Nearly Half of Borrowers Who Took Out Personal Loans in Past Year Did So to Pay Off Debt

Consumers’ saving and spending habits have changed dramatically amid the coronavirus pandemic. With shutdowns and quarantines leading people to spend more time at home, savings surged and Americans paid down debt. As a result, personal loan inquiries from potential borrowers to pay off debt declined sharply.

“Lower debt means less need for refinancing and consolidation,” says Matt Schulz, LendingTree chief consumer finance analyst. “That’s great news for consumers, but it’s not so great for personal loan lenders.”

While personal loan inquiries for credit card refinancing and debt consolidation are still only about half of what they were in late March 2020, the newest LendingTree analysis shows that nearly half of all consumers who took out personal loans in the past year did so to manage existing debt. But despite the spike in these types of personal loans, consumers sought more funding, on average, for home improvement projects.

Key findings

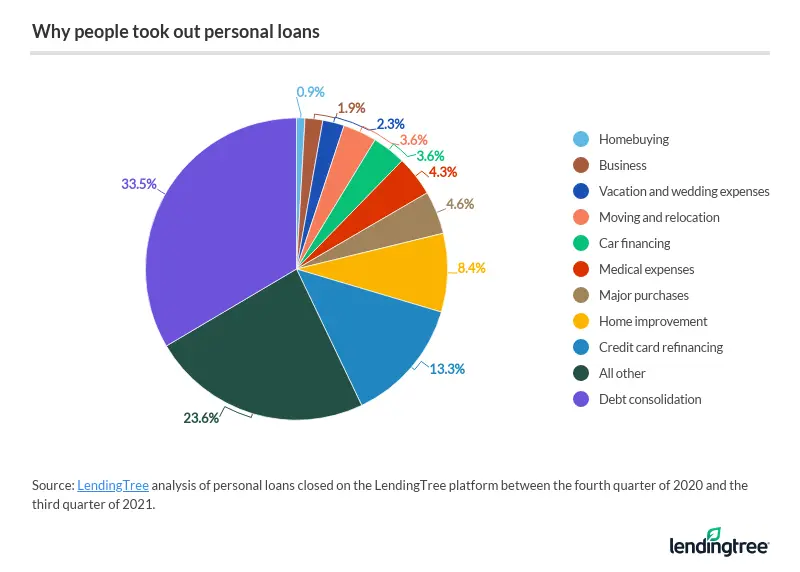

- Nearly half of people who took out personal loans on the LendingTree platform in the past year did so to manage existing debt. 33.5% planned to consolidate their debt, while another 13.3% planned to refinance credit card debt.

- Among people who inquired about personal loans, those seeking funding for home improvements were the most likely to complete the loan process. That’s followed by debt consolidation, credit card refinancing, and vacation and wedding expenses. Those inquiring about extra cash for homebuying, business expenses and car financing were the least likely to borrow the money.

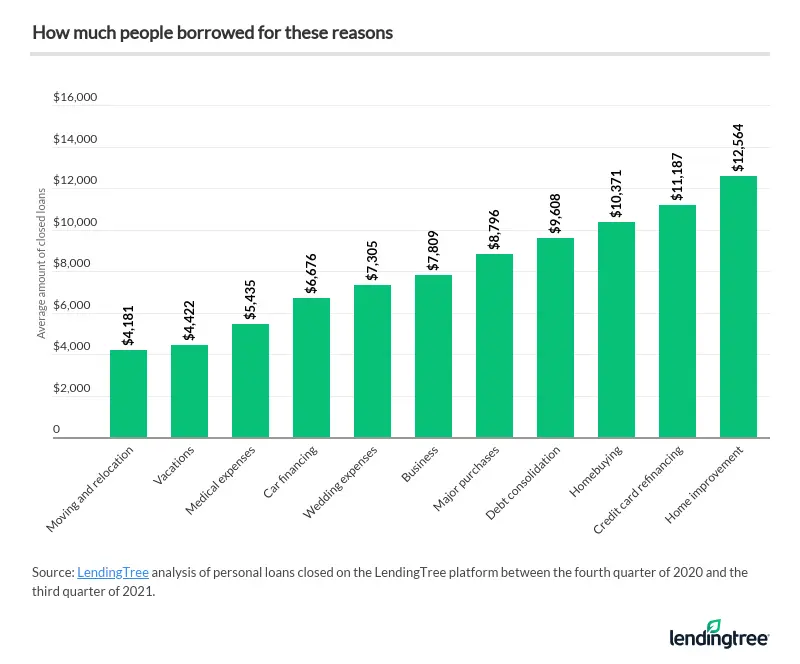

- Consumers taking out personal loans borrowed the most for home improvement projects. For these projects, they borrowed an average of $12,564. As a comparison, the average amount borrowed was $11,187 for credit card refinancing and $9,608 for debt consolidation.

- Rhode Island (30.3%), Utah (30%) and New Hampshire (29.7%) have the largest percentages of inquiries into loans to pay for debt consolidation. For home improvement, the largest percentages are in West Virginia (9.2%), Alabama (8%) and Louisiana and Mississippi (both 7.7%).

- For medical expenses — a personal loan sector that’s seeing growth — the biggest percentages for inquiries are in Utah (6.4%), South Dakota (6.1%) and Texas and Wyoming (both 5.9%).

Why people took out personal loans in the past year

Almost half of the consumers who took out personal loans on the LendingTree platform in the past year used the funds for debt payoff. About one-third (33.5%) of consumers used a personal loan to consolidate debt, while 13.3% used one to refinance credit card debt.

In contrast, less than 5% of consumers took out personal loans for vacation and wedding expenses in the past year.

“That’s not surprising at all, given the travel issues we’ve all been facing for the last two years,” Schulz says.

Meanwhile, less than 2% took out personal loans for business expenses. But with the federal government’s expansive COVID-19 aid to businesses, this figure suggests that those in need of funding were able to find it elsewhere.

Home improvement borrowers the most likely to take out personal loans

Of those who inquired about personal loans through the LendingTree platform, consumers looking for funds for home improvement projects were the most likely to complete the application process and take out a loan.

Consumers looking to consolidate debt were the next most likely to take out a personal loan, followed by those looking to refinance credit card debt, as well as vacation and wedding expenses.

Again, this aligns with pandemic spending habits: In addition to paying off debt, consumers have also spent more on home renovations. Those who inquired about loans for homebuying, business expenses or car financing were the least likely to close the loan.

Home improvement borrowers took out the highest average personal loan amounts

Not only were home improvement borrowers the most likely to take out personal loans over the past year, but they also borrowed the most on average at $12,564.

“We’ve all been spending a lot more time at home over the past two years, so it makes a lot of sense that people would focus their time and money on remodeling and improving their homes,” Schulz says. “The problem is that it can be superexpensive. Because of those sky-high costs, many people look to personal loans to help them.”

Home improvement loans were, on average, larger than loans for debt payoff — the reason why nearly half of all borrowers took out personal loans over the past year. Credit card refinancing and debt consolidation averaged $11,187 and $9,608, respectively.

The lowest average loan amount was for moving and relocation expenses, at $4,181. This is less than one-third of the average loan amount among those who chose to renovate their existing home.

“Today, people don’t necessarily need to relocate to start that new job or new career,” Schulz says. “Remote work is far more common now and will likely be a bigger part of our lives even once the pandemic is behind us.”

Borrowers in Southern states least interested in debt payoff, most interested in home improvement

Interest in personal loans for debt consolidation was highest in the Northeast and West. About 30% of borrowers in Rhode Island, Utah and New Hampshire inquired about personal loans for debt payoff. In fact, 9 of the 10 states with the highest percentages are all in the Northeast and West.

Meanwhile, borrowers from Southern states were among the least interested in taking out loans for debt consolidation. Arkansas, Mississippi and Louisiana each only saw 20% of borrowers express interest in taking out loans for this purpose. Debt consolidation was still the reason with the highest percentage of inquiries among borrowers within these states, though at about 10 percentage points lower than the three highest named above.

In contrast, interest in home improvement loans was higher in Southern and more rural states. After West Virginia, Alabama, Louisiana, Mississippi and Arkansas saw the highest percentages of interest expressed in home improvement loans. This suggests that more rural, less densely populated areas with a lower cost of living were among the parts of the country most interested in home improvement projects in the past year. Meanwhile, western states — including Utah, Hawaii, Oregon, Nevada and Washington — were at the bottom.

Notably, while borrowers in the District of Columbia were among those least interested in home improvement projects, those who did take out loans for this purpose took out the highest amount overall — $31,500.

| States where borrowers took out the biggest personal loans, by reasons | |||||

|---|---|---|---|---|---|

| Debt consolidation | Home improvement | Business | |||

| 1 Massachusetts | $15,341 | 1 District of Columbia | $31,500 | 1 Montana | $18,065 |

| 2 District of Columbia | $14,968 | 2 Massachusetts | $20,513 | 2 West Virginia | $17,787 |

| 3 New York | $14,663 | 3 Hawaii | $19,659 | 3 Hawaii | $13,713 |

| 4 Maryland | $14,170 | 4 Colorado | $19,492 | 4 Maine | $13,193 |

| 5 New Jersey | $13,726 | 5 South Dakota | $17,238 | 5 Minnesota | $12,507 |

| Credit card refinancing | Major purchases | Moving and relocation | |||

| 1 Massachusetts | $15,169 | 1 District of Columbia | $15,624 | 1 Hawaii | $8,228 |

| 2 District of Columbia | $14,794 | 2 New York | $13,004 | 2 District of Columbia | $8,095 |

| 3 Colorado | $14,444 | 3 Maine | $12,758 | 3 Massachusetts | $7,761 |

| 4 New York | $14,037 | 4 Hawaii | $12,397 | 4 West Virginia | $7,621 |

| 5 Maryland | $13,987 | 5 Massachusetts | $12,287 | 5 Iowa | $7,151 |

| Car financing | Medical expenses | Vacation expenses | |||

| 1 Massachusetts | $13,161 | 1 West Virginia | $10,345 | 1 Vermont | $10,750 |

| 2 District of Columbia | $12,773 | 2 Massachusetts | $9,942 | 2 Connecticut | $7,706 |

| 3 Colorado | $11,773 | 3 District of Columbia | $9,739 | 3 New Hampshire | $7,222 |

| 4 New York | $10,562 | 4 Iowa | $9,373 | 4 Maryland | $6,566 |

| 5 Maryland | $9,818 | 5 New York | $8,860 | 5 Colorado | $6,563 |

Texas metros among those most interested loans for medical expenses, New York and Connecticut metros the least

Although medical expenses were the reason for only 4.3% of personal loans nationwide, they make up a growing share of personal loans. However, borrowers from metros across the U.S. vary widely in interest in taking on loans for medical costs.

Among the top 20 metros with the largest percentages of borrowers seeking personal loans for medical expenses, Texas claimed the most spots. Beaumont, Corpus Christi, Houston, Dallas, San Antonio and Austin were all toward the top at around 6%.

In contrast, metros in Northeastern states feature prominently in the bottom 20, or those with the smallest percentages of borrowers inquiring about personal loans for medical expenses. Connecticut and Massachusetts both had three, Pennsylvania had four and New York had five. Notably, New York’s five metros (Rochester, Buffalo, Syracuse, Albany and New York City) are all in the bottom 10, with percentages below 4% (3.1% to 3.7%).

4 reasons to get a personal loan

Personal loans can be flexible, whether you seek them for car repairs, major home renovations or weddings. And with personal loan interest rates that can often be lower than credit card APRs, they can offer more affordable ways to finance major expenses.

Here’s a few common reasons why to take out a personal loan:

- You may lower your interest rate. APRs for new credit cards average 19.49%, so you may be able to take out a personal loan with a lower interest rate. This will depend on your creditworthiness, but a lower interest rate could make debt payments more manageable.

- You can pay off debt faster. With a lower interest rate, you can pay off the loan principal more quickly. If you’re struggling with credit card debt, consolidating your debt into a lower-interest personal loan may help you manage payments better.

- It’s easier to budget. Personal loans often come with defined payment schedules and fixed interest rates, which makes them easier to budget, especially compared with credit card payments.

- It might help your credit score. While you may see your credit score temporarily dip when you apply for a personal loan, your credit score could improve over the long term if you make regular payments. This is because payment history is one of the most important factors in calculating your credit score. Plus, making regular payments also consistently reduces your credit utilization ratio, another key factor in your credit score.

“A personal loan is super useful because it can save you a lot of money while simplifying your financial life at the same time,” Schulz says.

Methodology

Researchers reviewed online forms filled out by people inquiring about personal loans on the LendingTree platform between the fourth quarter of 2020 and the third quarter of 2021, as well as the terms of closed loans during that period.

Get personal loan offers from up to 5 lenders in minutes