Survey: Women Feel Saddled With ‘Unmanageable’ Student Loan Debt and Fears of Losing Household Income

American women feel the financial pinch at a greater rate than men, especially when it comes to managing student loan debt and preparing for retirement.

Our latest survey finds that women feel less secure than their male counterparts when it comes to their finances and being prepared for the future.

From managing their student loan debt to saving for retirement, women are worried about money. Here’s what we found.

Key survey findings

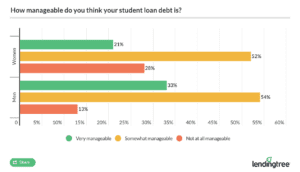

- Women are more than twice as likely as men to feel their student loan debt is unmanageable. In fact, 28% of women with student loan debt said it was “not at all manageable,” compared to 13% of men who referred to their student debt that way.

- Almost half of women (48%) say they regret taking out student loans. They said that they wouldn’t take student loans again if they could go back in time and do it again.

- Women were less likely than men to have refinanced their student loans. Not only were men more likely to have heard about student loan refinancing (79%) than women (63%), they were more likely to have refinanced. Of those who knew about refinancing, 57% of women had not refinanced as compared to 32% who had.

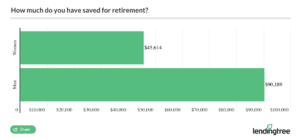

- Women don’t feel as prepared for retirement as men. Only 52% of women have a retirement savings vehicle, while 71% of men have access to a savings vehicle. On top of that, women have about half as much saved, on average, as men do.

Women are more than twice as likely as men to feel their student loan debt is unmanageable

On average, our survey indicates that American women have $91,647 in student loan debt. That’s slightly less than the average of $110,327 held by men. However, even though women have less student loan debt, they’re more likely to feel overwhelmed by their student loans.

Twenty-eight percent of women surveyed said their debt was “not at all manageable,” compared to 13% of men who referred to their student loans in the same way.

Additionally, more women than men regretted their decision to take out student loans. When asked if they would go back in time and use student loans for their education, almost one-half of women (48%) said no. Forty percent of men also said they wouldn’t.

But men were more likely to talk about student loan debt in terms of its necessity in getting an education to move forward with a career. “I had to take them out to continue my education,” wrote one male respondent. “The same would apply now.”

Other men wrote that they wished they had worked more during school to reduce the need for student loans, citing high monthly payments and interest rates.

Women were more likely to lament being in circumstances where they don’t use their degrees. “I hate having to make large monthly payments,” wrote one woman who wouldn’t take out student loans if she had to do it again. “I’m not even utilizing my degree.”

Other women reported similar experiences when answering qualitative questions about their student loan debt. They wrote about how they don’t work in their field of study or how they’ve left the workforce to care for children.

Women are less likely to be familiar with student loan refinancing

One way to get student loan payments under control is through refinancing. By refinancing to a lower rate, you can pay less each month and save money on interest, freeing up room in your budget for other expenses.

Men (79%) were more likely than women (63%) to be familiar with student loan refinancing.

Of those who reported knowing about student loan refinancing, men (69%) and women (64%) were both likely to have considered it.

However, even though they were almost as likely to have thought about refinancing their student loans, fewer women had gone through with it. More than one-half (57%) of women who knew about refinancing hadn’t tried it. On the other hand, only 32% of men who were familiar with the concept hadn’t refinanced.

Of those respondents who had refinanced, their No. 1 reason for trying it was to lower monthly payments. Seventy-two percent of women and 57% of men said lower payments were their primary reason for refinancing.

Women and men also saw saving money on interest as an inducement for refinancing. However, men were more likely to refinance in order to do the following:

- Transfer a Parent PLUS Loan to a child or student.

- Release a cosigner.

- Convert a variable-rate loan to a fixed-rate loan.

Lorna Kapusta, vice president of women investors at Fidelity, pointed out that many women don’t know their options when it comes to student loan debt and aren’t sure refinancing is the best choice.

“Women are in control of so many things at so many levels,” Kapusta said. “When it comes to money, though, they’re not as confident as they could be. They underestimate their abilities and worry about their lack of knowledge, so they aren’t making the decisions they need to.”

Women are less likely to feel prepared for retirement

Women aren’t just more concerned about their student loans. They’re also more likely than men to feel worried about retirement — and for good reason. On average, the women we surveyed had about one-half the amount ($45,614) in retirement savings as men ($90,189).

Only 52% of women reported having a retirement savings vehicle. On the other hand, 71% of men reported having a way to save for retirement. It’s no surprise to see that only 23% of women felt on track for retirement, compared to 48% of men in our survey.

The most commonly cited reasons among both women and men for not being on track for retirement included living paycheck to paycheck and student loans.

“I’m paying bills and not earning enough money to keep up with all my current payments,” wrote one male respondent. This sentiment is unsurprising, considering 73% of those surveyed had other debt in addition to their student loans.

Additionally, many respondents expressed a lack of knowledge about investing for retirement, especially among women.

“I don’t feel like I understand how to prepare for future retirement,” wrote one female respondent. Another cited her “lack of knowledge about retirement planning” as the main reason why she hadn’t started saving.

How can women get a better handle on retirement?

Kapusta said she sees this worry among many of the women she works with. “Women worry more than men about their lack of knowledge,” she said. “Traditionally, in our society, investing is something women stay away from.”

In order to help women feel more prepared for retirement, Kapusta is working toward helping them with a mindset shift.

“First, we need to help women feel comfortable with the knowledge they already have,” she said. “Research indicates women are better investors in the long run, so we need to reinforce that.”

Next, women need to know where they can access retirement and investment tools and resources. “It’s not that complex once you have the knowledge,” said Kapusta. “Once women learn about investing, it cultivates a feeling of can-do. They can take steps to feel more confident and in control of the situation.”

Finally, Kapusta said women should realize they can work on repaying student loans while saving for retirement.

“We focus on student loan debt because we’re scared of debt,” she said. “And, yes, you need to be paying down that debt. But saving for retirement needs to be in those goals. Don’t neglect retirement as you’re paying off student debt.”

Even if you can only put a small amount toward retirement, it’s important to start saving as early as possible, Kapusta pointed out. Plan to increase what you save for retirement as your debt is paid off.

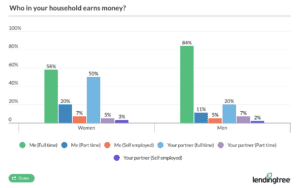

Women are more stressed about the potential loss of a partner’s income

Finally, despite the advances women have made in the workforce in recent decades, many of them still rely on a partner’s income. When it comes to caregiving, traditional gender roles continue to exist, said Ginger Dean, a psychotherapist and the founder of the women’s financial education website Girls Just Wanna Have Funds.

“Women feel especially stressed about household debt because it’s added to their list of things they have to do,” said Dean. “And women are still very reliant in many ways on a partner’s income, even if they have their own jobs.”

Fifty-six percent of women in our survey said they’d be concerned about their finances if a partner lost their income. Forty-three percent of men expressed the same concern.

In our survey, women (58%) were also less likely than men (84%) to be a full-time source of household income. This indicates that women are more dependent than men on a partner’s income.

When asked about the challenges they’d face with a loss of income, men largely mentioned a difficulty in paying bills.

“Paying the mortgage and monthly bills would be a struggle,” wrote one male respondent. “Student loan debt would add to that puzzle.”

Others pointed out that if their partner lost income, they’d be fine, even if they had to reorder their priorities and cut back on expenses.

“If my wife lost her income, the only thing that would change is that we would only be able to put $1,000 a month extra toward our student loan debt instead of $2,000,” wrote a male respondent. “We could survive on my wife’s income if I lost mine, but we’d have to really tighten our budget.”

Women, caregiving, and personal financial power

Not one male respondent in our survey mentioned children. But women (45%) were more likely than men (32%) to make less than $50,000 per year. And they worried about how they would take care of their kids with the loss of income:

- “I’m on the Pay As You Earn plan, so my student loans would not be affected. But I’d worry about how to pay bills and feed my kid.”

- “I’d lose my home and have no way to take care of my children.”

- “Since I don’t currently work and I stay at home with a child, it would affect me and my family immensely if my spouse lost his income.”

- “I have a child to raise and the student loans only make it worse.”

Society largely considers men to be the breadwinners. Recent findings from the Pew Research Center indicate about 72% of men and 71% of women believe a man must be able to provide for his family to be considered a good husband or partner.

Conversely, 25% of men and 39% of women believe women need to provide in order to be a good wife or partner.

On top of that, in about two-thirds of married or cohabiting couples, men outearn women. This can worry women, said Dean.

“Money equals power in so many aspects of our lives,” she said. “Many women find their choices constrained when they have children and debt and rely on their partners for the income they need to survive.”

The end of a relationship can complicate matters for women

Another reason women feel stressed about their debt, said Dean, has to do with the fact that they can have a hard time improving their situation. With caregiving responsibilities, women need a strong support system in order to feel in control of their finances, she pointed out.

Plus, with the way the student loan program is set up, continuing an education can be difficult for recently divorced women.

Dean knows this from experience. After her own divorce, she had a hard time funding a degree that would lead to a higher income.

“When you fill out the FAFSA, they base your need on the previous year’s tax returns,” Dean said. “Well, you filed jointly, so your ex’s income is considered. The only problem is you don’t have that money anymore.”

The same issue can thwart women who try to get on an income-driven repayment (IDR) plan after the end of a marriage, said Dean. “It takes time for all of that to shake out and for the government’s system to catch up with your actual income situation.”

How can women reduce their feelings of financial stress?

“Women feel more stressed out about finances and planning,” said Kapusta. “It’s one of the top issues keeping women [up] at night.”

So, with that in mind, how can women improve their finances and reduce financial stress?

Kapusta said that learning about investing can help women feel like they can plan for the future. “Our research shows that investing is the No. 1 thing women want to learn about,” she said.

In order to get that knowledge, Kapusta suggested that women speak with a financial professional.

“A professional can walk you through your options, as well as help you make a plan to pay down your student loans while investing for the future,” she said. “Find a financial professional you’re comfortable with. Aside from that, there are plenty of tools and resources online and in books that can help you gain a working knowledge of money and investing.”

Dean recommended creating a plan to deal with debt. “Figure out what you have control over and make a plan to deal with [debt],” she said. “You’ll feel better.”

Review options such as IDR and student loan refinancing, Dean suggested.

She also pointed out that women often revisit their mistakes and worry about how they got to where they are. “No matter why you’re in debt, you have to take care of it,” Dean said. “Look ahead to your desired outcome and find ways to make that happen.”

Finally, Dean said it makes sense to increase your earning potential. “Start a side hustle, go back to school, or increase the hours you work,” she said. “It’s not easy, but try to find a support system that can help you as you increase your financial power.”

Survey Methodology: LendingTree conducted this survey via SurveyMonkey on Feb. 2, 2018, and collected responses from 1,776 adults living in the United States. The margin of error is plus or minus 2 percentage points.