LendingPoint Personal Loan Review

- APR

- 7.99% – 35.99%

- Eligibility and access: 5/5

- Cost to borrow: 3.6/5

- Loan terms and options: 3.8/5

- Repayment support and tools: 3.5/5

LendingPoint offers personal loans ranging from $1,000 to $50,000 to people with credit scores as low as 660. LendingPoint considers other factors besides credit history to determine approval, such as income and employment.

- Fast funding: After you sign your loan agreement, you could get your money as quickly as the next business day.

- Clear eligibility requirements: LendingPoint is transparent about what you need to qualify for a personal loan, including minimum credit score, income requirements and which geographical areas the company serves.

- Loans not offered in all 50 states: LendingPoint does not serve residents of Nevada or West Virginia.

- Charges an origination fee: Depending on what state you live in, you may have to pay an upfront origination fee (Up to 10.00%).

- No joint applications: LendingPoint does not allow you to apply for a personal loan with a co-borrower or a cosigner.

- Best for small loans: Since you can only borrow up to $50,000 with LendingPoint, this lender is best for borrowers who need a small loan. LendingPoint is also best for those looking for fast funding since customers typically receive funds the next business day.

LendingPoint pros and cons

Before applying for a LendingPoint personal loan, consider this lender’s highlights as well as its downsides. Here’s what you need to know:

Pros

- May get money in one business day

- Can qualify with fair or good credit

- Considers more than credit scores

Cons

- May charge an origination fee (Up to 10.00%)

- No option for co-applicants

- High maximum APR (35.99%)

LendingPoint has some of the quickest loans on the market. You’ll get your money as soon as one business day after signing your loan agreement. Those with low credit scores may especially appreciate LendingPoint’s personal loan criteria, as this lender has a credit score requirement of just 660 and considers more than just your score when evaluating your personal loan application.

However, depending on where you live, you may be stuck paying an origination fee, which can get as high as 10% in some parts of the country. LendingPoint also has a high maximum annual percentage rate (APR) of 35.99%, so compare rates from several different lenders before committing.

LendingPoint requirements

Aside from being at least 18 years old, you’ll need to meet the following criteria in order to receive a LendingPoint personal loan offer:

| Minimum credit score | 660 |

| Residency | No loans offered in Nevada or West Virginia |

| Minimum income | $35,000 |

| Required documentation |

|

If LendingPoint’s loan options won’t work for your borrowing needs, be sure to shop around for a lender that helps you meet your financial goals and can offer you the best-fitting rates, terms and amounts.

How to get a personal loan with LendingPoint

The LendingPoint personal loan application process is straightforward and fairly simple to navigate. Here’s what to expect when you submit an application:

Prequalify

LendingPoint allows you to prequalify for a personal loan, meaning you can submit an initial application without seeing your credit score dip. This is also known as a soft credit inquiry. During this process, you’ll need to supply LendingPoint with your basic information, income, how much you want to borrow and what you intend to use the funds for.

Review offers

Once you submit this information, you’ll be able to see your potential rates, amounts and terms. If you decide to proceed with LendingPoint, you’ll need to submit documents verifying the information you provided. This may include pay stubs, W-2s and a government-issued form of identification.

Get approved

After LendingPoint verifies your information, the company will run a hard credit inquiry on you which may cause your credit score to dip by a few points. This impact, however, is temporary.

Sign the loan contract

If you pass a hard credit inquiry, LendingPoint will then send you a loan agreement to sign. After you’ve signed, you’ll get your money as soon as the next business day.

If you’re turned down for a personal loan or worried you may not qualify, consider improving your chances of getting approved by working on your credit score and beefing up your credit profile.

How LendingPoint compares to other personal loan companies

Even if you believe LendingPoint aligns with what you’re looking for in a personal loan, it never hurts to shop around and compare other lenders. Here’s how LendingPoint stacks up against similar personal loan lenders.

| LendingPoint | Avant | LendingClub | |

|---|---|---|---|

| LendingTree’s rating | 4/5 | 4.3/5 | 4.4/5 |

| Minimum credit score | 660 | 580 | 600 |

| APRs | 7.99% – 35.99% | 9.95% – 35.99% | 6.53% – 35.99% |

| Loan amounts | $1,000 – $50,000 | $2,000 – $35,000 | $1,000 – $60,000 |

| Repayment terms | 24 – 72 months | 24 – 60 months | 24 – 84 months |

| Origination fee | Up to 10.00% | Up to 9.99% | 0.00% – 8.00% |

| Funding timeline | Receive funds as soon as one business day | Receive funds as soon as one business day | Receive funds as soon as one day |

| Bottom line | With low credit requirements and a quick funding timeline, LendingPoint is a good option for borrowers whose credit profiles are less than perfect. | Avant may have higher starting APR than LendingPoint, but it also has a much lower minimum credit score as well as quick funding to match. This lender may be best for small loans. | LendingClub‘s loan terms are similar to LendingPoint’s, but LendingClub offers loans to borrowers with lower credit scores. That said, LendingPoint offers longer repayment terms and lower starting rates for borrowers with excellent credit. |

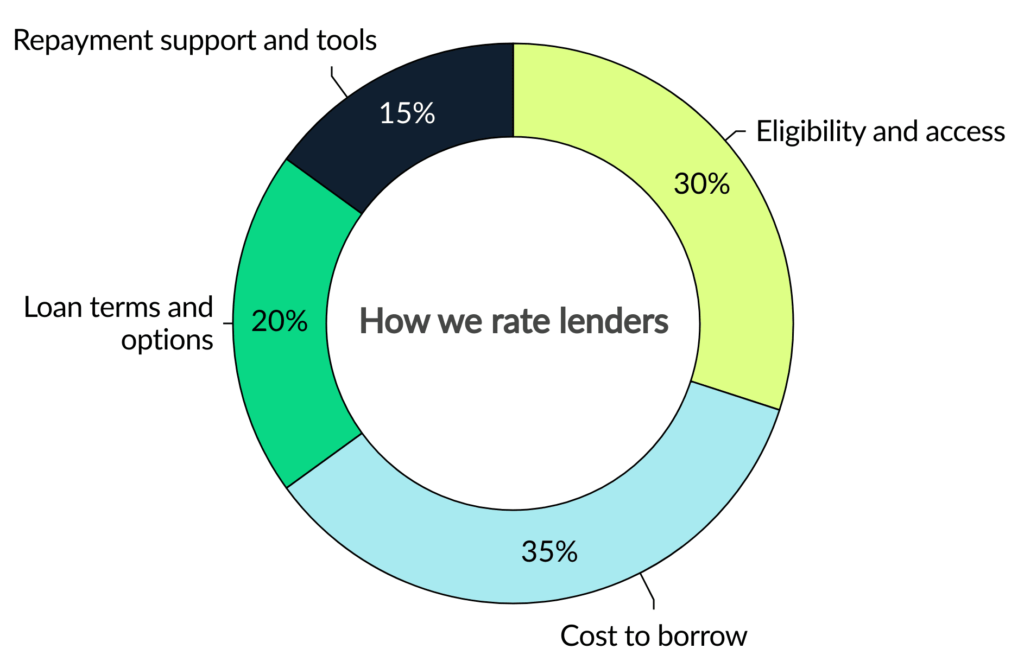

How we rated LendingPoint

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

Yes — LendingPoint is a legitimate lender that offers loans ranging from $1,000 to $50,000 with APRs ranging from 7.99% to 35.99%. LendingPoint gets 4.9 out of 5 stars from LendingTree users, who recommend LendingPoint 99% of the time. You can read LendingPoint personal loan reviews from real LendingTree customers.

Finding out whether you prequalify for a LendingPoint personal loan may take only a few minutes. However, LendingPoint does not specify how long it takes to receive official approval for a loan. With many lenders, this process can take a few days. Once you receive your loan agreement, however, it takes as little as one business day to receive your loan funds.

LendingPoint may be a viable option for those looking for bad credit loans as this lender has a minimum credit requirement of 660. Unfortunately, this lender does not offer joint applications, which could make it easier for some poor-credit borrowers to qualify for a loan.

Get personal loan offers from up to 5 lenders in minutes

Recommended Articles