.

While that adds up to 90% of people feeling at least some confidence about paying off BNPL loans on time, it still means a significant number of people take out these loans with doubts about whether they’ll be able to pay them back without incident. That’s far from ideal.

If you pay late, many BNPL lenders will charge you a small late fee. A December 2025 Consumer Financial Protection Bureau (CFPB) report said the average late fee assessed in 2023 was $9.99. The good news, however, is that you have a good chance of getting that fee waived if you ask. Our January BNPL Tracker shows that 84% of those who had asked to have a late fee waived on a BNPL loan either got the fee reduced or waived entirely.

How much do Americans spend with a buy now, pay later loan?

According to that CFPB report, the average transaction amount for a BNPL loan was $135 in 2023, the most recent year for which data is available.

However, our survey found that most BNPL users don’t stop at just one loan. In fact, 60% of BNPL users say they’ve held multiple BNPL loans at one time, including 23% who have held three or more.

The younger you are, the more likely you are to have had multiple BNPL loans simultaneously. About 7 in 10 Gen Z BNPL users (71%) say they’ve done that, including 26% who’ve had three or more. Additionally, two-thirds of BNPL users who are parents of young children have had multiple BNPL loans at the same time.

The survey results make clear that BNPL purchases aren’t just about luxuries for many Americans. We found that 33% of BNPL users view the loans as a bridge to their next paycheck, up from 30% a year ago and 27% the year before. Meanwhile, about half of BNPL users (49%) say the loans are their preferred payment method for so-called stretch purchases.

What do Americans buy most often with a buy now, pay later loan?

Clothing, including shoes and accessories, is the item most commonly bought with a buy now, pay later loan, but technology devices and home decor aren’t far behind.

The survey found that a growing percentage of BNPL users are utilizing the loans to buy groceries. This year’s survey found that 25% of BNPL users have done so, up from 14% the previous year. Gen Z is the most likely age group to have done so, with 33% of BNPL users in that age range having used BNPL to buy groceries. It was the fourth-most common BNPL purchase for the age group, trailing clothing, technology and home decor items. Among other age groups, groceries never ranked higher than fourth.

Groceries aren’t the only food purchases being made with BNPL. About 1 in 6 BNPL users say they’ve used the loans to buy food delivery or takeout from a restaurant and 13% say they’ve used them for dining out. About two-thirds of BNPL users say they’d consider using BNPL to pay for food delivery. Businesses see that demand, given the announcement that food delivery giant DoorDash is partnering with one of the biggest BNPL services, Klarna, to make it easier for people to use these loans to get food delivered.

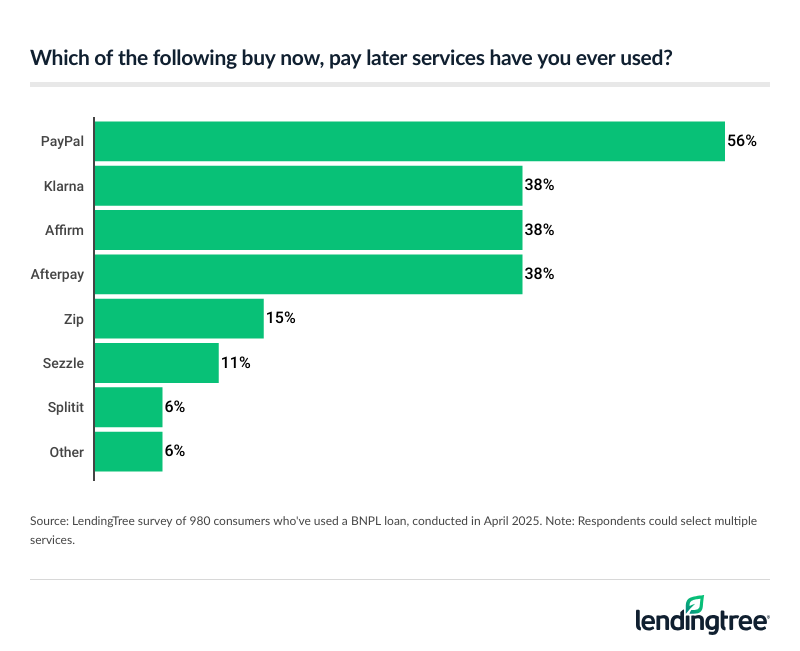

What are the most popular buy now, pay later services?

PayPal is the most commonly used BNPL lender, utilized by 56% of the BNPL users in our survey. However, three other services — Klarna, Affirm and Cash App Afterpay — are also popular. All three companies have been used by 38% of BNPL users. No other service tops 15%.

Do on-time payments on buy now, pay later loans help your credit score?

No, on-time payments made on buy now, pay later loans don’t help your credit score, at least not yet.

In June, credit-scoring giant FICO announced the launch of new credit-scoring models that incorporate BNPL loans for the first time. FICO announced that these new models will be available to lenders in the fall. However, it’s essential to recognize that these changes take time to fully implement. For example, not all lenders will upgrade quickly to use the new formula, similar to how many consumers take time to upgrade to a new version of a browser or phone. These things often move slowly.

Unfortunately, our survey — fielded before FICO’s announcement — shows that 62% of BNPL users believe these on-time payments help their credit score. The younger you are, the more likely you are to believe it. Men are more likely than women to hold this view, and higher-income earners are more likely than those with lower incomes.

How do I avoid regretting my buy now, pay later purchase?

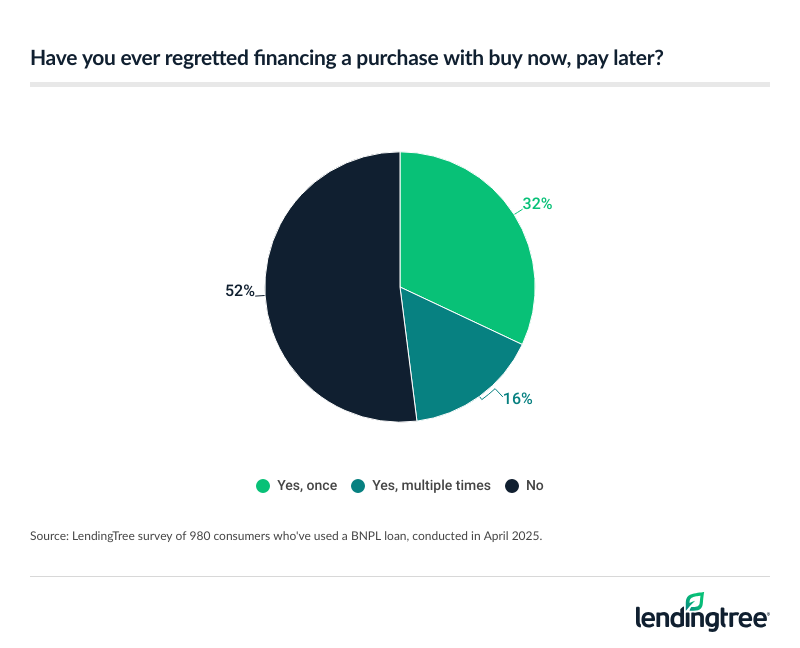

Nearly half of BNPL users (48%) say they’ve regretted buying something with BNPL. That includes 16% who say it has happened more than once.

Gen Z is the most likely group to express regret (64% have done so, including 24% who’ve done so multiple times), but no demographic is immune:

- 57% of millennials (ages 29 to 44 in 2025) have regretted a BNPL purchase, as have 37% of Gen Xers (ages 45 to 60 in 2025) and 20% of boomers

- Men are more likely than women to have regretted a BNPL purchase (55% versus 41%)

- 58% of parents of young kids have regretted at least one

- Perhaps surprisingly, higher-income BNPL users are more likely to express regret than their lower-income counterparts

While we all experience buyer’s remorse at times, here are a few things you can do to make it less likely that you’ll feel that way after your next BNPL purchase:

- Stick to one loan at a time. BNPL’s popularity has exploded in part because it’s easier to get than many other loan types. However, that easy access also makes it dangerous. Getting more than one loan at a time makes managing them more challenging, especially since most of these payments are tied to checking accounts. Having multiple loans means you have to be certain you’ll have enough money in your account to make payments on all those loans when they’re due, typically every two weeks.

- Use a credit card instead if you think you may need to return the item. BNPL loans are notoriously tricky when it comes to returns. Returning an item purchased with a credit card is generally pretty straightforward, but that’s not often the case for BNPL purchases. For example, you may not be able to complete a return until you have paid off the BNPL loan. That could mean potentially waiting weeks — and making more payments — even after you’ve decided to return the product.

- Take your time. Retailers and lenders do an incredible job of making it easy to spend a lot of money in a short period. BNPL services are no exception. However, just because you can borrow the money doesn’t mean you should, and just because you’ve worked with one BNPL lender in the past doesn’t mean they all operate the same. Before you get your next (or first) BNPL loan, take a moment to make sure you understand the basic rules, including any fees that might be involved. What you don’t know can cost you.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 79 from April 2 to 3, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Separately, we commissioned QuestionPro to conduct an online survey of 2,050 U.S. consumers ages 18 to 80 on January 2, 2026, for our monthly BNPL Tracker and to gather data on requests to have late fees waived.

For this survey, we defined generations as the following ages in 2026:

- Generation Z: 18 to 29

- Millennial: 30 to 45

- Generation X: 46 to 61

- Baby boomer: 62 to 80

Get personal loan offers from up to 5 lenders in minutes