Nearly 8 in 10 Parents Say Saving for College Harder Than Anticipated

With tuition costs higher than ever, it’s no surprise that parents are having trouble saving for their children’s college education. In fact, the situation is dire enough that less than one-third of parents think they’ll have enough to cover the cost of attending college, according to a new LendingTree survey.

After polling more than 500 parents currently saving for college for one or more children, we found the vast majority are having a tougher time than they thought, with almost half wishing they had saved more.

Find out how these parents are facing the challenges of saving for higher education, even while many are paying off student loans of their own.

Key findings:

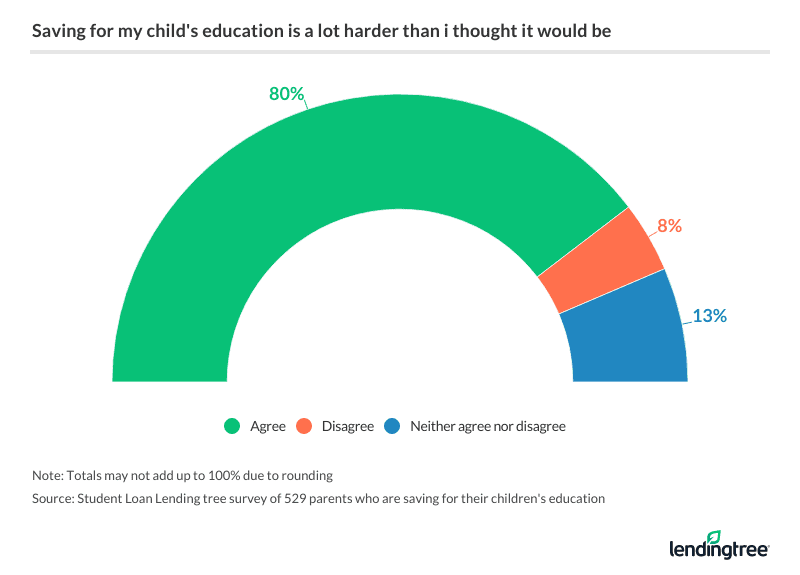

- Nearly 8 in 10 parents say saving for their child’s education is much harder than anticipated.

- 43% of parent savers feel guilty they haven’t been able to save more for their child’s education.

- Nearly 36% of parent savers are currently paying off their own student debt while trying to save up for their children’s education.

- Nearly 57% of parents plan to help their children pay off their student loans.

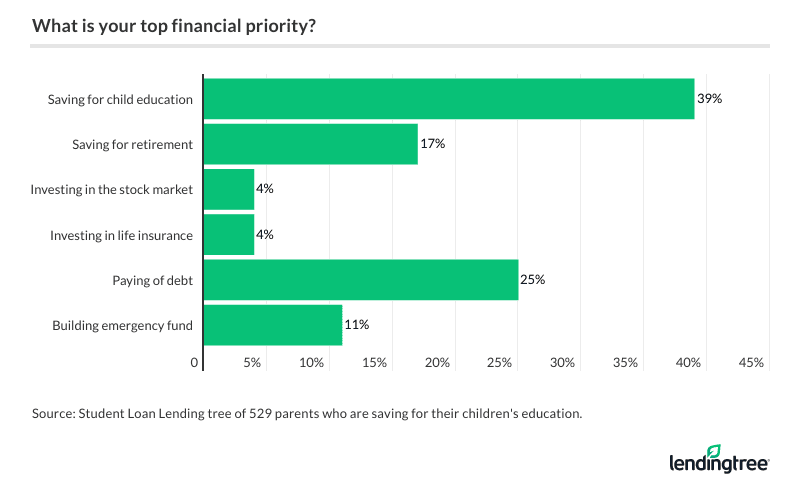

- 39% of parents say saving for their child’s education is a bigger priority than saving for retirement (17%).

- For 57% of parents, their financial support comes with strings attached.

Majority of parents say saving is harder than they expected

For the vast majority of parent savers, guilt is a familiar feeling as they get ready to send their child off to college. Among respondents, nearly 79% said saving for their kid’s education was much harder than they anticipated.

For some parents, part of the problem might be setting unrealistic goals. 1 in 5 parents putting away money for their child’s education plans to save more than $50,000, but the vast majority of savers (59%) currently have just $10,000 or less saved.

Overall, just 28% of parents think their savings will be enough to cover their child’s cost of attendance. While many parents have lofty college savings goals, they’re finding it challenging to meet them.

Almost half of parent savers feel guilty they haven’t saved more

Falling short of college savings goals is causing guilt for a lot of parents.

Among respondents, 43% feel bad that they haven’t been able to save more for their child’s education. Moms are feeling slightly more guilty than dads about their lack of college savings (46% versus 40%).

And those whose own parents did not help them pay for college are more likely to feel guilty than those who did get help (48% vs. 36%). These parents want to provide their children with the financial assistance they didn’t have but find it tough to keep up with today’s tuition rates.

Most parents relying on savings, cash rather than a 529 plan

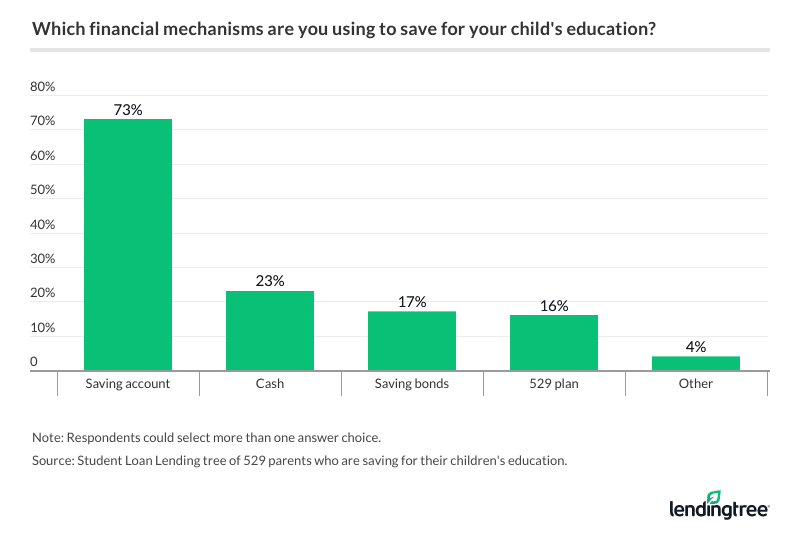

For parents, savings accounts are by far the most common method of saving for college, with 73% using them for their child’s education costs. Other tools parents are using include cash (23%), savings bonds (17%) and 529 Plans (16%).

As tax-advantaged accounts, 529 plans are useful vehicles for saving for college, but only a small number of families are accessing them. And more than 1 in 5 parents are simply saving cash, which means those savings could lose value over time due to inflation.

Parents who are struggling to meet their savings goals should look into 529 plans, which allow your money to grow tax-free over the years, or prepaid tuition plans, which let you lock in tuition payments for the future at today’s lower rates.

Nearly one-third of parents considering a personal loan to cover college costs

Since many parents don’t think their savings will fully cover the costs of college, they’re looking into alternative methods to fill the gap. In fact, 69% of parents plan to go beyond their savings to help pay for college.

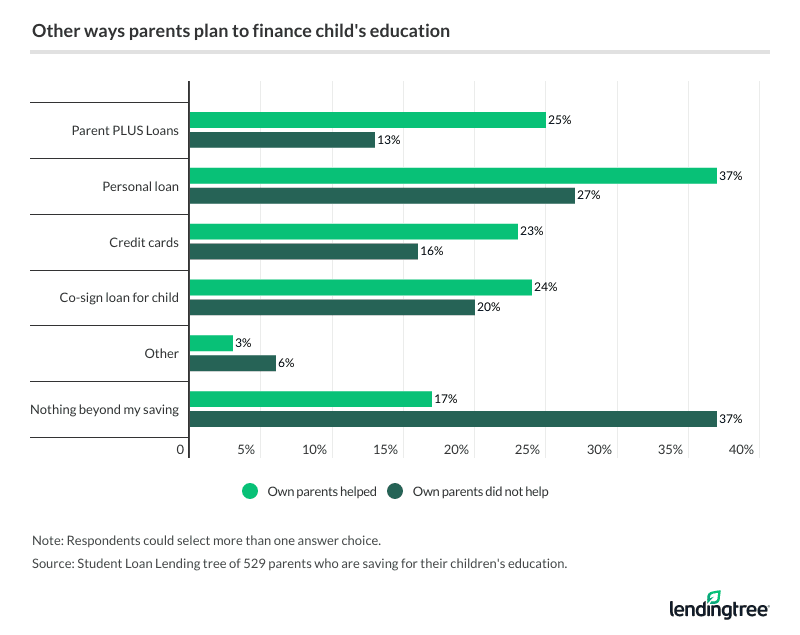

Among respondents, 32% plan to take out a personal loan, 21% intend to co-sign a loan in their child’s name, 19% say they will use a credit card, and 17% plan to take out a Parent PLUS loan. Personal loans and credit cards likely have much higher interest rates than student loans, so most parents should look into private student loans or Parent PLUS loans before considering these alternative options.

Those whose own parents helped them pay for college are especially likely to consider other methods to pay for college, as compared to those who were on their own. For instance, 25% of parents who got help from their families would consider Parent PLUS loans, compared to just 13% of parents who paid their own way through college.

More than one-third of parents also paying off their own student debt

With nearly 45 million Americans owing $1.56 trillion in student loans, it’s not surprising to learn that many parent savers are also paying off their own student loans — in fact, 36% of parents saving for a child’s education still carry some student debt.

Having experienced the challenges of debt payoff firsthand, nearly 4 in 10 parents want their child to avoid taking on student debt at all costs. Another 50% don’t love the idea but know it’s a possibility.

If their kids do have to take on student loans, 57% of parents say they’d help them with repayment, and 34% would consider it. This might mean many parents end up with the double challenge of paying off student loans for both themselves and their children.

39% of parents prioritize saving for college over retirement

When we surveyed parent savers last year, 44% said they were prioritizing retirement savings over college savings. But this year, that figure fell to just 17%, while 39% said saving for their child’s education was the top priority (versus 37% in the previous year).

This was a big shift, and perhaps it has something to do with greater national awareness around the student debt crisis. Our survey also found that almost half of parents (47%) would “definitely” consider tapping into their retirement savings to cover a child’s college costs.

Parents seem very motivated to help their children pay for college and even repay their loans, but draining their retirement savings to do so could threaten their own financial well-being in the future.

For many, financial support comes with strings attached

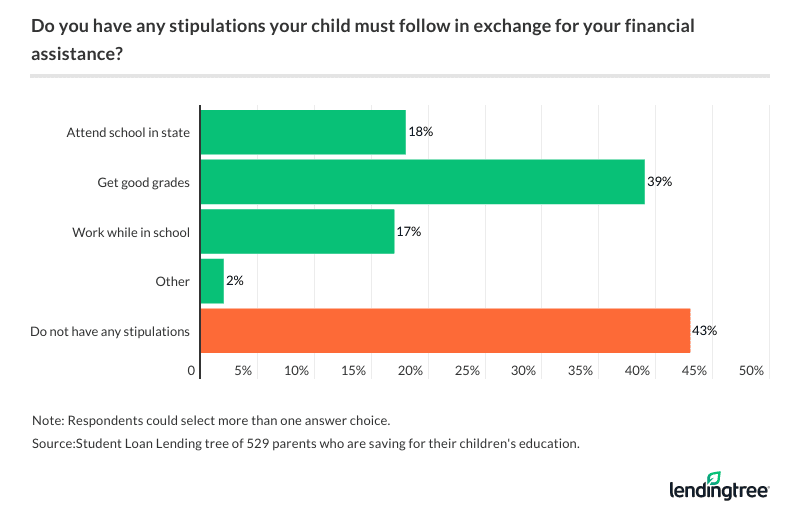

While many parents are planning to help their kids pay for higher education, their help doesn’t always come for free. For 57% of parents, financial support has some strings attached.

Among respondents, 39% say their child must get good grades in exchange for their financial assistance, 18% want their child to attend school in-state, and 17% say their child will need to get a job while in school.

How parents can save for their child’s college

Choosing how much to support your child through college is a personal decision that depends on a number of factors. But if you are trying to save, find the best way that will work for your own situation.

While a savings account or certificate of deposit (CD) is an easy place to park your money, you won’t see huge gains over the years. For greater returns, as well as tax advantages, look into a 529 account. Your post-tax contributions could grow much faster than with a CD, and like a Roth IRA, you won’t have to pay taxes when you withdraw the money.

Prepaid tuition plans can also be a useful option, as they let you lock in today’s tuition rates at public colleges. But of course, they wouldn’t be as useful if your child decided they didn’t want to attend the school for which the prepaid tuition plan applies.

If you need extra money to pay for college, try to use student loans rather than personal loans or credit cards. Student loans tend to have lower rates, and many come with flexible borrowing terms.

Although you should always avoid over-borrowing, a reasonable amount of student loans can be a useful tool for covering a gap in funding. Just be careful to read over all the terms and conditions before signing any paperwork, so you understand exactly what financial commitment you or your child is taking on.

And make sure to shop around with multiple lenders, so you can find a student loan with the best possible rates.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 529 parents who are currently saving for their children’s education. The survey was fielded May 24-27, 2019.