How Long Does It Take to Get a Personal Loan?

- How long it takes to get a personal loan depends on the type of lender, but it usually ranges from the same day up to five business days.

- Online lenders are usually fastest for approval and funding the loan.

- Having your documents, checking your credit score and comparing multiple lenders could all speed up the process.

When you really need access to cash, every minute of waiting can feel like an eternity. Fortunately, you can get a personal loan on the same day you apply — without resorting to predatory payday loans. You just have to know where to look.

How long does it take to get a personal loan?

Depending on the lender, you could go from application to approved to funded in less than 24 hours, so long as you have your required documents ready and can sign the loan agreement right away.

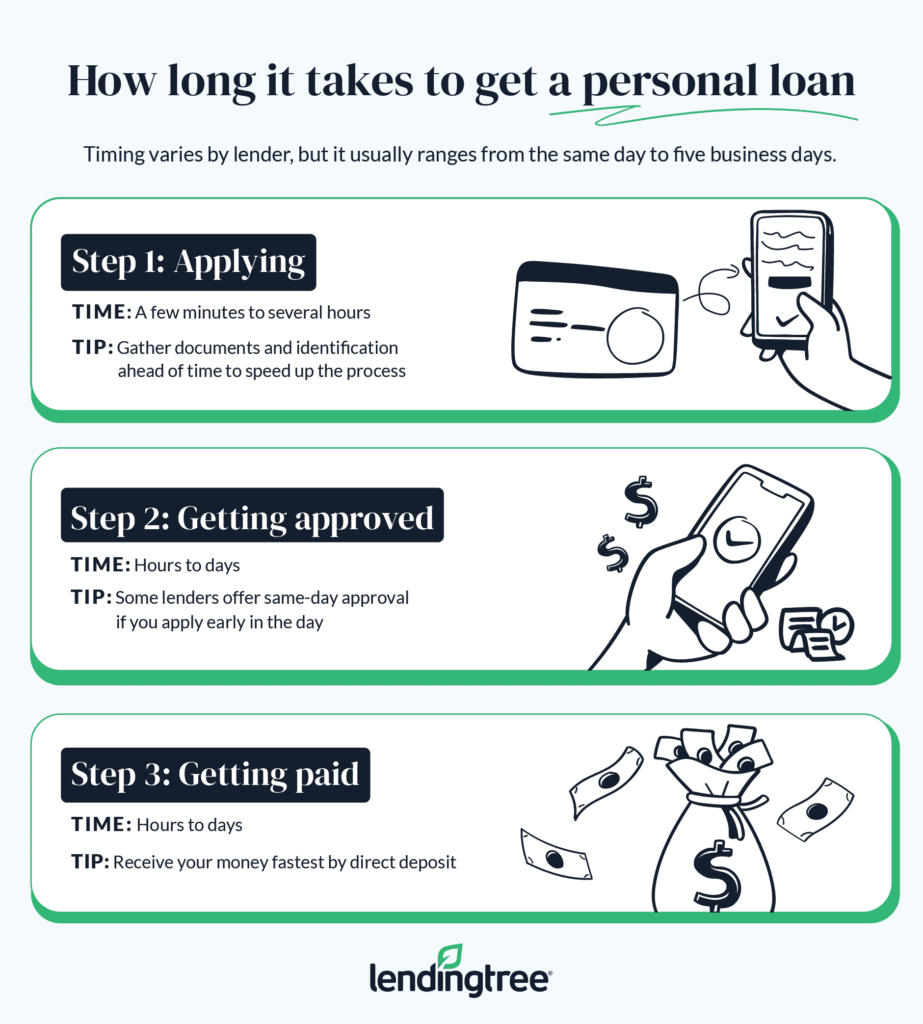

Here are the three main steps and how long each takes:

1. Applying for a loan

Your personal loan application may be physical or digital, depending on the lender you choose. You’ll need to provide information about yourself and your finances, including your Social Security number, in order to run a credit check and confirm your details. The exact application will vary from lender to lender.

- How long does it take to apply for a loan? A few minutes to several hours, depending on how long you need to get your required documents.

2. Getting approved

The lender will then review your documents and credit history to see if you meet its various requirements. Approval speed will depend on the lender, but if, for example, the agent needs additional information, or if you apply outside of normal business hours, then the process can take longer.

- How long does loan approval take? Hours to days, depending on your lender and when you apply.

3. Funding

If you get approved, you’ll have to sign your loan documents before the lender can send you (or your creditors) the funds. You can usually choose to receive funds via direct deposit to your bank account, but some lenders may have other options, like issuing a check.

- How long does it take to get loan funds? Hours to days, depending on your lender and how you choose to get paid.

Typical lending timeline by lender type

| Lender type | Approval timeline | Funding timeline |

|---|---|---|

| Banks | 1 to 5 business days | 1 to 5 business days |

| Credit unions | 1 to 5 business days | 1 to 5 business days |

| Online lenders | Several hours to a few business days | Several hours to a few business days |

Banks

Brick-and-mortar banks are a popular source of personal loans, but the processing time from application to funding is usually longer than with an online lender. Typically, it can be funded one to five business days after submitting your application, assuming it’s approved.

Credit unions

Credit unions are very similar to banks when it comes to a personal loan, except that you have to be a member, and the requirements for membership will vary. As with banks, it can take up to five business days to get the funds deposited into your account, though this will vary depending on the credit union. And if you’re not already a member of the credit union, you’ll need to join first, which can also take some time.

Online lenders

Online lenders specialize in processing and funding loans. Because everything is done digitally, getting an application approved and funded can be quick. In fact, some may be able to approve and fund your loan the same day you apply, if not the next business day.

How funding timelines compare among top lenders

| Lender | Funding timeline | |

|---|---|---|

| 24 to 72 hours | |

| As little as 24 hours | |

| 3 to 6 business days (up to 30 days for funds going directly to creditors) | |

| 1 to 3 business days | |

| As soon as the next business day | |

| Within 30 days | |

| Within one hour | |

| 5 to 7 business days (by check) | |

| 1 to 3 business days | |

| Within a few days | |

| As soon as 24 hours |

How to get a personal loan faster

There are things you can do to reduce how long it takes to get a personal loan. By making sure your credit report and documents are in order and that you’re applying to lenders that will process your loan quickly, you can get your funds sooner.

Check your credit report for errors

Your credit report is an important key to qualifying for a personal loan, so be sure to check it before applying. You have different options to review your credit report for free and can also get your credit score via LendingTree Spring.

If you find an error when reviewing your report, inform the credit bureaus as well as the lender or creditor connected to that false information. They should be able to remove the wrong information from your credit file.

Gather required documentation beforehand

Even if your lender offers fast application processing, it won’t be able to start until it gets your requested documents and information.

The requirements will depend on the lender, but you’ll usually need to have the following on hand:

- A copy of your Social Security card or driver’s license

- Name and contact information of your employer

- Proof of income (through documents like recent pay stubs, bank statements or W2s or last year’s tax return)

- The amount you pay each month for your mortgage or rent

- Information about where you want the funds sent, with your account number or your creditor’s details

Apply online

Online applications usually get processed faster than paper ones, so online lenders may be your best bet if you need a personal loan quickly. Also, you can securely send digital copies of your key documents, such as a digital tax return, rather than rely on snail mail or personally delivering the paperwork.

Compare multiple lenders at once

Be sure to shop around for the best rates and terms, comparing several lenders to seek out the best deal. You can check out some of LendingTree’s best personal loan picks and then follow the directions below.

Or if time isn’t such an issue after all, you could consider getting prequalified for the personal loan in advance.

How to get a personal loan through LendingTree

- Check your credit score. Lenders will have a minimum required credit score. Know your score so that you can pick lenders likely to accept your application.

- Get free offers. Once you complete the application — it should only take a few minutes — LendingTree will use it to provide you with free offers from multiple lenders.

- Compare and save. After you get your offers, look through them to find the best mix of terms, costs and loan amounts. You can also use a personal loan calculator to make sure the payments will fit your budget.

Get personal loan offers from up to 5 lenders in minutes