Credit Report vs. Credit Score

- Your credit report is a record of your recent financial history and activity.

- Your credit score is a three-digit number (300-850) based on your credit report.

- Your credit report and credit score determine whether you qualify for credit cards, loans and mortgages.

- The higher your score, the less you have to pay to borrow money.

What is a credit report?

A credit report is a document that summarizes how you handle money and your financial accounts, like credit cards and loans.

The three major credit bureaus — Equifax, TransUnion and Experian — each create and update your credit report based on data from lenders (e.g., credit card companies and banks).

Why does it matter? Lenders offer lower rates to people with a credit report that shows a history of on-time payments, less debt and accounts in good standing. The more responsible you are with money, the less you’ll have to pay to borrow in the future.

What is on a credit report?

- Personal information (name, addresses, Social Security number, etc)

- A list of your financial accounts (loans, credit cards, mortgages, etc.)

- Account limits and balances

- Any accounts in collections

- Any liens, bankruptcies, civil lawsuits or foreclosures

- Hard credit inquiries

Who looks at your credit report?

Lenders use credit reports to decide whether to offer you loans, credit cards and mortgages. The activity on your credit report can determine what interest rates you get and how much you’ll pay to borrow money.

Landlords, employers and insurance companies can also perform credit checks under certain circumstances. Bad credit can disqualify you from getting certain jobs or a lease.

How to get a credit report

You can get free credit reports from all three bureaus at AnnualCreditReport.com. You may also have free access to credit reports through your bank or credit card company. Chase Credit Journey shows you your Experian credit report, for instance.

How long will something stay on your report?

Negative marks can stay on your credit report for two to 10 years, but your credit score can recover in the meantime. Here’s how long it takes for the following to drop off your report:

- Late payments: 7 years

- Bankruptcy: 7-10 years

- Hard credit inquiries: 2 years

You can change your personal information and dispute credit report errors directly with the credit bureaus.

What is a credit score?

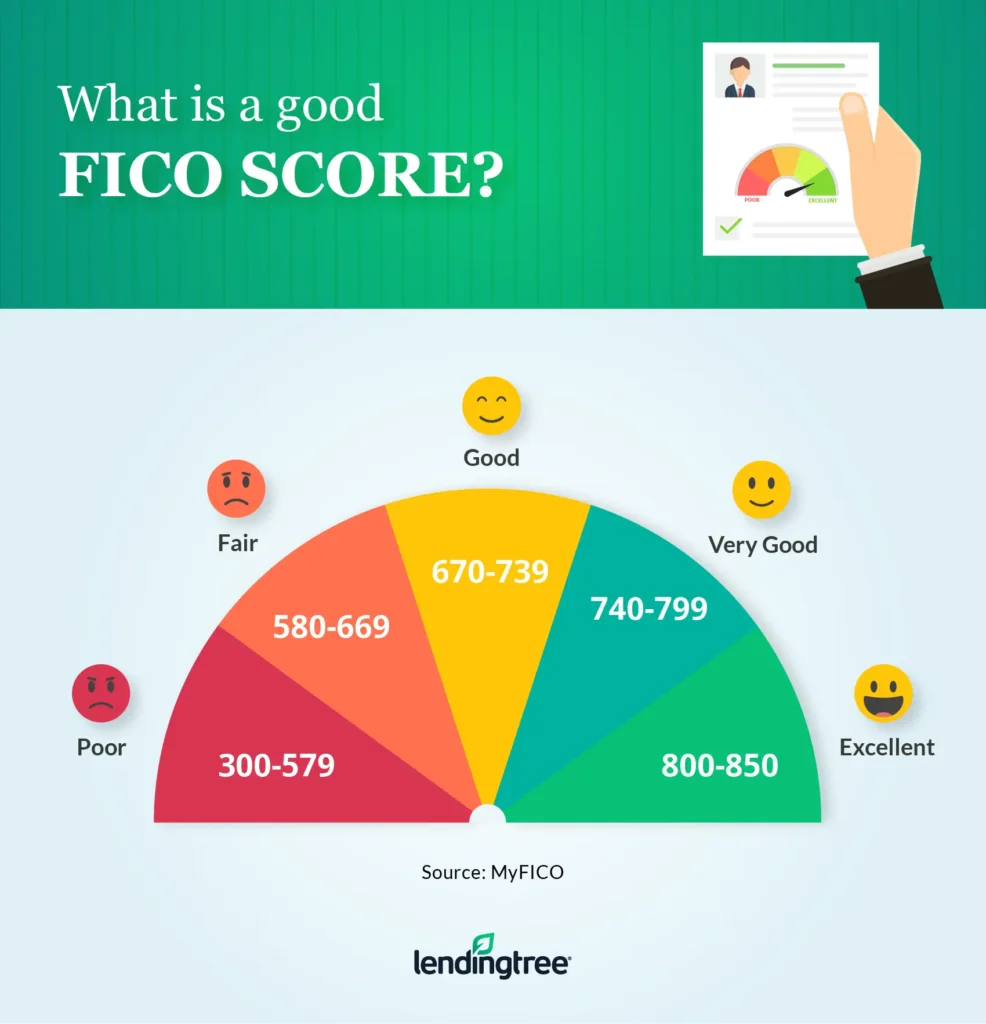

A credit score is a three-digit number that the credit bureaus calculate based on the activity in your credit report.

Think of it like a grade for your credit. Lenders use this number, along with your credit report, to determine whether to give you loans and how much you’ll pay in interest.

The two main types of credit score are FICO and VantageScore. These models calculate your credit score differently, but the same factors impact your score: payment history, how much you owe, how long you’ve had credit, account mix and new credit.

What credit score do I need?

To qualify for a loan, mortgage or credit card, aim for at least fair credit. Here are the minimum scores you’ll need for the most popular types of loans:

It’s possible to get loans and credit cards with even lower scores, but you’ll pay interest rates so high that you may not be able to afford the monthly payments.

How to check credit score

You can see your credit score in minutes with LendingTree Spring. We’ll also give you personalized financial advice and free score updates. Checking your score won’t affect your credit.

What’s the difference?

| Credit report | Credit score |

|---|---|

|

|

Frequently asked questions

The three credit reporting agencies are Experian, Equifax and TransUnion.

Once you take out a loan or credit card, your starting credit score will be somewhere in the middle of the credit range of 300 and 850. If you haven’t used any financial products yet, you won’t have a credit score.

No, checking your own credit score won’t lower it. When you check your score using a credit monitoring service, it won’t impact your credit.

Credit reports from the major credit bureaus are legitimate records of your financial activity. You can dispute any inaccurate information on your report. The credit bureaus must investigate and fix errors within a specific time frame (typically less than two months).

In general, credit reports and credit scores update at least once a month. Lenders report your activity monthly. Since there’s no set day for every lender to make the report, your credit reports and scores can change throughout the month if you have multiple loans or credit cards.

Get personal loan offers from up to 5 lenders in minutes