Happy Money Personal Loan Review

- APR

- 7.95% – 29.99%

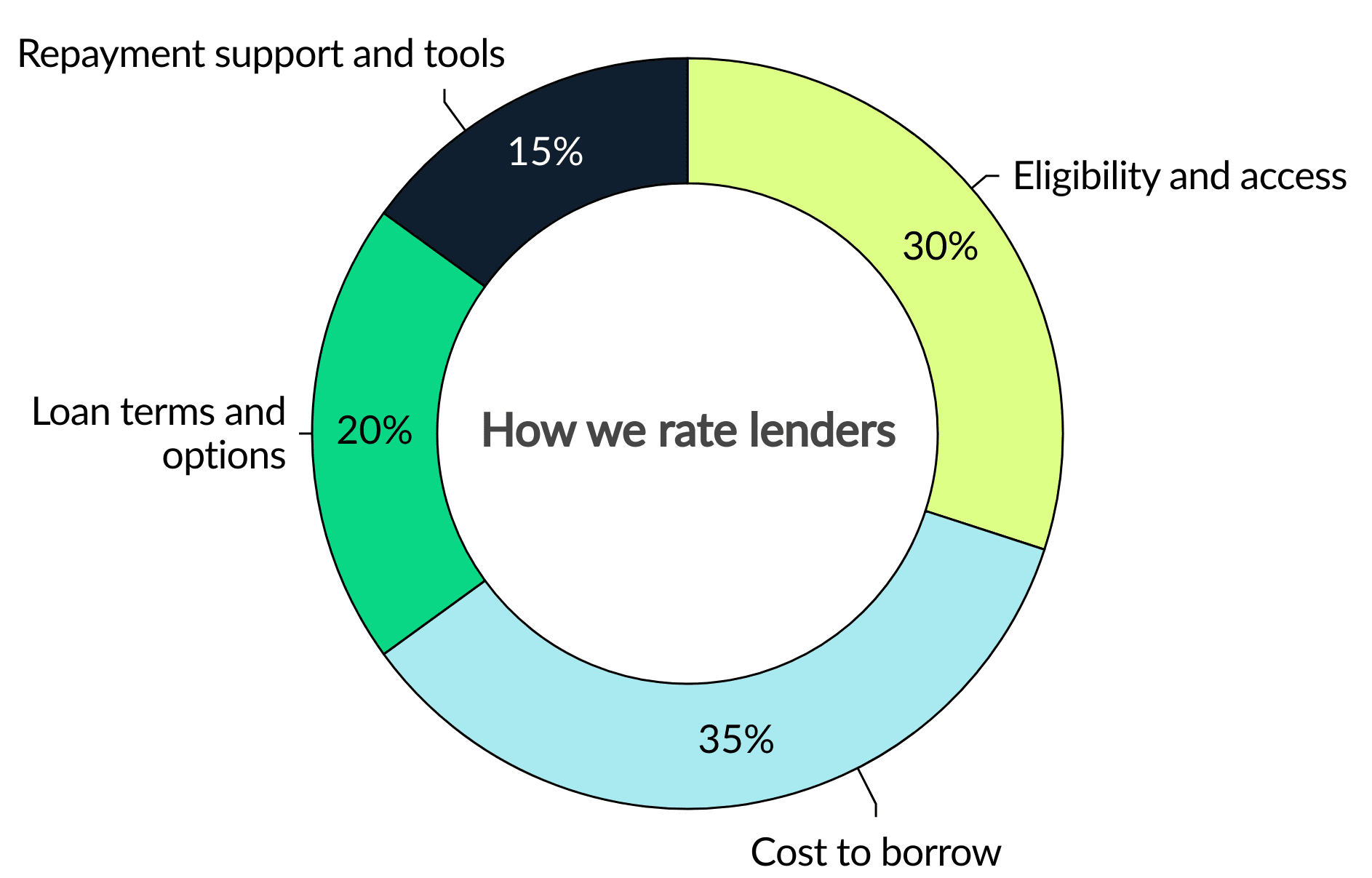

- Eligibility and access: 4/5

- Cost to borrow: 3.6/5

- Loan terms and options: 3.8/5

- Repayment support and tools: 5/5

Happy Money offers personal loans specifically designed to refinance credit card debt. This lender’s personal loans are funded by their partners on their lending network and are available to borrowers with credit scores above 640.

- Low rates: While some companies charge loan annual percentage rates (APRs) as high as 36%, Happy Money’s maximum APR is well below that mark, at 29.99%.

- Will pay your credit cards directly: To streamline the debt consolidation process, Happy Money will repay your current creditors directly using your loan funds. If you’d rather repay your debts yourself, the lender can also deposit funds into your bank account.

- Free monthly credit score updates: Happy Money customers get access to their free monthly FICO Score, so you can work on building your credit while you pay down your debt.

- Can only be used for credit card refinancing (usually): Many lenders will let you use a personal loan for just about anything. But you can only use a Happy Money loan to consolidate credit card debt. Happy Money may allow you to consolidate unsecured personal loans, too (or, personal loans that don’t require collateral).

- Charges an origination fee: Happy Money customers have to pay an origination fee, ranging from 0.25% - 10.00%. This is a one-time fee that will be taken out of your loan funds before they are sent to you.

- Can’t include a second person to your loan: Unfortunately, Happy Money doesn’t offer joint loans or allow cosigners. This means that you’ll have to qualify for a Happy Money loan on the strength of your credit alone.

- Best for credit card consolidation: Qualifying for a lower rate on your high interest credit card debt with a Happy Money loan may save you money in interest payments. This lender may also be a good fit if you’re looking to improve their credit.

Happy Money pros and cons

Happy Money offers many benefits to credit card borrowers who want to consolidate their debt. However, it’s not a good fit for everyone, particularly those with bad credit.

Pros

- Will send your loan to your credit card companies on your behalf

- Free FICO scores

- Rates are capped at 29.99%

- Reports to all three credit bureaus

Cons

- Can only use for debt consolidation

- Keeps 0.25% - 10.00% out of every loan as an origination fee

- Can’t boost your approval odds by getting a cosigner or co-borrower

- Can take up to seven days for an approval decision

- Doesn’t offer any interest rate discounts

Paying off a bunch of credit cards with a debt consolidation loan can be as tedious as juggling the credit card bills themselves. Happy Money can make the process easier by sending your loan to your credit card companies on your behalf.

Another big benefit to Happy Money are its low rates. Happy Money isn’t a lender. Instead, it connects borrowers (like you) with partner lenders. It often works with credit unions and by law, federal credit unions can’t charge rates higher than 18%.

However, unlike many other personal loan companies, Happy Money loans can only be used to pay off credit cards (and some unsecured installment loans). The lending platform also doesn’t offer any rate discounts.

Happy Money personal loan requirements

Unlike many lenders, Happy Money offers clear eligibility requirements for potential borrowers.

| Minimum credit score | 640 |

| Payment history | Zero current delinquencies |

| Residential requirements | Loans not offered in Iowa, Massachusetts or Nevada |

| Required documents |

|

If Happy Money’s loan options won’t work for your borrowing needs, be sure to shop around for a lender that helps you meet your financial goals and can offer you the best-fitting rates, terms and amounts.

How to get a Happy Money personal loan

Getting a personal loan from Happy Money is a straightforward process, similar to other lenders.

Check your credit

Check your credit score and credit reports before applying for a Happy Money personal loan. This can help you determine whether you meet Happy Money’s basic loan requirements and if you have any incorrect information on your credit reports that could be holding your credit score back.

During this time, be sure to crunch the numbers to understand how you can afford to borrow by using a personal loan calculator to estimate your monthly payments.

Prequalify for a loan

Once you determine how much you need to borrow, submit some preliminary information and prequalify for a loan. This process involves a soft credit pull, which won’t impact your credit score. If you prequalify for a Happy Money loan, you’ll be able to see the rates, terms and amounts you may receive. Keep in mind that this offer isn’t guaranteed.

Accept an offer

If you want to proceed with a Happy Money loan, your next step will be to fill out a formal application. You’ll need to provide any required documents, such as bank statements, W-2s and a government-issued form of ID. Happy Money will run a hard credit pull, which can cause your credit score to temporarily drop by a few points.

Close on your loan

Happy Money will review your application and credit profile. If your loan request is approved, you’ll sign your loan agreement and make a plan to repay your new personal loan. It can take three to six business days before you see your loan funds in your bank account. Happy Money can also send your money directly to your credit card issuers.

How Happy Money compares to other personal loan companies

Even if you believe Happy Money aligns with what you’re looking for in a personal loan, it never hurts to shop around and compare other lenders. Here’s how Happy Money stacks up against similar personal loan lenders.

| Happy Money | Achieve | LendingPoint | |

|---|---|---|---|

| LendingTree’s rating | 4/5 | 4.4/5 | 4/5 |

| Minimum credit score | 640 | 640 | 660 |

| APRs | 7.95% – 29.99% | 8.99% – 29.99% | 7.99% – 35.99% |

| Loan amounts | $5,000 – $50,000 | $5,000 – $50,000 | $1,000 – $50,000 |

| Repayment terms | 24 to 60 months | 24 to 60 months | 24 to 72 months |

| Origination fee | 0.25% – 10.00% | 1.99% – 9.99% | Up to 10.00% |

| Funding timeline | May receive funds within three to six business days | May receive funds as soon as one to three business days | May receive funds as soon as one business day |

| Bottom line | Happy Money loans are specifically designed for credit card refinancing. It also has a lower maximum APR than Achieve and LendingPoint, which could make it the cheapest option if you have a credit score around 640. | Achieve offers three rate discounts: one for adding a co-borrower, one for allowing it to pay your credit cards directly and another for having a well-funded retirement account. However, compared to Happy Money, it has higher origination fees. | LendingPoint offers smaller loans than Happy Money and Achieve. It also has the lowest starting rates, so it may be the best choice if you have excellent credit. |

How we rated Happy Money

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

You must have a credit score of at least 640 to qualify for Happy Money, so you need at least fair credit. You also can’t have any delinquent debt on your credit report. You can see how likely it is that Happy Money will approve you by prequalifying on its website.

Happy Money’s personal loan funding timeline is three to six business days after you’ve signed your loan agreement. That is, if you’ve opted to get your loan funds sent to your savings or checking account. If you’d like Happy Money to pay your credit cards directly, you should see those payments reflected on your credit card statement within 30 days.

Also, keep in mind that it can take Happy Money up to seven days to decide whether you qualify for a loan.

Yes. Formerly known as the Payoff Loan, Happy Money was founded in 2009, Happy Money is a legitimate lending platform that connects borrowers with partner lenders (many of which are credit unions).

Get personal loan offers from up to 5 lenders in minutes