40% of Americans Cried About Money in Past Year — Including More Than Half of Millennials

It’s no secret that the past year has been tough financially for millions of Americans. The cost of seemingly everything from gas and groceries to travel and furniture has soared higher in short order.

That has put an enormous strain on Americans’ budgets — and their emotional well-being. According to a new LendingTree survey of nearly 1,600 Americans, 4 in 10 adults — including more than half of millennials — say they’ve cried about money in the past year, with more than 90% of them having done so more than once.

Some tears were joyous as folks got out of debt or got new jobs. However, most were not happy tears, as inflation continued to take a toll on households throughout the U.S. Consumers don’t expect that to change anytime soon.

Key findings

- 40% of Americans say they’ve cried about money in the past year. Consumers most likely to shed tears over their finances include those unemployed and looking for work (59%), parents with children younger than 18 (53%), millennials (53%) and women (52%).

- Nearly every person who cried about money in the past year did so multiple times. 94% say they cried at least twice — if not more often. Women cried more than men (39% cried five or more times, compared with 20% of men), while 45% of those making less than $35,000 cried five or more times.

- The top three reasons consumers cried about money over the past year are not being able to afford things their family wants or needs (46%), inflation (39%) and debt (34%).

- While the vast majority cried due to a negative emotion, more than a third (34%) say they cried because of something positive. The most common reasons for happy tears include paying off debt (9%), receiving an unexpected financial gift (9%) and getting a new job (8%).

- A third of consumers say they’re likely to cry about money in the next six months. That jumps to 43% among parents with children younger than 18 and 41% among women and millennials.

Women, millennials among those most likely to have cried about money in the past year

While millions of Americans have shed tears over their financial situation in the past year, some demographics are far more likely to do so.

For example, women are twice as likely as men to say they’ve cried over money in the past year — 52% versus 26%. While we’ve come to expect significant differences between the genders in surveys such as this one, it’s still eye-opening.

The gap is smaller among some of the generations. Millennials ages 26 to 41 (53%) are significantly more likely than Gen Xers ages 42 to 56 (44%) or Gen Zers ages 18 to 25 (43%) to say they cried over money in the past year. Millennials are nearly three times as likely as baby boomers ages 57 to 76 (18%) to say so.

Some of the disparities are more predictable:

- Those making $35,000 or less a year are twice as likely to say they’ve cried over money in the past year as those making $100,000 or more (50% versus 25%)

- Those with kids younger than 18 are far more likely to have done so than those with no children (53% versus 36%)

- Those unemployed and looking for work are far more likely to say they’ve cried over money in the past year than those working full time (59% versus 43%)

These consumers most commonly cry about money at home (90%), followed by in their car (22%), at work (8%) or at a friend or family member’s house (7%).

More than half of them (53%) were alone, while 40% were with someone supportive. Among those who cried in front of someone, 10% say they made up another reason for their tears.

More than 90% of those who cried did so more than once

These tears being shed are not often a one-time thing. Our survey shows that most people who cried over money did so multiple times, and a third have done so five or more times.

Those most likely to say they’ve cried in the past year were most likely to have done so multiple times. Women are nearly twice as likely as men to say they cried five or more times in the past year — 39% versus 20%. Americans with the lowest incomes ($35,000 or less) are more than twice as likely as those with the highest incomes ($100,000 or more) to say they cried five or more times in the past year — 45% versus 19%.

While parents of young children are far more likely than those with no kids to have cried at least once, there was little difference between the two groups in terms of how often those who cried did so. Among those with no kids, 32% of those who cried did so five or more times, compared with 30% among parents of young kids.

What’s driving people to tears?

There’s usually not solely one reason why someone is struggling, whether financially or emotionally. As the old saying goes, everyone is likely fighting some battle you have no idea about. With that in mind, we asked people to choose the reasons behind their tears from a list of possible options.

The one thing that stood out most from the results was not happy tears. The most common answer was not being able to afford things their family wants or needs. Nearly half of those who cried over money (46%) say that was why they did so.

To no one’s surprise, inflation was a common choice. Nearly 4 in 10 (39%) who cried over money in the past year blamed inflation. About a third of those (34%) who cried cited debt as a cause for their tears.

About 1 in 10 of those who cried say they did so happily after paying off debt or receiving an unexpected financial gift or windfall (both at 9%) or finding a new job (8%). However, none of those “happy tears” moments were among the top 10 reasons for crying over money.

It’s a very simple, yet powerful reason, and it speaks to the insidiousness of inflation. Most Americans want to be able to provide for their family. That gets much harder when the most fundamental costs of life — gas, groceries, cars — get pricier. When you can no longer easily afford the most basic of bills, it’s easy to feel like things are out of your control, and that’s often when the tears start to flow.

Many expect to cry in the next 6 months, too

As hard as the past year has been for many Americans, some expect the tears to keep coming. A third of consumers (33%) say they’re likely to cry about money in the next six months.

Again, women are far more likely than men to say so — 41% versus 24%. Millennials are more likely than other age groups, though only narrowly, with 41% saying they expect to cry again soon, versus 39% of Gen Zers and 37% of Gen Xers. (Just 15% of baby boomers say so.)

Also, the higher your income, the less likely you are to expect to cry over money soon. Four in 10 (40%) of those earning $35,000 or less say they would, versus 25% of those making $100,000 or more.

It’s time to take action

People are rarely more emotional than when things feel out of their control. That feeling of powerlessness can be devastating and debilitating and lead to a tidal wave of tears.

When you feel helpless and overwhelmed, one of the best options is to take steps, even small ones, to try to regain control. Perhaps the best news is that many people are doing just that.

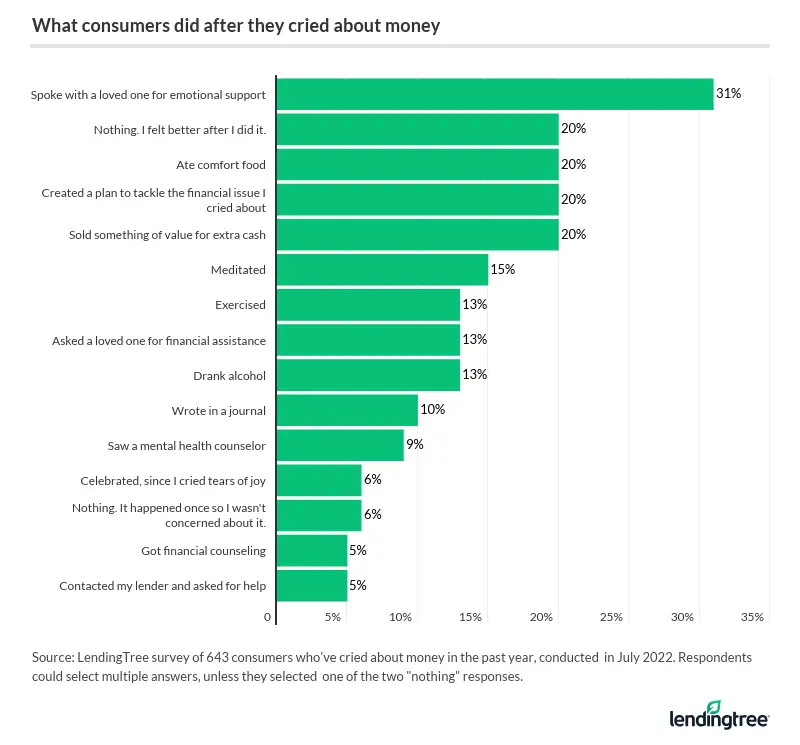

We asked respondents what they did after they cried about money, providing more than a dozen possible choices and letting them pick multiple answers. The option selected most was speaking with a loved one for emotional support — about a third (31%) of those who had cried chose that. Another 20% say they did nothing after they cried, with the tears having made them feel better. The other most popular answers typically involved action.

Some took steps to help their financial situation, while others focused on bettering their mental or physical health. Others found solace in comfort food or alcohol. And, yes, some celebrated because their tears were joyful, though that wasn’t the case for most.

You should consider healthy, positive steps to take greater control and feel more empowered. Many of the choices in the above chart are suitable places to start, including:

- Creating a financial plan or budget to pay off debt

- Selling something of value to earn extra cash

- Seeking counseling, whether for your financial or mental health (or both)

- Relieving stress by exercising, meditating, journaling or reading

- Asking your lender for help

Another great option could be to refinance and consolidate your debt using a 0% balance transfer credit card or a low-interest personal loan. Those could save you money and shorten your to-do list by reducing the number of accounts you have to manage.

The key is to get started. The first steps may seem small and insignificant, but they can start the ball rolling. When it does, real change can come, which might help keep some tears at bay.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,598 U.S. consumers ages 18 to 76 from July 8 to 15, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

Get personal loan offers from up to 5 lenders in minutes