50% Say Mass Student Loan Forgiveness Unfair to Former Borrowers: Survey

Americans owe a collective $1.51 trillion in student loans, so it’s no surprise that student debt has entered the national conversation, with some presidential candidates calling for a blanket forgiveness of all federal student loans.

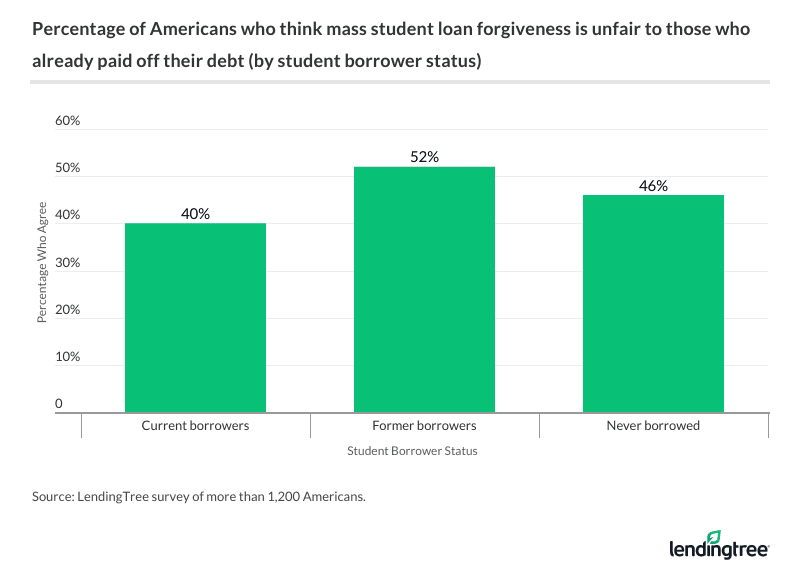

To find out what voters think of the idea of mass student loan forgiveness, LendingTree surveyed nearly 1,250 Americans. The results show that while a large number of people support mass forgiveness, there are also many who say it would be unfair to former borrowers who already paid off their debts.

Key findings

- Forty-six percent of Americans think mass student loan forgiveness is unfair to former borrowers, while 39.1% said it would be unfair to those who never had student loans. (See more)

- Slightly more than 56% of respondents said those who previously paid off their student loans should be compensated if the government does implement widespread student loan forgiveness. (See more)

- Millennials want student loan forgiveness more than other generations: 50.5% of them think everyone’s loans should be forgiven, compared to 44.1% of Gen Xers and 31.4% of baby boomers. Baby boomers are more than three times as likely than millennials to say that no one‘s loans should be forgiven. (See more)

- Tuition-free college is the student loan-related policy consumers most want the federal government to enact, supported by 34% of respondents. This is followed by federal student loan forgiveness after 15 years (26%) and widespread forgiveness for all borrowers (24%). (See more)

Nearly half of Americans think mass forgiveness would be unfair

When asked whether mass student loan forgiveness would be unfair to former borrowers, 46% of respondents agreed. Specifically, those who have already paid off their student debt were more likely to find it unfair than those who never had debt in the first place (52% compared with 47%).

Men were significantly more likely to say mass forgiveness would be unfair, with 53% saying it wouldn’t be equitable, as compared to 40% of women. Along similar lines, 45% of men thought it would also be unfair to those who never borrowed, as compared with 34% of women.

That said, 35% of respondents did not think mass student loan forgiveness would be unfair to past borrowers, while 19% said they didn’t know where they stood on this hotly debated issue.

Compensating former borrowers could help

One potential way to address these concerns over fairness could be to offer retroactive compensation to borrowers who have already paid off their student loan debt.

Among respondents, more than 56% said that those who previously paid off their student loans should be compensated if the government does allow widespread student loan forgiveness.

Men especially favored this idea, with 64% calling for compensation of former borrowers, as opposed to almost 49% of women.

Those who were paying off their own student loans were also more likely to agree with this idea than their debt-free counterparts, by 63% versus 53%.

Here, too, this proposal also saw greater support among millennials than with other generations — more than 64% of millennials supporting compensation of former borrowers versus approximately 59% of Gen Xers and 48% of baby boomers.

But while there are generational disagreements, there’s some consensus to be found between Democrats and Republicans. Nearly 60% of voters in both parties believe borrowers who have already paid off their debt should be compensated if mass forgiveness becomes reality.

Millennials want student loan forgiveness the most

Given the fact that millennials have faced higher tuition costs and rates of student loan borrowing than earlier generations, it’s not surprising that they want student loan forgiveness more.

Among millennials, 51% think everyone’s loans should be forgiven versus 44% of Gen Xers and slightly more than 31% of baby boomers. Plus, millennials were the least likely to say that forgiveness would be unfair to former borrowers, compared with respondents from other generations (more than 42% for millennials, versus almost 45% among Gen Xers, and just above 48% of boomers).

The difference is greatest between millennials and baby boomers, with boomers being three times more likely than millennials to say that no one’s loans should be forgiven (almost 25% versus just under 8%).

Which loans should be forgiven?

While almost 40% of consumers believe everyone’s student loans should be forgiven, just short of 16% think no one should receive forgiveness. Others support forgiveness options in between.

For instance, 12% said that only those who earn less than $100,000 should have their student loans forgiven, and about the same said (11.5%) forgiveness should only go to those who owe $50,000 or more.

Another 18% said only borrowers who qualify for Public Service Loan Forgiveness (PSLF) should have their loans forgiven. PSLF is a program that cancels borrowers’ remaining federal student debt after 10 years of working full time in a nonprofit or other qualifying organization.

Not surprisingly, student loan borrowers were the most likely to support mass forgiveness. Of borrowers with current loans, more than 51% supported mass forgiveness, as compared with about 36% of those without. In fact, less than 3% of those paying off student loans agreed that no one should get loan forgiveness, as opposed to 21% of their counterparts with no current student debt.

One-third call for tuition-free college

While not everyone is in favor of mass student loan forgiveness, there are other policies voters would like to see become law.

Tuition-free college appeared to be the most popular student loan-related policy proposal studied, capturing the support of 34% of respondents. This was followed by federal student loan forgiveness after 15 years (26%) and widespread forgiveness for all borrowers (24%).

Among self-identified Republicans, just under 23% said they wanted the federal government to enact tuition-free college. That number is almost doubled among self-identified Democrats, with almost 43% supporting tuition-free college.

Meanwhile, close to 19% said they want to see an expansion of the Pell Grant program, which offers aid to students with financial need. Similarly, just under 19% wanted the federal government to make it easier for student loan debt to be discharged in bankruptcy.

Explore other options for student loan forgiveness

While mass student loan forgiveness remains up for debate, there are some existing student loan forgiveness programs that could help wipe away your debt. Depending on your profession or place of employment, you might get partial or total student loan forgiveness through one of the following programs:

- Public Service Loan Forgiveness

- Teacher Loan Forgiveness

- Nurse Corps Loan Forgiveness

- Income-driven repayment plans

Check out our big list of student loan forgiveness programs, and don’t forget to explore our database of student loan repayment assistance programs to find other ways to get debt relief.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,248 Americans, with the sample base proportioned to represent the overall population. The survey was fielded Oct. 15-17, 2019.

For the purposes of our survey, generations are defined as the following age ranges in 2019:

- Millennials are ages 23-37

- Gen Xers are ages 38-53

- Baby boomers are ages 54-72