Cheapest Renters Insurance Companies

Cheapest companies for renters insurance

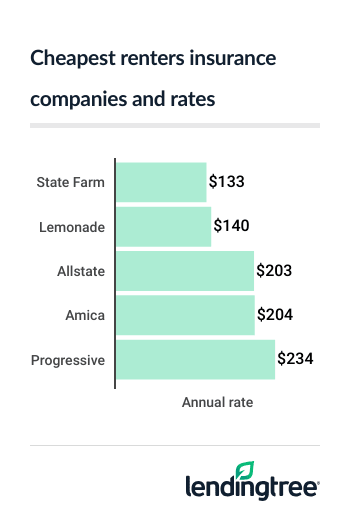

Cheapest renters insurance rates

State Farm has the cheapest renters insurance nationwide, with rates that average $133 a year, or $11 a month.

At $12 a month, Lemonade is only slightly more expensive than State Farm. However, Lemonade offers some standard coverages State Farm doesn’t. It’s only available in 29 states, though, while State Farm is nearly everywhere.

Allstate and Amica are next, each with an average rate of $17 a month.

Allstate and Amica offer more discounts than State Farm and Lemonade, which could make them more affordable if you qualify for a few. Amica also scores better with customers.

Renters insurance rates by company

| Company | Annual rate | Monthly rate | LendingTree score | |

|---|---|---|---|---|

| State Farm | $133 | $11 | ||

| Lemonade | $140 | $12 | |

| Allstate | $203 | $17 | ||

| Amica | $204 | $17 | |

| Progressive | $234 | $19 | ||

| Assurant | $267 | $22 | |

| Farmers | $274 | $23 | ||

| American Family | $328 | $27 |

Renters insurance only costs an average of $18 a month nationwide. You can get it for an apartment, condominium unit, house or other home that you rent from someone else.

Your actual rate depends on factors like your location and the type of home you rent. It’s good to compare renters insurance quotes from a few different companies when you buy or renew a policy.

Cheapest renters insurance by state

State Farm has the cheapest renters insurance in 29 states. Lemonade is cheaper than State Farm in 17 states, including California, New York and Texas. Amica has the cheapest renters insurance in two states: Michigan and North Carolina.

Your state’s cheapest renters insurance

| State | Cheapest company | Monthly rate |

|---|---|---|

| Alabama | State Farm | $15 |

| Alaska | State Farm | $12 |

| Arizona | State Farm | $9 |

| Arkansas | Lemonade | $14 |

| California | Lemonade | $10 |

| Colorado | Lemonade | $9 |

| Connecticut | Lemonade | $9 |

| Delaware | State Farm | $9 |

| Florida | State Farm | $18 |

| Georgia | State Farm | $18 |

| Hawaii | Allstate | $13 |

| Idaho | State Farm | $8 |

| Illinois | State Farm | $8 |

| Indiana | Lemonade | $11 |

| Iowa | State Farm | $8 |

| Kansas | State Farm | $11 |

| Kentucky | State Farm | $13 |

| Louisiana | State Farm | $20 |

| Maine | State Farm | $7 |

| Maryland | State Farm | $9 |

| Massachusetts | Lemonade | $10 |

| Michigan | Amica | $16 |

| Minnesota | State Farm | $9 |

| Mississippi | State Farm | $20 |

| Missouri | State Farm | $14 |

| Montana | State Farm | $7 |

| Nebraska | State Farm | $9 |

| Nevada | Lemonade | $10 |

| New Hampshire | State Farm | $8 |

| New Jersey | State Farm | $8 |

| New Mexico | Lemonade | $8 |

| New York | Lemonade | $9 |

| North Carolina | Amica | $9 |

| North Dakota | State Farm | $7 |

| Ohio | State Farm | $11 |

| Oklahoma | Lemonade | $13 |

| Oregon | Lemonade | $9 |

| Pennsylvania | Lemonade | $8 |

| Rhode Island | Lemonade | $7 |

| South Carolina | Progressive | $13 |

| South Dakota | State Farm | $8 |

| Tennessee | Lemonade | $10 |

| Texas | Lemonade | $14 |

| Utah | State Farm | $10 |

| Vermont | State Farm | $9 |

| Virginia | State Farm | $11 |

| Washington | Lemonade | $7 |

| West Virginia | State Farm | $11 |

| Wisconsin | Lemonade | $8 |

| Wyoming | State Farm | $6 |

Best companies for cheap renters insurance

Along with low rates, Amica, Lemonade and State Farm offer good service. All three companies have high overall satisfaction ratings from J.D. Power

Renters insurance company ratings

| Company | Monthly rate | Satisfaction score* | LendingTree score |

|---|---|---|---|

| Amica | $17 | 695 | |

| Lemonade | $12 | 682 | |

| State Farm | $11 | 679 |

Cheapest overall: State Farm

State Farm gives you a generous discount for bundling a renters policy with your car insurance. This makes its low renters insurance rates even cheaper.

State Farm also offers flexible shopping and policy management options. Its website offers quotes within minutes. Its smartphone app makes it easy to manage your policy from anywhere. It also offers personalized service through local agents in most communities.

Pros

- Cheapest average renters insurance rates

- Good customer satisfaction rating

- Personalized and automated service options

Cons

- Lower satisfaction score than Amica and Lemonade

- Lemonade is cheaper in some states

Most convenient coverage options: Lemonade

Lemonade’s policies cover your possessions at their replacement cost

Like most companies, Lemonade gives you a discount for bundling your renters and car insurance. Unfortunately, Lemonade only offers car insurance in seven states. This makes it impossible to bundle in the other 22 states with Lemonade renters insurance.

Pros

- Cheap renters insurance

- Easy online quotes, billing and claims

- Very good satisfaction rating

Cons

- Renters insurance only available in 29 states

- Auto and renters bundling only available in seven states

Best for customer satisfaction: Amica

Although Amica is more expensive than State Farm and Lemonade, it also has a better satisfaction score. This means it generally has happier customers than its competitors.

Amica’s flexible coverage options let you tailor your policy to your needs and budget. For example, you can choose between actual cash value and replacement cost coverage for your belongings. Replacement cost provides more coverage, but actual cash value is cheaper.

Pros

- Better satisfaction rating than most other companies

- Cheapest company in Michigan and North Carolina

- Flexible coverage options

Cons

- Other companies have cheaper rates

How to get cheaper renters insurance

Shopping around and using discounts are good ways to get cheaper renters insurance.

Advantages of shopping around

Shopping around helps you find the cheapest available rate, which can change over time.

Most companies regularly update the system they use to determine your rate. A company that quoted you a higher rate in the past may give you a lower rate today.

Meanwhile, your own rate qualifications can also change. For example, if your credit has recently improved, you are likely to get cheaper rates now than you did before.

Renters insurance discounts

Checking for renters insurance discounts is another good way to reduce your rate.

- Most insurance companies give you a big discount for bundling a renters policy with your car insurance.

- Home safety devices can also get you a discount. Basic features like deadbolt locks and smoke detectors usually get you a small discount. You can often save more if your apartment or home has monitored security and fire protection.

- Several companies also offer payment discounts. You can often get a small discount for setting up automatic payments from a bank or credit card account. You usually get a larger discount for paying for your policy in full up front.

- A few companies offer discounts to mature renters. With Allstate, for example, you can save up to 25% if you’re 55 and retired.

Many of the questions on a quote request form are designed to check your discount eligibility. It’s still good to ask about discounts when you get your quote, in case any have been overlooked.

Methodology

LendingTree collected thousands of renters insurance quotes from the largest insurance companies in each state, based on data availability.

We used thousands of renters insurance quotes from across the U.S. for a 30-year-old single woman who has no recent renters insurance claims. Your rates may vary. Coverage limits include:

- Personal property coverage: $20,000

- Deductible: $500

- Personal liability: $100,000

- Guest medical protection: $1,000

- Loss of use: $9,000